The Sandbox is an Ethereum-based blockchain project that has gained tremendous attention for its ties to the metaverse. On The Sandbox platform, users can create their own virtual worlds, interact with others, and create digital assets like non-fungible tokens (NFTs). These can either be integrated into this online game or added to the platform’s marketplace. Interest in the metaverse has spiked, following a series of high-profile moves from big tech players in recent weeks. Most readers know about the high-profile renaming of Facebook to Meta Platforms.

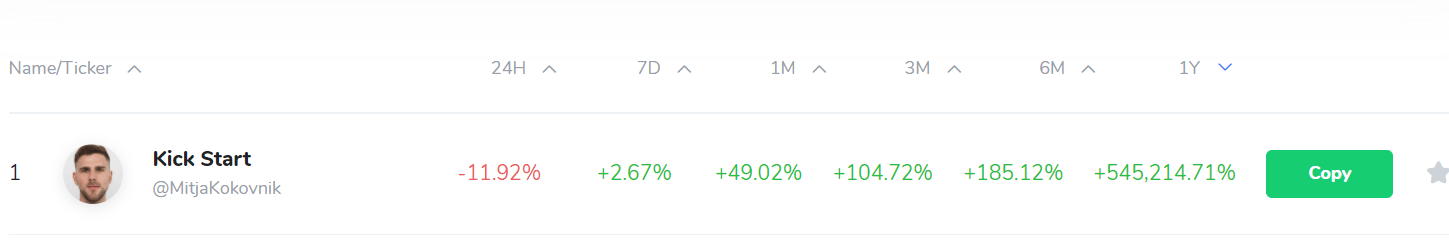

One trader on Iconomi Platform killed the Sandbox and Shiba Inu euphoria by generating 600000% returns over a year giving me major FOMO ! Back home panic around the upcoming crypto bill shook the Indian crypto prices compared to the global peers.

My Alternative Investment Portfolio Performance

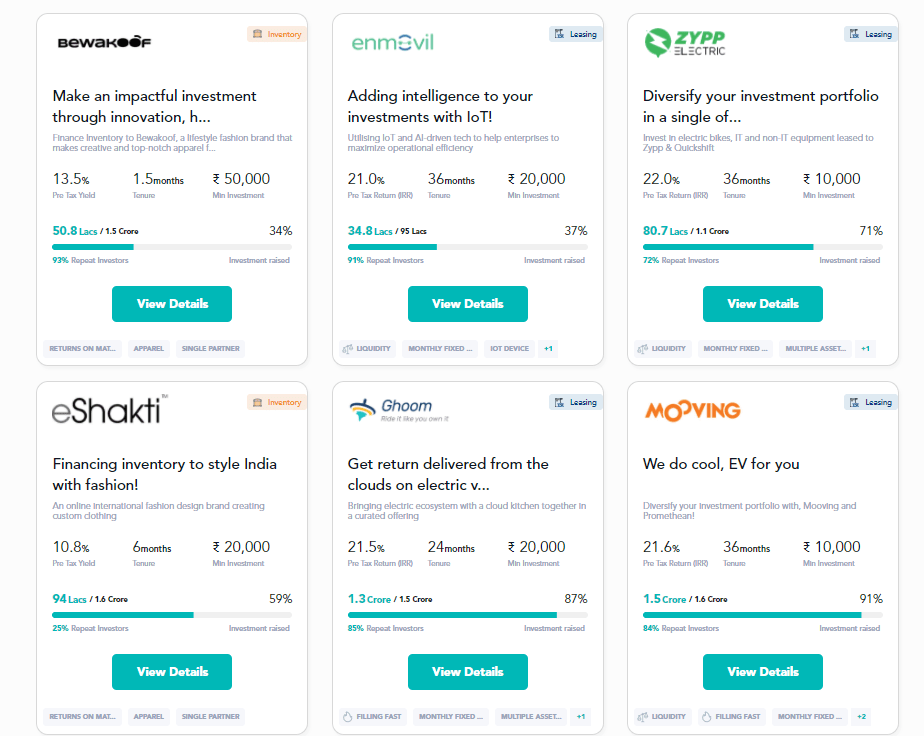

This month have added a new product – Cashkumar Elastic Run Asset

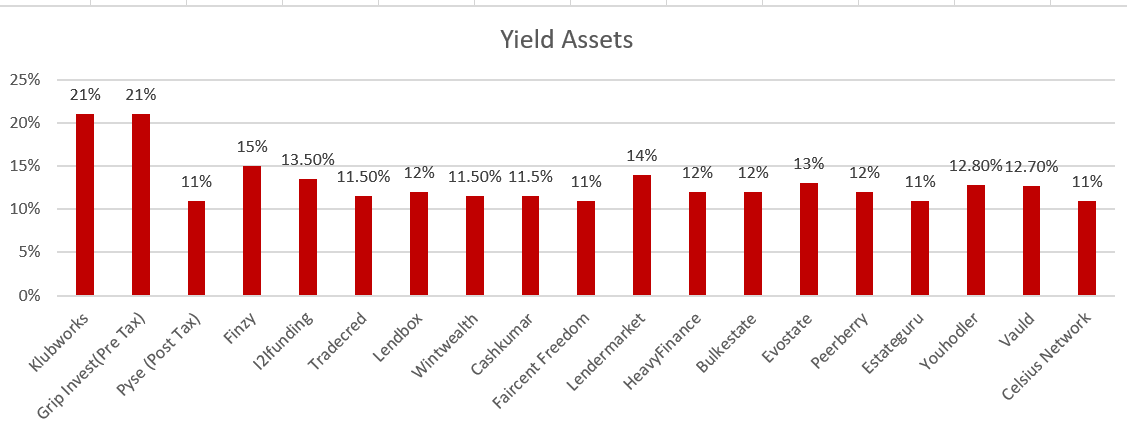

Structured Lending Investment

| Platform | Return | NPA |

| GRIP Invest | 12-13% (post tax) | Nil |

| Klubworks | 20-23% | Nil |

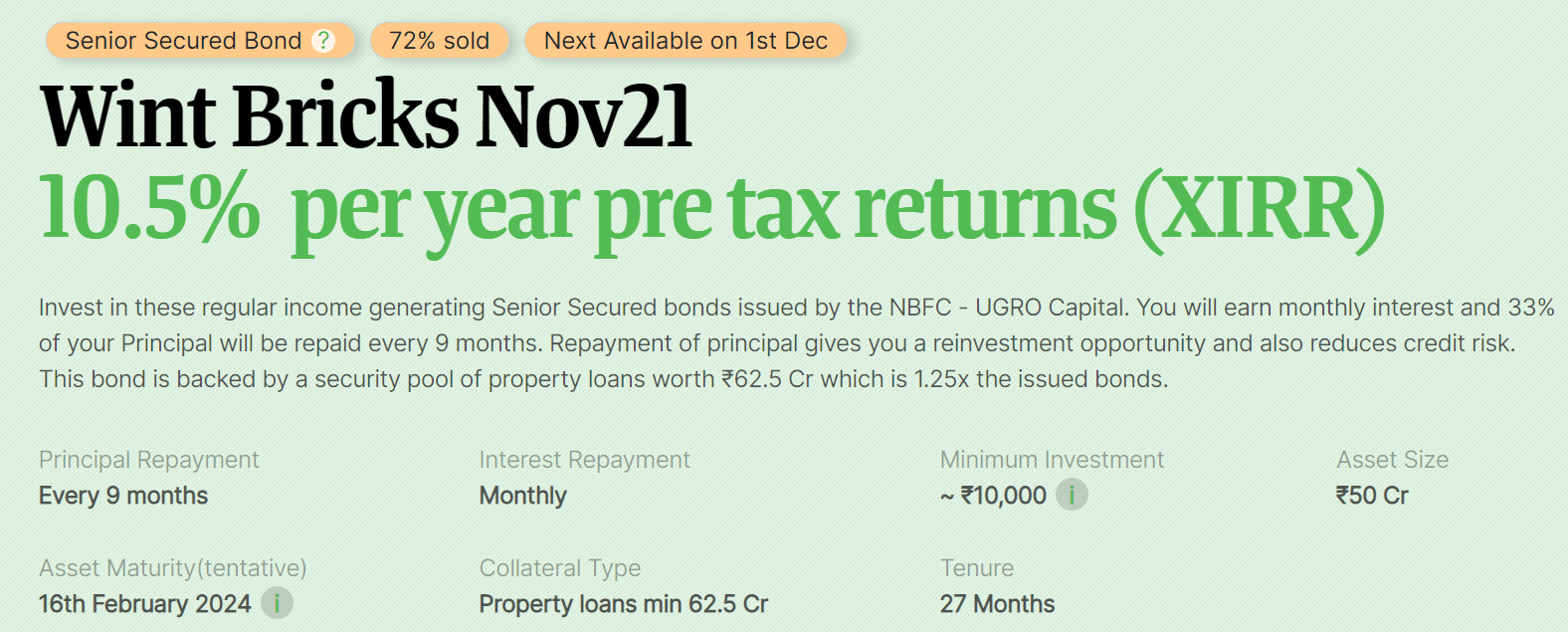

| GrowFix(Wealth Wint) | 10%-11.00% | Nil |

| Pyse | 10%-11%(post tax) | Nil |

- Wealth Wint Issue for Senior bond is live with INR 10k minimum investment

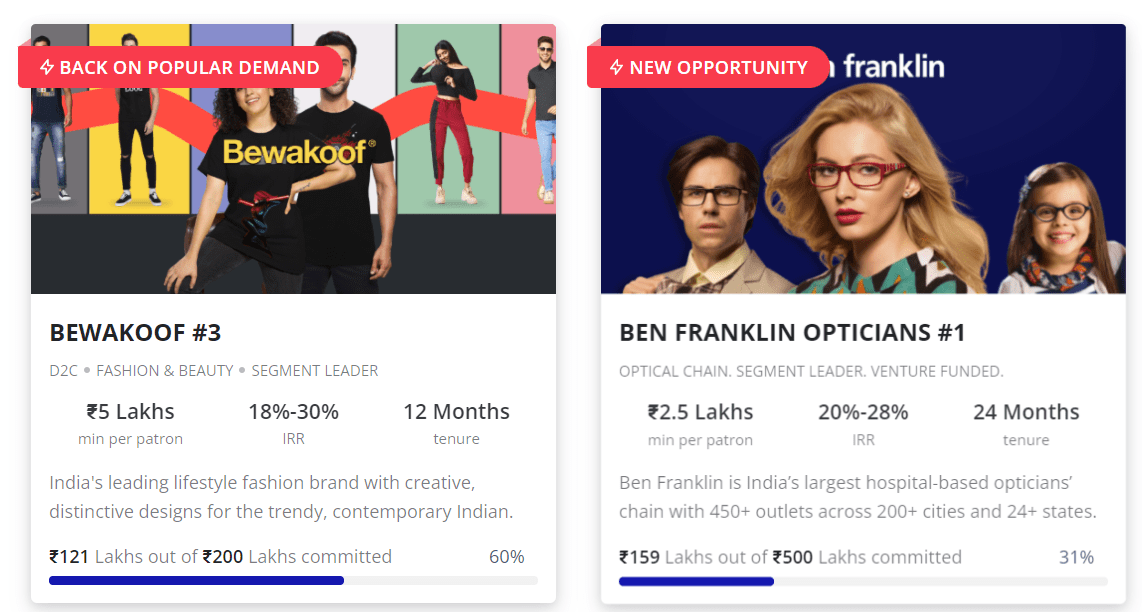

- Grip has recently launched a 1.5 Month deal with Bewakoof with 10.5% yield!

- Klubworks had few new deals including Bewakoof etc

- All my cashflow in Klubworks, WintWealth,Pyse and GripInvest are as per plan.

New Deals

Invoice Discounting and Settlement Finance

| Platform | Returns | NPA |

| TradeCred | 12% | Nil |

| Lendbox(settlement Finance + gold Loans + Per Annum) | 11.70% | Nil |

| Cashkumar(Elastic Run) | 11.50% | Nil |

- TradeCred listing frequency has increased considerably for investment tickets

- Lendbox settlement finance returns and Per Annum returns are as per expectations

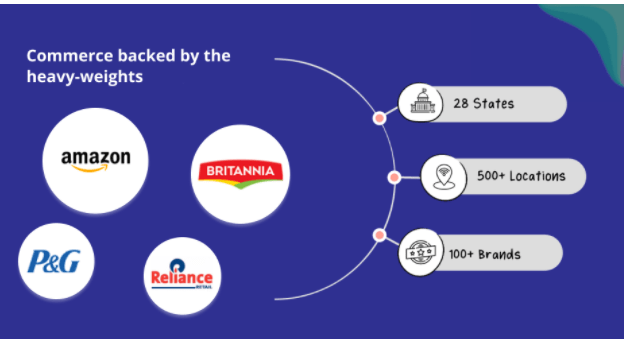

- Have invested in Cashkumar Elastic Run Product which gives fixed yield.

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(Stopped) | 13% | 5.5% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- Use Winvesta multicurrency for managing a global portfolio (now Winvesta has zero maintenance Fees)

- Covered Reinvest24 this month. Platform is doing great with new opportunities in different geographies

Equity Market

- Highly-vaccinated Austria has imposed a new COVID lockdown in response to increasing case numbers .Other european countries also saw an uptick in cases.These events have driven some risk-off sentiment, with tech stocks outperforming the broader market .

- IPO Frenzy in India met with a rude shock when Paytm tanked 25% on listing day. People expecting IPO listing to be free lunch can relook their opinion

Crypto Lending Investing

| Platform | Return |

| KuCoin | 20%(market dependent 10-60%) |

| Celsius Network | 11.5% |

| BlockFi | 8.6% |

| Youhodler | 12.7% |

| Vauld | 12.6% |

- Coindcx is also offering 14% return on USDT

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Youhodler Paxg (Gold backed coin) offering 8.2% yield over gold returns

People who bought Tether at 60 when it crashed on rumours of crypto ban ,got a great deal. Others can wait before fresh investment as volatility can be high due to upcoming bill

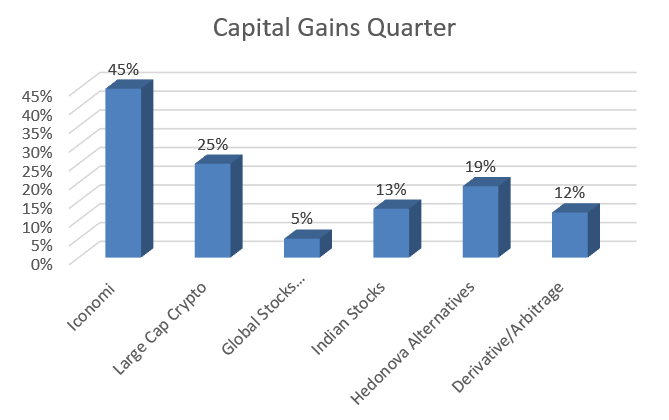

Crypto Investment

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 55% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 6% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 10% |

- A trader on ICONOMI generated 600000% returns in a year.Which means if someone invested 1000 USD in the strategy he would have made 6 Million USD!!

P2P Investment

Current allocation:

- Rupeecircle- 5%

- I2IFunding- 15%

- Finzy- 20%

- Lendbox-25%

- Faircent-20%

- Cashkumar-15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks backed loans,E-Rickshaw backed loans,education loan,NBFC backed loans(Monedo etc) Group loans | 13.6% | 5% |

| Cashkumar | Elastic Run Product | 11.5% | 0% |

| FINZY | Prime Borrowers,High Salary ,A category | 14.2% | 3.5% |

| Faircent ( Only Pool Loans) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- Have added Cashkumar in my portfolio for Elastic Run Product.

- Systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

Other Alternative Assets

| Platform | Assets |

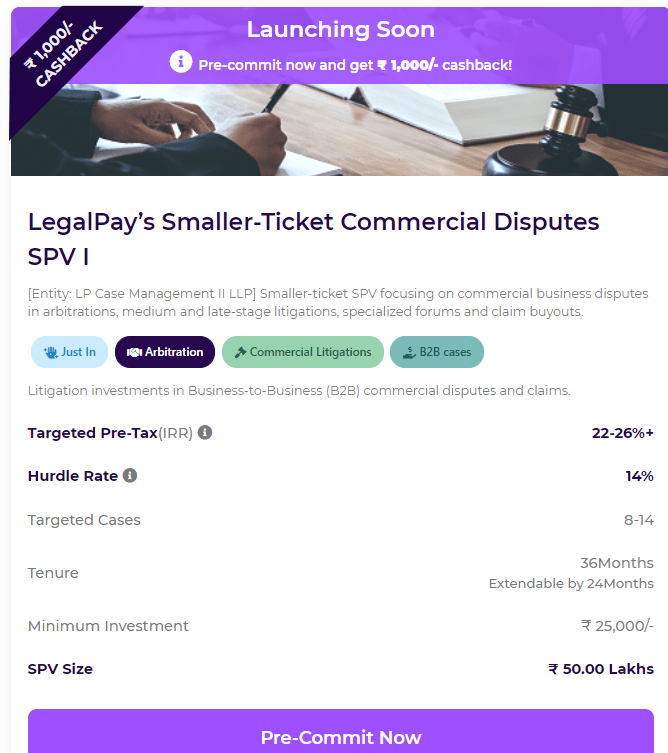

| Legalpay (Promo code FV48G4) | Litigation Funding |

| Raison | Tokenized Pre IPO stocks |

| METEX | Palladium/Platinum |

| Vinovest | Exotic Wines |

- There is an upcoming deal on Legalpay. Prebook and get 1000 cashback! We will get the status of the first investment by January 2022.

- Some of the investment in Raison have done well!