This month I have added FinancePeer in my portfolio to take exposure to Education Loan borrowing. Apart from publishing my portfolio performance I will also cover :

- My Receivable Finance Portfolio Investment

- Capital Structure of my investment and Liquidity Analysis

Portfolio Composition

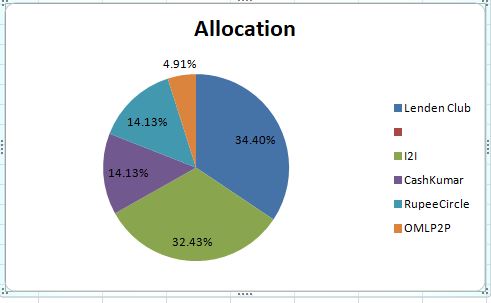

May Allocation:

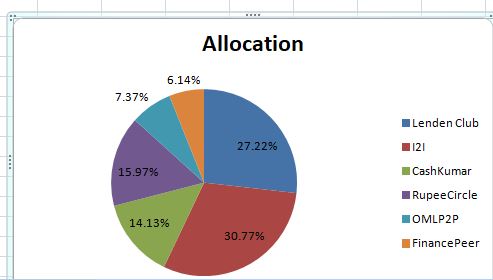

June Allocation

Portfolio Changes:

- I have started investing FinancePeer

- I have increased my portfolio exposure to RupeeCircle,OMLP2P

- Have cut down my “InstaLoan” Portfolio in lenden .No more fresh deployment to instamoney

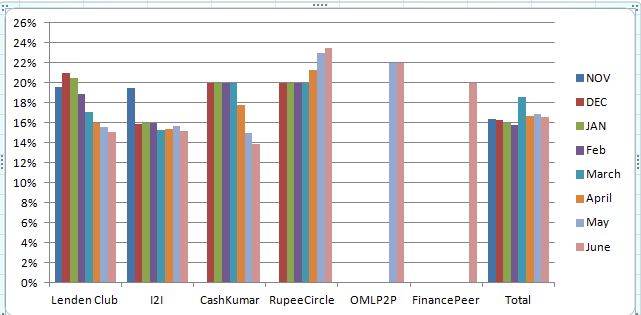

Portfolio Performance:

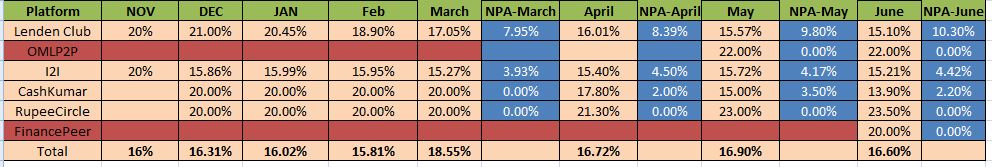

Performance Analysis:

Key Points from this month’s performance are:

- If you see lendenClub performance it has gradually dipped. Major culprit has been insta loans. Now as I am cutting down my Insta Loan exposure hopefully I will be able to gain 1-2% yield in next 4-5 months.

- I2I has been more or less (between 14-16%). People who are starting in I2I should focus on safer loans( preferably C and good D) .

- RupeeCircle has been the only platform where yield have actually gone up with time. This is the first month where I have delay in EMI.If it doesnt go back to normal I may see a drop 1-2% in yield after 2 months when I put it as an NPA though I have already considered 3% of return as NPA in form of provisioning.

- Cashkumar have only 2.5% but due to short term lending and small size of book overall returns look low,which should improve with time.

- FinancePeer I am sticking to only educational loans .Hope NPA are low as promised in the category.

- OMLP2P ,as of now I have not faced any NPA but as my investment are fresh I will wait for a month or 2 before giving any verdict.

Invoice Discounting Performance:

I have been investing in a couple of Invoice discounting platforms. Some of the companies whose invoice I inivested in are Paytm and Indian Oil. Most of the invoice are blue chip.Some of the Invoice available to invest are:

- Cognizant

- Maersk

- Yesbank

- Amazon

- Wipro

- Oracle

- BHEL

The range of yield is between 12-15% for the invoices and duration 30 -90 days

My current Portfolio yield and duration:

Capital Structure:

Lot of people ask why they should invest in other assets when equity can give 10-15% in long run. The answer is ,do they have the capacity to digest monthly volatility of 5-6% on their complete corpus.Second, how do they mange their liquidity. What if they need money in next 3-6 months will they book losses in mutual funds and redeem them?

Alternate asset class is a way to fill the place between low yield and high yield , low liquidity vs high Liquidity .It also ensure construction of a portfolio where asset classes have low correlation among them.

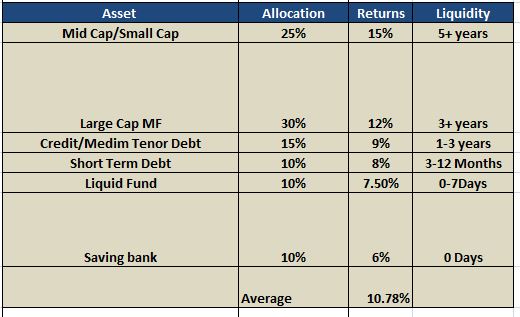

Let’s Look at how a conventional portfolio looks like:

The allocation may vary depending on age. For instance a 35 year guy will allocate more to equity than 45 year old. If someone has 20 Lakh then 10% is saving = 2Lakhs, 25% small cap = 5 Lakh etc.

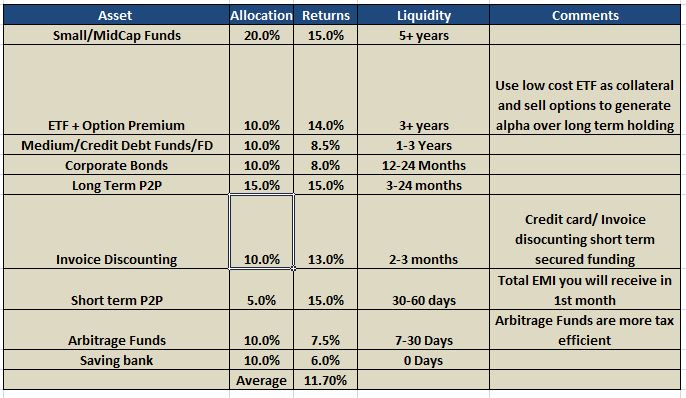

Now look at a portfolio with alternatives:

Three things stand out:

- Overall return is higher 11.7% compared to 10.7% as our capital is not tied to low yielding assets.

- We have more liquidity. Almost 50% portfolio cashflow is received within 2 years ,which implies we can use it for emergency or for near terms goal as we have more certainty.

- Our asset classes have very low correlation among themselves.

in original portfolio our equity can have 10% drawdown in a month and as 50% of our portfolio is in equity almost 5 percent of our portfolio will drop.

In alternate portfolio we have reduced equity allocation to 30% thus only 3% impact ,thus overall volatility of portfolio drops.

Therefore adding alternate asset classes in portfolio helps to improve Returns, Liquidity and lower Volatility

Footnotes:

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

For starting invoice discounting mail me or drop a message on 9967974993 or mail me at rohanrautela9@gmail.com