The world of alternative investments is full of different innovative approaches to investing. At a time when traditional markets around the world have witnessed stretches of volatility and uncertainty, alternatives are becoming more and more lucrative for what they offer- an opportunity to diversify. Invoice discounting is one such innovative alternative approach to investing where the investor cashes in on businesses looking for funds to solve their short-term capital requirements by financing their unpaid invoices.

In this article, we will look at a detailed review of Monytics, an alternative investment platform that offers low-risk, short lock-in period investment opportunities in the form of invoice discounting along with innovative investments like Media invoice discounting and fractional real estate. We will start by briefly explaining invoice discounting, then look at what Monytics is, how it works, what it offers, and the team behind the invoice discounting platform.

Please note that Monytics is not a new platform. It used to be called Lendzpartnerz earlier. They received funding and have rebranded themselves. Now they offer more asset classes. We have reviewed Lendpartnerz in the past and have participated in multiple deals.

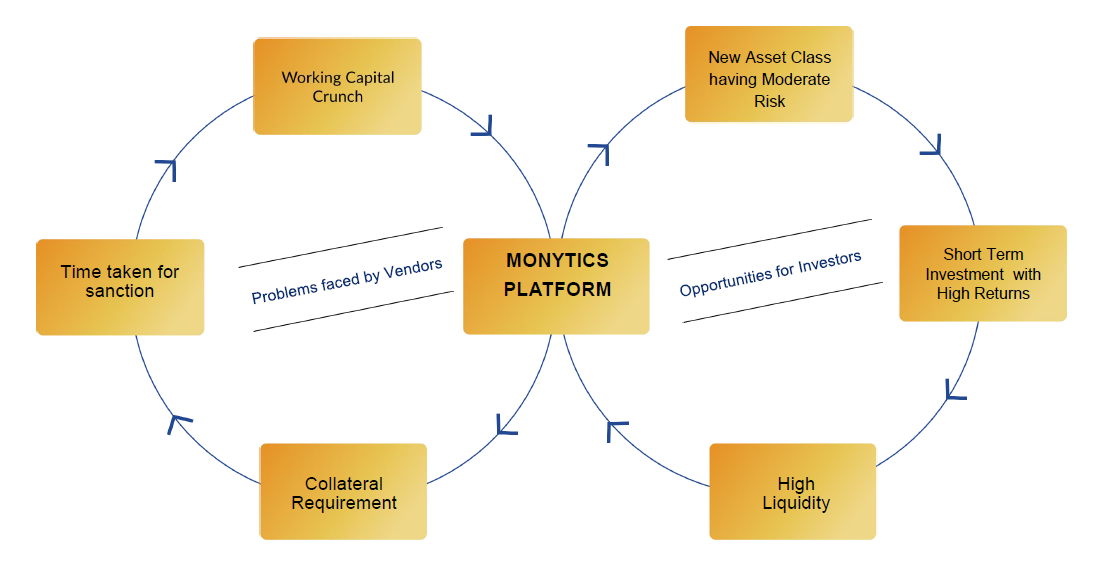

Before we evaluate the platform, for the sake of new investors, let us first understand invoice discounting alternative investment channels and their benefits in brief.

What is Invoice Discounting?

Invoice discounting is a financial arrangement where a business sells its unpaid invoices to a third-party financier or investor at a discount to secure its working capital without having to wait for the invoice’s payment term. The business receives immediate cash at a discount from the original value of the invoice, while the investor receives the full invoice amount when it is finally paid. Thus, the discount is the return that the investor gets.

For illustration, let us take the example of a business that delivers goods or services to a customer and raises an invoice for INR 10,000 with a 30-day payment term. Now, instead of waiting for the completion of the 30-day period, the business can offer its unpaid invoice to investors at a discount of, say, 5% for INR 9,500, thus receiving that amount upfront, fulfilling its short-term capital requirements. In return, the investor receives the full amount of the invoice on completion of the 30-day period, thus making a 5% return.

Why should you Invest in Invoice Discounting?

Before we look at what Monytics has to offer, let’s look at a few reasons why you should consider investing in invoice discounting.

- High Returns: Invoice discounting is an alternative that offers high returns over short investment periods, usually ranging between 30 to 90 days. A short lock-in period coupled with relatively high returns offers a reliable investment opportunity with predictable returns. Short investment durations offer quicker turnaround times and the opportunity to reinvest funds more frequently, potentially maximizing your returns.

- Relatively Low Risk: While not entirely risk-free, invoice discounting is generally considered less risky than other High Yield investment options, especially when the underlying invoices are from creditworthy businesses.

- Diversification: Investing in invoice discounting can effectively diversify your investment portfolio with an instrument that offers predictable returns over the short term. Investing in a portfolio of invoices from various businesses can help diversify risk and reduce exposure to any business or sector.

- Liquidity: Easy Liquidity as the tenor is short compared to other asset classes where liquidity is stuck.

It’s important to remember that invoice discounting also carries risks, such as possibly non-payment by customers and potential credit losses. Investors should carefully evaluate the creditworthiness of the businesses involved and the terms of the invoice discounting agreement before making an investment decision.

What is Monytics?

Monytics is an alternative investment platform primarily offering investors an opportunity to invest in invoice discounting, offering up to 12-15% returns. Besides invoice discounting, the platform also offers innovative opportunities to invest in media invoice discounting and real estate through fractional ownership. We will look at the details of each of these investment opportunities in the coming sections.

Monytics’ performance can be gauged from the infographic below:

Team Behind Monytics

The core team of Monytics includes Shashank Lunkad, Mohit Kokil & Kshitij Lunkad, who are the CEO, CTO & legal adviser, respectively. All of them have years of experience in finance & their respective domains. The team has the backing of several entrepreneurs and banking & finance experts as their advisors and angel investors.

Investment Opportunities on Monytics

While invoice discounting is Monytics’s primary focus, the platform also offers two other investment opportunities, which we have briefly covered earlier. Let’s look at the different investment opportunities offered by Monytics in greater detail.

-

Invoice Discounting

Monytics offers invoice discounting opportunities, allowing investors to invest in the invoices of blue-chip companies. Monytics takes unpaid invoices as collateral and allows investors to invest in these while generating working capital for businesses. The platform claims to thoroughly check the credibility of the invoices using proprietary AI and ML technology. The lock-in period for invoice discounting is shorter, with the vendor (debtor) paying the money within a duration of 60-90 days. One can expect returns of up to 12-15%. It is ideal for investors seeking short-tenure, low-risk opportunities.

-

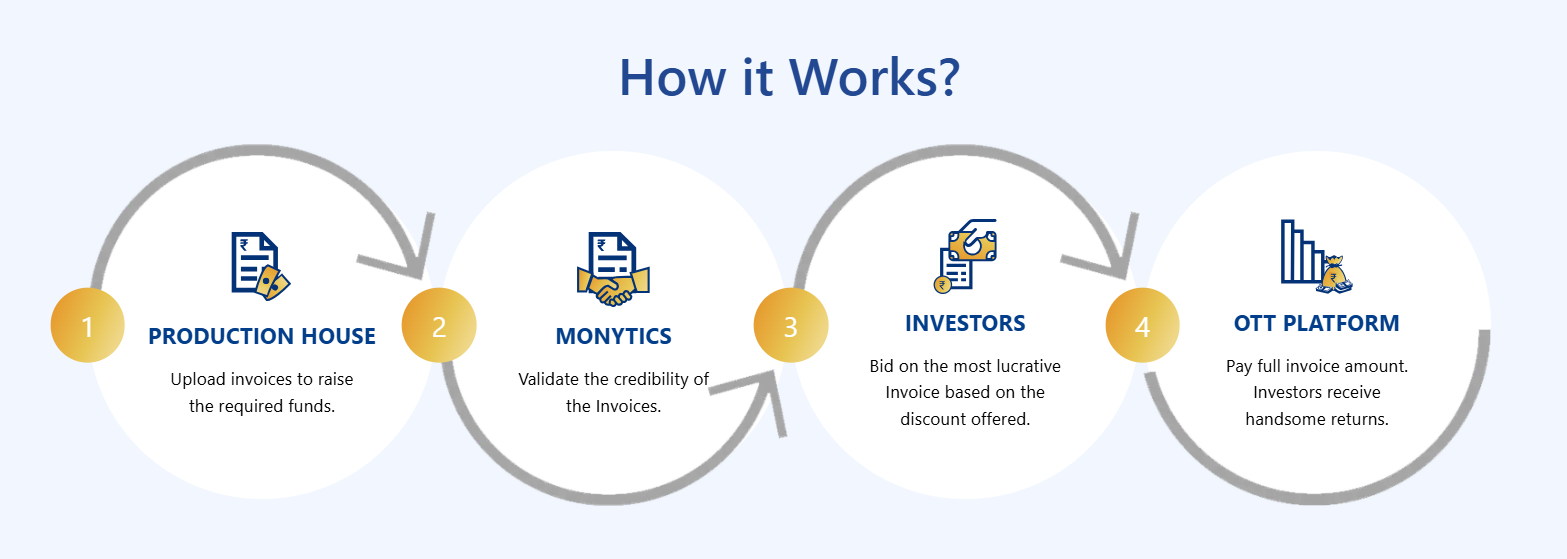

Media Invoice Discounting

Media invoice discounting is a financing solution that allows production houses to generate cash by using their sale invoices as collateral. Similar to how invoice discounting works in general, Monytics uses unpaid invoices from production houses as collateral, enabling investors to invest while providing working capital for these businesses. The lock-in period is usually 3-12 months, and an investor can expect a 12-16% return.

-

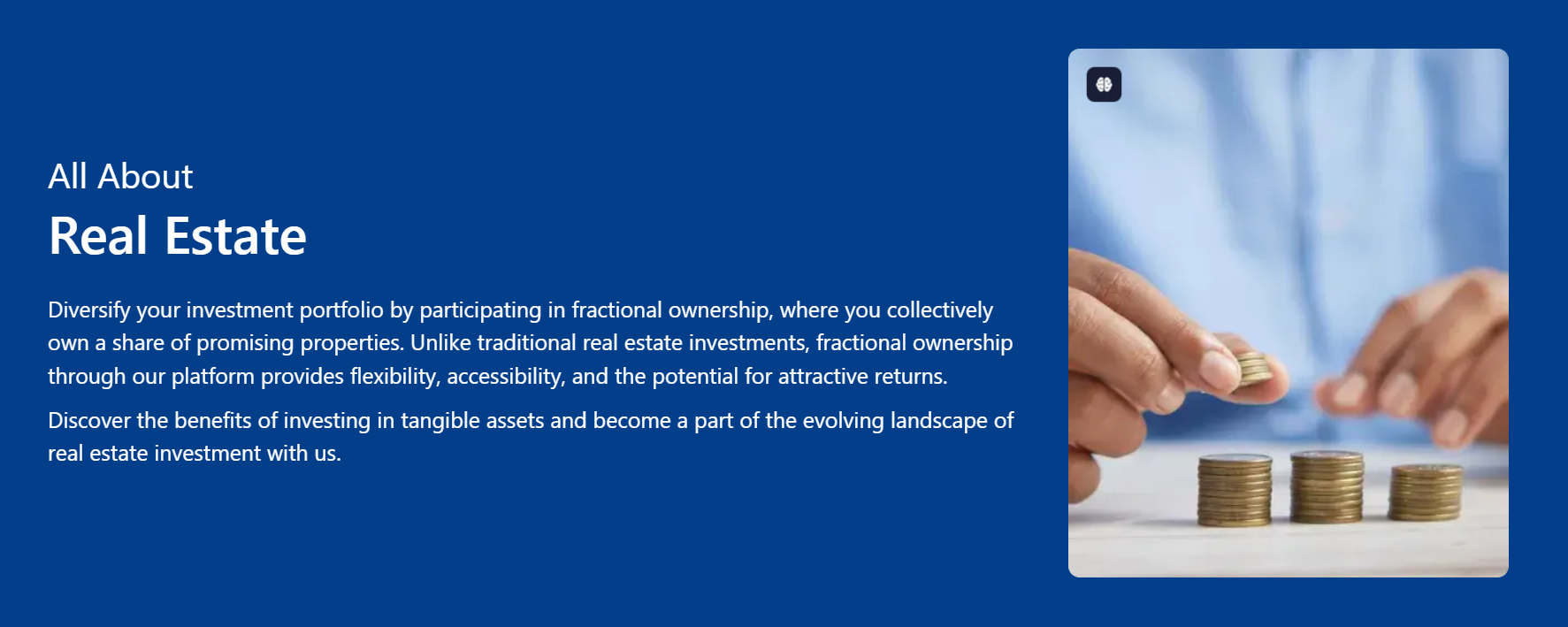

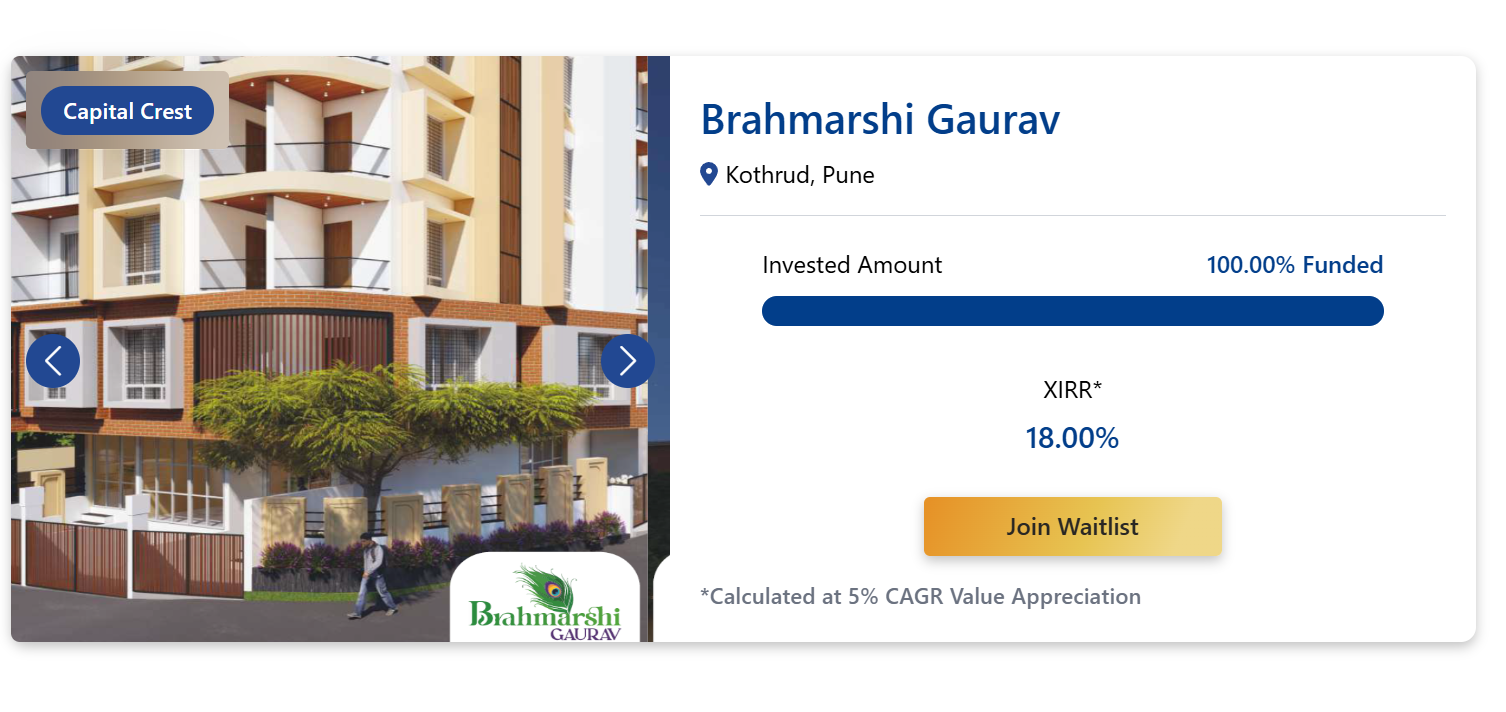

Real Estate

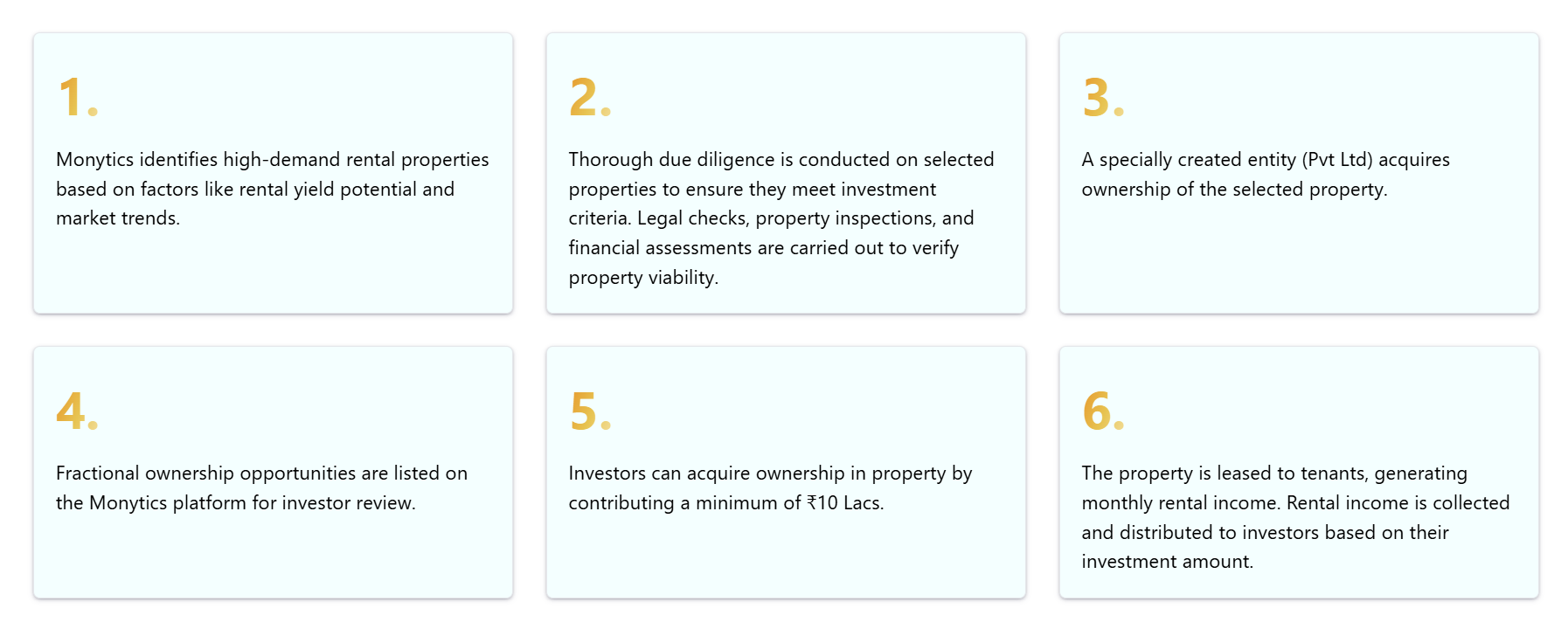

Monytics allows you to invest in real estate through fractional ownership of properties. The platform allows investors to explore available properties, review legal documentation, and understand the financial aspects. Fractional ownership allows you to own a share of high-value commercial or residential real estate properties for a significantly lower investment amount compared to traditional real estate. Monytics claims that its rigorous vetting process ensures that investors’ capital is deployed into secure real estate opportunities, minimizing risks for a safer and more reliable investment experience. It is ideal for investors looking for medium-to-long-term opportunities in real estate or a relatively lower ticket size.

How Monytics Works?

Now that we have looked at the different investment opportunities available on Monytics let’s understand how the platform works and how you can benefit from these opportunities.

As an investor, you are simply required to sign up on the platform, and you’ll get access to a range of investment opportunities from the categories we have discussed above. The platform’s interface lets you navigate through available deals, with information on what each deal has to offer, invest funds, and track your returns.

For Invoice Discounting, vendors or debtors looking to raise short-term working capital upload their unpaid invoices on the platform, which Monytics then assesses to validate their credibility before offering the deals on the platform to investors. Once the deals are listed on the platform, investors can bid on the most lucrative Invoices based on the discounts offered. On completion of the lock-in period, the vendor pays the full invoice amount, and the investor receives the discount as a return.

A similar model is followed for media invoice discounting opportunities on the platform.

For Real Estate, Monytics offers three different types of real estate investment:

- Capital Crest: Offers a single, substantial payout at the end of the investment period.

- Harvest Flow: Provides regular interest payouts, offering a reliable source of passive income.

- Fractional Investment: Allows investors to own a portion of real estate properties without the need for substantial capital. An investor enjoys the dual benefit of regular rental income and potential capital appreciation. Investors can acquire ownership of a share in the property by contributing a minimum of ₹10 Lacs.

Real Estate Opportunities on Monytics Explained

Capital Crest model

- Monytics identify and shortlist top location and builder

- Agreement between builder and LLP( a new company for investing)

- Investors invest in 5% of Asset value to become partners.

- The property investment is done at a discount.

- After the end of the holding period property is sold at the market rate.

- Minimum Investment INR 10 Lakh

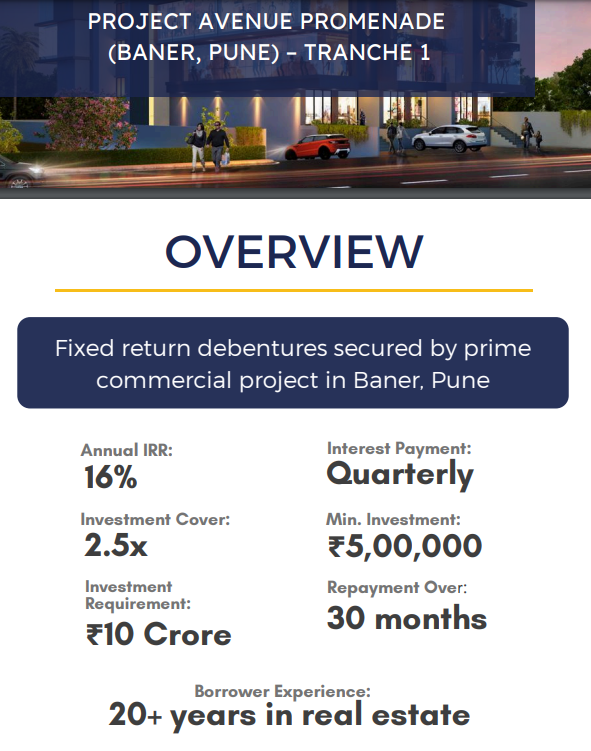

Harvest Flow Model

Monytics offers high-yield NCD for real estate projects with hard collateral as a guarantee.

- 2x principal cover, backed by mortgage

- Escrow Account: All cash inflows will be deposited into a trustee-controlled escrow account to ensure transparent fund management.

- Project Monitoring: A dedicated project monitor will oversee construction progress and approve payments to ensure smooth execution.

- High Demand: Invest only in opportunities where a significant chunk of the project is already sold, and strong purchase interest is evident, minimizing the risk of project delays.

- Minimum Investment INR 5 Lakh

Personal Experience of Investing in Monytics

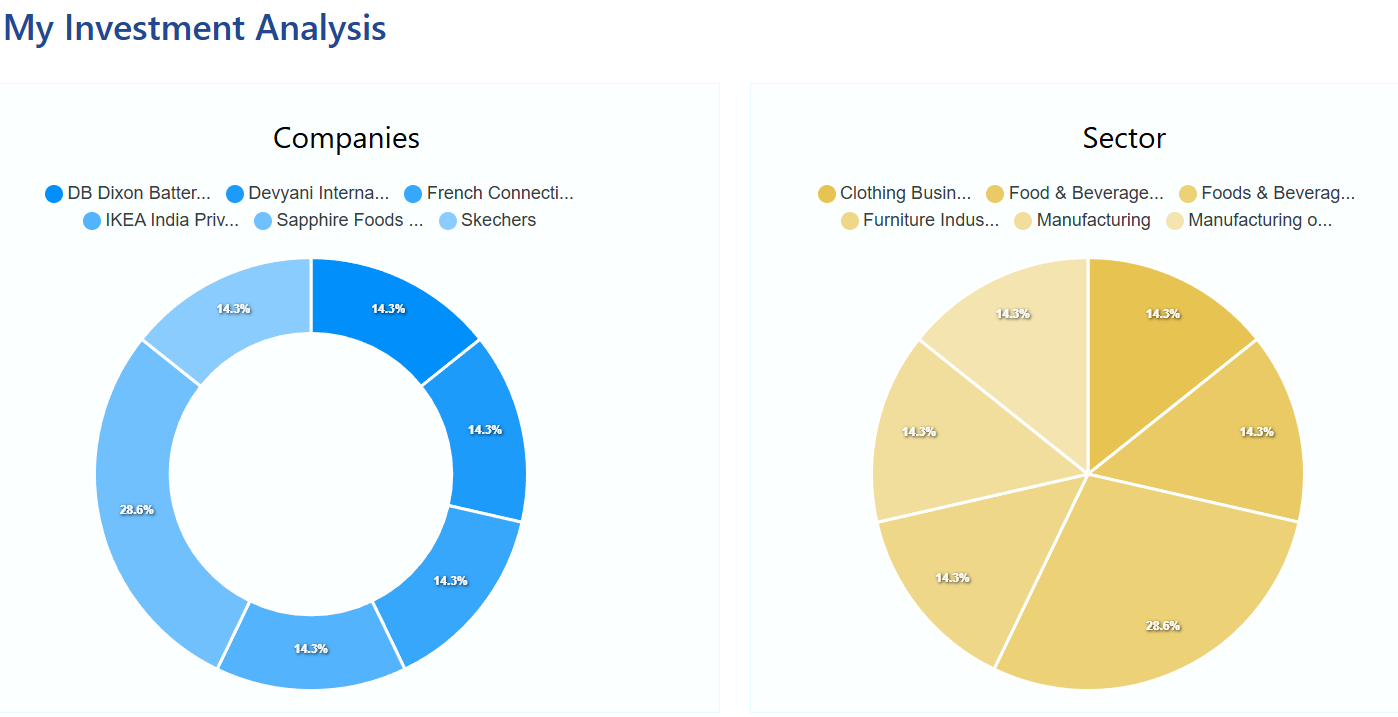

We have participated in multiple invoice discounting deals on Monytics in the past. Their performance has been good without any delays or defaults faced in any investment. Other investors also had a positive experience. Some of the deals we participated in :

- KFC

- French Connection

- Sapphire Foods

Monytics Alternatives

Several players in the alternative investment space primarily deal with invoice discounting. Some of them have been in the market for more than 4-5 years and are quite popular. We have published detailed reviews for the popular ones listed below and have been investing in most platforms since their inception.

- Tradecred- Tradecred Review | 3 Year + Experience with Tradecred

- Altgraaf- Altgraaf Review

- Betterinvest – Betterinvest Review

- Tapinvest- Tapinvest Review

Conclusion

Invoice discounting can be a rewarding alternative investment, especially if one is looking to make relatively high returns in shorter periods. Monytics is a promising alternative investment platform that offers invoice discounting opportunities, among other alternatives, such as media invoice discounting and fractional ownership.

Several well-known companies like Cipla, Colgate, and Devyani International Limited (KFC) offer invoice discounting deals on Monytics. Besides, the platform has a good track record with over 95% repeat investors.

Monytics has listed a few interesting opportunities for real estate also that can be evaluated and compared with similar opportunities in the market. We will share our experience of investing in other opportunities also in monthly review on randomdimes.com

Hello,

Could you please sugesst which is most safest platform & instrument in alternative investment category. I had invested whole year(2023) with altgraaf and whatever i earned, I lost in single deal due to default (Aarzoo deal) with altgraaf. Scared to start new investment with any platform. therefore request you to write one blog on safe way of investment with alternative investment and safe suggestions.

Hi Kamlesh,

Unfortunately all form of investments come with their risk such as credit, market or regulatory.

Diversification is one way to reduce the risk . Do not invest significant amount in one deal. Maybe you can also explore platform like Policy Exchange that have less credit risk as investment is in gsec. However you should understand the product in detail before starting your journey