This month I will cover a couple of topics apart from my overall portfolio Performance:

- How to choose invoices to invest in invoice discounting platform

- How to Manage your Liquidity efficiently

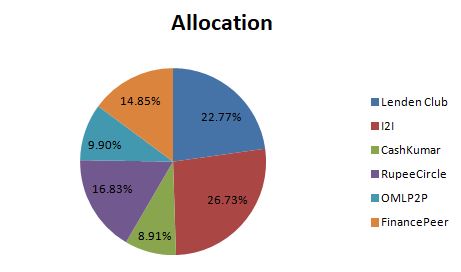

Portfolio Composition

Portfolio Changes:

- My portfolio composition has been changing recently based on availability of loans. I prefer to be able to check out loans before investing which makes it difficult to invest in platform like cashkumar were loans disappear in a blink of an eye

- I2I , RuppeeCircle and Financepeer have adequate frequency of available borrowers in the respective order

- Lendenclub has many insta loans which I am not a big fan of. I have recently started investing in Insta loans of repeat borrowers only.

- OMLP2P has good loans but off late frequency has been quite low so I have not increased my exposure

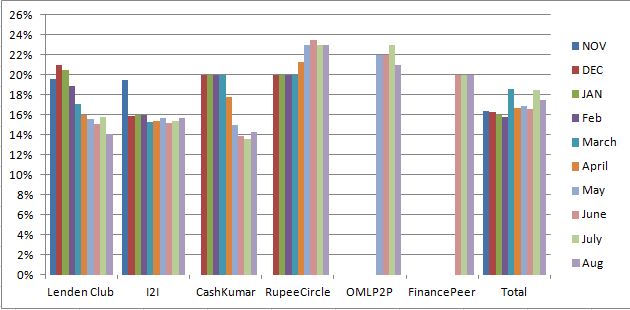

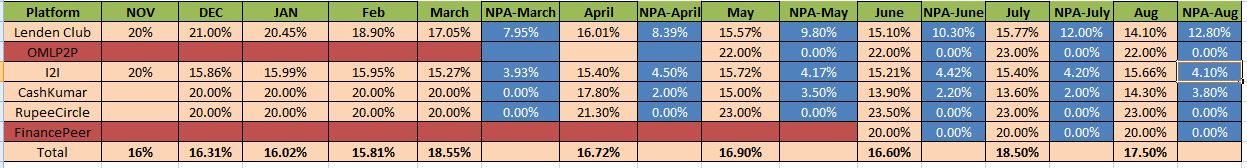

Portfolio Performance

Performance Analysis:

Key Points from this month’s performance are:

- LendenClub: I am using InstaLoan only for repeat borrowers now. The impact of stopping auto invest in insta loans should start showing up from next month and yield should pick up from here

- I2IFunding : Interestingly collection was able to get back some money from a delinquent loan which came as pleasant surprise.

- RupeeCircle :Only one delay till now ,that too within 30 Days, not much to complain

- FinancePeer : Still following my plan of investing in only education loans. No delinquency till now

- OMLP2P : Very few loans this month so not much change in my exposure here

- Cashkumar: Good platform but loans disappear really fast .I am keeping my exposure to a small amount as I don’t want most of the capital lying idle in escrow

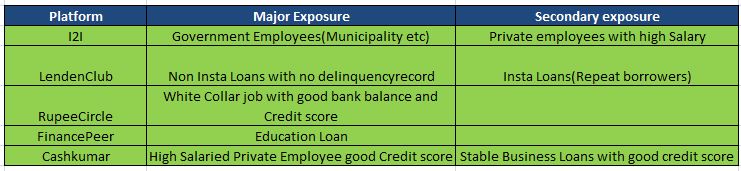

Exposure Type in each platform

Over the last 12-18 Months I realised that certain platform specialise in specific loans and most of my exposure to that platform comprise those loan. If I have to choose a speciality borrower of each platform which gave me the best purchase for my buck then it would be :

Invoice Discounting Performance:

I keep rolling my invoice discount investments. Currently I am invested In PaytM.

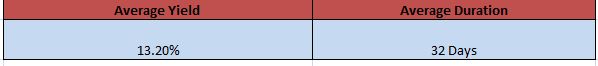

My current Portfolio yield and duration:

How to Select an Invoice:

In Invoice discounting 2 parties are involved viz an Enterprise which is going to pay the invoice money and a vendor which has raised an invoice and to whom you will pay the money now. To be really safe we ensure both our enterprise and vendor are sound even if the deal might be for 30 days

Choosing Enterprise

- Go with a big name like Infosys, Wipro, Amazon ,Flipkart who are more trustworthy

- Check Latest Quarterly report if available

- Current Leverage and cashflow

- Any adverse news in the last 3 months.

Choosing vendor

- Financial strength of the vendor to ensure in the scenario enterprise fail to honour receipt , the vendor is able to pay me .

- Only invest in those invoices for vendors who have decent record of raising money through the platform and avoid someone who has recently been on boarded

Preferred Tenure of Investment:

I prefer shorter dated invoices: 20 -40 days. The reason is

- Chances of adverse impact in short duration are less to an enterprise than in 2-3 months.

- You have more liquidity to meet your short commitment (Liquidity Buffer)

Managing Liquidity Like a Bank

Unlike how most individual manage liquidity poorly banks and other institution try to optimize their liquidity ,though in the recent market turmoil we have seen that even some institution do not manage liquidity efficiently and thus pay a heavy price.

How does a an average person manage his liquidity?

Let’s assume he has a 25 Lakh corpus , he thinks he need to have some fund for contingency like a job loss or sudden increase in expense!

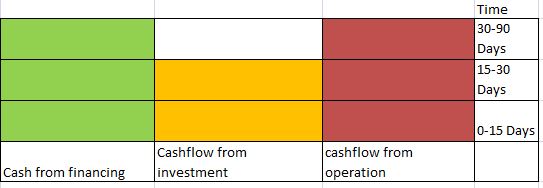

Unlike retail People Banks take care of 2 things

a)Total sum of liquidity in a given time bracket (Asset Liability Management)

b) Quality of Assets (haircut you would need incase you have to liquidate an asset immediately

Most banks have to follow a stringent liquidity requirement called SLR(statutory liquidity Requirement) which is around 18% now which implies that 18% of banks asset should be available to meet any liquidity .SLR has to be maintained in the form of gold, cash or approved securities notified by RBI such as central and state government bonds

Look at how a bank’s liquidity looks like

Its a parallel combination of multiple investment. Some of it would be investments, some cash inflows etc and after deducting all liabilities will be the net liquidity (after haircut)

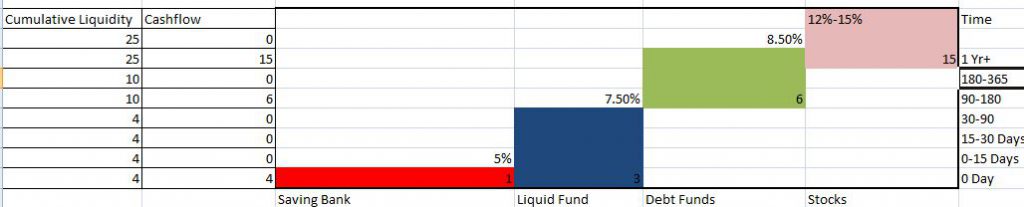

Now let’s see how a Retail guys manage Liquidity

There are 2 problem with this approach of serial combination of liquidity rather than parallel(Institutional)

- Capital is scarce so you either pay rent if you want to own it or you get rent for lending. In our case we are lending through Liquid Fund, Debt and saving bank .The rent we are getting is quite low.

- When we need more liquidity we will have to liquidate Debts or Equity assets where we will have to take a hit. Lot of people assume that market will correct quickly and then they can use the capital but

“Market Can stay irrational longer than you can stay Liquid”

It means that we should not think of stocks or long term debt as a liquidity resort.

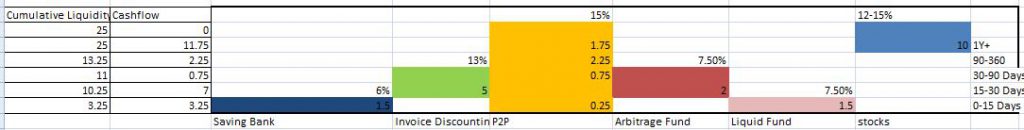

Now if we use combination of multiple asset classes parallel we can create a better and more efficient Liquidity.

Now we have overcome both our problems:

- We Don’t need to liquidate stocks for short term liquidity

- Our Assets give us higher rent with better liquidity( our average earning shoots up from 7% to 12%). We are also more efficient as Arbitrage tax lower than debt!

Footnotes:

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

For starting invoice discounting mail me or drop a message on 9967974993 or mail me at rohanrautela9@gmail.com