How would have a portfolio of just equity and bond funds performed vis-a-vis hybrid portfolio of (equity + Alternatives)?

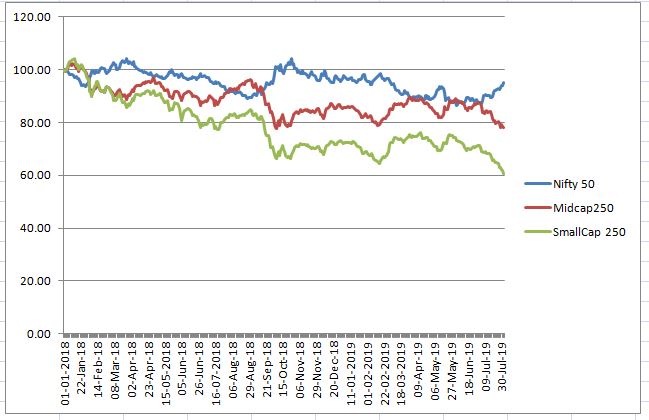

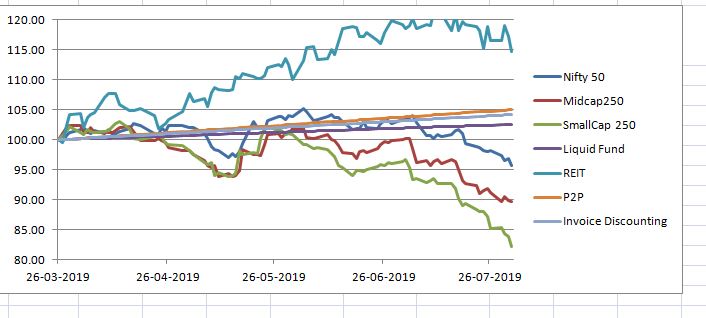

First let’s see how the equities performed in the last 12 months. I will take the Index performance for large cap, mid cap and small rather than some mutual fund as it will give a better unbiased picture.

- Stock only Portfolio Performance

I have taken 100 as a base to make it easy to comprehend

It shows that if someone started with 10 Lakh in small cap fund in Jan 2018 they would have 6 lakh left after 1.5 year.

Lot of people think about stocks in terms of volatility and Return but drawdown is one really important factor to consider. How many people can digest 40% loss in value of their portfolio. Though I am sure if they hold it for a long time they will eventually make money but it’s easier said than done.

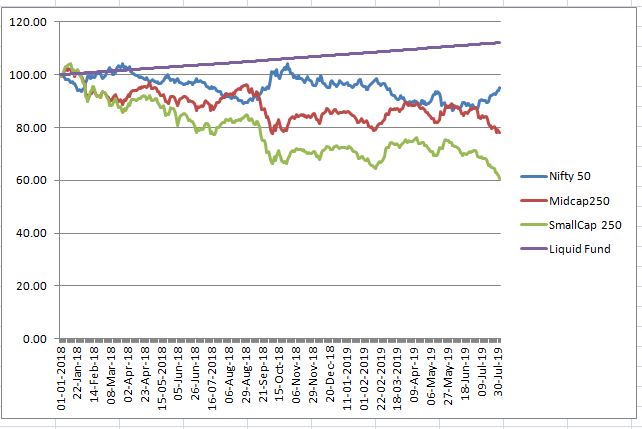

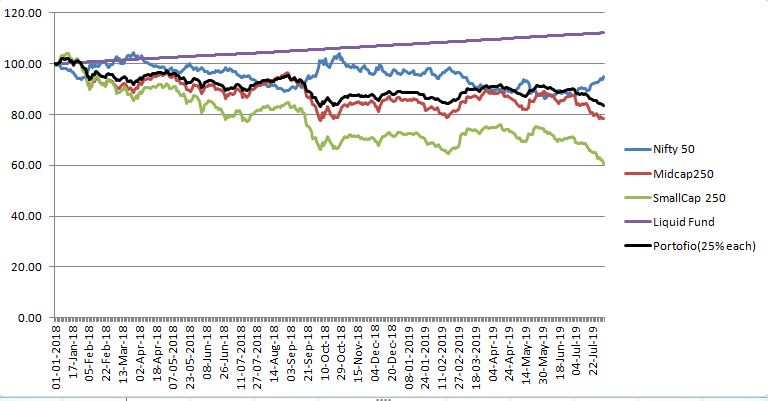

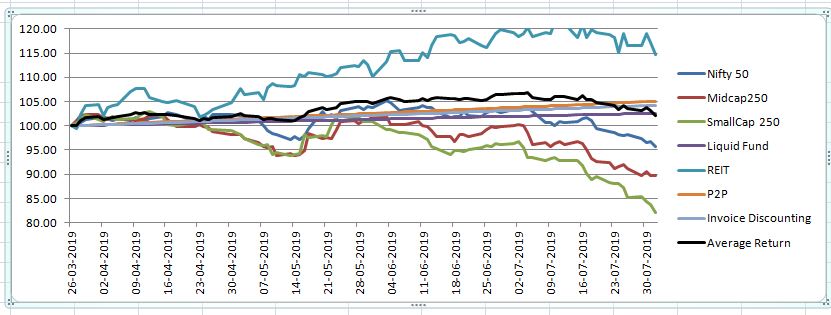

- So we move on to our second portfolio which people generally hold : combination of debt and equity.Let’s say we hold 25% debt and 75% equity divided equally between large ,midcap and small cap .Now how will our return look like

So total portfolio return will look like:

In 1.5 year you achieved a 17% loss on capital or 1.7 lakh loss.

Points to consider

- Lot of people invest through SIP and believe that they would be able to ride volatility but unless you have recently started a SIP it wont really help you in averaging.

I had written a blog post on this topic

http://randomdimes.com/2019/is-sip-better-than-lumpsum-investment/

To put it simply Let’s say you had accumulated 100 shares at average cost of 1 rs over 100 months.Now your total asset value is 100

If market drops by 50% you will buy 1 share at .5 rs your average cost = (.5*1 +1*100)/(101)=.995 also your total portfolio loss is 50 Rs regardless of the SIP.

- Without going into any maths it is quite evident all the index are moving together which implies our losses and gain will move together ie. either we will make lot of money or lot of losses.

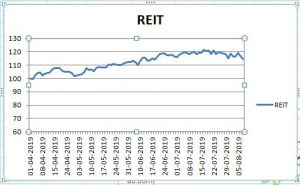

Alternate Assets Performance:

- REIT performance from the time it was launched in April 2019 ,staggering 18% return in 4 months

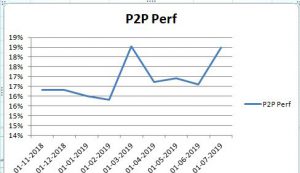

- My P2P portfolio performance

Let’s say average return on P2P is approx 15%

I will take average of my Invoice Receivable average return is 12.5%

If I add all the alternate investment with stock portfolio then last 4 months the graph would look like:

It is clearly evident that correlation between stocks and REIT or stocks and P2P investing is very Low or -ve ( the graph are in opposite direction). If we combine the assets uniformly we can get a portfolio which has lower drawdown and higher returns .Even with the stocks performing poorly this portfolio did not face any drawdown,.

So how to allocate weights to various assets.

There are two types of asset allocation : Strategic Asset Allocation and Tactical.

- Strategic asset allocation

It is your base level allocation which you follow most of the time.You can either construct it mathematically

The easiest mathematical ways to do it is Mean Variance optimisation and Black Litterman .

People do not need to actually to follow a rigorous methodology but based on their age and risk appetite they can allocate to stocks and bond and the rest to alternate.

eg: for a 30 year old 50% stocks 20% bonds 30% alternate is decent while for a 50 year old 30% stocks 35% bonds 35% alternate can be better.

Off course the individual risk aversion is paramount to create a strategic allocation

- Tactical Asset Allocation

If someone believes market is efficient then there is no scope of tactical allocation as we expect all information is factored in the prices but we do invest in mutual funds because we think that market are not perfect and there is scope to outperform it.

Tactical asset allocation is one way in which we can go overweight or underweight on market during certain times

Basically market returns are a a factor of Value and momentum to an extent. During phases when stocks are fundamentally undervalued we can overweight our equity portfolio while during times when market is in euphoria we can gradually start reducing our allocation.Here I would like to add the primary aim is to reduce risk as we do not wish to get caught with a huge position in a stock bubble

The problem with conventional Bond and Equity portfolio is that there is a huge opportunity cost of not investing in equity 100% of the time as bond returns around 7.5% are too less to offset the missed chances of bull rally . ie. if you take out money out of equity and put in bond you get only 7.5% while you wait for market to correct and you miss lot of returns in the meantime.

Now our portfolio has stocks,bonds and alternates,how do we go about creating a tactical allocation

When we have alternate which provide almost same return as midcap stocks then we can always increase their allocation during an equity euphoria.

I prefer the PE and Rolling Returns based approach as it is the simplest. These are not rules but just indicators.

Empirically it has been shown that market has given a higher average return when PE levels had been low and vice versa

For instance if Nifty PE has crossed 30 I would be wary of the market and would try to book some of the profit and transfer it to P2P, Invoice discounting ,debt etc while if PE is below 20-22 I will gradually increase equity allocation.

The problem is sometimes market continues to rally during a growth stage and sometimes it keeps falling. I am fine with that as my alternate are already giving a decent return and I don’t want to take the risk of a sharp equity fall during overvaluation phase

Other problem with PE based investing is that over a period Nifty PE has gone up due to changes in its composition, PE doesn’t factor in inflation etc but what we want is just to get an idea about market not some sacrosanct number.

eg : if Market goes to 9000 in next 3 months we can increase our allocation while if it rushes to 13000 in next 3 months we can go overweight alternatives.

Conclusion: Backtesting a hybrid portfolio shows how a low correlated portfolio helps in reducing risk and can be an important tool in tactical asset allocation during a recession or a rally.

Footnotes:

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

For starting invoice discounting mail me or drop a message on 9967974993 or mail me at rohanrautela9@gmail.com