In this smallcase review, we will cover the benefits of Smallcase. If you want to make an equity investment as an investor in the stock market, there are two ways of investing in equity: buying the stocks directly. A thorough understanding of financial markets, company analysis, and research methods are necessary for investing in individual stocks. Before utilizing it, experts spent years learning about it. Frank talk: not all of us have the time.

So here comes the second option, which is to buy portfolio stocks. That is, you can buy a portfolio of stocks, i.e., two or more stocks at once. What kind of stocks are these? It could represent an industry. For example, renewable energy Suppose, according to you, renewable energy will boom in the next 10–20 years, so instead of picking a particular company to invest in, you bet on the whole renewable energy industry as a whole and buy a basket of stocks of all major renewable energy companies.

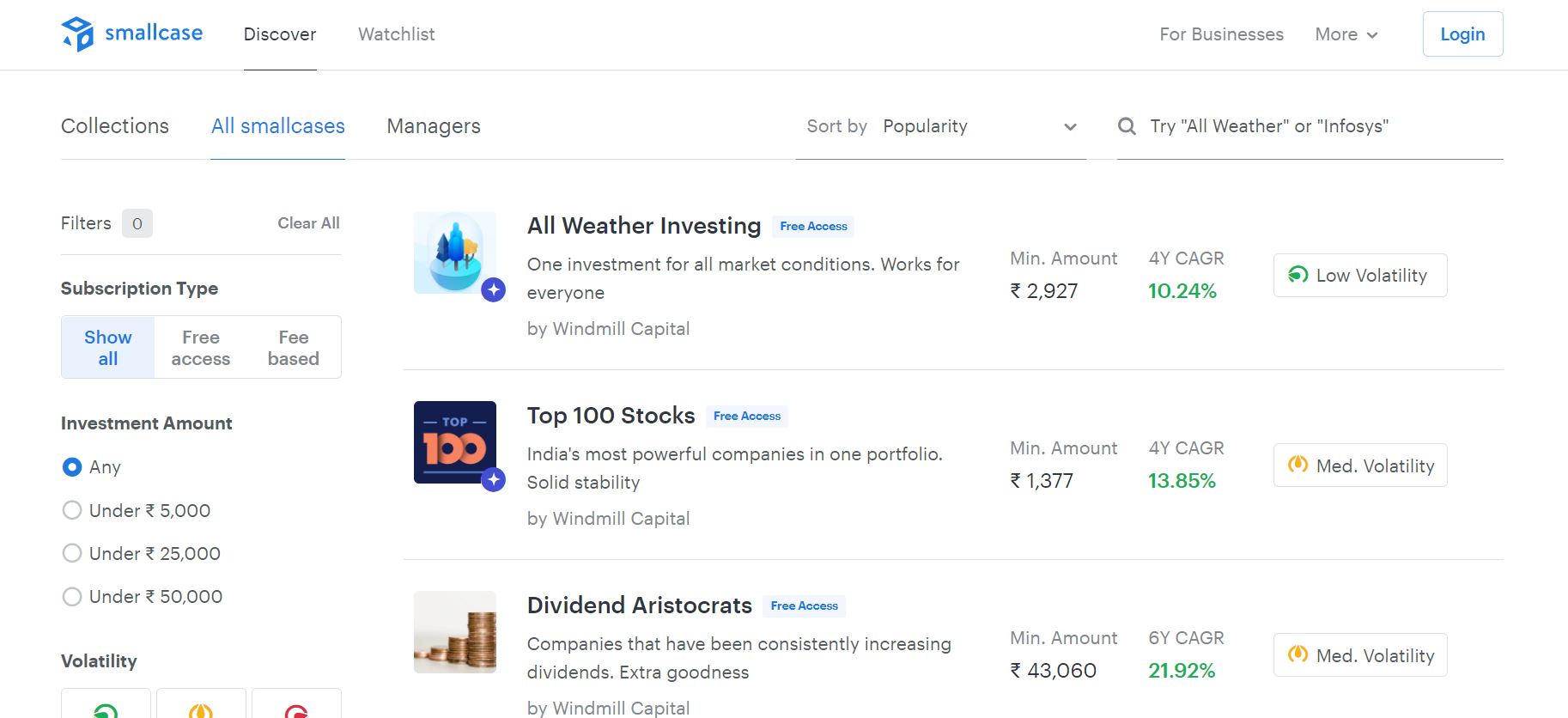

This way even if a company underperforms, the rest can back it up, and it all balances out as you are representing the industry. This is what a mutual fund is. But mutual funds have certain disadvantages, like the fact that they are expensive, with a high expense ratio and a high expense load. But the biggest disadvantageous thing is that you are not in control. There is a fund manager who manages these funds and oversees everything. But as an investor, one might not want that. Instead, they want to have full ownership of the stocks, track them, and buy and sell them on their own accord. This is where smallcase comes in. On smallcase.com, you can buy a portfolio of stocks with one click. You can track your smallcase anywhere on mobile through an app and also on the website at all times and look over your portfolio on your own. You can invest in SIPs and even make your own smallcase where people can buy into the one smallcase you created.

Smallcase Get DiscountHow to use Smallcase

To use Smallcase, you must first sign up with your name, email address, and phone number. Then it asks for your brokerage account. To use smallcase, you need a brokerage account, which is your Demat account through which you buy and sell stocks. It can be 5paisa, Zerodha, or any other Demat account, and you tie it up with smallcase.com. Once it is ready and you have linked it to your brokerage account, you are ready to make your first smallcase investment. You can select a basket to invest in and it will show you the return rate compared to inflation, equity, and other investment options. It also shows in what ratio it allocates your investment in various fields. You put in the amount you want to invest in and it will still maintain the same ratio. The order will be placed after you click “Place Order.”

When you buy a Smallcase of stocks and the stocks change, you will receive an email notification and all can be done with a simple click. Smallcase will buy and sell them on your behalf, all of which will be reflected in your brokerage account.

Advantages of Smallcase

It has some baskets maintained by some highly professional SEBI-registered individuals who are stock market experts. It allows you to create smallcases and gives you the tracker, which helps you to know the risks involved in the smallcase. Just a small click of a button lets you buy all the stocks at once.

It allows you to sign in with your broker account, so you’re in a safe environment, and any stocks you buy on smallcase are reflected on your trading terminal. It provides a bunch of articles and blogs about different kinds of smallcases, which allows you to be more rational about your investments.

Disadvantages of Smallcase

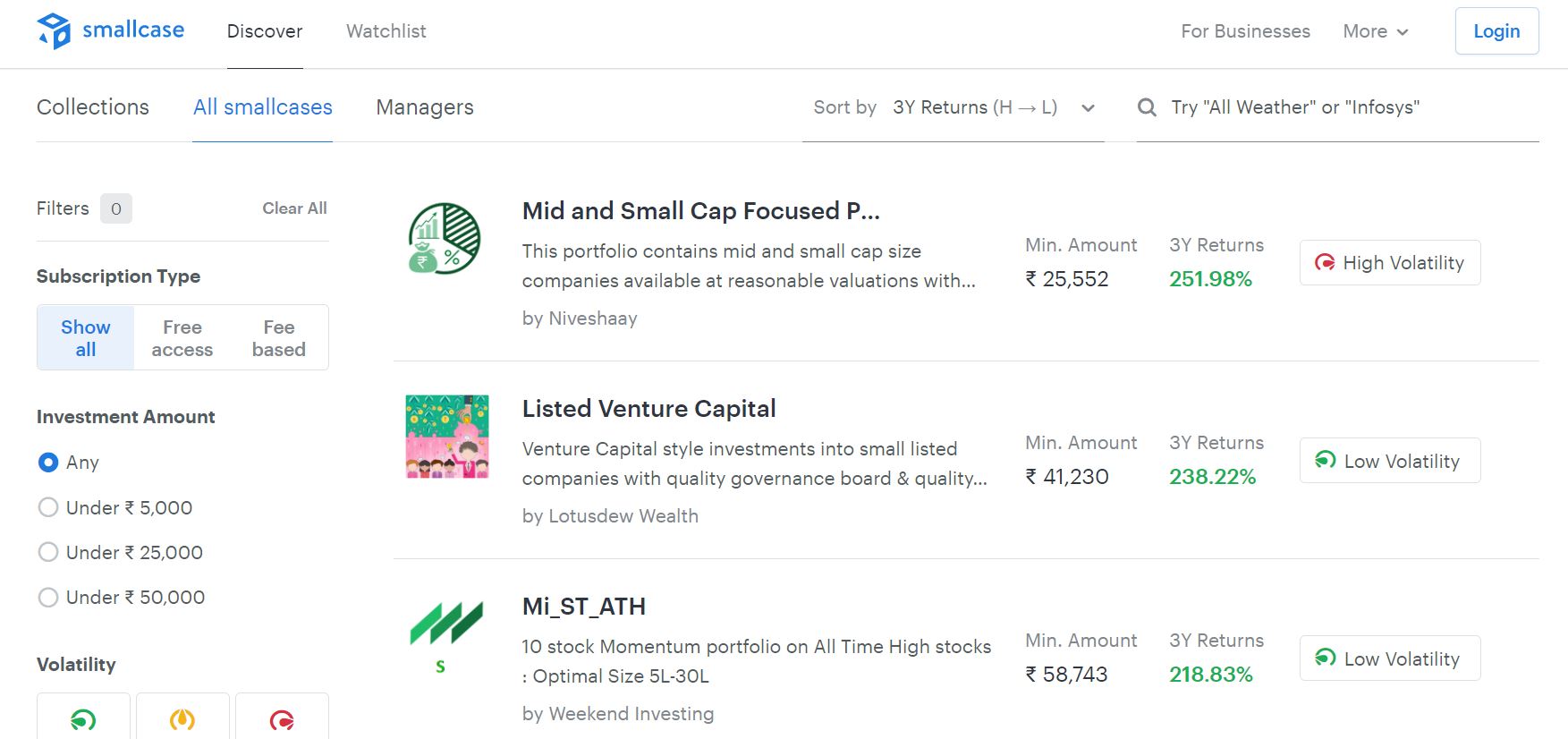

Smallcase utility is somewhere between direct stock investing and passive mutual fund investing. People who are choosing Smallcase to invest in should be able to understand the performance history of the smallcase basket hence they need to have a decent understanding of the economy and various sectors. Smallcase is beneficial for only those people who want a more hands-on approach to investing.

Secondly, there is a transaction cost associated with buying and selling equities which need to be factored in. If there is a lot of rebalancing then the cost can add up.

Thirdly, some performances of baskets are not a correct representation as they do not account for stock rotation and give out a wrong picture. A smallcase would show a high performance based on backtesting but might not account for the holdings it had rebalanced in the past.

Fourthly, Some of the most popular smallcase charge monthly fees which makes them unfeasible for people looking to invest a smaller amount.

Smallcase Risk

The risk of investing in smallcases is similar to that of investing in the broader equity markets. Though it is known to be the best wealth creator over long periods of time, equity is considered riskier than other asset classes like gold or fixed income over shorter time periods.

This is mostly caused by the degree of short-term volatility seen in the stock market. Hence, one should assess their risk tolerance and financial goals before investing in equity markets, even in smallcases. Most smallcase portfolios are for investors that have the objective of creating wealth over the long haul.

There is a risk that your smallcase investment might severely underperform the broader market. This could be because even though current returns are good it could be because of highly risky bets taken by the smallcase manager which may lead to larger losses too in the future.

Smallcase vs Mutual Funds

One of the biggest differences between smallcase and mutual funds is in core fund management. Mutual funds have strict mandates on the allocation, stock universe, cash allocation, etc, and follow them. Most mutual fund managers do not like to try more aggressive styles because they want to perform slightly better than the benchmark index. However, in smallcase depending on the investor’s style you can choose more aggressive or passive baskets which may work out really well or badly.

FAQ

What are smallcases?

Smallcases are modern investment baskets that help you build a low-cost, long-term, and diversified portfolio. Each smallcase is an expertly managed collection of stocks or ETFs that represent a certain idea, theme, or strategy.

How do smallcases work?

Firstly, Investing. You invest in a smallcase by using funds and can either start a SIP or make a lump-sum investment. Your Demat account will be updated with all of the smallcase constituents you invested. Secondly, Tracking. You can track your invested smallcase’s performance, dividends, and evaluate your portfolio under “Investments” Thirdly, management. You have complete control over your investment. Any stock in your smallcase can be added, modified, or removed at any time. You can also see and review rebalance updates, edit your SIP, etc., from your “Investments”.

Who manages smallcases?

Smallcases are created and managed by SEBI-registered professionals. They primarily focus on building stock and ETF-based portfolios for retail investors.

What are the smallcase fees charges?

For every smallcase, you are only charged a one-time fee of 100 + GST at the time of purchase. There are no charges for any future orders or on existing smallcases.

Can I start SIP in smallcases?

You can start a SIP in smallcases in two ways: Choose Monthly SIP when making a fresh investment and this SIP mode will be Manual. From your investments, you can also select a smallcase and click on Start SIP, and it will start an automatic SIP.

Can I create my own smallcase?

Select up to 50 stocks or ETFs listed on the NSE and organize them into segments then weight them individually. Compare them with the past performance of selected stocks. Invest in your smallcase or save it as a draft to invest in later, and let people invest in it too.

How are smallcases taxed?

1-Short-Term Capital Gains (STCG)-Stocks sold less than 12 months of the holding period would be taxed at 15% of the gains. Not applicable on losses.

2-Long-Term Capital Gains (LTCG)-Stocks sold more than 12 months of holding period with a gain of over 1,00,000 would be taxed at 10% of the gains.

Final Verdict

A smallcase is a modern investment product that aids in making better and more effective stock market investments. Smallcase came into existence because of the absence of efficient-enough methods for a new investor to invest in the equity markets.

Smallcase makes investing in ideas easier and more intuitive. With smallcases, you invest in a theme, strategy, or objective that the smallcase is built on rather than a single stock or an arbitrary portfolio of stocks.

Smallcase creates portfolio diversification easily. A smallcase is a portfolio of stocks that when you invest, gets directly credited to an investor’s Demat account. The danger of a loss across several stocks is reduced by portfolio diversification, which is not the case with single-stock investments. Therefore, investing in a portfolio of stocks is far better than investing in a single stock.

However, smallcase is not ideal for new investors or someone who does not follow the market. It is more beneficial to those people who have convictions in certain sectors or styles of investing and want to pursue it without the hassle of day-to-day stock management.