In a bid to find out P2P platforms with short term loans and investor protection I had invested in PeerBerry . Now I am adding another short term investment platform ,with sound record ,high yield and buyback guarantee.

What Is Lendermarket?

Lendermarket is a p2p lending platform established in June 2019 and is located in Dublin, Ireland. While it has been only established for a short period of time, it is a sister company of Creditstar Groups AS. It is a consumer financial services company established in 2006. The Group has 12 subsidiaries that issue loans in 8 different countries.

At the time being, you will only be able to find loans from Creditstar on the platform. These loans are already issued, and you are in practice investing in parts of the loans. This allows Creditstar to get more liquidity to issue even more loans. Creditstar is the originator and it is downselling the loans to get liquidity to further lend.

Salient Features of the Platform:

- Buy Back Guarantee (Principal + Interest) if the loan is delayed for than 60 days.

- Originator and buyback guarantee provided by Creditstar which is a respectable firm.More on the financials below.

- Short Term loans available which suits my style in buyback guarantee

- 12-13% Interest Rate on short term loans is attractive in the current low yield environment.

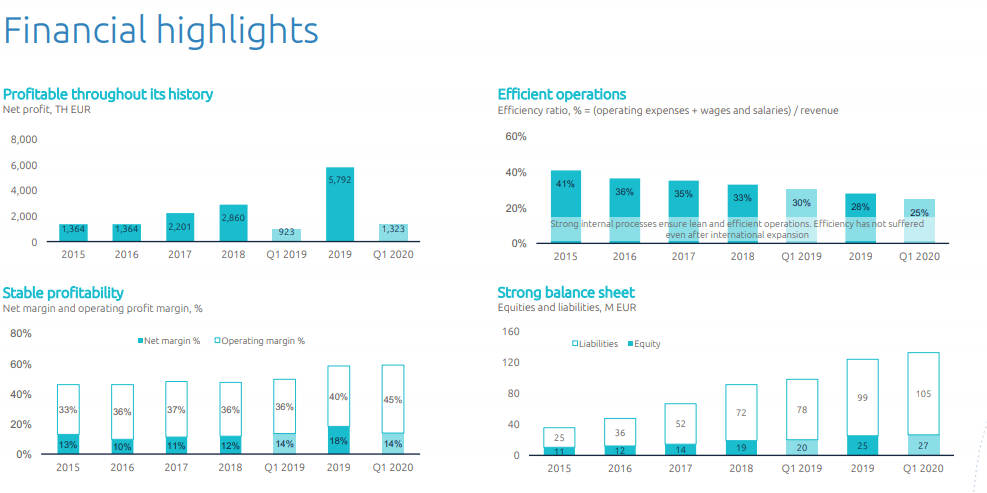

Performance of CreditStar

The company has strong growth and performance every quarter.

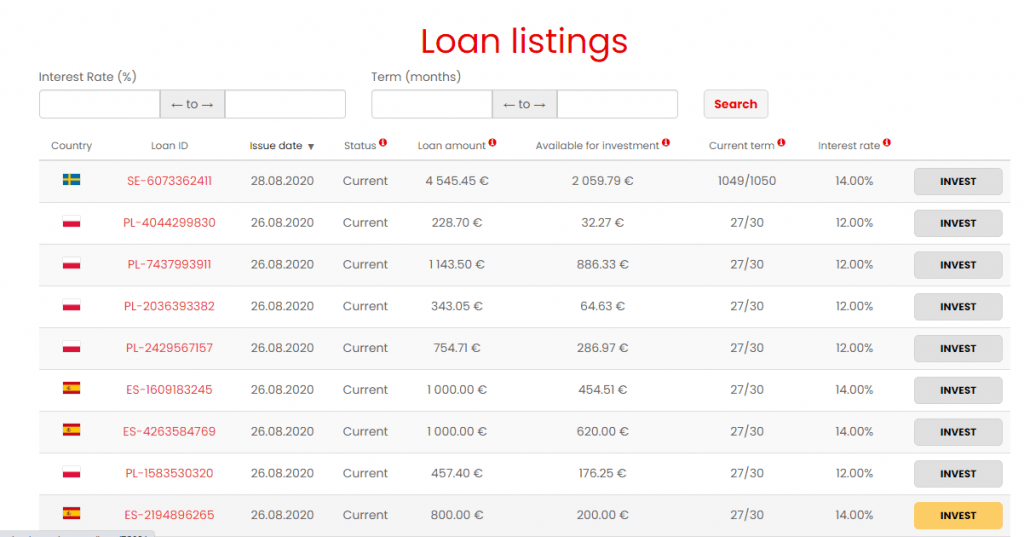

Type of Loans:

As evident in the picture below 30 Days loan are available at 12-14% annualized rates!

How safe are the investments?

The first thing we looked into when creating this Lendermarket review, is how secure the investments are.

Loan originator risk

All loans on Lendermarket come from the lending company Creditstar. So when you are investing in loans on Lendermarket, you are exclusively exposed to risk from one loan originator.

This is not very good for diversification, which is why you would probably benefit from using multiple platforms

However, Creditstar has existed since before the financial crisis in 2008 and has been profitable for many years in a row.

Buyback guarantee

On Lendermarket, you will be able to get your loans covered by a buyback guarantee. This means that your investments will be bought back, if the borrower doesn’t repay before the loan is 60 days overdue. But as previously mentioned in this Lendermarket review, a buyback guarantee is only as solid as the one behind it – which in this case is Creditstar.

How strong is the company?

Lendermarket is a very new company that started operating in May 2019. Therefore, it is also difficult to come up with a complete assessment of how solid the company really is. However, they are a part of a big profitable finance group which is a huge plus.

We, therefore, believe that Lendermarket has good conditions for becoming a large P2P platform.

Registration Process

You can register using the link and avail a 5Euro bonus:

People who have created an European IBAN account can seamlessly transfer the money after doing a KYC and get started.People who do not know how to setup an IBAN account can read this blogpost:

I had also covered PeerBerry another P2P platform with buyback guarantee

Conclusion

My conclusion about the platform is that it seems like a a fairly secure platform due to the fact that they are managed by a profitable finance group. It has taken quite a few steps on its part to secure investors money.

One drawback of the platform Lendermarket is that the diversification options are limited as there is only one originator . It can be added to the portfolio along with other platforms to enhance yield.

However with that said, I do actually believe that Lendermarket is here to stay, and that we will see it grow over the next few years.

Lender market will stay but we need to wiestion the interest rates that are passed to the borrower and finally to the consumet.A cap on interest rates with not more than 8 per cent is good.i call it as frugal economy.

Lender market will stay but we need to wiestion the interest rates that are passed to the borrower and finally to the consumet.A cap on interest rates with not more than 8 per cent is good.i call it as frugal economy.