One Important feature of P2P lending is that it pays EMI which is sum of the principal Invested and Interest.

I had covered how it can be used as an emergency fund in one of my earlier article.

http://randomdimes.com/2018/parking-emergency-fund-in-p2p-platform/

Today I will demonstrate how to get a ball park figure of your liquidity and how to optimise it to your advantage.

Tenor of P2P loans are from 3 months to 3 years. We can clearly demarcate the Platforms as short dated Loan platform and long dated.

Cashkumar and LendenClub are the short dated.

I2I funding , Rupee Circle are Long Dated.

How Does this information help me?

I Can calculate the average maturity of my platform which will give me an idea of my future EMI. I will tell you the shortcut method. To calculate the exact liquidity you need to download the report and then calculate EMI

- For Lendenclub its very simple,Let’s say you have invested 2 Lakh. 90% is in 3 months loan.Its means around 1.8Lakh is going to be received in the next 3 Months. The amount will be slightly higher due to interest .

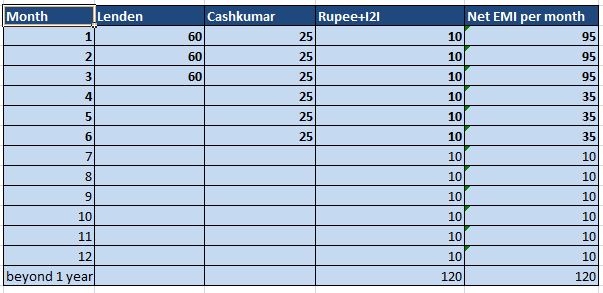

If we consider equal instalments I Can assume that around 60K will be received every month.

- Cashkumar has higher tenor ,approx 4-10 Months. We can take average as 6 months. Let’s say we have 1.5 lakh invested.It means that around 25k per month.

- For I2I and RupeeCircle average duration is around 24 Months. So we divide by 24.If we have 2.4 Lakh in total. It means I will get 10k per month.

If I calculate the net available EMI each month then this is what I will get:

It mean’s I have around 1 Lakh at my disposal in the next 3 months.How can I use this to my advantage:

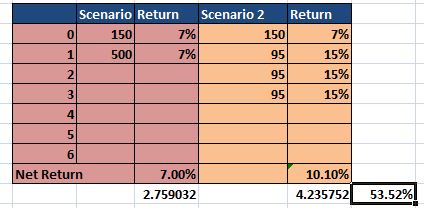

Let’s compare 2 scenario .

One in which a person keeps 5 Lakh in Liquid Fund for liquidity and Emergency and second scenario where we use P2P lending to create liquidity.

One important factor is zero day Liquidity. You need to have a portion of your liquid wealth which can be drawn at any time. I recommend having atleast 1-1.5 Lakh for someone who has almost zero liabilities. It can vary depending on the number of dependent and liabilities

The difference in the net return show how much better scenario 2 is . In a period of 15 years this strategy will help you to achieve 50% higher corpus.

If we wish to have more liquidity we can put more money in Lenden and Cashkumar or if we have sufficient liquidity we can put money in Long dated platform like I2I and Rupeecircle to lower reinvestment risk due to cash drag.

PS:

I2I Account Referral Link(Use Code I2I50%DISCOUNT while paying to get 50% off,Mail me after registering to get further benefits)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

Mail me to get Cashkumar Referral