I have been actively following the P2P market in India.Having tried some of the platform with my own money I was able to short list some of the most consistent players.One big factor I consider while investing is ,how open the platform is in sharing its loan performance data .I have compiled the loan performance of my top 3 platforms.

I have caluclated the expected payoff as the determining factor to invest in a category of loan.

Expected Payoff = Average return* Probability of non default- Principal * probability of Default

basically it tells you how much you will make in the long run for a given default rate in a category:

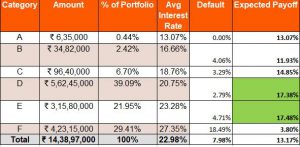

I2I Performance:

As it is evident Category D and E have performed best with average expected payoff of 17.5%

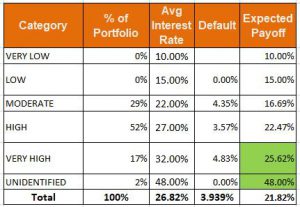

Faircent:

Faircent highest performance has been in the medium risk category.The result across categories show less variation compared to I2I

LendenClub

Lenden Club has been a winner with great returns in the High and Unidentified Risk.Unidentified risk are generally 2 months loan given to salaried people

Some other factors need to be considered during investing apart from just returns:

- Tenor of Loan

- Type of borrower:Purpose,details of documents submitted,cibil report,gender

- Amount of investing in one loan