Government bonds are debt instruments issued by the state and central government. Whenever the government fund shrinks, they issue bonds to the public. Government bonds give a sovereign guarantee and a fixed rate of return. Investors can invest in government bonds directly or through mutual funds. Read more to know more about it in detail.

What are Government Bonds in India?

Government bonds are debt instruments issued by the government. These instruments are issued for government spending by the Central and State Governments of India. These instruments are popular among investors for their fixed-income benefits.

Government bonds in India are generally a long-term investment that can range from 4-40 years, and it comes under the government securities (G-Secs) category.

Types of Government Bonds in India

Government bonds may vary based on tenure, coupon rates, and the issuer of the bond. Let’s have a look at different kinds of Government bonds:

Fixed Rate Bonds

As the name suggests, the rate of interest remains fixed throughout the investment tenure. Market rate fluctuation does not affect the coupon rate of return in fixed-rate bonds however price fluctuation can occur due to changes in interest rates in the market. It is a good investment option for conservative investors who seek to hold the bonds till maturity.

Sovereign Gold Bonds (SGB)

SGBs are issued by the Central Government of India where the underlying asset is gold. This is a good investment option for investors who wants to invest in gold for an extended period without holding it physically. Moreover, it is more efficient in terms of returns as compared to physical gold. There is a 2.5% annual coupon apart from the gold price benefit.

Inflation Indexed Bonds

In this kind of bond, the principal and the interest earned are proportional to inflation or deflation, also called inflation-linked bonds. They can be traded in the secondary market and are issued to retail buyers. Currently, there are no inflation-linked bonds available in the Indian market.

RBI Floating Rate Bonds

As the name suggests, this kind of bond periodically changes its rate of return. Changes in the rate of interest are declared before these bonds are issued. For example, a floating-rate bond could announce an interval of 6 months where the interest rate changes every 6 months over the bond’s tenure.

- 7.5% GOI Savings Bond: As per the rules set by the RBI, this kind of bond can be held by-

- An individual or individuals who are not NRIs

- A minor having a legal guardian representative

- A Hindu Undivided Family (HUF)

Earnings in the form of interest from these bonds are taxable based on the investor’s income tax slab, according to the Income Tax Act 1961.

Zero-Coupon Bonds

Zero-Coupon Bonds give zero interest. The investor generates income in these bonds in the form of a difference in the issue price and the redemption value. These bonds are generally issued at a discounted and can be redeemed at par.

Pros of investing in Government Bonds in India

- Sovereign Guarantee: With a sovereign guarantee, the government is obliged to pay the investors back in cases of default on the payment by the primary obligor. The investment is secure, and it is the main advantage for the investors buying Government bonds.

- Regular Source of Income: According to the RBI, interest earnings accrued on Government Bonds are to be distributed every six months to the investors which gives a great opportunity for the investors to earn regular income.

- Assured Returns: As mentioned, the investors get a sovereign guarantee and fixed rate of interest for a certain period, and that is the reason they are preferred over equities for investors who seek assured returns.

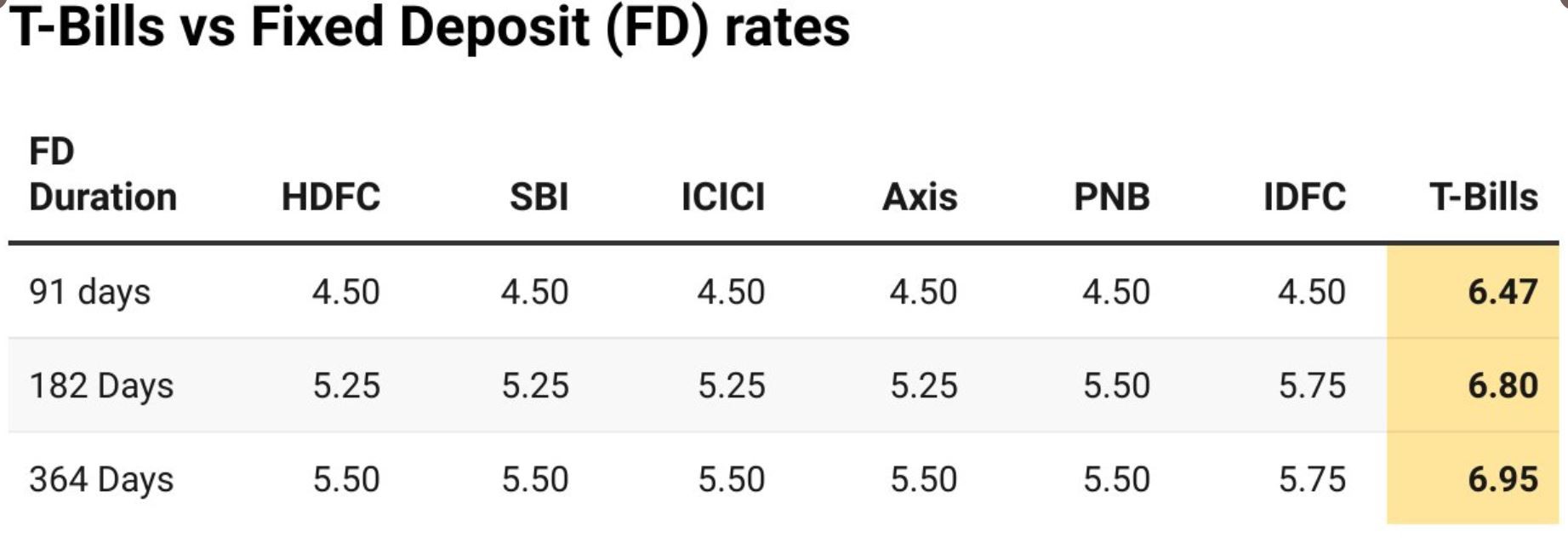

As seen in the current market scenario yields on T-bill and Government securities are higher than Bank Fd and are a good replacement for them

Risk of Investing in Government Bonds in India

- Less Income: The yield of most government security is less than 7%. The taxation of these instruments is also at a marginal tax rate applicable to your bracket. Earnings in other investments can fetch a higher yield

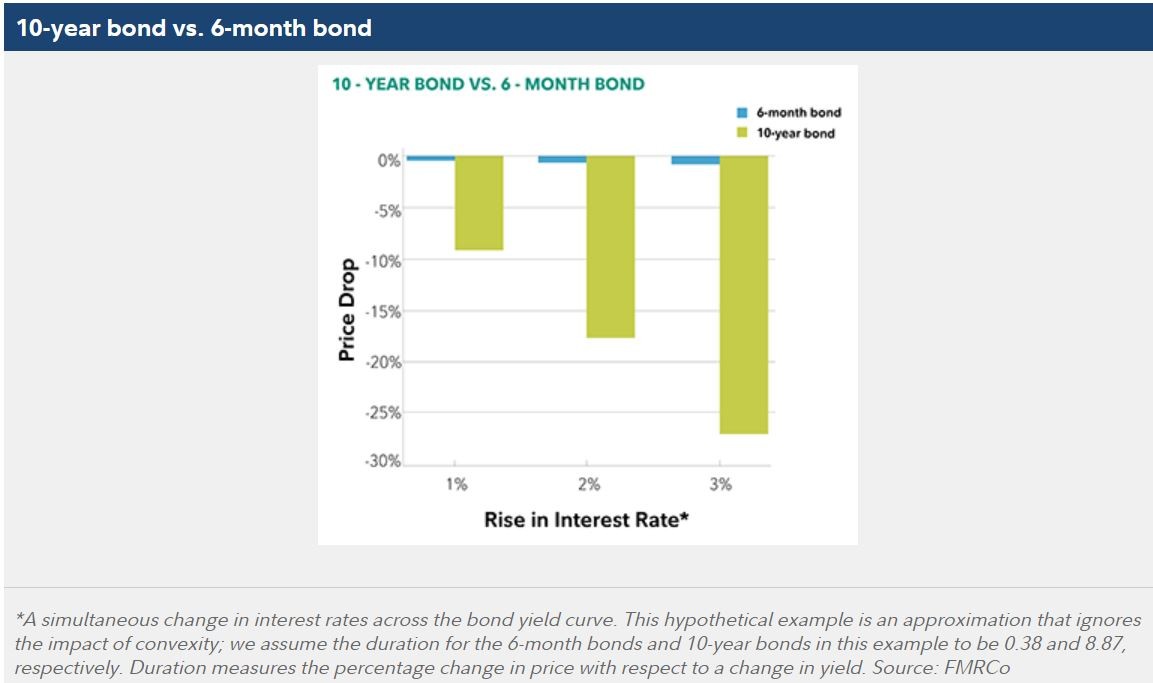

- Interest Rate Risk: The tenure of investment in Government Bonds for the long term can be 4-40 years which means there is a high-interest rate impact, also called duration risk for any increase in interest rate. Holding long-duration bonds makes sense for only those investors who have a view on the interest rates or plan to hold the bonds till maturity

Who Should Invest in Government Bonds?

- Conservative Investors-Government Bonds give a fixed rate of returns for the long term and give Sovereign Guarantee and it can be a great investment option for the investor who does not have much exposure to the stock market. The yields are higher than saving bank account and deposit even for 90-day Government T Bills hence should be preferred.

- To Diversify– Investors looking to diversify the risk from their portfolio may invest in Government bonds as it provides a fixed interest rate.

- Low Investment Amounts-Individuals can invest in Government bonds for as low as Rs. 1000 which makes it attractive to beginners who are just starting their investment journey.

How to Invest in Government Bonds in India?

Whenever the Government needs to raise funds for government spending, they issue bonds to the public. Investors can buy government bonds directly or through mutual funds. Let’s have a look at how you can invest in government bonds:

- GILT Mutual Funds– The most common way to invest in government bonds is to invest through GILT Mutual Funds, the funds are invested in government bonds. The investor gets accumulated interest in the bond as well as capital appreciation on the maturity of the bonds. The GILT funds have very high duration risk and should be used by only those who think the interest rate hike has ended.

- Direct Investment- Another way to invest in Government bonds is to invest them directly, you just need to have a Demat account, and you are eligible to invest in a variety of government bonds available.

- Participate in Bidding- Government bonds can also be purchased by participating in bidding also known as Non-competitive bidding. You can place the bid on the goBID web portal or NSE goBID mobile application. The yield of the bond is determined based on bids received from the investors.

Direct investment is the easiest method for retail investors. You can use your broking account like Zerodha to invest in these securities. Every Monday and Tuesday you can choose the government bonds to invest in. Here is a link on zerodha coin.zerodha.com/gsec

Investors looking to diversify in other high-yield investment options can check our portfolio at randomdimes.com

Conclusion

Investing in Government Bonds can be a great way to diversify the portfolio as it has less risk as compared to equities and Mutual Funds. Also, investors who are looking to start their venture can invest their excess funds in government bonds.