The equity market has been in a tear and recently China joined the party

“Conventional wisdom has been pointing to a rough end of the year for investors. However, the US Federal Reserve pulled off a masterstroke by aggressively cutting interest rates without sparking fears of an impending recession. Since then, the sentiment has shifted: what if risky assets don’t just hold steady, but melt up?”

Historical Trends Support This: US rate cuts around a recession typically coincide with declines in stocks and other risky assets. But when the economy is stable, as it seems now, markets tend to surge.

Deutsche Bank examined the past 70 years of US rate-cutting cycles. They found that the S&P 500 tends to fall over the following months if rate cuts are tied to a recession. However, when rate cuts occur without a recession, markets often soar. According to strategist Jim Reid, the median gain in such scenarios is nearly 50% two years later.

Reid also notes that this time, US stocks have already surged ahead of the cuts, marking the biggest pre-easing rally in 70 years. So while a 50% gain may be optimistic, there’s still potential for upside.

One key reason is the Fed’s proactive approach—steering the economy away from a potential jobs market crash before it happens.

Lombard Street Research, now TS Lombard, echoes this sentiment, suggesting a “melt-up” in risky assets is on the table.

Earlier this year, many feared rising interest rates would devastate corporate balance sheets, leading to widespread defaults. However, that scenario never materialized. Instead, data from S&P Global shows that the trailing 12-month US corporate debt default rate has already begun to fall, dropping from 4.8% in June, with forecasts suggesting it could fall as low as 2.75% by next June in an optimistic scenario.

And the surprise support doesn’t stop there—China, despite its rough market performance this year, has rolled out a safety net for its economy, potentially providing a tailwind for global investors. European markets are catching on too, with Barclays dubbing this an “early Santa rally.”

At this point, it feels like you almost have to search for reasons to be pessimistic. The US economy is holding up, and central banks seem to have investors’ backs. The path of least resistance? More gains—potentially even rapid ones.

The biggest joker in the pack could be the escalating Middle East conflict and spiraling Oil Prices.

However, it is best to follow moderation and remember the words of Warren Buffet ” Be Fearful when everyone is greedy”.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital Freeze Update

- Wisex Fiasco

Growpital Freeze Update

Update on SEBI matter:

This is the first time that a ray of hope has developed in getting back part of the principle. In the latest SAT hearing, the jury thought that money kept frozen in Zetta Farm bank accounts should be returned to investors. Now the final verdict is pending for mid-October. Hopefully, investors will be able to get back part of their capital. The expected amount is approx INR 55 Crores which is approx 27% of the invested value.

Mr Upadhyaya has summarized the outcome in the video.

Wisex Restructuring

Recently there has been a major restructuring in Wisex, the fractional ownership platform that was bought by Aurum. They have fired the complete existing team along with the Ceo, Aryaman Vir.

Below is the link to the news article.

Due to this issue, there has been delay in payment of one of the assets on the platform, Attic. There has been no point of contact for most investors. At this point, investors should reach out to the compliance team of the platform as it a listed company and has a grievance officer.

Alternative Investment Portfolio Updates

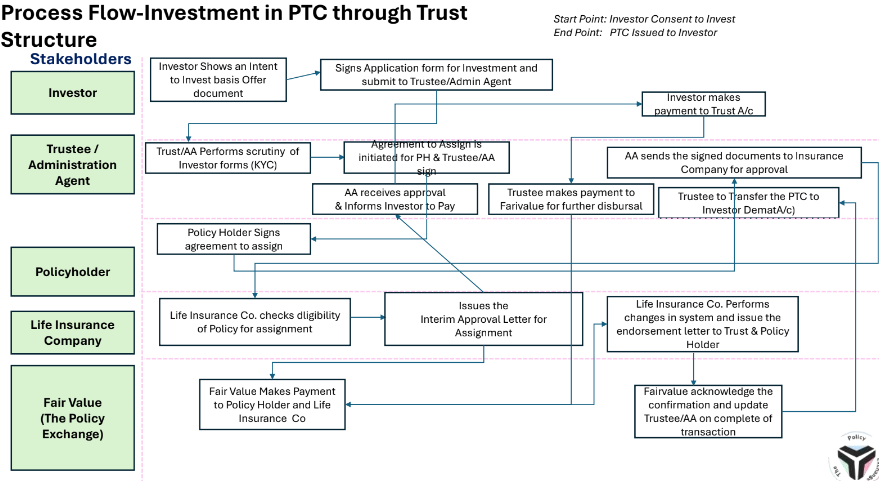

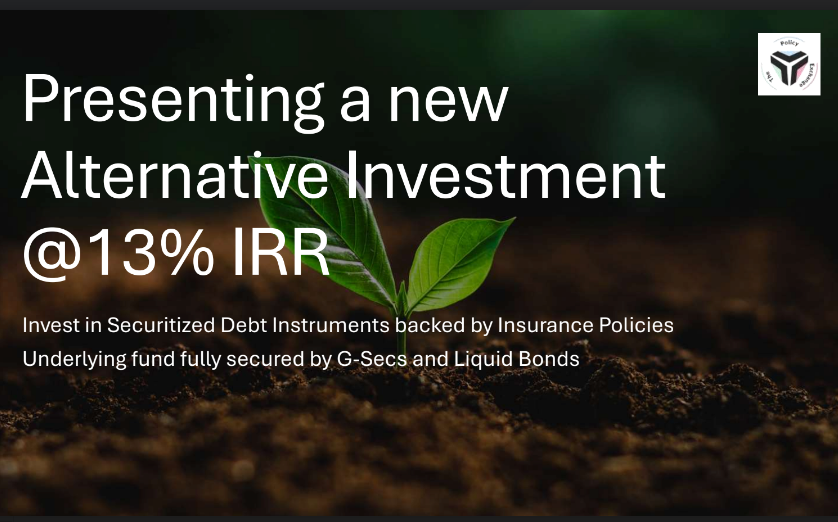

This month we explored an alternative investment product from Policy exchange with 13%+ return with tax exemption

Some of the key interesting opportunities for the month are –

- Policy Exchange PTC product

- AltDRX Pune Godrej Opportunity

Policy Exchange PTC product -13% Government Bonds

- Investors purchase PTCs (Pass-Through Certificates) issued by a Securitization Trust

sponsored by FairValue - The Trust purchases separate individual policies for each PTC holder

- The policies are acquired at a calculated surrender value (which is at a discount to the

fund value) giving an IRR of @13% to the investor - Funds are kept in Max Secure Fund which has given a return of approx. 7% in the past

year - At the end of the lock-in period, the policy is liquidated, and the fund value is paid to the investors

- The life insured not only gets a monetary payment but also continues to have a partial life

cover after the assignment. - In case of death, the sum assured minus the Investor’s return is paid to the nominee

Safeguards for investors

- The investors’ funds are fully secured by way of an underlying portfolio of G-Secs & Liquid investments of Max Life Secure Fund

- Trust is governed by Catalyst Trusteeship Ltd., one of the largest SEBI registered debenture trustees in India managing over 80000 crores of AUM.

- In case of death of the life insured, the death claim is split at the insurer level as follows:

– Investor’s investment amount +IRR returns given to the investor

– The remaining amount is given to the Life Insured’s nominee - Next issue of PTCs is being rated by CARE

We are planning to do a webinar with the founders this month- Register here

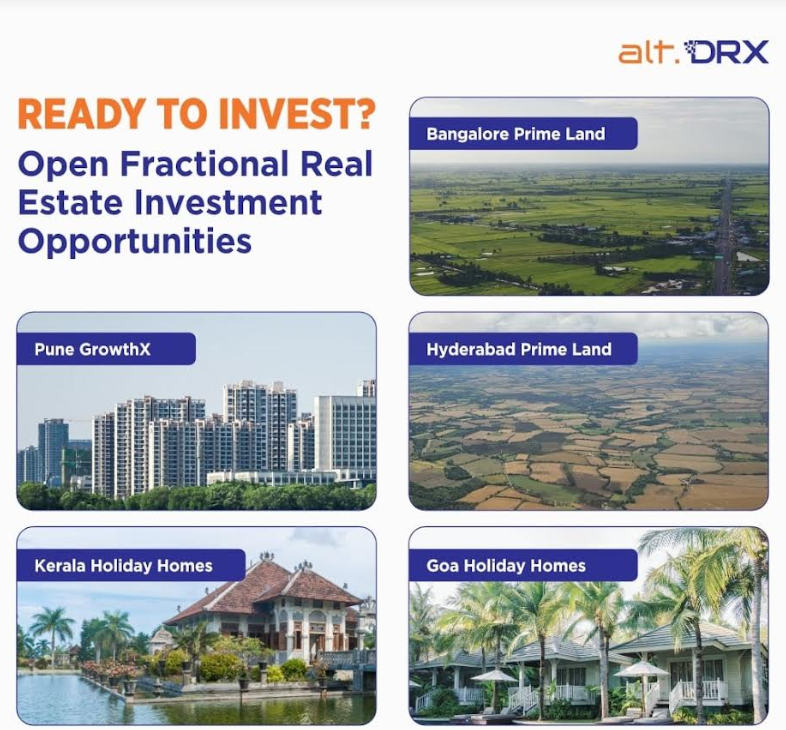

ALTDRX Opportunities (15-17%IRR)

AltDRX has launched multiple projects targeting different investment objectives. Some of the best opportunities include

- Kerala Holiday Home

- Pune Underconstruction Godrej Property

- Hyderabad Land

AltDRX has also launched a private opportunity where market makers can get a 15% fixed+ Revenue Share. However, this opportunity is available only for a few anchor investors. You can register and we can connect you to the point of contact for this deal.

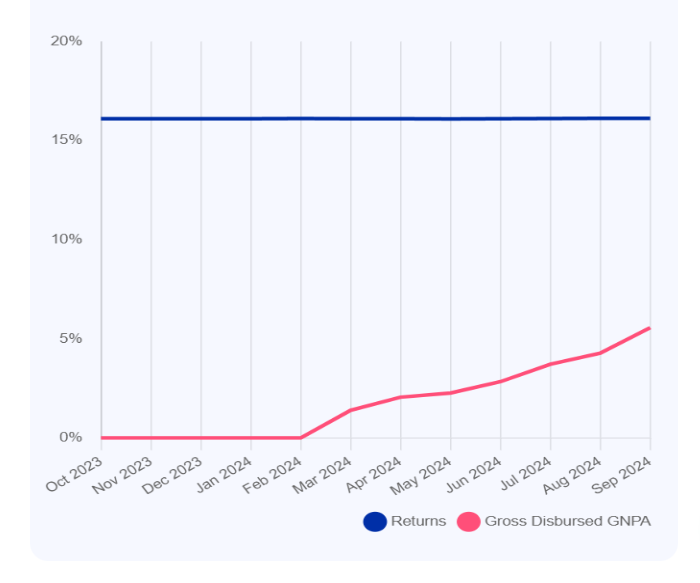

Lending Investment

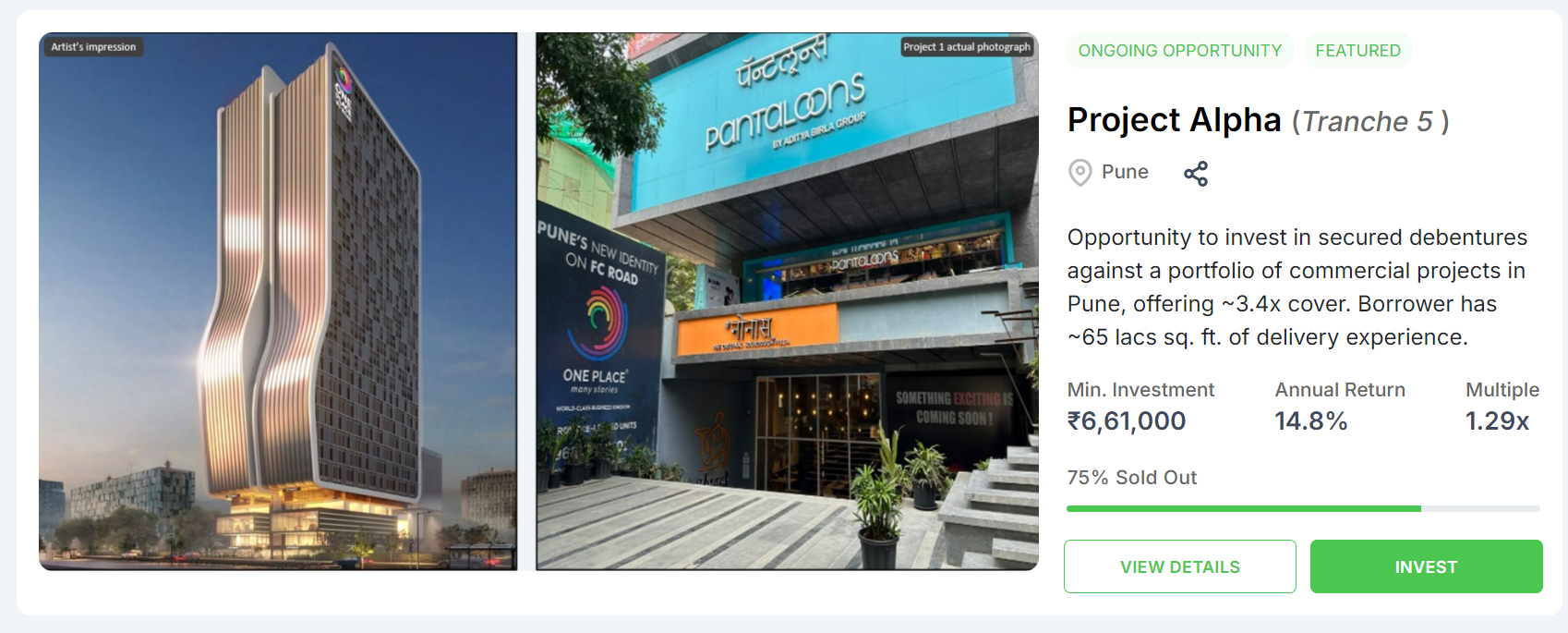

We invested in a few high-yield real estate NCDs on Earnnest and Assetmonk

- Earnnest – Project Alpha 14.5% (Use Code PX64XW to get 0.5%

- Assetmonk – Nova 17%

- Tapinvest – Blusmart 15%

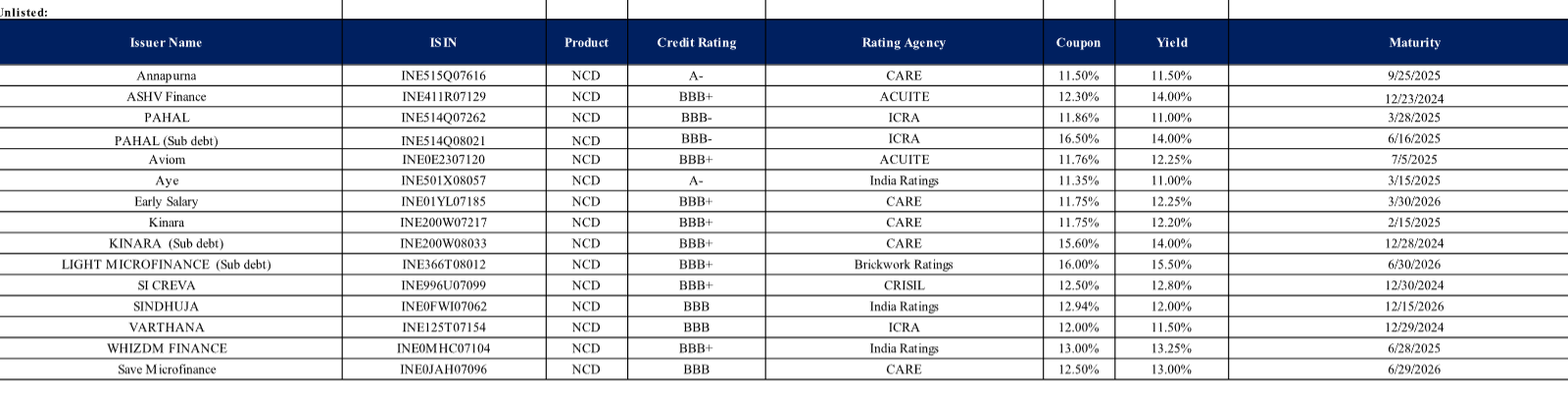

Altifi also offers high-yield unlisted bonds through Northern Arc offline. Some of the bonds available are. We update the telegram with the latest deals. Interested people can connect with the RM through our Telegram channel.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse (stopped) | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- We have stopped using some platforms like Klub and Pyse due to non-availability of deals

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 2 Invoice deals on Tapinvest and 1 on Lendzmarket

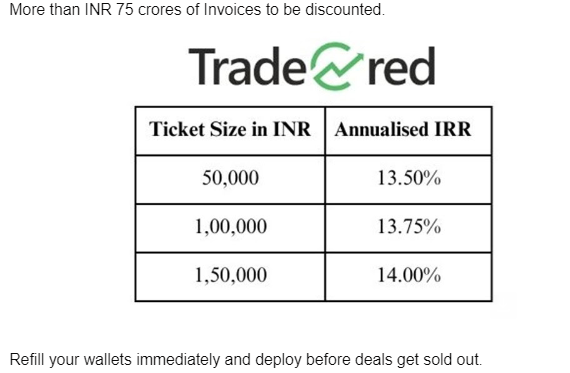

- Invested in 2 deals on Tradecred

- Invested in 2 ID deals on Altgraaf with trade insurance

- Tradecred Navratri offer is going on currently

Crypto Investing

Crypto asset manager Bitwise has filed an initial registration statement with the U.S. SEC for an exchange-traded product for XRP tokens, as it seeks to introduce more crypto products after a landmark regulatory decision to approve spot bitcoin ETF earlier this year. Gradually crypto is becoming a mainstream investment.

We are planning to share details on some of the interesting blockchain protocols that have potential.

We would be happy to have an active community participating in discussions on Telegram to identify great projects!

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 45%

- I2IFunding- 28%

- Finzy-7%

- Faircent Pool Loan -10%

- 13 Karat – 10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.8% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 15.5% | 2.3% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- While my NPA is close to 2.3%, the platform has an NPA of 5% and it is higher than that for some people. The difference can be attributed to the exposure investors had at various times. The NPA rise has happened in the last few months hence new investors can have significantly higher NPA.

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it already following direct borrower lending. The returns have been around 14% to date.

Equity Market

PreIPO Stocks

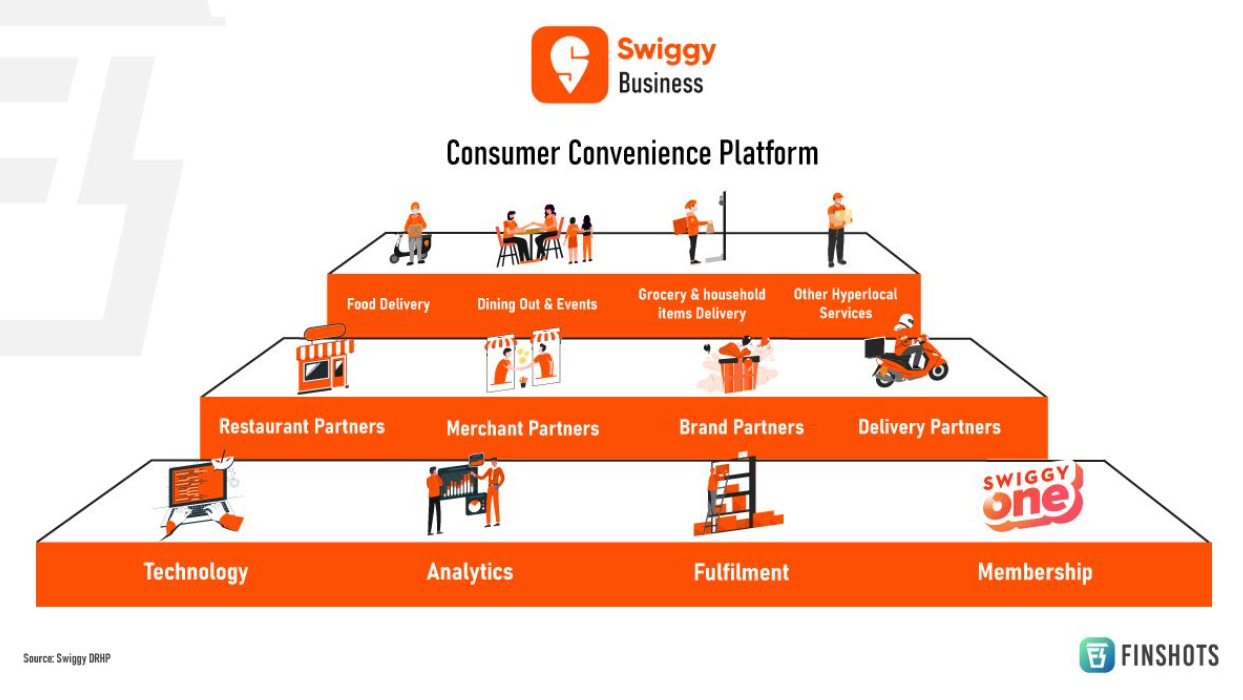

We have picked up Swiggy shares in the unlisted market as there is a lot of demand for the share and considering the current bull run, a premium listing cannot be ruled out.

Swiggy has filed for close to INR 12,000 crore IPO. However, there are risks such as the 6 month holding period and other macroeconomic factors that can derail the bull run.

Swiggy is in high demand in the secondary market but supply is limited! Check out Altius for financials

Listed Stocks

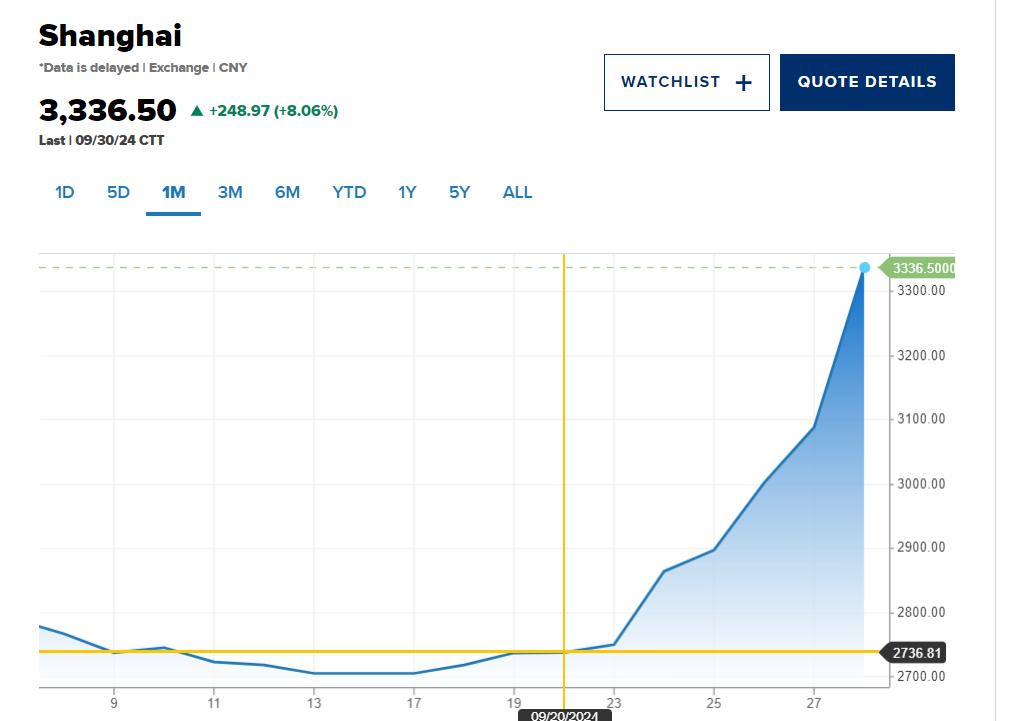

China’s Stock market has delivered more than 25% return in a month! This is significant considering it is an Index of large-cap stocks.

We have been adding China stocks for the last 1 year. Finally, the moment arrived when global investors started lapping up China’s equity due to the strong Chinese government stimulus through rate cuts to drive the economy.

Historically buying Stock market indexes that were grossly undervalued can give outsized returns albeit with the risk of volatility and drawdowns.

Here is an article we had published on China investment

OptionTrading

Currently, I have switched to 60% discretionary along with algo trading as the market regime has changed and it is difficult to make consistent returns with algo. September was an average month. While we were up close to 6% in the first 14 days, we lost 4% during the second half and ended up with 2% for September.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.