Why is Nasdaq Special? Way Back in 1991, when the Indian Economy opened up for global investors it was touted as the land of opportunities, possibly because it was such an untapped market with so much potential. Fast forward to a little over 30 years from then, those words have been proven to be true – the Bombay Stock Exchange (BSE) has risen from just 1000 points then to having touched 60,000, India has received the most FDI, and FII inflow than any other emerging country, and the country is not done yet. So ‘not done,’ the investors of the country find it difficult not to be a part of the diversification and globalization theme going around and constantly look for opportunities outside to invest and have greater global exposure by being part owners of the most dynamic, high performing, trendsetting companies in the world. It is common knowledge that most of the best companies are listed in the USA. One such Index with huge potential for investors has proven out to be the NASDAQ 100 Index, In 1985 the average component market cap was only about $580 million, compared with $53 billion today which adds up to a 90-fold increase. The NASDAQ 100 index has more than $50 billion of investments in exchange-traded products, making it the most tracked index in the world.

Let’s talk about NASDAQ and the NASDAQ 100 Index

Nasdaq which stands for National Association of Securities Dealers Automated Quotations Stock Market was founded on February 8th, 1971, it currently has 3554 listings of companies and its total market capitalization stands at $19.4 trillion as of 2021, only second to the NYSE. It is located in New York City, USA. The Nasdaq-100 was one of two indexes that debuted on Jan. 31, 1985. One focused on financial companies listed on Nasdaq (Nasdaq Financial-100), and the other on nonfinancial companies (Nasdaq-100). The Nasdaq Financial-100 is still nothing compared to the behemoth the Nasdaq-100 is. There are no financial utilities, oil and gas, and basic materials stocks in the Nasdaq-100 by design. The Nasdaq-100 is home to many category-defining companies that are at the forefront of innovation in their respective industries. The sales growth of the index components is among the highest in the industry-seven components have averaged more than 50% sales growth over the last three years.

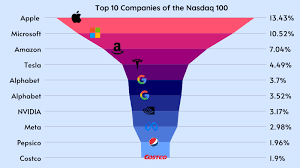

With Fully paid Capital for long-term investing and derivatives and the notional value of financial instruments that follow the index exceeds $1 trillion for the NASDAQ 100 index. The NASDAQ 100 index is known as a tech-heavy index with

● Apple (Weightage in NASDAQ 100: 13.684% )

● Microsoft (Weightage in NASDAQ 100: 10.439% )

● Alphabet (Weightage in NASDAQ 100: 7.194% )

● Amazon(Weightage in NASDAQ 100: 6.939% )

● Tesla (Weightage in NASDAQ 100: 4.085%)

● Meta (Weightage in NASDAQ 100: 2.693%)

These 6 heavily technology development companies add up to 45.03% of the entire NASDAQ 100 Composite. At its inception, the Nasdaq-100 was a pure market-cap-weighted index. That changed in November 1998, to make it suitable for the basis of an exchange-traded fund. It now

follows a modified cap-weighted method.

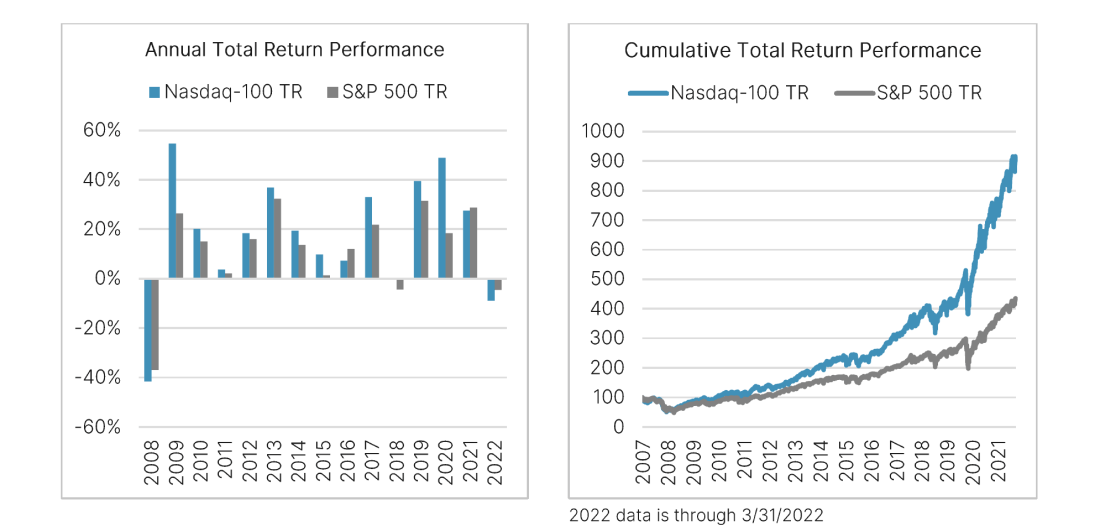

Nasdaq Performance 2022

Nasdaq performance in 2022 has been dismal. On one hand, this might seem like bad news but on the other hand, this is an opportunity for a lot of investors to enter Nasdaq.

Nasdaq has historically outperformed the broader market due to its composition which includes tech and growth companies. Higher returns come with higher volatility and anyone investing in Nasdaq should brace for periods of fast rise and sudden crashes.

How can Indians invest conveniently in the NASDAQ 100 Index?

In India, the easiest way to invest in a foreign fund or company is very tiresome involving a lot of paperwork and an even more complex fee structure, the easiest way has always been through passive investing. That is from there that the entire concept of investing in the exchange-traded fund (ETF) and Fund of Funds (FoF) find most of its backing and the NASDAQ 100 ETF as well as the NASDAQ 100 FOF is something that has definitely caught the eye of the Indian investor and bankers have paid due attention to it by launching such schemes in India for Indians who want a piece of the pie the best of the west is offering. An ETF or exchange-traded fund or index fund is a type of pooled investment security that operates much like a mutual fund. Typically, ETFs will track a particular index, sector, commodity, or other assets and can be bought and sold from the stock exchange the same way a normal stock can. Whereas a Fund of Fund (FoF) is a mutual fund that invests in the units of other mutual funds including but not limited to index funds and ETFs. The underlying funds may or not be managed by the same Asset Management Companies (AMC) which is managing the FoF.

Some of the funds that are present in India are present as follows along with some details about them:

Kotak NASDAQ 100 Fund of Fund – Direct Plan-Growth

● NAV – Rs. 9.417

● AUM – Rs. 1450.62 Cr

● Expense Ratio – 0.27%

● Inception date – 2nd February 2021

● 98.45% Allocation is in international Mutual Fund units namely – ‘Ishares Nasdaq

100 UCITS ETF USD’

● Rest is in TREPs

● Returns in 1 year have been -20.52%

Aditya Birla Sun Life NASDAQ 100 FOF – Direct Plan-Growth

● NAV – Rs. 7.6765

● AUM – Rs. 96.76 Cr

● Expense Ratio – 0.13%

● Inception Date – 1st November 2021

● 98.1% Allocation is in international Mutual Fund units namely – ‘Ishares Nasdaq

100 UCITS ETF USD’

● The rest is in Clearing Corporation Of India Limited

● Returns in 1 year have been -23.46%

Motilal Oswal NASDAQ 100 ETF

● NAV – Rs. 89.81

● AUM – Rs. 4911.31 CR.

● Expense Ratio – 0.57%

● Inception Date – 29th March 2011

● 100% Allocation is directed towards replicating the NASDAQ 100 index

● Returns in 1 year have been -16.6%

Motilal Oswal NASDAQ 100 FOF

● NAV – Rs. 19.125

● AUM – Rs. 3087 Cr.

● Expense Ratio – 0.10% (direct plan)

● Inception Date – 29th November 2018

● 99.5% Allocation is in international Mutual Fund units

● Rest is in TREPs

● Returns in 1 year have been -19.69%

Navi NASDAQ 100 FOF

● NAV – Rs. 8.15

● AUM – Rs. 245.16 Cr.

● Expense Ratio – 0.13%

● Inception Date – 23rd March 2022

● 102.81% of the total fund has been allocated to the INVESCO NASDAQ 100 ETF

● A negative or short position of 2.81% has been created toward TREPS

● Returns since inception have been -19.16%

ICICI Prudential NASDAQ 100 Index Fund – Direct Plan-Growth

● NAV – Rs. 7.99

● AUM – Rs. 304.04 Cr.

● Expense Ratios – 0.5%

● Inception date – 18th October 2021

● 99.02% of the funds have been allocated to foreign securities in the NASDAQ 100 composite in order to replicate the composite itself.

● Rest 1.08% is in TREPS

● Returns since inception have been -21.00%

Conclusion

One of the many unforeseen butterfly effects of opening up our economy in 1991 was how globalization widen our horizon of thinking and dreaming, the NASDAQ 100 Index provided a real-life example that still motivates investors, company heads, and index stakeholders across India even today to reach a similar point of zenith where the Products tied to the Nasdaq-100 are available in 27 countries along with its 90 times growth since inception, and having companies with staggering growth. The most convenient and safe way to be a part of future successes will be by investing in the aforementioned funds and believing in the power of compounding.