Option Trading is both a science and art. Options give you a way to perfectly play your market view which is not possible with future or cash position. I will start publishing weekly strategies with risk and reward for each of them.

Before starting that it’s essential to lay down the background of options and the various requirement for trading.

Why Option Trading? People can have different motivation to Trade.

- Hedging the portfolio

- Incorporate Directional view

- Incorporate view on Volatility

Is Option Trading Profitable? It’s like saying ,is insurance business always profitable? is running a casino profitable? Option Trading is akin to insurance business. You selling or buying insurance or owning a casino where you can lose many times but make money in the long run if you find an edge in the trades you too make money. If you take random bets(selling insurance at low price analogy) you will lose

Major factor in OptionTrading is “Implied Volatility” which determines how much market expects the future to be volatile.More expectation means more risk hence more expensive options.

Most of the time ImpliedVolatility is higher than actual volatility because people are ok to pay more to have a peaceful sleep.

Hence option selling theoretically has positive expected value but there is one caveat.In the long run selling might be profitable but in the short run bad luck can screw us. Option are priced based on assumption of normal distribution which means that chances of extreme movement of underlying is very rare but in real world these things can happen.

Thing about it:

Say you sell a put every month on stock which is at 100.Put is for 2 rs. 3 months you collect say 6 Rs market going up then suddenly market crashed 10% .You end up losing 10Rs.So in 4 months you end making -2 Rs.

That is why selling naked options is very risky unless you are a professional and have a big account .By Trading limited risk strategy we can still make decent returns and sleep peacefully.

Best books on Option Trading:

My personal favorite is Option Pricing and Volatility.Complete List of top books compiled by me:

Which platform to use for Trading?

Three things are required for trading:

- Cheap brokerage

- Option price and volatility analysis

- Strategy Tester.

Upstox provide these tools(Option chain and strategy builder) free while zerodha charges for these and brokerage is same so I recommend setting up account on Upstox.You can register here

or you may use Zerodha: register here Zerodha Link

Capital Requirement: 1.5- 2 lakh is the minimum i suggest for margin requirement.

You can keep 1 Lakh of your long term shares as margin by pledging your stocks(check with customer support) and the other 1 lakh cash.

Option Volatility Analysis :

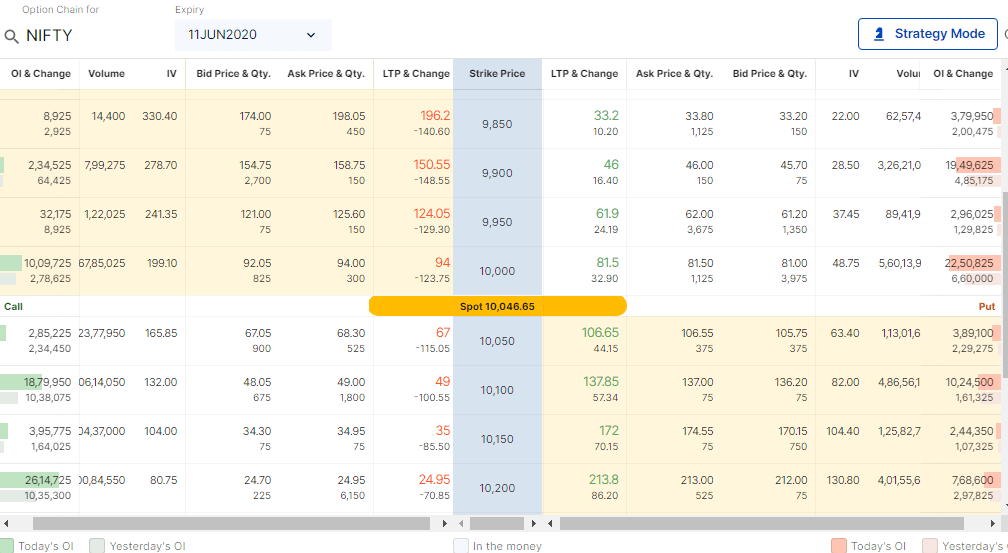

You can view the option chain in Upstox as given below,Implied volatility is given for all options. As a thumb rule try selling high IV(relatively) and buy low IV whenever possible.

You can check the IV column to see how expensive or cheap the option is on Upstox option chain.

Option Strategy builder:

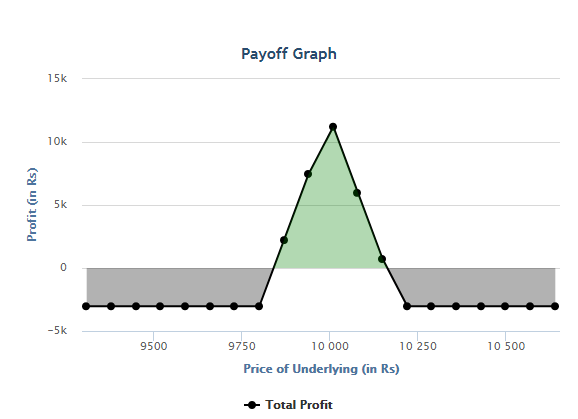

This is the most important tool for someone starting option trading, to check the risk reward of the strategy.Upstox has this feature available for .free:

https://upstox.com/tools-and-calculators/option-strategy-builder/

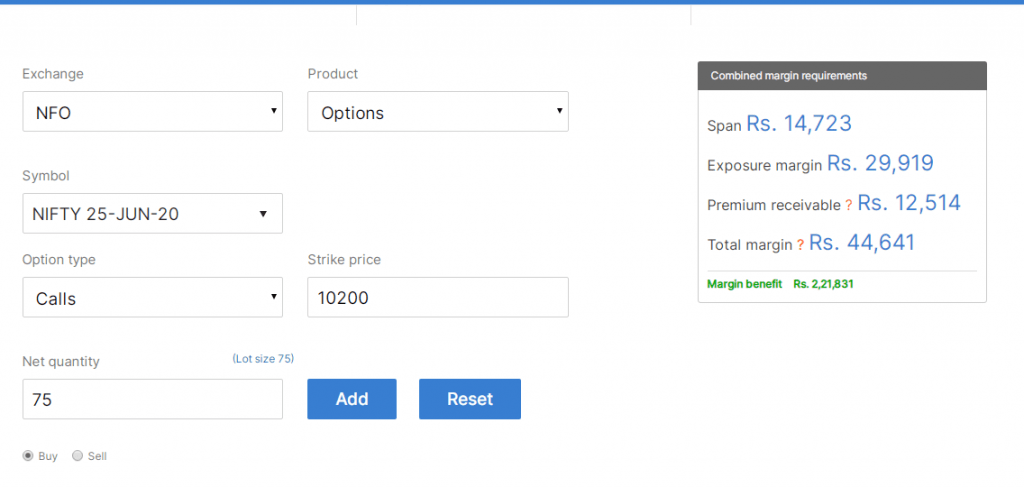

I have noticed that Upstox prices and margin are not latest ,hence you can check payoff in Uptox while you can check the prices and margin in zerodha margin calculator

https://zerodha.com/margin-calculator/SPAN/

Example of Strategy recommendation:

I Have created a strategy example above. Will publish similar graph and Profit loss along with strategy description

View : Nifty to remain around 10000 June Expiry:

Strategy : Iron Butterfly

Sell 10000 Nifty CE and PE

Buy 9800 PE and 10200 CE

Total Margin =44000

Max Profit = 12500 if Nifty stays at 10000

max loss = 2500 Rs if nifty is higher and lower than 9800 or 10200

profit/loss =5:1

you can book profit before maturity if you have already made decent profit.Also you can adjust trade like selling a put spread if market going up etc.

Conclusion:So Set up an account,process takes 1-2 days,start small, avoid unlimited risk strategy, read option books recommended,download investing.com app to track global markets and soon you will be managing position on your own.