Crypto Arbitrage has become quite profitable in the current market. The highly volatile market in cryptocurrency gives most investors a high-risk and high-return investment profile. It’s normal to see a coin surge up to 20% and then head to a 20% correction on the next day. In addition to the spot market, lots of exchanges also offer perpetual futures contracts that allow traders to use up to 125x leverage, making the cryptocurrency market even more volatile.

On the other hand, these inefficiencies caused by volatile market give us plenty of opportunities to arbitrage. It’s easy to reach 15%-50% APR with arbitrage strategies. Binance and Deribit are 2 platform where you can execute such trades

What is Spot Future Crypto Arbitrage ?

A futures contract allows an investor to speculate on the direction of a security, commodity, or financial instrument

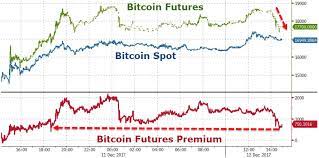

Let’s move on to the arbitrage itself. These futures mostly trade near the spot price but not exactly at the same price. Sometimes they are more expensive (futures trade in contango), sometimes they’re cheaper (futures trade in backwardation).

The difference between spot and futures price is called basis and it tends to shrink as time gets closer to expiration and eventually it goes down to zero. This means that if the price of futures differs substantially from spot price there can be opportunity to buy one and sell the another (with respect to which one is cheaper/more expensive). Normally big price difference can be explained (for example with storage costs) but it’s not the case here.

Arbitrage in Crypto

Bullish investors who want to buy Bitcoin can take a large position in the future market by locking a price that is just a bit higher than the current price at a future date

In simple terms, if the current price of Bitcoin is $50,000, and you think it will be $80,000 in 3 months’ time (but you don’t have the cash right now to buy a large position) it’s an easy decision to enter into a futures contract to buy large quantity of Bitcoin in 3 months’ time, at say a price of $60,000( Premium to spot)

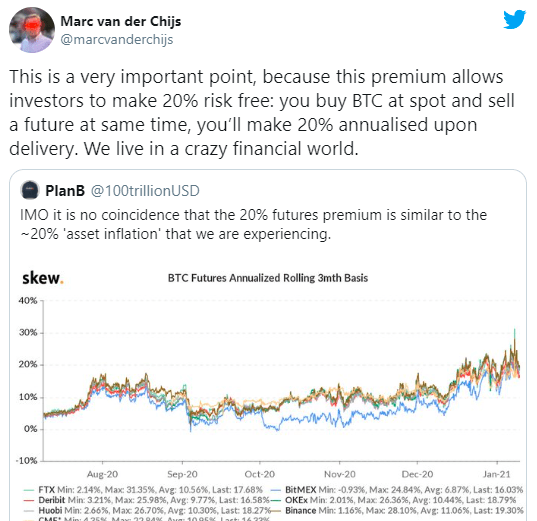

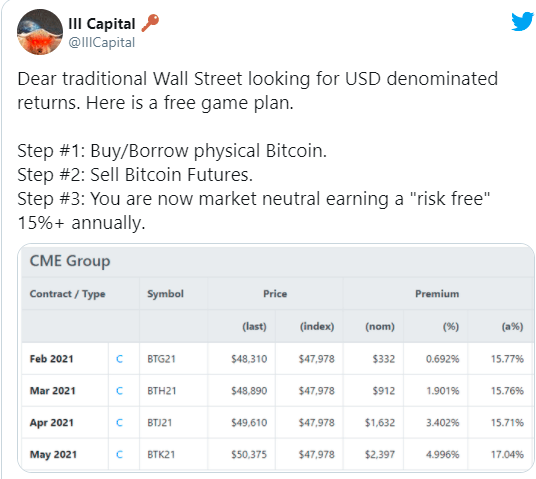

Bitcoin quarterly futures usually trade with small premium of 2 or 3 percent to spot but with BTC growing at such a fast pace, the premium reached more than 25% for contracts with expiration at the end of June. At the time of writing this article the premium is still almost 23 %. Those who do not want to execute complex strategy can earn 12.5%+ on Celsius Network(use code 133908fe3e) and Youholder

To capture the premium it’s necessary to buy BTC on spot market, transfer funds to futures account and sell the corresponding amount of futures. At the expiry futures and spot price must be the same and therefore the trade should generate sure profit. You need to quicky lock in the rates before the arbitrage goes down.

Risk in Crypto Arbitrage Strategy

Spot-futures arbitrage is interesting strategy and at the first sight it can look like there’s free money on the table. However, like any other strategy it also possesses some risks. The major risk in the strategy are:

- Operational risk: Since you need to make three operations (1. Buy crypto on spot market, 2. Transfer to futures account, 3. Sell futures) to lock up the profit, there’s a certain risk involved that the price changes before you manage to do all three steps.

- Market risk: The risk that the spot price will go up so much (and the basis will increase) that you’ll get a margin call. I think this risk does need to be managed only if you trade long-term contracts. For short-term contracts this risk is highly unlikely

- Risk that exchange will be hacked or will go bankrupt.

Executing The Crypto Arbitrage

Let’s assume someone wants to execute this strategy with 10000 USD .Step by Step guide to implement it.

Step 1) Register on Binance or Deribit using the link. You will be eligible for referrals

Step 2) Transfer USDT to Binance Account

Step 3) BTC Quarterly contract premium over spot (Deribit shows it autmatically)

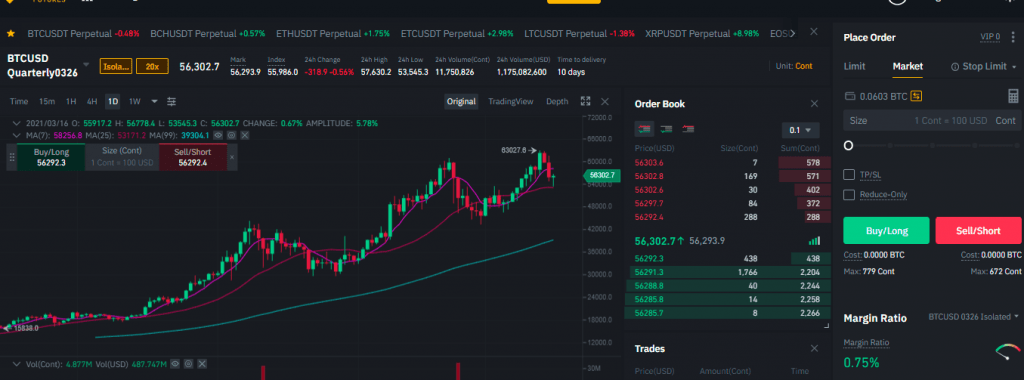

Binance premium is somewhat similar ,you can calculate using the formula

(Future/Spot)^(365/(days to expiry) -1

Now if the premium is juicy we go to step 4 !

Step 4 ) Here 3 things you have to do almost simultaneously

I suggest opening two screens for this

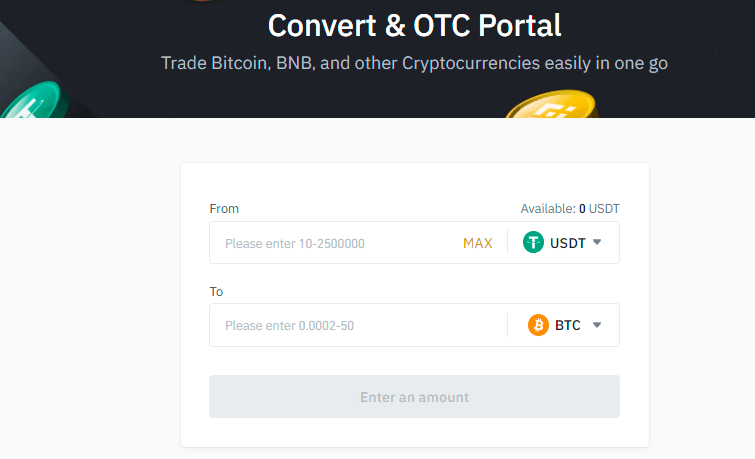

a) Buy Bitcoin – Use classic convert to immediately buy BTC

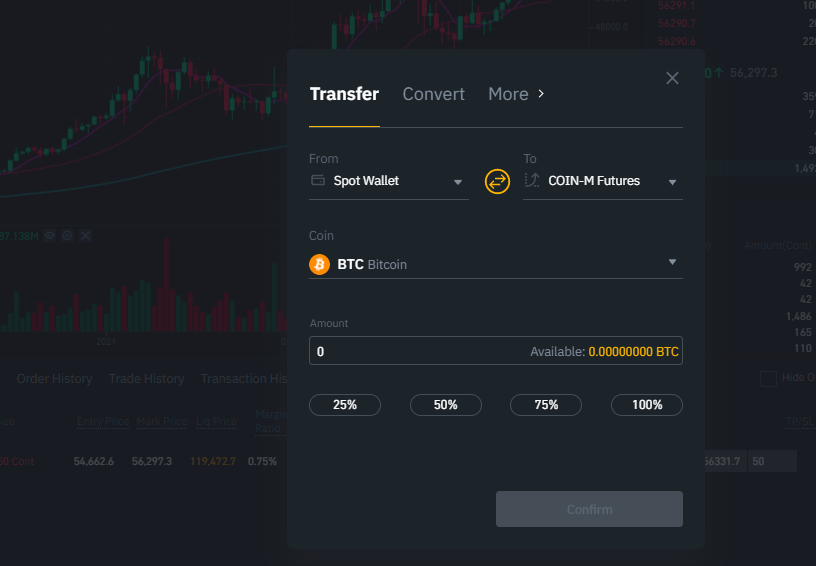

b) Transfer the BTC to Coin- M Future

You can also otherwise keep small amount of BTC before execution of arbitrage (as Binance provide 125x leverage)

c) Short Bitcoin Future ( Coin- M Future)

Keep in mind you short the right contract( Quarterly or June maturity)

Step 5 ) Wait and watch as the Spreads contracts converge near the expiry. You can rollover if the spread for next month is also attractive

Advanced traders can execute more sophisticated strategy to capture spread between Coin- M future(Bitcoin denominated future) and USD- M future(USD denominated future) as it allows leverage which can multiply return but requires detailed understanding of margin

Conclusion

Crypto exchanges constantly develop new financial instruments which allow investors to create more sophisticated strategies and manage risks better. The introduction of crypto futures created new opportunities for all traders and investors. Spot-futures arbitrage can be profitable strategy but it is essential to understand the risks involved.