Alternative Investment Portfolio Performance

Structured Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 11-12%(Post-Tax) | 0% |

| Klubworks | 17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-16% | New |

| Pyse | 10-11% (Post-Tax) | 0% |

| Legalpay( Promo code FV48G4) | 14-16% | New( 5 payments ) |

| Growpital(Promo code GROWRDIMES) | 12% (Tax-Free) | New (3 Payment) |

- Have invested in Clairco at 11.7% on Jiraaf

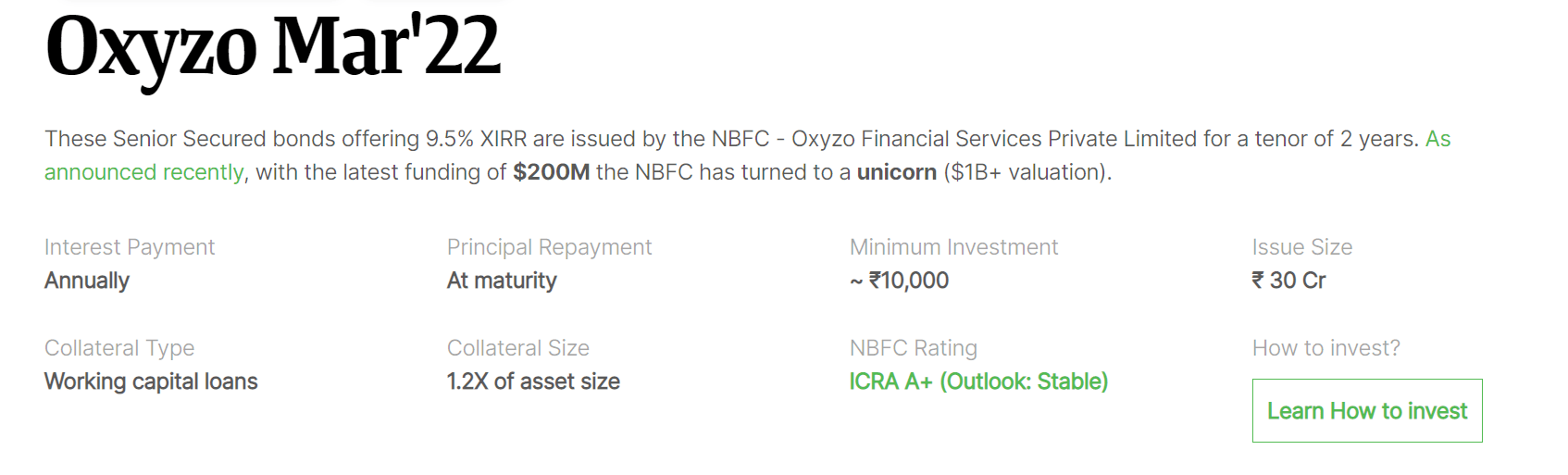

- Invested in Slice Oxyzo on Wealth Wint at 9.5% ( Already 99% sold)

- Received payment for Growpital

- Invested in Freyr Energy on Klubworks (5 deals done till now)

- All my cash flow in Klubworks, WintWealth, Pyse, and GripInvest are as per schedule.

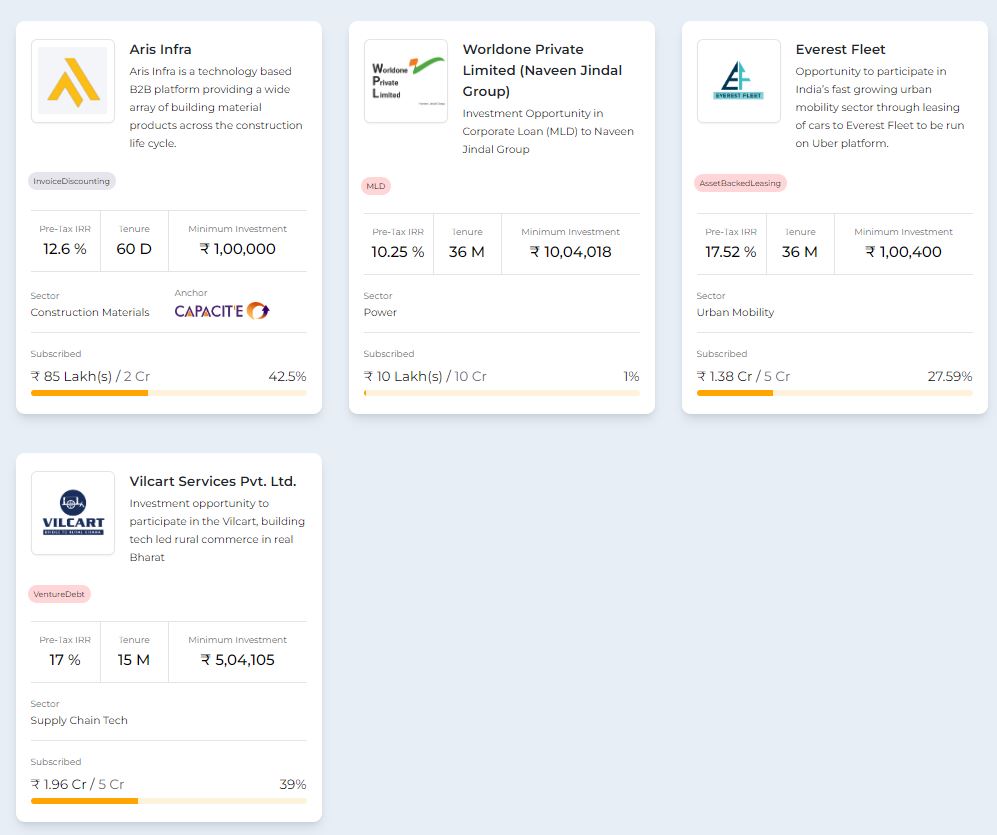

- 2 high Yield Deals live on Jiraaf ( Jindal MLD -10.5% and Vilcart -17%)

- Growpital will be soon raising funds on Tyke

New Deals

Jiraaf deal

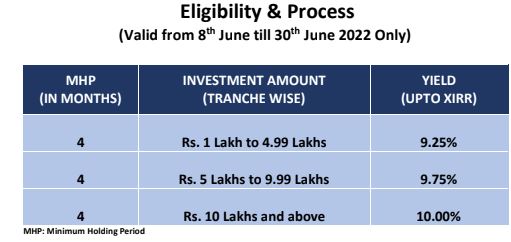

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 13% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- 10% IRR deal available on Liquiloans for 4 Months Holding Period

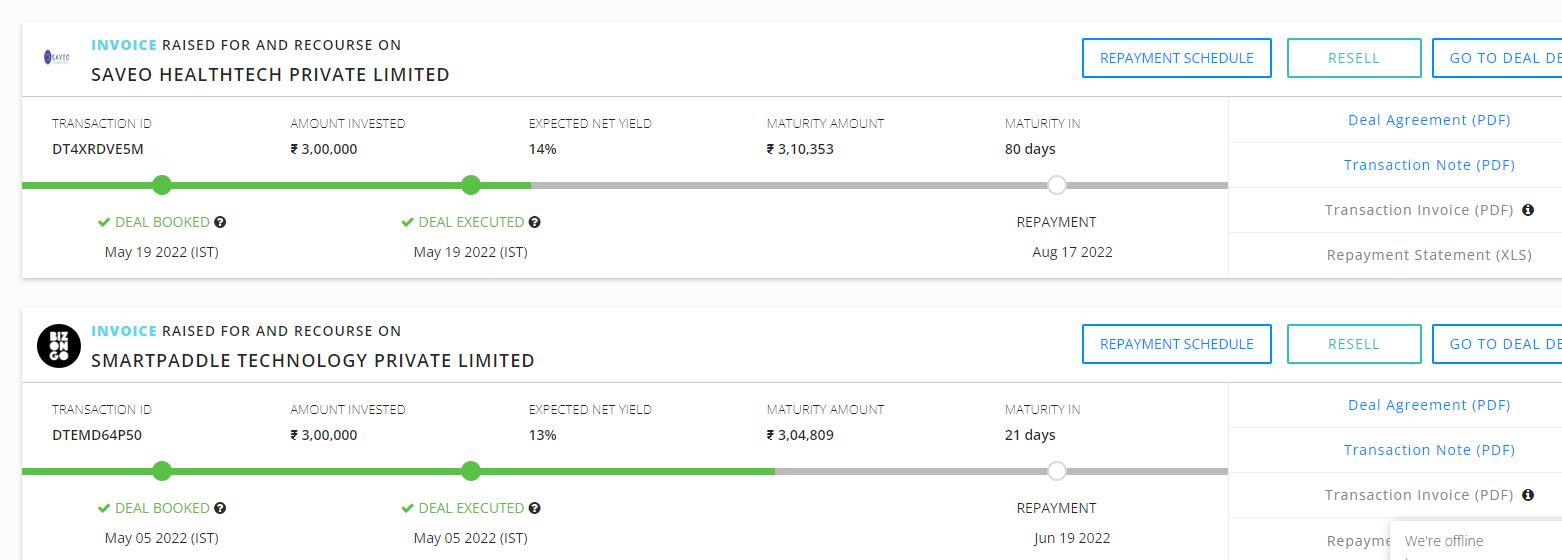

- I Invested in a Kredx deal this month- Saveo and Bizongo (Bizongo has recently raised money)

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1% |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 13% | 1% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- We will be soon covering how to seamlessly invest in European platforms using MCA

- Lofty provides daily accrual of rent. You can keep track of your total rent on a daily basis.

Equity Market

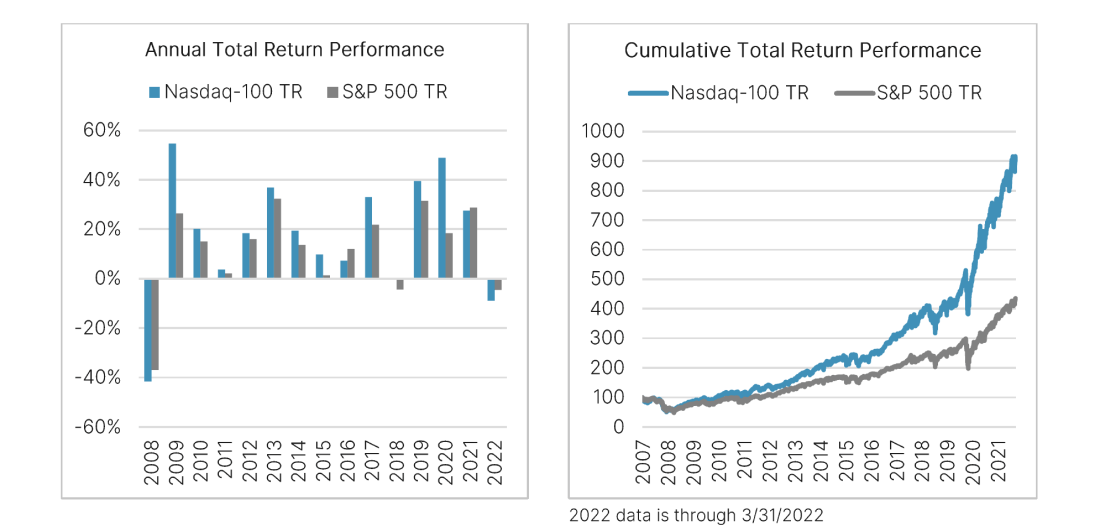

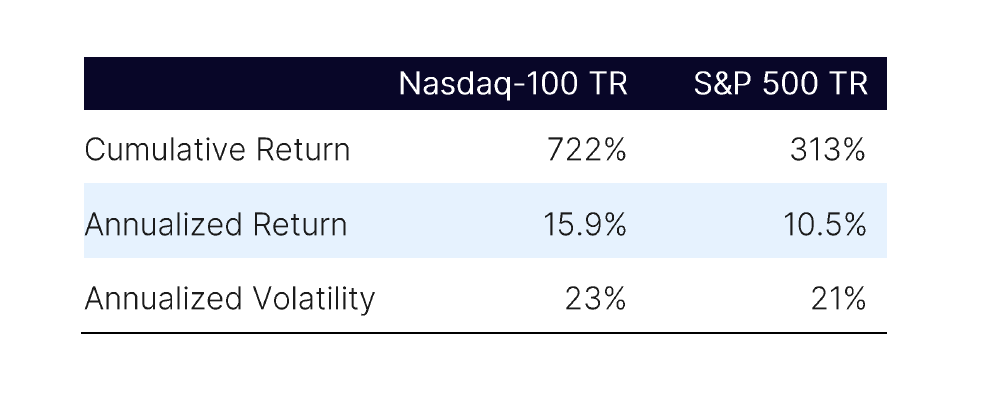

Global shares ended May largely flat in US dollar terms. Markets continued to be dominated by worries over rising inflation and a potentially faster pace of central bank tightening, as well as the ongoing war in Ukraine. Someone who had no exposure to Global markets could use this opportunity to start adding some ETFs.

Nasdaq has historically outperformed the broader market due to its composition which includes tech and growth companies. Higher returns come with higher volatility and anyone investing in Nasdaq should brace for periods of fast rise and sudden crashes.

Crypto Lending Investing

| Platform | Returns | Capital Loss |

| Kucoin | 5-50% | Nil |

| Flint | 10.00% | New |

| Youhodler | 12.50% | Nil |

| Vauld | 12.70% | Nil |

| Coindcx | 14% | Nil |

- Coindcx is also offering a 14% return on USDT

- Would be Keeping allocation to Crypto lending to the minimum at the moment due to the heightened volatility and possible repercussion of the Luna Terra fiasco

Crypto Investment

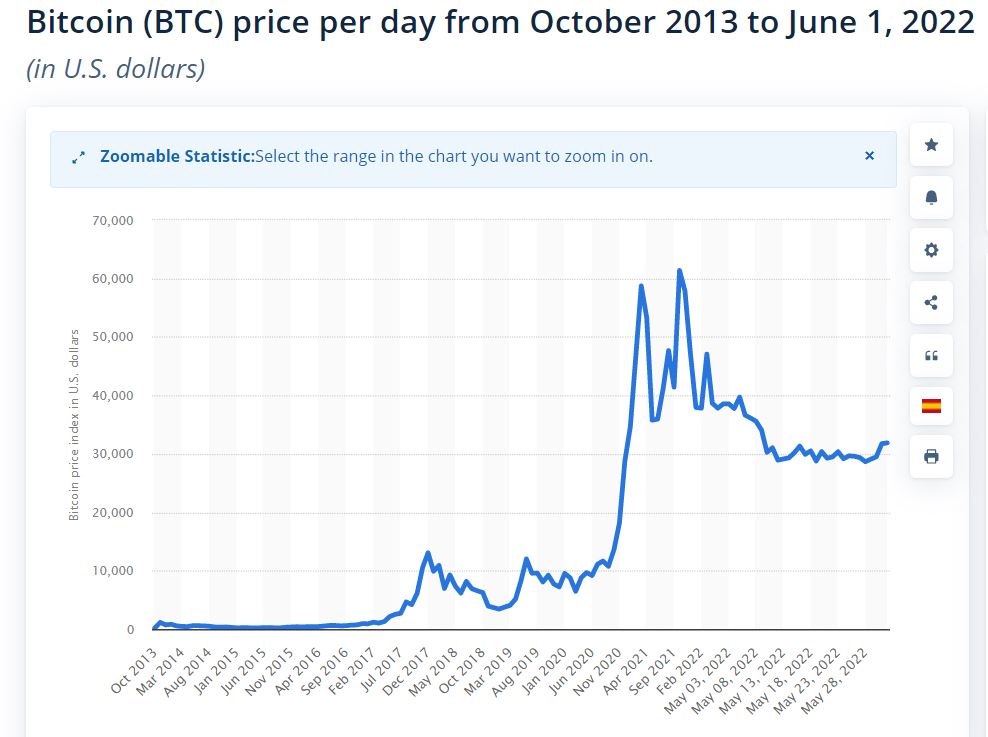

Cryptomarket is in deep winter for the last few months. I feel there can be more downside from the current level. If the market does fall substantially I will allocate some risk capital and wait for the bull market which eventually will come (could take more than a year). Crypto has fallen more than 60-70% in past too and if we go by history it has been a good opportunity for accumulating at those levels.

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | -10% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 2% |

| Bitcoin Trading(Wazirx/Binance/CoinDCX) | 5% |

P2P Investment

Current allocation:

- India P2P – 15% (new)

- 12Club – 5%

- Rupeecircle- (stopped)

- I2IFunding- 40%

- Finzy-40%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks-backed loans, E-Rickshaw backed loans, education loans, NBFC backed loans(Mondeo etc) Group loans | 13.5% | 4.9% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- Will be slightly increasing my investment in IndiaP2P this month. The performance of the platform looks good.

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

- Completely stopped RupeeCircle

Other Alternative Assets and Platform Updates

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. I have received 5 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 5.00 |

Upcide Updates

Upcide has recently listed a new opportunity. The volume on the platform is low but the deal selection is decent (access code RDIMES to get early access)

Hi, have you invested in any start-up deals on Tyke?

No deals till now. Anyway cosnidering the macroeconomic scenario I feel lot of startup valuation will go down significantly and we can get better deals better.

Hi Rohan,

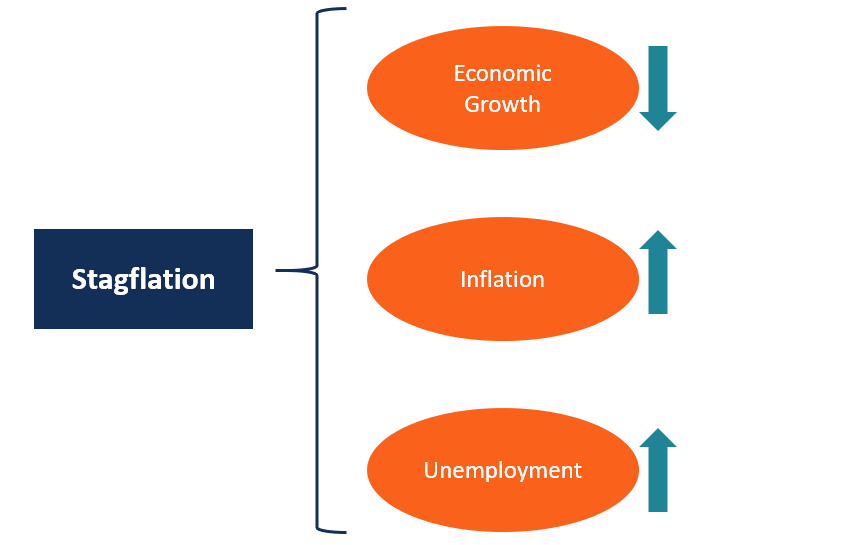

Considering the current uncertainties regarding stagflation, quantitive tightening, and increased repo rate (with a projection of further increase), I decided to stick with debt only portfolio.

I decided to stick with more regulated kindf safe products with highly reputable with little exposure to new options.

Here is a look at the debt based investment lot with the max allocation (slowly allocated on salary day) what do you think I should adjust considering inflation.

https://ibb.co/dbHLxt2

Hi Zac ,

In terms of interest rate going up I sticking to shorter dated fixed options such as liquid fund, short duration fund, some invoices,bonds up to 15 months

The bigger threat I feel is the liquidity drying up in market and companies with weak financials can suffer hence I ensure doing lot of due diligence on each deal from from a credit risk point of view and avoiding high exposure in any one issuer.

I am buying equity US and India in staggered manner and will gradually keep increasing allocation to equity if market goes further down

How do you exactly evaluate authenticity of a platform or company listed on that platform?

For example if a bond issuing company defaults, it is sebi who intervenes and represent lender interests in the court, etc.

In conjecture, Im concerned about asset leasing or invoice discounting deals/platforms.

What if tommorow startup like xyz listed on gripinvest or relatively new P2P platform defaults.

In that case who represets lenders/investors in bankrupcy court.

I am not being paranoid or hypercautios, just caught the eye about hedonova’s recent mint expose (many many thanks to you).

Its been around month of this uncover, no big economic publication has covered it or tried to investigate the matter.

These are completely digital companies, most them are not acknowdledged by major media houses or youtubers (Wintwealth & Tradecred being an exception), I can only study their backgroud on crunchbase or other online aggregator or your blog.

In that case how can we evaluate authenticity of a company or in worst case senario, in case of default how can a regular job goer like me recover my money?

Hi Zac,

Evaluation of a platform can be broken into two parts:

1) How genuine the platform is ?

2) What happens in case the deal defaults

For the first part, I try to find out as much information available about the founders through the internet(Linkedin, MCA website , Network,funding details ) etc. I thus always start with a small investment and gradually increase the allocation when I develop more confidence. I guess for most platforms you can ascertain something is off in a few months at max.

The second part is where I feel there is a larger scope of things going wrong as once an issuer of company defaults there is a long drawn recourse process even in the case of regulated entities(syntax, DHFL, Reliance capital, Yesbank AT1, etc). Even though We can argue that P2P platforms are under NBFC P2P guidelines or Wintwealth/Jiraaf bonds have trustees and follow SEBI guidelines, the recovery process is tedious if it comes to defaults. The best way for me to deal with it is a) I research each deal independent of platform rating and b) Never invest too much in 1 deal.

I am planning to create a database in the future where I can take the collective experience of all investors to identify the performance of various deals on all alternative platforms