One thing is on everybody’s mind these days. What to buy at these level when economy and financial markets are at extreme opposite end of performance!

When all the asset class are rallying everyday it’s hard to compare the valuation and risk .We end up choosing from a small set of securities without considering about the available universe.The problem is that it is so hard to stand aside from all of the emotional triggers that are going off in our heads during those times.

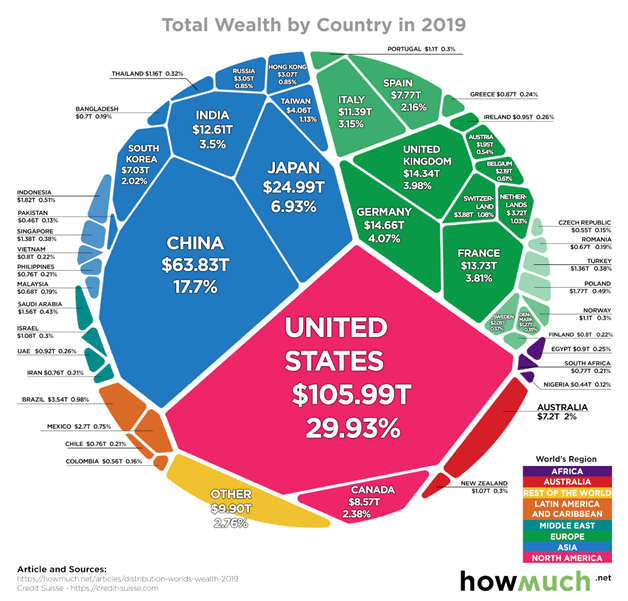

It’s best to take a step back and analyze the size and valuation of the global market as a whole

To start with we cannot ignore the elephant in the room : USA !

It is by far the biggest market by capitalization .

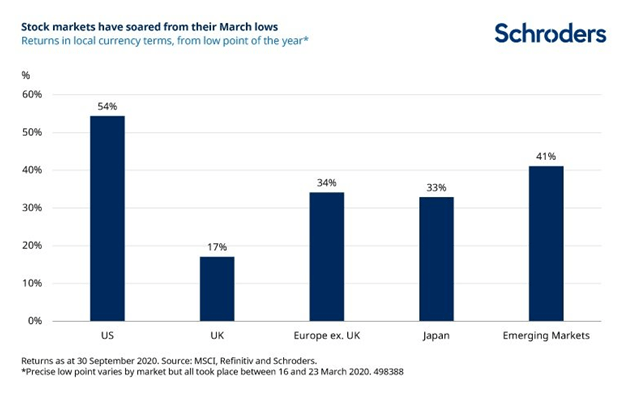

How much have the market in various countries gone up since the crash ??

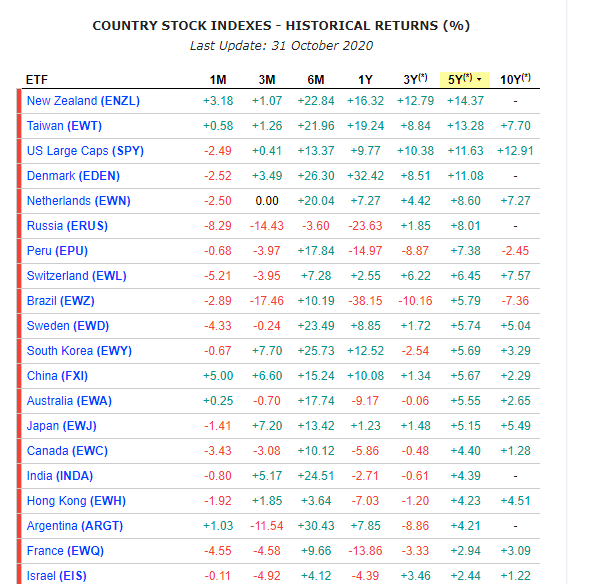

Which countries have performed the best in last 1 ,3,5 and 10 years?

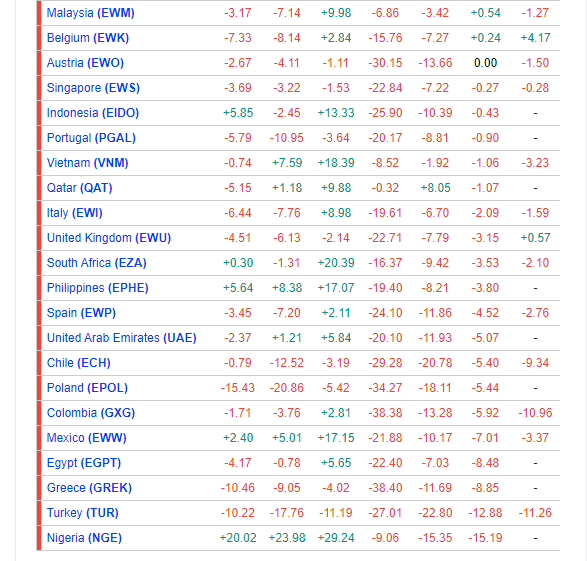

Which countries have performed the worst in the same period? (arranged by 5 year performance

What are various ways to calculate valuation of markets?

Forward P/E

A common valuation measure is the forward price-to-earnings multiple or forward P/E. We divide a stock market’s value or price by the earnings per share of all the companies over the next 12 months. A low number represents better value.

An obvious drawback of this measure is that it is based on forecasts and no one knows what companies will earn in future.

Trailing P/E

This is perhaps an even more common measure. It works similarly to forward P/E but takes the past 12 months’ earnings instead. In contrast to the forward P/E this involves no forecasting.

CAPE

The cyclically-adjusted price to earnings multiple is another key indicator followed by market watchers, and increasingly so in recent years. It is commonly known as CAPE for short or the Shiller P/E, in deference to the academic who first popularised it, Professor Robert Shiller.

This attempts to overcome the sensitivity that the trailing P/E has to the last 12 month’s earnings by instead comparing the price with average earnings over the past 10 years, with those profits adjusted for inflation. This smooths out short-term fluctuations in earnings.

When the Shiller P/E is high, subsequent long term returns are typically poor. One drawback is that it is a dreadful predictor of turning points in markets. The US has been expensively valued on this basis for many years but that has not been any hindrance to it becoming ever more expensive.

Price-to-book

The price-to-book multiple compares the price with the book value or net asset value of the stock market. A high value means a company is expensive relative to the value of assets expressed in its accounts. This could be because higher growth is expected in future.

A low value suggests that the market is valuing it at little more (or possibly even less, if the number is below one) than its accounting value.

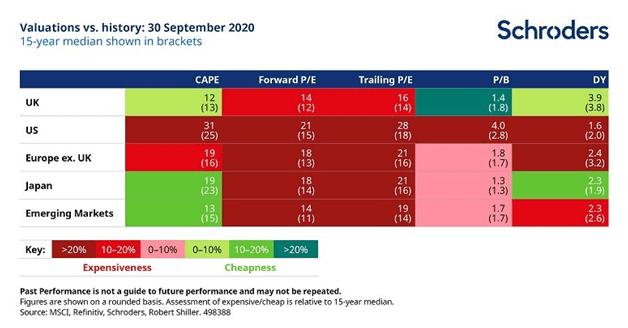

Current valuation of various countries?

Valuations are expensive!!

The big downside of share prices having run so far ahead of company fundamentals (e.g. earnings) is that, when we update our regular analysis of stock market valuations, it is not a pretty sight.

Whereas, back in mid-March, our valuation grid was a field of green, today it looks more like someone has spilled a glass of red all over the page. Of the 25 measures of stock market valuations in the table (five markets and five measures for each), 19 are in expensive territory. 12 are more than 20% expensive compared with the median of the past 15 years . Nothing looks especially cheap. Investors have to brace themselves for lower expected returns across the board.

Four of the five cheapest stock markets in the world today are in emerging markets, according to analysis by the publication Investment Week*. Russia, Turkey, Poland and Korea are joined in the ranking by sole developed market Spain.

Turkey has been the worst performing market of the five year-to-date and is down 26.5%**. It is followed by Spain (-19.8%**), Russia (-18.2%**) and Poland (-13.8%**). Only Korea is in positive territory with returns of 2.75%**

How to buy these countries?

You can find ETF from all developing countries on ETFdb.com website.You can either choose specific countries or buy ETF with allocation across geographies. You also need to analyze the the reason for the countries underperformance

https://etfdb.com/etfdb-category/emerging-markets-equities/

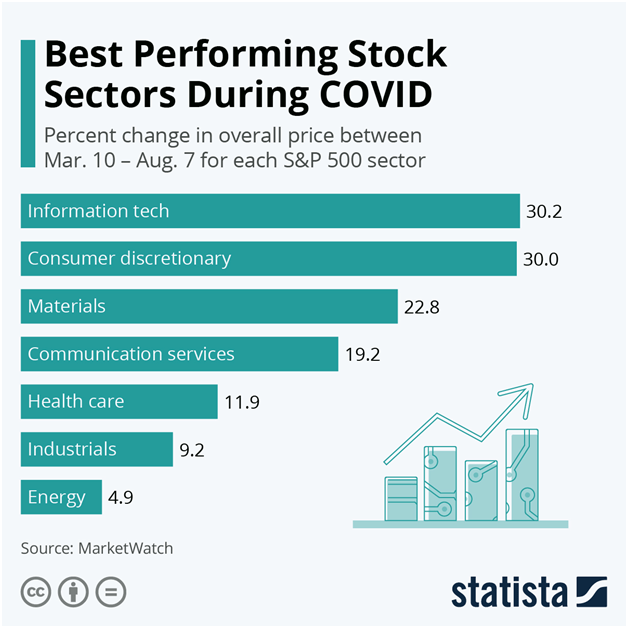

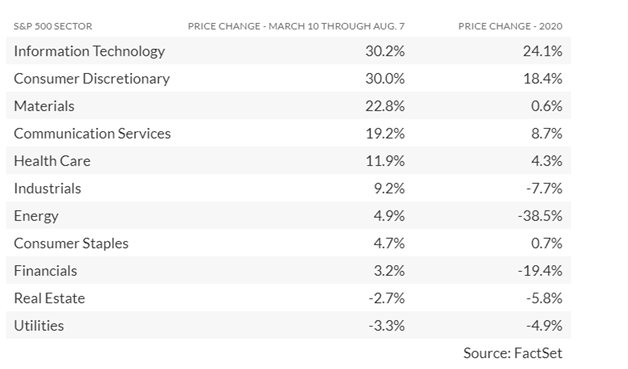

What about Sector Performance this year?

It Is evident that Real Estate and utilities have lagged while Technology has benefitted during covid period.

The information technology sector has been the strongest during the pandemic and for all of 2020 so far, but the consumer discretionary sector (which includes Amazon.com US:AMZN, up 67% during the pandemic and up 71% for 2020) is close behind. The energy sector has pulled back from its level at the end of the pandemic’s first 100 days, even though the price of oil has risen another 10% since June 17.

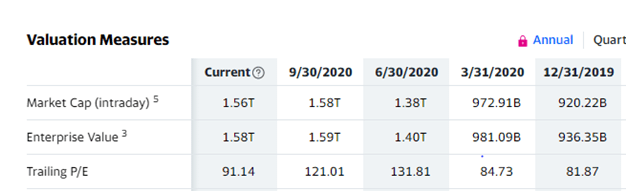

FAANG valuation has been crazy..eg Amazon currently at 90 PE !

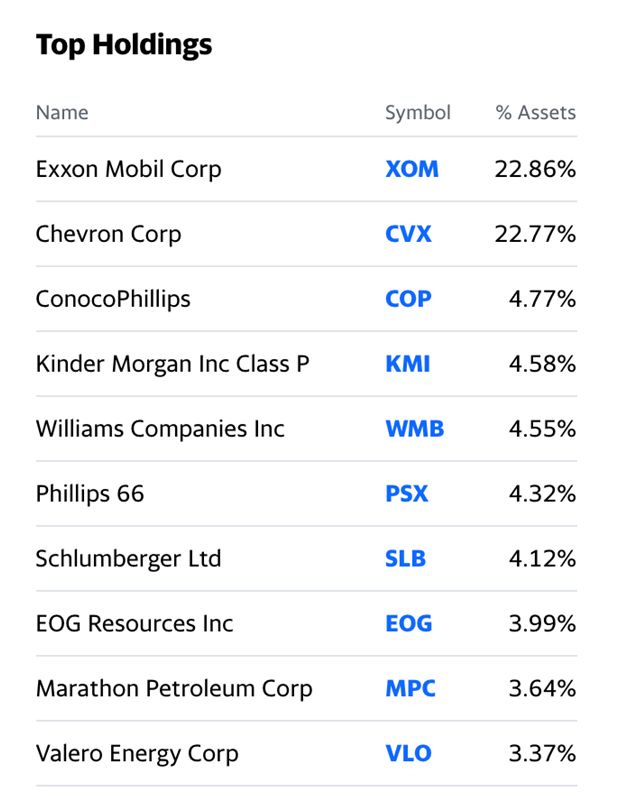

People looking to buy stocks at cheaper valuation can look at Real Estate, Energy and Utilities or maybe financials

How to buy these sectors?

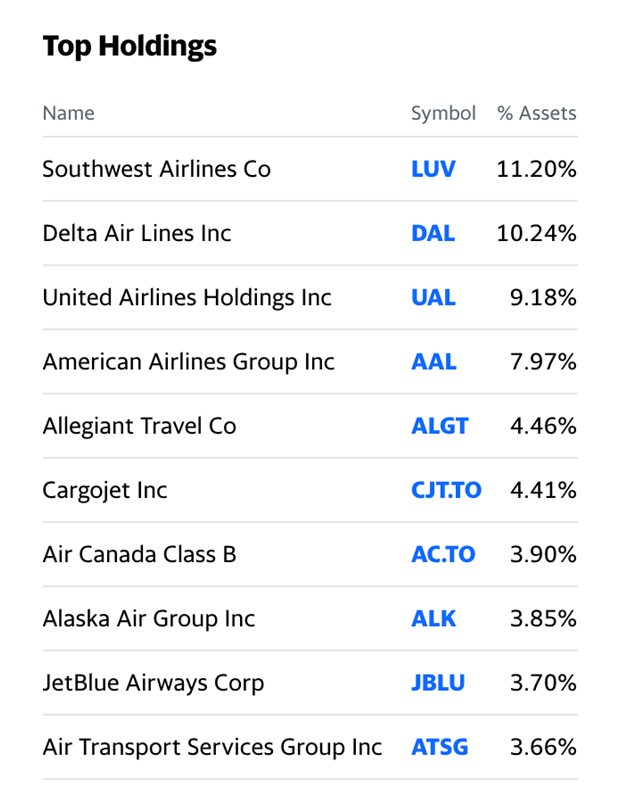

Lower oil prices typically are bullish for airline stocks as they reduce operating costs. Meanwhile, the reason for the decline in the price of oil sent airline shares lower. The spread of coronavirus that caused lockdowns caused the demand for crude oil to evaporate earlier this year. The price of the energy commodity on the CME’s NYMEX division fell below zero for the first time since trading began in the 1980s. Business and pleasure travel ground to a halt as many areas banned all visitors. Coronavirus took a heavy toll on the energy and airline sectors. As the second wave of the virus is now spreading across Europe and with rising cases in the US, the pressure on energy stocks and airlines continues as we head towards the end of a very usual year.

While the stock market experienced an almost V-shaped recovery since March, the energy and airline sectors did not participate. High-flying technology stocks rose to incredible levels over the past months, leaving the debt-laden energy and airline sector in the dust. The stocks of many of the leading companies in these two sectors are trading at bargain-basement prices. The second wave that is now bearing down on Europe and the US is likely to push share prices even lower, which could create an opportunity for the coming year.

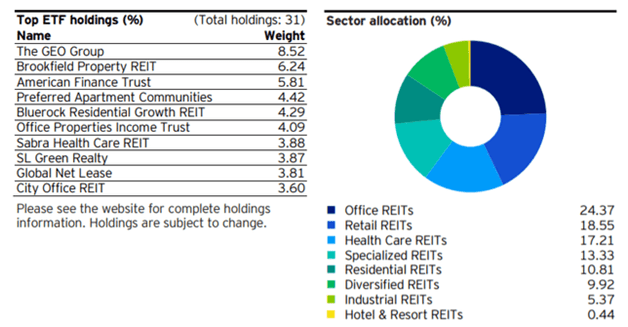

Similiarly Real Estate was hit due to lockdown as Malls,Schools, Restaurants, Gym and Offices closed which was big loss of rental income for REITS.Some of these REIT are trading at attractive valuation now

REAL estate exposure can be taken through REIT ETF or individual REIT.

Example KBWY REIT ETF offering 8% yield at current price

Energy Select Sector SPDR Fund (XLE)

Other covid impacted industey which are lagging include airline .Exposure can be taken through US Global Jets ETF product (JETS)

How to buy selected ETF/REIT?

People in India can easily register on Stockal or Vested to buy these ETF /Stocks. These platform now allow online money transfer .Your money is secured under The Federal Deposit Insurance Corporation (FDIC). A detailed comparison between the 2 in my other post

A good resource on REIT

Good Resource on ETF

https://seekingalpha.com/etfs-and-funds/etf-screener

Conclusion

Stocks are at crazy valuation but there are sectors and geographies which have underperformed. If people can tactically invest in those geographies and sectors in a phased manner they can expect good risk adjusted returns .However all sectors have a decent beta so this is not the best time for going all in but a staggered approach is advised.