Nifty Financial Services Index or FINNIFTY as the ticker for the derivatives trading for the same is called as, is one of the many sectoral indexes in the NSE consortium. The Nifty Financial Services Index is designed to reflect the behavior and performance of the Indian financial market which includes banks, financial institutions, housing finance, insurance companies, and other financial services companies. Unlike Nifty Bank, Nifty Financial services try to encapsulate all the companies under the BFSI (Banking, Financial Services, and Insurance companies) umbrella In order to be eligible for FINNIFTY, companies should be included in Nifty 500. These in fact tell us a lot about the economic development and smooth functioning of the economy and thus also the economic health of the country.

The Base Date and Base Value for the index are 1st January 2004 and 1000 points respectively, It is currently at 19,249 points indicating a Holding Period Return of 19.25 times since inception some 18 years back.

FINNIFTY Characteristics and Constituents

NIFTY Financial Services Index is computed using the free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to a particular base market capitalization value, the same capitalization method as used by Nifty Bank as well as the other indexes in the NSE universe.

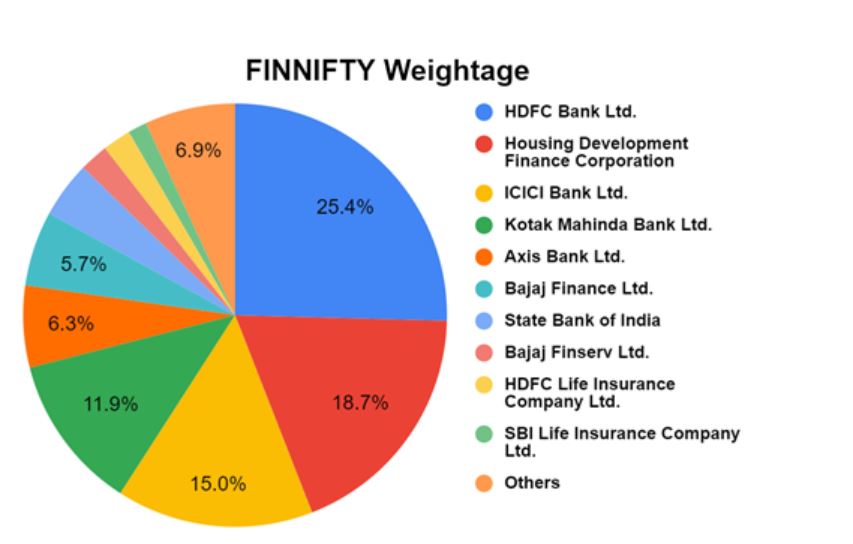

The Index is rebalanced semi-annually on 31st January and 31st July every year wherein stocks are included and excluded and newer weightage is given if necessary. The index is compromised of 20 stocks or constituents having the names of all of the big banks and other financial institutions’ names in it namely – HDFC bank with the highest weightage at 22.12%, ICICI Bank with a weightage of 20.75%, and HDFC with a weightage of 15.26% compromising of the top 3 constituents on the basis of weightage for the month ending on November 2022.

Top Banks such as Kotak Mahindra Bank, Axis Bank, and SBI bank also finds its name on the list along with NBFCs such as Bajaj Finserv and Bajaj Finance as well as insurance companies such as SBI Life Insurance and Hdfc Life Insurance. Banks have a total Weightage of around 63%, Housing Finance of around 17.5%, and NBFCs of around 8% the same as Insurance while the rest come under others.

Index Data Details – For the month ending November 2022 with the Index Price – 19,358

Price to Earnings (PE) Ratio – 19.45

Price to Book (PB) Ratio – 3.75

Dividend Yield – 0.75

Earning per Share (EPS) – 995.31

Introduction of FINNIFTY as well as its comparison with BANKNIFTY

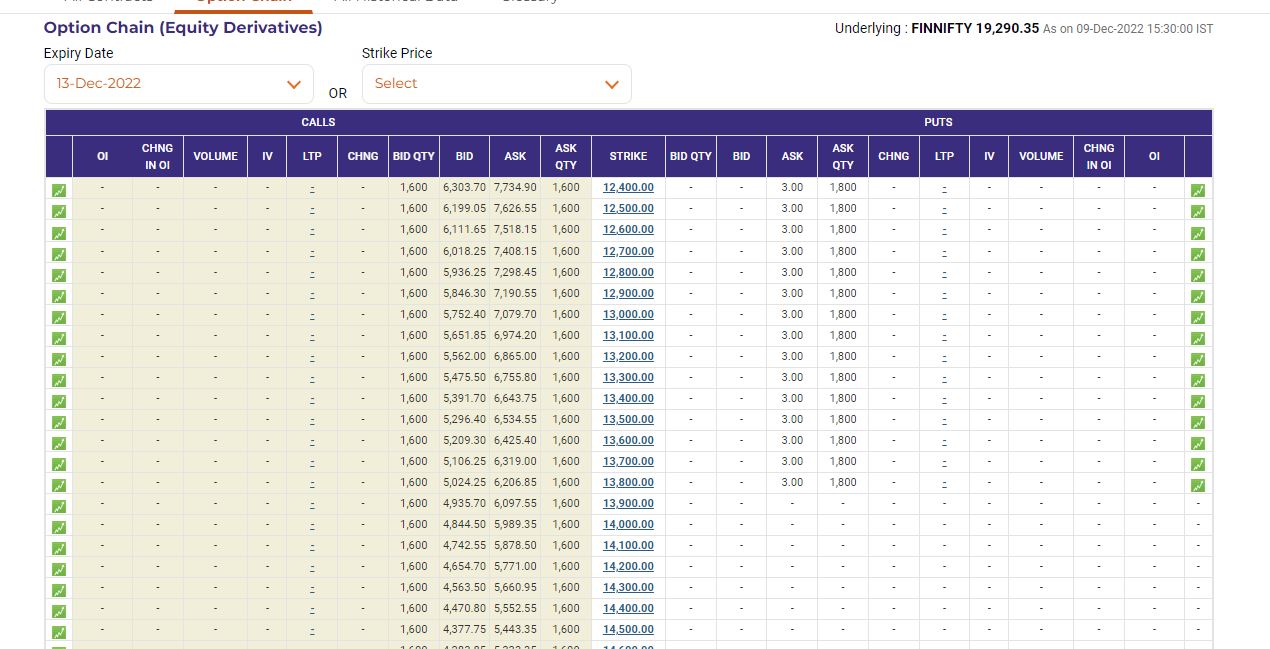

- FINNIFTY as mentioned above is the ticker name for the derivates traded with Nifty Financial Services Index as its underlying asset, the same as BANKNIFTY for Nifty Bank Index. The base date of the index is 1st January 2021, with each future and Options contract having a lot size of 40 as compared to Banknifty’s 25, and Nifty’s 50. FINNIFTY derivatives are settled in cash and the expiry date for the weekly and monthly contracts is the Tuesday of the week and the last Tuesday of the month respectively. The NSE has put Futures and Options in seven serial weekly contracts and three serial monthly contracts on offer, which means that one can buy or sell weekly contracts from then till 7 weeks and buy or sell monthly contracts 3 months from then.

- Futures that were always settled monthly will for the very first time now be settled weekly in FINNIFTY. They are a relatively cheaper index with a total contract value of 6 Lakh Rupees whereas a Bank Nifty contract value is around 8 Lakh Rupees leading to lesser margin requirements, these are at the time of introduction prices for the contracts.

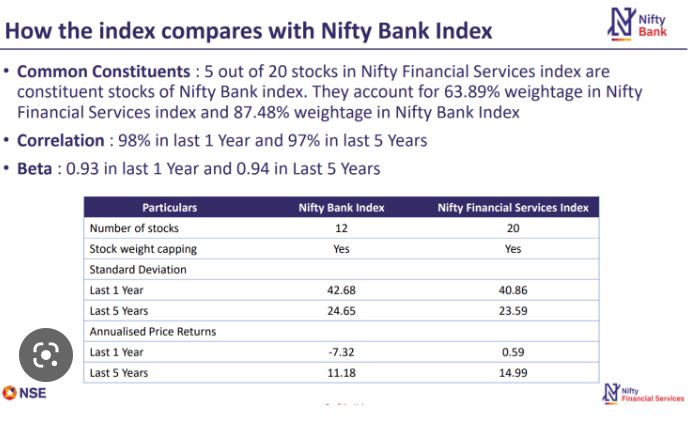

It provides much greater diversification than the Bank Nifty sector which has also, in turn, proven to be historically less volatile than the latter with FINNIFTY having just 63% of banks in its constituents but banks in Bank Nifty constituting 100% of it. - FINNIFTY has also over the past few years captured the massive move-up recorded by the insurance sector as well as the NBFC sector which the banking index could not, leading to theFINNIFTY being a historical outperformer.

- In just the past 5 years the Nifty Bank Index has given a total return of 71.5%, and the Nifty 50 has given a better return during the same time period at 79.0% whereas the Nifty Financial Services Index has beaten both by giving a return of 85.1%.

How to Invest in the FINNIFTY Index

So far the FINNIFTY index has performed very well. With more diversified exposure to different sectors of the Indian economy, it provides more opportunities to investors. With better diversification, lesser volatility, and greater returns than the Bank Nifty, FINNIFTY’s performance has been promising so far and is drawing more investors and traders to the NSE.

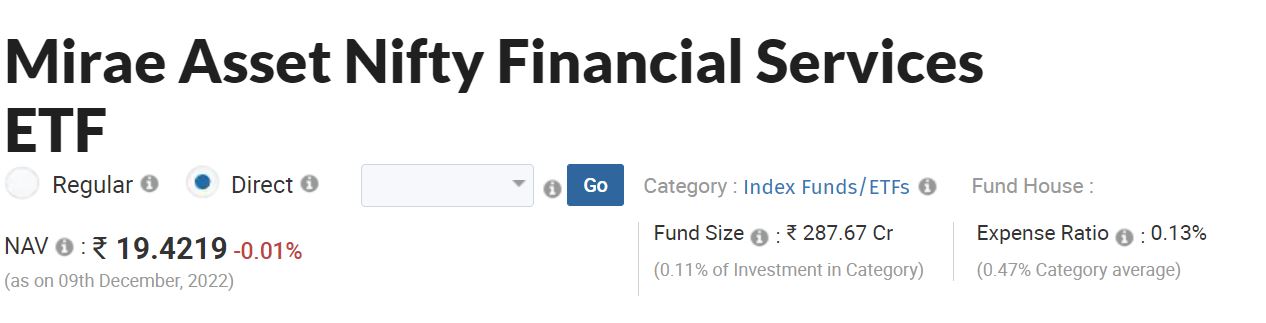

Investors cannot buy the index directly. However, they can invest via mutual fund schemes in funds that possess a weightage that is equal to and reflects FINNIFTY’s results. In order to be able to purchase FINNIFTY as an index, investors will have to buy the entirety of the 20 stock constitution in the correspondent weightage as mentioned. Such as through fund houses that have Nifty Financial services ETF available such –

- Mirae Asset

- Aditya Birla Sun life, and

- ICICI Prudential’s

Traders can trade the FINNIFTY index which has both weekly and monthly futures and options expiries on Tuesdays, for smaller timeframes than ETF investors. Although marred with criticism about its very small attraction which leads to usually very dynamic and high spike trades as compared to the Banknifty options. It is also according to an independent study concluded that the FINNIFTY options Volume is 25 times smaller than the BANKNIFTY options on a contract value basis. Traders are always advised to use caution and use stop loss limit orders.

Conclusion

The Nifty Financial Services Index represented also as FINNIFTY has proved to be an interesting investment option for investors, both due to its historical performance as well as futuristic growth projections, it should see more inflows and greater traction very soon from investors and the trading instrument for the same having extremely shallow options chains does have a future of growing and becoming a more regulated index. The Stock exchange has time over time shown a lot of effort being put into the promotion of this index and future investing and trading in this counter is bound to grow

Information required regarding forex trading investment and best broker which is authorized by RBI and SEBI also.

Hi,

Forex trading through online platforms is not approved by SEBI or RBI. You can only trade Forex on NSE through your broking account. Any broker such as Zerodha,Upstox etc allows trading in pairs such as USD/INR etc