Peer-to-peer (P2P) lending has emerged as a revolutionary financial model, disrupting traditional banking systems and providing a platform for individuals and small businesses to borrow and lend money directly. In India, P2P lending has gained significant traction as an alternative investment avenue. This guide aims to provide an in-depth understanding of P2P lending, covering its definition, working mechanisms, business models, risks, and opportunities.

We have also included an exhaustive list of all P2P lending platforms in India that are registered with RBI and tried to summarize their model, returns, and performance. For the benefit of new investors, we have kept this article as simple as possible without getting into much technicalities and jargon so that it’s easier for novice investors to understand this channel.

What is P2P Lending?

Peer-to-peer lending, often abbreviated as P2P lending, is a decentralized financial model that connects individuals or businesses looking to borrow money (borrowers) with those willing to lend money (investors or lenders) through an online platform. This eliminates the need for traditional financial intermediaries like banks.

How P2P Lending Works?

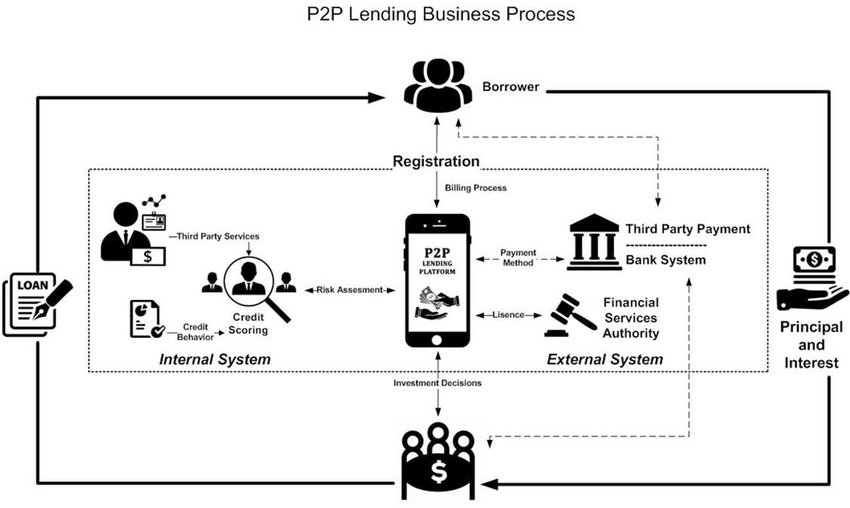

1. Registration and Verification:

- Borrowers: Individuals or businesses seeking loans register on a P2P lending platform. They typically undergo a thorough verification process to assess their creditworthiness.

- Lenders: Investors register on the platform, providing necessary information for KYC (Know Your Customer) compliance.

2. Loan Listings: Borrowers create loan listings with details such as loan amount, purpose, and interest rate. Lenders can browse through these listings and choose loans to fund based on their risk appetite and preferences.

3. Risk Assessment: P2P platforms often employ advanced algorithms and credit scoring models to assess the creditworthiness of borrowers. This helps in assigning risk categories to loans.

4. Funding of Loans by Borrowers: Lenders may decide to participate & fund a borrower’s loan. The interest rate is determined by multiple factors. Alternatively, some platforms offer pool loans with fixed interest rates.

5. Loan Approval and Disbursement: Once the loan is funded, the platform facilitates the approval process and disburses the loan amount to the borrower.

6. Repayment: Borrowers repay the loan in installments, and P2P platforms ensure the timely collection of payments.

7. Returns to Investors: Investors earn returns in the form of interest paid by borrowers. Returns vary based on the risk associated with the loans.

Different types of P2P Platform Models

While the traditional P2P model involves a single or a pool of lenders lending to a borrower, several P2P platforms have tweaked their models for the benefit of all parties involved in the process- borrowers, lenders, and platforms. Following are some of the prevalent models in India.

Direct Lending to Borrowers

This is the simplest and oldest model where investors choose the borrowers and invest in them directly by reviewing them. The platform provides multiple data points like credit scores etc. One drawback of this was that investors do not have sufficient data to make informed decisions while choosing credit and also many time allocation is done incorrectly leading to different NPA for different users. Eg some investors may put 20% of capital in one borrower and if it defaults then they have lost a chunk of their capital. This model didn’t work out and by 2021 most p2p stopped this and created auto-invest rules that choose borrowers based on their risk preference.

Platforms – Monexo, Indiap2p, I2Ifunding

B2B Tie-ups with Companies

In this model rather than sourcing borrowers and lenders directly these platforms work with institutions that can provide access to lenders and borrowers. Borrowers of BNPL companies etc source capital from the p2p lenders, and lenders are sourced from fintech that have a large pool of users. Many of these platforms provide liquidity by selling the loans when investors require liquidity. These platform provide a fixed return to investors and manage the diversification on their behalf.

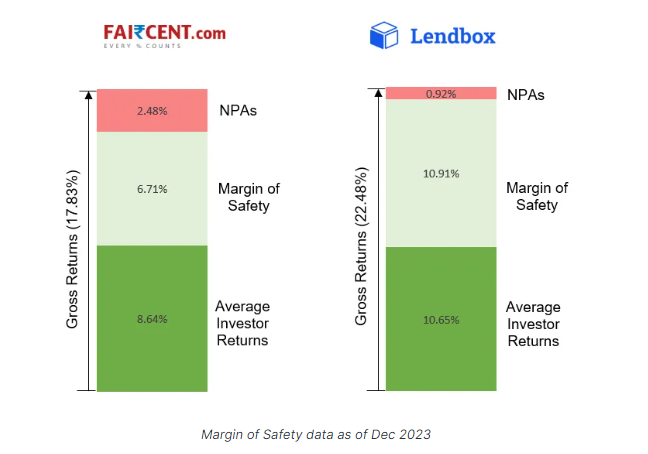

They manage the fixed return by creating a buffer between the actual borrowing rate and fixed return as a cushion to absorb NPA.

Platform – Lendbox, Liquiloans

Fintech Platforms

These are not actual p2p platforms with NBFC licenses but collaborate with platforms like Lendbox to provide p2p access to their user base. Most of these platforms already have their borrower base such as Bharat pe and Mobikwik. We generally avoid these platforms due to the concentration of similar borrowers.

Platform – Mobikwik Xtra, Credmint

Social Upliftment Loans

These provide low-interest opportunities as the prior motive of these platforms is to enable borrowers to access low-cost funding. The borrowers are generally those who are not able to access capital from traditional channels and these loans can benefit their economic conditions such as farmers.

Platform – Range de

There are several other types of models and lending profiles of the 20+ P2P platforms in India.

List of RBI Approved Peer to Peer Lending (NBFC – P2P) Companies in India (As on January 31, 2022)

| S No | Name of the Company | Website |

| 1 | ETYACOL TECHNOLOGIES PRIVATE LIMITED | Cashkumar.com |

| 2 | Lf2peer Financial Services Private Limited | LF2Peer.in |

| 3 | MICROGRAAM MARKETPLACE PRIVATE LIMITED | Micrograam.com |

| 4 | RANG DE P2P FINANCIAL SERVICES PRIVATE LIMITED | RangDe.org |

| 5 | MONEXO FINTECH PRIVATE LIMITED | Monexo.co |

| 6 | DIPAMKARA WEB VENTURES PRIVATE LIMITED | I-Lend.in |

| 7 | FINCSQUARE FINTECH PRIVATE LIMITED | PeerLend.in |

| 8 | LUHARIA TECHNOLOGIES PVT LTD | Anytimeloan.in |

| 9 | SRS FINTECHLABS PRIVATE LIMITED | Oxyloans.com |

| 10 | RNVP TECHNOLOGY PRIVATE LIMITED | I2IFunding.com |

| 11 | 5Paisa P2P Limited | 5 Paisa |

| 12 | BIGWIN INFOTECH PRIVATE LIMITED (NBFC – P2P) | PaisaDukan.com |

| 13 | BRIDGE FINTECH SOLUTIONS PRIVATE LIMITED (NBFC – P2P) | Finzy.com |

| 14 | FAIR VINIMAY SERVICES PVT LIMITED (NBFC – P2P) | IndiaMoneyMart.com |

| 15 | FINTELLIGENCE DATA SCIENCE PRIVATE LIMITED (NBFC – P2P) | Rupeecircle.com |

| 16 | Innofin Solutions Private Limited (NBFC – P2P) | Lendenclub.com |

| 17 | NDX P2P PRIVATE LIMITED (NBFC – P2P) | Liquiloans.com |

| 18 | OHMY LOAN PRIVATE LIMITED | OhMyLoan.com |

| 19 | OHMY TECHNOLOGIES PRIVATE LIMITED (NBFC – P2P) | OMLP2P.com |

| 20 | TRICKLE FLOOD TECHNOLOGIES PRIVATE LIMITED | IndiaP2P.com |

| 21 | VISIONARY FINANCEPEER PRIVATE LIMITED ( NBFC-P2P ) | FinancePeer.com |

| 22 | ANTWORKS P2P FINANCING PRIVATE LIMITED | rm@antworksmoney.com |

| 23 | Creditech Solutions Private Limited | admin@alphamoney.in |

| 24 | FAIRASSETS TECHNOLOGIES INDIA PRIVATE LIMITED | Faircent.com |

| 25 | Peerfintech Solutions Private Limited | LendTree.in |

*The above list of companies has been taken from the RBI website. The list may not be complete and there might be more companies that might not have been included in the list above.

Is P2P Lending Safe?

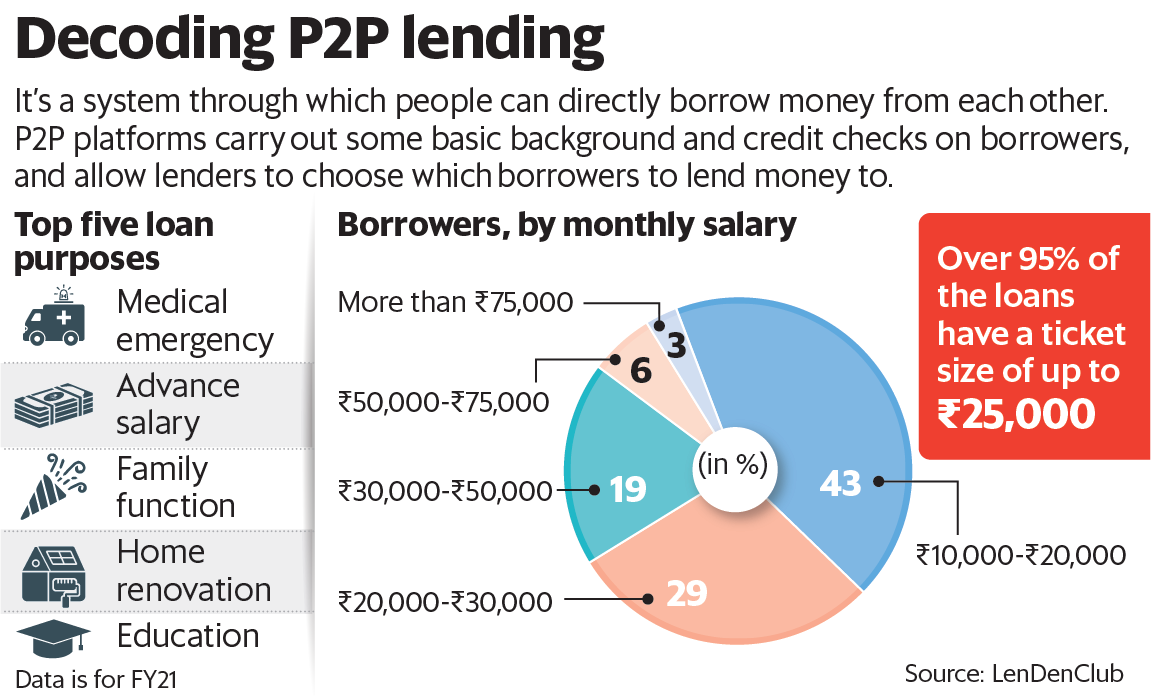

P2P lending is a much riskier asset class compared to traditional mediums like savings accounts, fixed deposits or even liquid funds. Many platforms do market and missell their offerings as an alternative to these, which is grossly incorrect. However, the returns provided by the P2P asset class are generally much higher than savings accounts, thus making it a lucrative option. One will have to tread with caution, do proper due-diligence and diversify investments to avoid risk and get maximum returns on their investments.

Risks in P2P Lending and Possible Mitigations

1. Credit Risk: Credit risk refers to the likelihood that borrowers will default on their loan repayments, leading to potential financial losses for the lenders.

Example: Borrower defaults on the payment.

Mitigation: Thorough credit assessments, credit scoring models, and risk categorization. Diversify investments across multiple loans to spread risk.

2. Platform Risk: It refers to the potential threats and uncertainties associated with the operational, technological, and business aspects of the lending platform- impacting the safety and performance of investors’ funds.

Example: Platform shuts down its operations.

Mitigation: Choose reputable platforms with a proven track record, strong security measures, and compliance with regulatory standards and diversify among multiple platforms.

3. Regulatory Risk: While most P2P platforms are registered with the Reserve Bank, they are not as highly scrutinized or regulated to the extent of banks. Also, many P2P platforms have tweaked models significantly to change the traditional P2P model.

Example: Restrictions on the platform which may lead to platform closure or disruption or stoppage of new borrower onboarding or repayments.

Mitigation: Stay informed about regulatory changes and choose platforms compliant with prevailing regulations.

P2P Lending on RBI Radar

Owing to the very high number of P2P platforms operational in the last few years and the increased competition, there are a few platforms that are indulging in misrepresentation of the concept, risks involved and not following the guidelines and regulations set by RBI. Many novice investors have started to believe P2P as an extension of their savings account without being aware of the risks involved. There have been recent reports that P2P platforms have been on the radar of the Reserve Bank of India for these issues. Link: https://economictimes.indiatimes.com/news/economy/policy/rbi-reins-in-peer-to-peer-lending-practices-sources/articleshow/105756923.cms?from=mdr

Our P2P Investing Experience

We have been exploring p2p since 2017 when this asset class was introduced in India. We had good experience in some of the platforms while poor in others. Below is a table of our investment experience to help choose platforms for new investors.

| Platform | Using Since | Performance | Feature |

| I2I funding(Referral code discount50@i2i) | 2018 | 14% | Urban Clap ,group borrowers |

| IndiaP2P | 2022 | 16% | women borrowers |

| Lendbox | 2021 | 12% | Instant liquidity |

| Liquiloans | 2021 | 10% | Instant liquidity |

| Faircent (only Pooled Loans) | 2021 | 12% | Instant liquidity |

| 13 Karat | 2023 | 12% | Fixed maturity,Cashe Borrowers |

Platforms with subpar performance

List of platforms that were not able to deliver the projected performance or where we lost capital

| Platform | Performance |

| Lendenclub | -20% |

| Rupeecircle | -15% |

| Financepeer | -10% |

| Finzy | 0% |

| Cashkumar | 0% |

| OMLP2P | 0% |

Some platforms that we skipped/stopped due to lower yield or low confidence in the borrower pool include are

- 12 club

- Credmint

- Mobikwik Xtra

Opportunities and Future Outlook

P2P lending in India presents opportunities for both borrowers and lenders. It allows investors to earn attractive returns while providing borrowers with an alternative to traditional banking. As the industry evolves, regulatory frameworks are likely to be refined, enhancing investor protection and fostering sustainable growth.

There have been recent reports (in December 2023) of P2P lenders having come under the radar for mis-selling and regulatory/compliance issues. This may have an impact on their performance and even the existence of some P2P platforms. Also, during & after COVID-19, there were too many defaults and delays in repayments on several platforms which impacted several lenders.

In conclusion, investing in P2P lending in India can be a rewarding investment option, but it requires careful consideration of risks, thorough research of platforms, and a diversified investment strategy. As the sector continues to mature, it is essential to stay informed about market dynamics and regulatory developments to make informed investment decisions.

If you are looking for other alternative platforms that offer up to 20% Return then check out the below list