WHAT IS BHARAT BOND ETF?

On December 4, 2019, the Cabinet Committee on Economic Affairs, led by Prime Minister Narendra Modi, approved the establishment of the Bharat Bond Exchange Trade Funds (ETF) with the goal of enhancing the corporate bond market and lowering borrowing costs.

Due to their ability to invest in a variety of assets, ETFs have grown to be a popular investment tool, including the Bharat Bond ETF. It is the nation’s first state-run company-issued corporate bond ETF that is traded on bourses and invested in the debt of public sector enterprises. Currently, the ETF solely purchases public sector bonds with a AAA rating.

A basket of bonds issued by public-sector companies or any government organization, the Bharat Bond ETF, will be tradable on the stock exchange. The bond now has multiple maturities series with each series having a separate index of the same maturity series. The index will be created by the National Stock Exchange (NSE), and the ETF will be introduced every six months. Apart from that, there are PSU index funds in the Bharat Bond series which track a portfolio of Government and state bonds

This will promote alternative sources of funding for businesses even as a string of corporate defaults keeps banks and shadow lenders on high alert, which will greatly benefit them. It will also help public-sector companies raise money through debt instruments, further develop domestic capital markets, and also involve retail investors who are currently underrepresented in the bond market due to liquidity and accessibility issues.

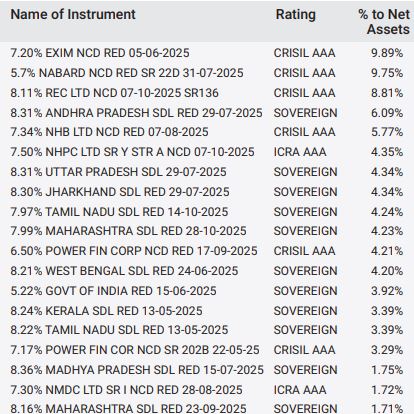

CONSTITUENTS OF THE BHARAT BOND ETF

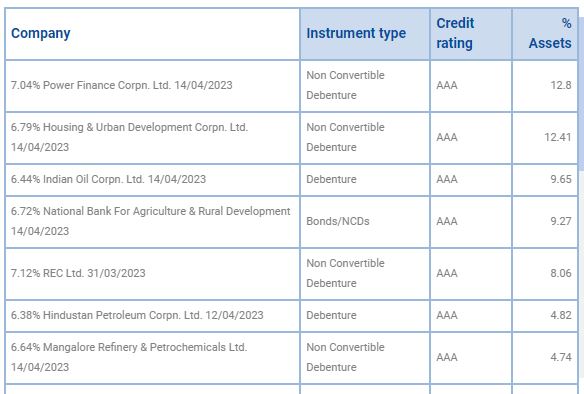

Bharat Bond ETF 2023 constituents:-

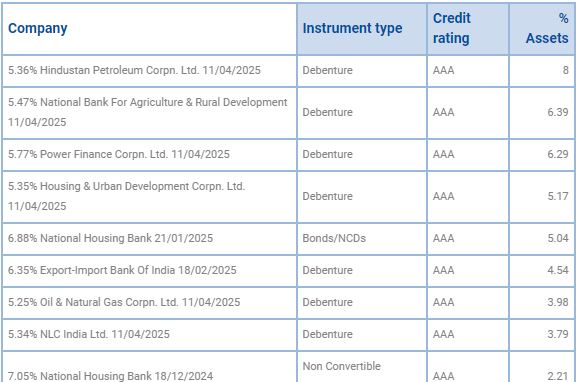

Bharat Bond ETF 2032 constituents:-

Edelweiss CRISIL PSU Plus SDL 50:50 Oct 2025 Index Fund constituents :-

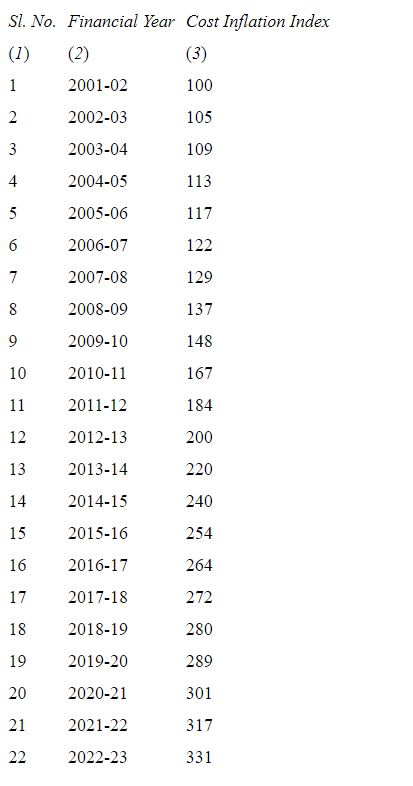

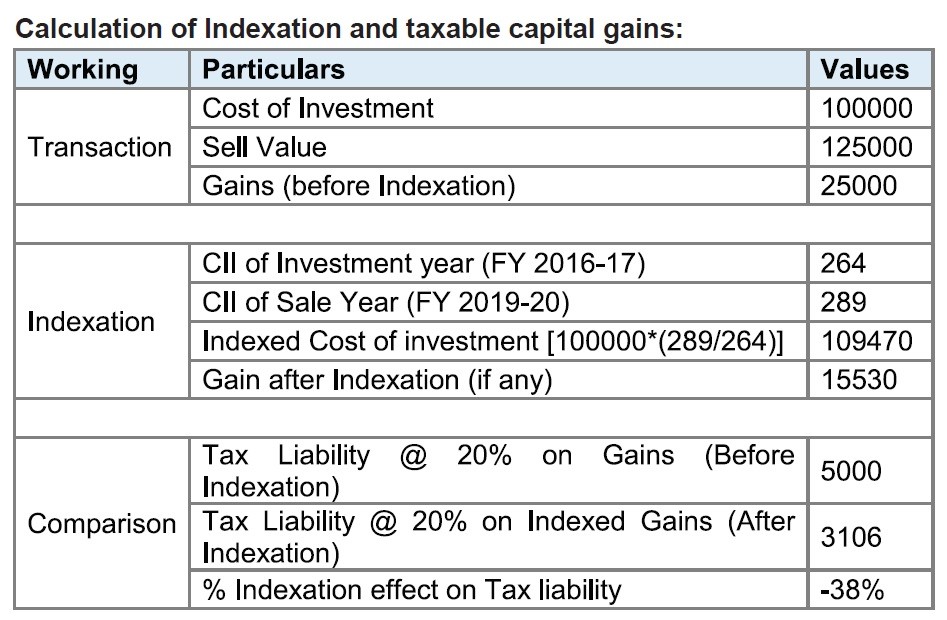

INDEXATION BENEFITS

kETFs, provide more tax efficiency compared to bonds as coupons from the bonds are taxed at marginal rates while Bond ETFs are taxed with the benefit of indexation, which significantly reduces the tax on the return for investors. As BHARAT Bond ETF will be investing in fixed income securities, debt taxation will be applicable. In contrast to other bonds, the Bharat Bond ETF has the same taxability as debt mutual funds, which means that short-term capital gains (STCG) are taxed at a marginal rate, and long-term capital gains (LTCG) after three years are taxed at a 20% post indexation benefit on Bharat Bond. So, investors holding the fund for more than 3 years would only have to pay a 20% tax after indexation on returns, making the Bharat Bond ETFs the most tax-efficient option for investors among other bond options.

Below is an illustration of the Indexation Benefit

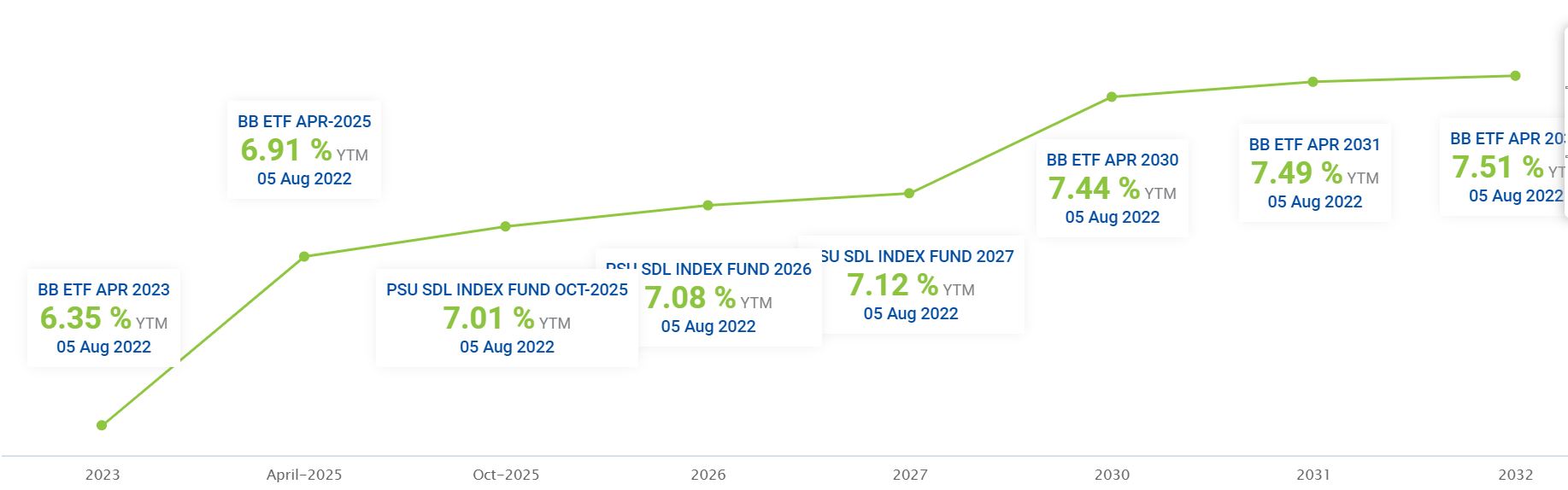

THE BHARAT BOND ETFs’ TERMS AND RETURNS

The Bharat Bond ETF offers 5 maturity terms currently: 1,2 8,9 and 10 years. PSU index fund is available for 3,4 and 5 years The Bharat Bond ETF invests in bonds issued by public sector entities such as PFC, National Housing Bank, NHPC, Indian Railway Finance Corporation, and others. It invests in bonds with high-quality ratings such as AAA and equivalent.

The tenures being offered come with interest rates that get locked in at the time of picking up the NFO. If held until maturity, the interest rate realized at redemption will be the yield on three-year CPSE bonds, which is around 6%, and the yield on 10-year CPSE bonds, which is around 7%.

If sold before maturity, the ETF units’ earnings realized will be based on either their net asset value (NAV) or their market price, depending on whom they are sold to, resulting in the bond ETFs functioning like fixed-income instruments if held until maturity.

The fund’s returns are stable and predictable thanks to the roll down or target maturity method. The underlying bonds’ coupon payments are not given to investors until they mature; instead, they are reinvested in the fund to increase returns. The ETF units may be sold on the secondary market and the market price received in exchange if one is unable to complete the tenure.

BHARAT BOND ADVANTAGES

Diversification

The fund is comprised of different investment portfolios in various bonds issued by PSUs like IRFC, PFC, Indian Oil Corporation, HUDCO, NABARD, etc., the Nifty Bharat Bond Index constituents. This gives the benefit of diversification to the investors, thereby reducing the overall risk of the portfolio. Also, the maximum allocation to a single issuing entity has been capped at 15% to avoid high concentration.

High Safety

Investments in high-quality securities or bonds issued by public-sector units reduce the risk of these funds significantly. As the concerned entities are backed by the government and have high credit ratings, the chances of default are pretty low. If we hold the units to maturity, we essentially have a low-risk, fixed-interest investment on our hands. The rate of interest not changing shows how we are owed redemption once the tenure ends.

The Debt Mutual fund does not have fixed maturity which means they keep buying new securities to keep the holding period constant. This makes them susceptible to interest rate risk when in a rising interest rate scenario.

Low Entry Barrier

Retail investors can subscribe to Bharat Bond ETFs for as little as ₹1000, making them accessible and affordable to a large number of investors. Also, the lower fund management costs help the investors earn higher post-expense returns as compared to other high-cost debt products. The cost structure of the Bharat Bond ETF also happens to be the cheapest in the world to date.

Higher Liquidity and Transparency

The Bharat Bond ETF provides higher liquidity than the other debt schemes as the units are listed on an exchange and investors can enter into transactions at any time as per their requirements. The Bharat Bond ETF presents higher transparency to its investors through the daily disclosure of portfolio holdings and lives NAV rates throughout the day. Also, the target maturity structure of the fund helps to provide stable returns to investors. As all the bonds mature before the fund’s maturity, there is also higher predictability of returns.

ALTERNATIVES to THE BHARAT BOND ETF

1. High-Yield Savings Accounts

High-yield savings accounts, offer returns akin to bond yields and other benefits. Since it is kept in cash, money in a savings account gives substantial liquidity. With these accounts, investors don’t have to worry about credit risk either, since most savings accounts are government-insured. These are taxed at a marginal rate.

2. Preferred Stocks

Another option other than common stocks is investing in preferred stocks. As fixed-income securities, the great majority of preferred shares have a fixed dividend payment, and these payouts are often higher than dividends given to holders of common stock. Preferred stock investors are compensated before common stockholders in the event of a company’s failure and liquidation, which increases the security of the investment.

3. Dividend Stocks

Dividend stocks, particularly blue chip dividend stocks, are great as blue chip companies are the largest and often the most stable companies in the world and are known for paying strong dividends to investors. You’ll get stability and income by investing in dividend equities of this particular type. Additionally, these stocks often grow on an upward trajectory that is slow and steady, so investing in them is also likely to result in price appreciation.

4. Mutual Funds

Mutual Funds are a great investment option these days. These funds pool investing from a large group of investors and use those funds according to their prospectus, paying investors their share of returns. You can gain diversified exposure to the bond market by investing in bond funds without having to undertake the arduous research required to select your own bonds.

5. Alternative Investments

Savvy investors have the option to explore some of which can provide post-tax returns up to 12%. Someone new to the alternative investment world can use the website for reference. Investors need to assess the risk of each alternative asset before investing as they have a higher element of risk compared to the Bharat bond!

HOW TO INVEST IN BHARAT BOND ETF

Investments in the Bharat Bond ETF can be made in the following ways:

Buy from Exchange: Investors can buy the already existing Bharat Bond ETFs, maturing in 2023 and 2031, directly from the exchanges. A De-mat account, made on the exchange, is mandatory to purchase ETFs.

Bharat Bond FOF: The Bharat Bond FOF is a fund of fund scheme that invests in the Bharat Bond ETF and is intended for investors who do not have a Demat account. The Bharat Bond FOF enables unit purchases without a Demat account at a somewhat higher cost structure. SIP investments are also possible in the Bharat Bond FOF.

PSU SDL Index Fund: This is an Index Fund scheme and can be bought through your mutual fund platform in SIP mode or Lumpsum.

BHARAT BOND ETF FINAL REVIEW / VERDICT

While the Bharat Bond ETF is one to consider for a retail investing portfolio, there are some drawbacks to be aware of before making a decision, such as the unit selling price — ETFs are passive funds, and their units, despite being open-ended funds, cannot be sold back to the fund house at retail prices. Either market makers or traders on the stock exchange (BSE or NSE in this case) can buy back (or sell) ETF units after their NFO.

While the Nav—the price an AMC buys back ETFs for—is significant to institutional investors. AMCs trade in ETFs in tranches of 25 crore rupees, which is outside the purview of a typical high-net-worth investor.

Therefore, we must keep in mind the main elements influencing the market price like the ETF’s liquidity. The AMC attempted to keep the Bharat Bond ETF ticket price low at ₹1,000 in an effort to increase the availability of the ETF. Additionally, it has enlisted market makers to guarantee liquidity and investors will be able to purchase shares of the ETF at different phases of its maturity thanks to the plan for subsequent launches of more units, increasing the product’s supply.

Though the pandemic has disrupted the investment behavior of investors, Investors are now more risk-averse and look for the safety of their investments. Due to this, investors are more drawn to fixed-income products like the Bharat Bond ETF. This may be attributable to the Bharat Bond ETF’s combination of tax advantages, low costs, returns, liquidity, and security. So, are you investing in The Bharat Bond ETF yet?

How do you file your US Return ?

You need to declare your foreign assets in ITR , interest income or capital gains like you do for indian