Cryptocurrencies and crypto-based investment products are revolutionizing the world of financial investments. Crypto assets are changing the way we look at monetary values. The rise of crypto assets is evident from acceptance from all stakeholders including financial institutions, intermediaries, and regulators. Even though across jurisdictions regulatory challenges still pose a risk as to how things will unfold in the future, the market for crypto assets as a whole is promising.

The Securities and Exchange Commission (SEC) recently approved 11 Bitcoin Spot ETFs in the United States. BlackRock’s Spot Bitcoin ETF has broken multiple exchange-traded funds (ETF) records, becoming the fastest ETF in history to reach $10 billion in assets under management (AUM).

Innovative investment platforms are enabling investors to explore crypto products, facilitating this transformation into a new world of alternatives. In this article, we will look at one such promising crypto asset investment platform, BitSave, and how it offers a range of investment products, simplifying investor experience in exploring and investing in crypto assets.

What is BitSave?

BitSave is a Bloomberg-licensed crypto fund house that offers passive digital asset investment products. It is a crypto asset management platform. Headquartered in Singapore, BitSave has a mission to make crypto investing simple and safe for all. In furtherance of that, the platform offers a safe and simple way to invest in crypto assets through a range of investment products. In simple terms, BitSave offers an opportunity to invest in crypto asset-based mutual funds.

BitSave’s investment platform is designed with a simple and intuitive interface that offers investors an opportunity to explore supervised crypto products and navigate easily. The platform has a clean and intuitive interface, offering users a simplified portfolio tracking experience.

BitSave has obtained a license from Bloomberg to build and market crypto investment products that are based on the Bloomberg Galaxy Crypto Index (BGCI). The company has partnered with Binance for Over-the-Counter trading facility. Assets you invest in through the platform are stored in safe cold storage, offered by a custodian, Liminal, and insured at Lloyd’s of London.

How does BitSave work?

BitSave offers Bloomberg-licensed crypto products that remove the complexities of constructing and managing a well-diversified crypto portfolio on your own. It lets you diversify by investing in well-diversified and strategically curated crypto investment products, relieving you of the hassle. Besides, the platform also offers an insured cold storage facility, ensuring the safety and security of your assets, along with a Proof-of-Reserves and Liabilities mechanism that lets you verify asset balances directly on the blockchain.

As an investor, you can download the BitSave mobile application from the Google Play Store or Apple’s App Store and sign up for the application with your mobile number. Upon registration, you can explore a range of supervised portfolios designed to maximize long-term growth portfolio. The platform offers a seamless and efficient experience. Upon completing your Know-Your-Customer (KYC) process, you can add funds to your BitSave wallet to invest on the platform using convenient deposit options, including instant UPI deposits. You can use your wallet balance to invest in BitSave crypto products, which will be allotted within 24 to 48 hours. The platform provides an intuitive tracking interface where you can monitor and track the performance of your crypto mutual fund investments.

Unlike a crypto exchange where you have to browse through multiple listings and conduct extensive research on individual crypto assets to invest, BitSave offers crypto products similar to mutual funds, simplifying the investment process. Unlike manual trading on crypto exchanges, where you would have to constantly track the volatile crypto markets and manage different wallets, incurring fees and taxes for each transaction, BitSave lets you hold a single investment managed by an experienced team of professionals.

BitSave Team

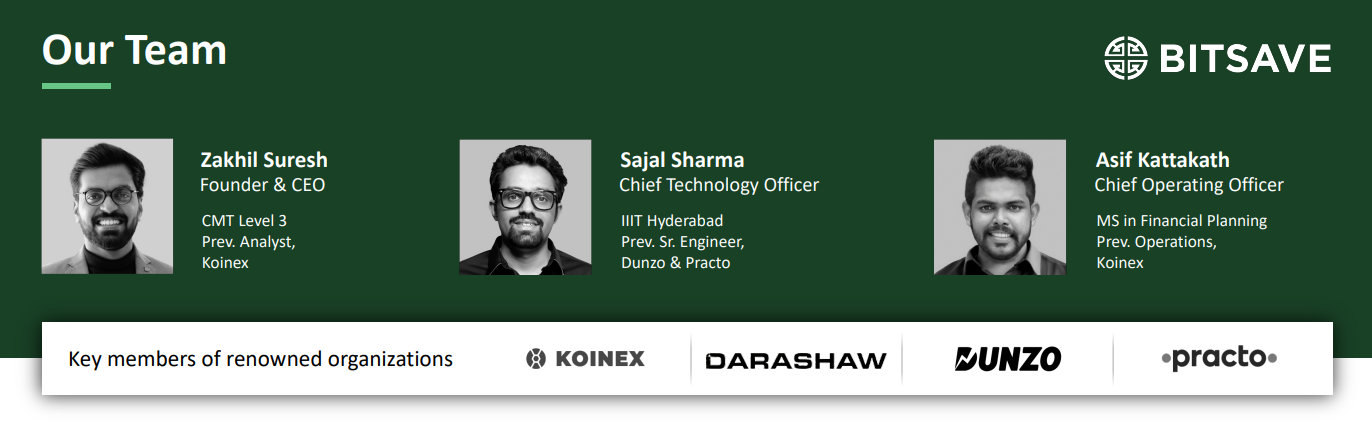

The team behind BitSave comprises skilled and experienced professionals with expertise in crypto assets, finance, and technology. The team has a collective experience of over 40 years in the crypto industry.

The founder and CEO of BitSave, Zakhil Suresh, along with the Chief Operating Officer, Asif Kattakath, served as the founding members of Koinex, India’s largest crypto exchange, during 2017-2019. The BitSave team is well-versed in the intricacies of digital asset management and has been involved with renowned organizations in the financial and entrepreneurship world.

BitSave Products

BitSave offers crypto investment products that are curated based on underlying crypto assets or indexes. Currently, the platform offers three distinct investment products:

- BitSave Crypto Index Product, which tracks the Bloomberg Galaxy Crypto Index (BGCI)

- BitSave Crypto & Gold Hybrid Product offers a strategic balance of the growth potential of Crypto and the stability of Gold.

- BitSave Bitcoin Product, which gives simple and safe investment access to Bitcoin.

Investors who want to have a balanced portfolio can also explore gold and Bitcoin hybrid product

Flagship Crypto Index Product

BitSave Crypto Index Product is the flagship offering currently available on the platform, which is a crypto index fund tracking the Bloomberg Galaxy Crypto Index (BGCI). BGCI tracks the performance of 12 large-cap Crypto assets. The index is rebalanced every month. Investing in the index fund lets you invest and benefit from the returns of these 12 Crypto assets selected by Bloomberg. As of April 2024, the underlying assets include Bitcoin and Ethereum, together making up to 70% of the weightage of the index, followed by Solana, Cardano, and Avalanche, among others. These 12 crypto assets are selected from the universe of the top 25 crypto assets based on market capitalization.

Being an index product, the BitSave Crypto Index Product offers lower expenses than other actively managed crypto mutual funds. It offers an ideal opportunity for investors looking for market-linked digital asset returns.

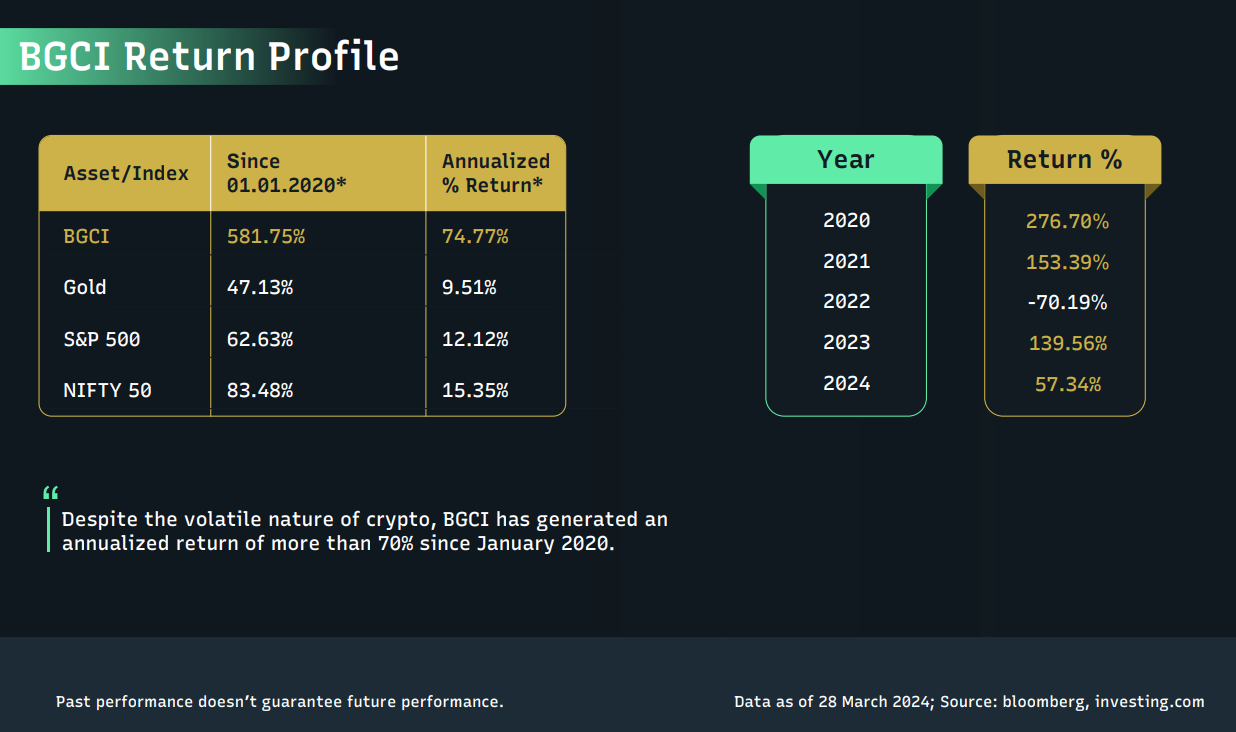

BGCI-based index products can be thought of as large-cap mutual funds and offer an opportunity to diversify into crypto alternatives. BGCI is widely recognized and is considered a barometer for the global digital assets market. Its underlying assets represent around 70% of the total crypto market cap. The index does not include meme coins such as DOGE or SHIB or high-risk projects such as LUNA. As of 31st March 2024, BGCI has given a return of 972.6% since 1st January 2020, translating into an annualized return (CAGR) of 74.7% over this period.

BitSave Crypto Index Product has no lock-in period and has zero entry load. An exit load of 1% applies if the investment is redeemed within 30 days and there is no exit load after that. There is a management fee of 1.5% per annum and no performance fee. Custody of the assets remains with Liminal, which is a secure, compliant, and insured digital asset custodian. The index project promises 100% transparency with proof-of-reserve and on-chain fund accounting mechanisms. The minimum investment amount is $50 at the entry level and $10 for additional investments.

Diversification Opportunity

BitSave and its crypto investment projects offer a safe and secure avenue to crypto assets, which is emerging as one of the most promising alternatives to traditional assets. As an investor, you can adopt a conservative, moderate, or aggressive approach to crypto investments depending on your risk appetite, with overall portfolio allocations ranging anywhere between 1% to 5% comprising crypto assets.

Crypto assets are known for their high volatility, often experiencing significant short-term price swings. This volatility, while risky, can also present substantial profit opportunities for savvy investors. Unlike traditional investments, which typically offer more stable but slower returns, cryptocurrencies can yield rapid gains. Additionally, their decentralized nature and potential for innovation make them an attractive alternative, providing diversification and hedging against traditional market fluctuations. However, due to their volatile nature, allocating a portion of your investment portfolio is always advisable based on your risk appetite.

Investors looking for direct investment consider wallets on Etherebit or ETFs on Stockal

BitSave Investment Planner helps platform users identify an optimum allocation based on a customized analysis guided by experts.

FAQs About BitSave

How Much Return Does BitSave Products Offer?

BitSave investment products are passively managed. The returns offered by these investment products are subject to market fluctuations and volatility in the underlying assets. For index-based products like BitSave Crypto Index Product, the returns depend on the performance of the underlying index (here BGCI) subject to tracking errors. In terms of past returns, the BGCI index, for instance, has offered a CAGR of 74.7% from January 1, 2020, to March 31, 2024.

What Deposit Options are Available on BitSave?

Funds can be deposited to your BitSave wallet using UPI, IMPS, or NEFT from your Indian bank account. Besides, the platform offers access to Binance Pay for depositing funds from your Binance account and USDT for on-chain transfers from wallets and other exchange accounts.

When Can I Withdraw My Funds?

Investors can withdraw their funds from BitSave at any time. There is no lock-in period for any investments in BitSave products. Upon exit from an investment, the amount would be credited to your BitSave wallet within 24-48 hours, and the wallet balance can be withdrawn to your bank account at any time.

Thanks for the great article. Can i invest through USDT if i have deposit in Binance ? Can i transfer through this exchange into my wallet in Bit save ?

Yes. You can use Binance Pay deposit option to move USDT from Binance to BitSave for free instantly.

can u tell about http://www.senxaxa.com platform

I will not recommend as no details of team members .In crypto its really easy to dupe people .Hence its best to stay away!

How will the taxation happen on the profits?? If we withdraw funds from Bitsave, will it be considered a crypto investment?

Yes correct taxation is same a virtual digital asset for any crypto investment