Why do we even need Health Insurance? How are these insurance companies making profit ? Are we being taken for a ride?

It’s very important to understand how insurance business works to appreciate that insurance can be a win-win situation for customer as well as the Insurance company. Any portfolio is incomplete without health Insurance!

Why Do we need health Insurance?

“Health insurance has to be the toughest thing on earth to sell,” said Christopher Graves, president and founder of Ogilvy’s Behavioral Science Center. “Especially if you’re trying to sell it to somebody who’s young, healthy and has not had some catastrophe health-wise.

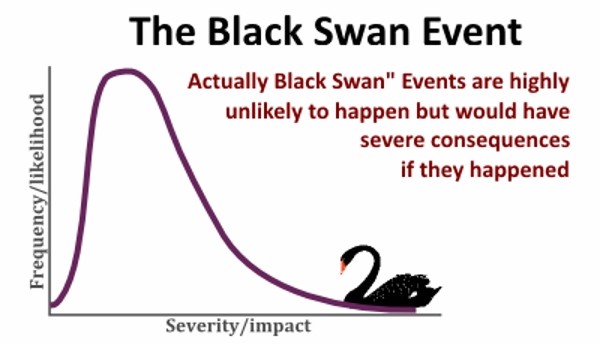

Health Insurance is Like a Put Option on Health if you choose not buy ,nothing will happen for years but one bad outcome and you can have unlimited losses. It’s best to buy health insurance which can protect you from worst losses in case of a Black Swan Event. If you have accumulated 1 Cr corpus you are always scared of a crash but nobody thinks how much impact a health crisis can do to your portfolio!

How do Insurance Companies Make Money?

Insurance works on 2 simple mathematical principals

- Law of Large Numbers

- Expected Value

Law of Large Numbers

The first concept that insurance relies on is known to statisticians as “ Law of Large numbers”

Think of Coin Tossing. You pull out a coin and you see how many heads you can flip in a row. You flip one or two heads in a row easily. But you start to find that it’s much harder to keep getting heads

This is because the probability of you flipping a head is 1/2 or 50%. But 2 heads in a row is (1/2)*(1/2) or 1/4 or 25%. So statistically you’ll only flip 2 heads in a row once out of every 4 tries.. The probability of flipping 6 heads in a row is 1/64 or 1.5%. As Insurance companies write millions of policy impact of bad luck due to few claims becomes insignificant

Expected Value

Think of a bet. You roll a fair dice; if you roll a 6, you get $6. If you roll anything else, you pay $2. Should you play?

The answer is no. You will lose money if you play long enough. Simply, the result is obtained by multiplying each probability by the money gained or lost and adding the results. In this case 6*1/6 – 2*5/6 = -4/3 i.e you end up paying.

Now replace price with premium and claim and probability which chance of paying claim. Actuary ensure that in the long run they have positive expected value.

Shortlisting a Health Insurance Policy

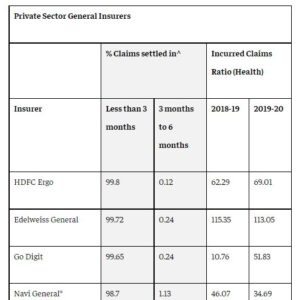

People keep checking hundreds of factor,most of them have no significant bearing ,but ignore critical factors. Example people are concerned about best Claim Settlement Ratio (CSR) ,however there is only a marginal difference for most top rated companies

Claim Settlement Ratio (CSR) is a percentage that reflects the total number of claims settled with respect to the total number of claims received by the insurance company. In other words, the CSR gives you an idea of the possibility for the insurance company to settle a claim that you are likely to make.

Things which matters the most while buying a policy

- How much cover to have?

- Essential Features Provided in Policy

How much Health Insurance cover to have ?

2 reasons people need insurance

- Unexpected sudden event like accident, covid etc,short term events but high impact

- Life Disease or long term health problems(cancer, heart condition)

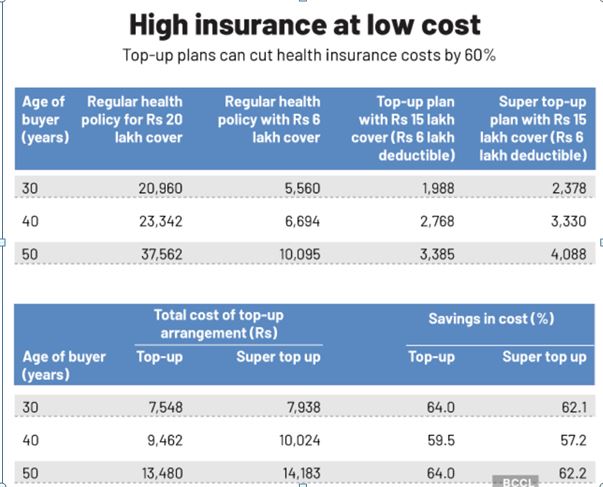

If you are younger case 1 has higher probability and case 2 will gradually catch up. The goal is to maximize the Cover at the lowest possible Price

Let’s say you are starting at 35 . Say if there are 5 people in family 2 parents and your spouse . The goal is to maximize cover for everyone .Efficient combination is

- Floater Policy

- Supertop up

Individual vs Floater Health Insurance

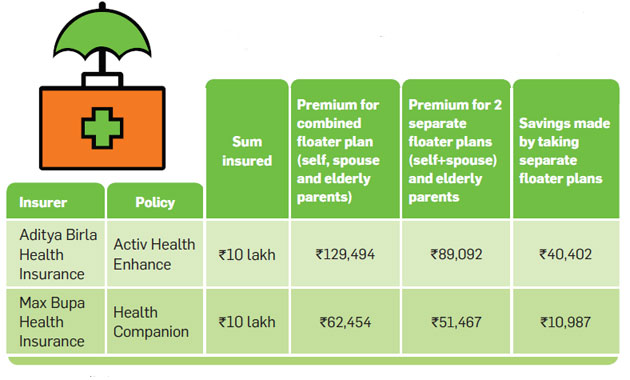

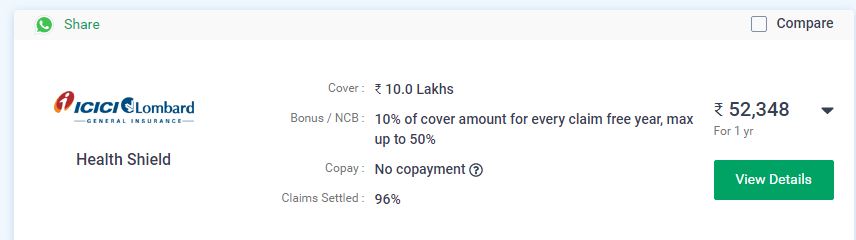

Individual policies are always more expensive than floater. Why ? Floater policy risk is less as total claim is less compared to multiple single policy . When you have old parents individual policy is super expensive. It’s a risky trade for the insurance company

You can imagine for both parents its close to 1 lakh

Another important feature of Floater is that the premium is calculated based on oldest person hence go for 2 floaters; 1for you and spouse and other for parents. This way you reduce premium also can collect no claim bonus as chances are you would have less health problem

*caveat in certain cases like prexisting condition better to go for specialized policy. A medical illness or injury that you have before you start a new health care plan may be considered a “pre-existing condition.” Conditions like diabetes, COPD, cancer, and sleep apnea, may be examples of pre-existing health conditions.

Super Top Up Policy

A super top-up health insurance plan is like an extension of a health insurance you can use when you’ve already used the maximum claim amount (during the year).it covers claims for cumulative medical expenses within a policy year once you’ve exceeded the deductible versus a regular top-up that only covers claims when a single claim goes above the deductible!

Think of it like an out of money put option. If things go bad beyond a point it covers you. Also remember go for super top not top up policy. Top up requires minimum deductible for each claim!!

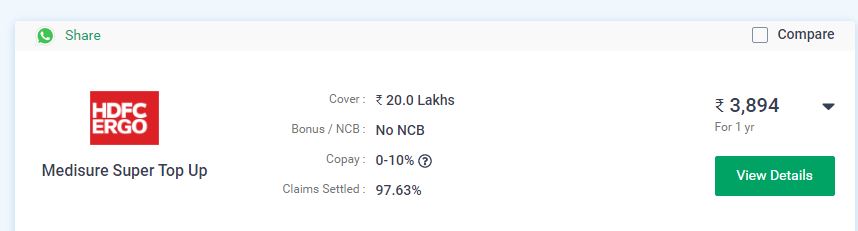

Super top up for you and spouseSupertop is slightly expensive than topup but very useful

Verdict

You can cover your family by Floater + Large Super Top up .You can save on tax in 80 D section which further lowers the outgo.

Essential Features Provided in Policy

- Avoid Copayment, You don’t know the amount of bill you might have to pay 30-40% Copayment can be huge. If policy is great maybe a 10% max

- Check for restrictions on room & room rent

- Check for Disease Wise Sub-limits

- Seek a Low Waiting Period (for those with existing conditon

- Opt for pre and post-hospitalization care

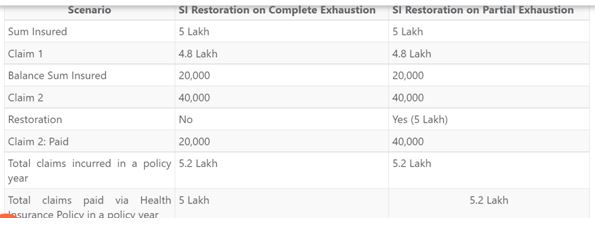

- Ask for restoration benefit (partial exhaustion is better)

Analyze if the selected plan is comprehensive or not. Keeping the policy price aside for a while, compare the plan in terms of premium versus benefit. Benefits such as pre and post hospitalization, day care procedures, OPD cover and maternity extensions or ambulance service, should be considered.

If you are considering buying a health insurance and looking to find the best policy do Whatsapp me

Conclusion

Health Insurance is a must with escalating cost of medical service. If you think you do not need to buy insurance you are living on hope which is not the greatest financial plan !