The world of fixed-income investing can be complex, with various types of debt instruments offering diverse risk-reward profiles. One category garnering significant attention lately is duration funds. These funds hold specific debt securities with varying maturities, and their performance is intrinsically linked to interest rate movements.

This article delves into the intricacies of duration funds, exploring their characteristics, potential benefits, and associated risks. We will also analyze the prospect of high returns in the context of anticipated rate cuts, providing valuable insights for investors considering this investment avenue.

Understanding Duration Funds: A Deep Dive

What are Duration Funds?

Duration funds primarily invest in government bonds and other fixed-income securities with longer maturities. These maturities can range from several years to decades, making them sensitive to changes in interest rates.

How do they work?

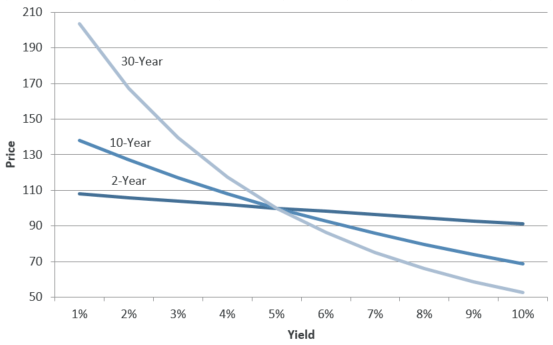

The fundamental principle behind duration funds lies in the inverse relationship between bond prices and interest rates. When interest rates decrease, existing bonds with higher fixed coupon rates become more attractive compared to newly issued bonds with lower rates. This increased demand drives up the prices of existing bonds, leading to potential capital appreciation for duration fund investors. Conversely, rising interest rates have the opposite effect, causing bond prices to decline.

Bond Duration Explained in Simple Terms

Imagine you have a piggy bank where you save money. Every year, the piggy bank gives you a certain amount of coins as a reward for keeping your money safe. This reward is like the interest you get on a bond.

Now, imagine you have two different piggy banks:

- Piggy bank A: This piggy bank gives you a small amount of coins every year for a short time, like 1 year.

- Piggy bank B: This piggy bank gives you a larger amount of coins every year, but for a longer time, like 10 years.

Which piggy bank do you think is more sensitive to changes in the overall amount of coins you can get in the future?

Piggy Bank B is more sensitive! Why? Because you’re locked into getting those larger rewards for a longer period. If the amount of coins you can get overall decreases, you’ll feel the impact more significantly with piggy bank B compared to piggy bank A.

If someone has to buy the piggy bank in a scenario when coins will decrease they will want to lock Piggy Bank B and hence be willing to pay more upfront.

This is similar to how bond duration works. Bonds are like piggy banks that promise to give you a fixed amount of money (interest) at regular intervals for a certain period (maturity). Bond duration tells you how sensitive a bond’s price is to changes in interest rates.

Key Characteristics of Duration Funds

- High-Interest Rate Sensitivity: As mentioned earlier, duration funds are highly susceptible to interest rate fluctuations. Longer-duration funds experience greater price volatility compared to shorter-duration funds when interest rates change.

- Credit Quality: Duration funds can invest in bonds with varying credit ratings, ranging from government-issued (considered relatively safe) to corporate bonds (carrying higher credit risk). The choice of credit quality significantly impacts the fund’s risk profile and potential returns.

- Active vs. Passive Management: Duration funds can be actively managed, where the fund manager selects specific bonds based on their judgment, or passively managed, where the fund tracks a specific bond index.

Potential Benefits of Duration Funds

- High Returns: When interest rates decline, duration funds have the potential to deliver significant capital appreciation. This makes them an attractive option for investors seeking higher returns compared to traditional fixed-income options like short-term deposits or savings accounts.

- Portfolio Diversification: Duration funds can diversify an investment portfolio by providing exposure to a different asset class compared to equities. This diversification can help mitigate overall portfolio risk.

- Regular Income: Many duration funds also offer regular interest payments from the underlying bonds, providing investors with a steady stream of income.

Risks Associated with Duration Funds

- Interest Rate Risk: As mentioned earlier, the primary risk associated with duration funds is interest rate volatility. Rising interest rates can lead to significant capital losses.

- Credit Risk: Investing in lower-rated corporate bonds exposes the fund to the risk of default by the issuer, potentially leading to loss of principal.

- Liquidity Risk: Unlike highly liquid instruments like bank deposits, duration funds may face liquidity challenges during periods of market stress, making it difficult to sell holdings quickly without incurring losses.

Prospects of High Returns in a Rate Cut Scenario

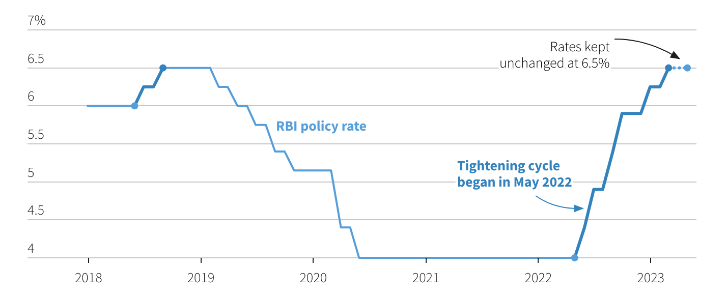

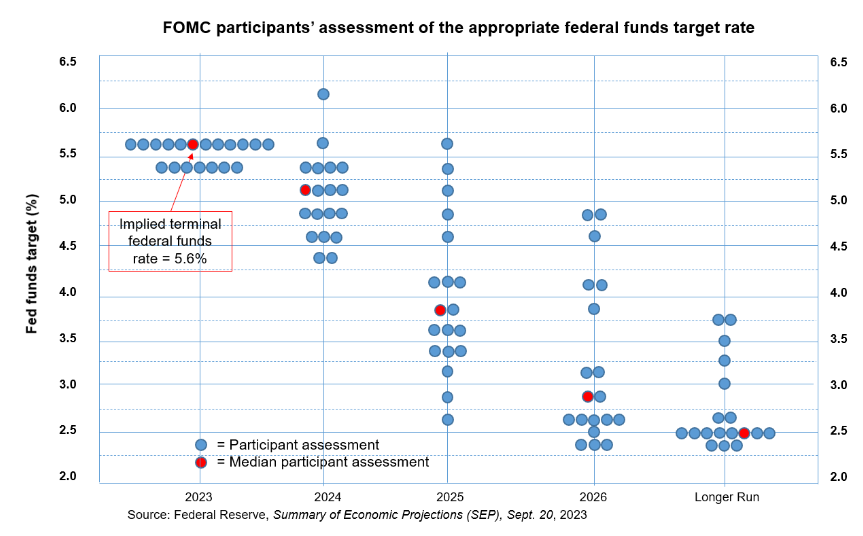

The potential for high returns in duration funds hinges on the anticipated decrease in interest rates. Central banks around the world have been raising interest rates to combat inflation. However, as inflation shows signs of cooling down, expectations are mounting for potential rate cuts in the future.

If these rate cuts materialize, existing bonds held by duration funds will become more valuable, leading to capital appreciation. The extent of these gains will depend on the magnitude of the rate cuts and the duration of the bonds held by the fund.

Important Considerations Before Investing in Duration Funds

- Investment Horizon: Duration funds are suitable for investors with a long-term investment horizon. The potential benefits of these funds can be fully realized only if held for a sufficient period to ride out short-term interest rate fluctuations.

- Risk Tolerance: Investors must carefully assess their risk tolerance before investing in duration funds. These funds can be volatile and are not suitable for risk-averse individuals.

- Diversification: Duration funds should not be the sole component of an investment portfolio. It is crucial to diversify across different asset classes to mitigate overall risk.

- Consulting a Financial Advisor: Seeking guidance from a qualified financial advisor is highly recommended before investing in duration funds. They can help assess your individual financial goals, risk tolerance, and recommend suitable investment options based on your specific circumstances.

A Perfect Scenario for Duration Funds in 2024

2024 presents a compelling opportunity for investors seeking attractive returns in the Indian debt market. A confluence of favorable factors is expected to drive a significant rally, particularly in long-duration debt funds.

Global Growth Slowdown and Normalizing Inflation

The global economic landscape is transforming. Major economies like the US and China are witnessing a sharp slowdown in growth, while the Eurozone struggles to maintain momentum. This synchronized slowdown, coupled with easing geopolitical tensions, is anticipated to normalize inflation globally. Consequently, central banks are expected to shift gears from tightening monetary policy to fostering economic activity through rate cuts.

India’s Advantage: A Beacon of Stability

Amidst global uncertainties, India stands out as a relative haven of stability. Robust domestic demand, coupled with the government’s commitment to fiscal consolidation, paints a positive picture for the Indian economy. Furthermore, India’s inclusion in the prestigious JP Morgan GBI EM Index, effective June 2024, is poised to attract significant foreign investment inflows, further bolstering the debt market.

Rate Cuts on the Horizon

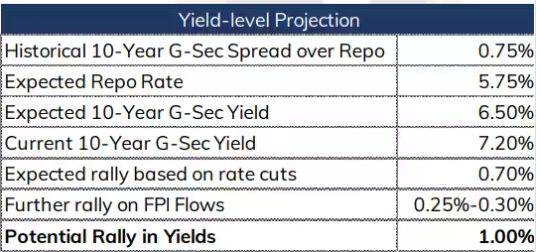

The Reserve Bank of India (RBI) is expected to follow suit with the global trend and embark on a rate-cutting cycle in the latter half of 2024. This, combined with the anticipated decline in global yields, is likely to push domestic bond yields lower, translating into capital appreciation for investors in long-duration debt funds.

Potential Returns: Double-Digit Bonanza

Many Investment houses are projecting attractive returns of 12% – 14% in duration funds during 2024. This optimistic outlook is based on historical precedents, where bond yields witnessed significant declines preceding actual rate cuts by the RBI. The report cites examples from previous rate-cut cycles, highlighting substantial returns even before the official policy changes.

Repo Rate is projected to fall by 75 Bps if the Gse yield falls by the same amount or higher, it can translate to 7-10% returns over the fund base yield of 7.5%.

Investment Strategies for Different Risk Appetites

Investors with a long-term horizon and the ability to tolerate volatility are well-positioned to benefit from this potential upswing. Dynamic Bond Funds and Duration Funds offer an ideal avenue to capitalize on this opportunity, as they provide fund managers with the flexibility to adapt to changing market conditions. However, a minimum investment horizon of 2-3 years is crucial to navigate potential short-term fluctuations.

For investors with shorter timeframes or lower risk tolerance, liquid funds remain a suitable option.

Top Duration Funds in India

Some of the most popular duration Funds in India are –

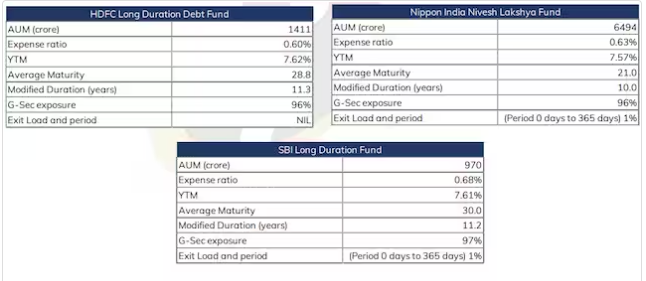

- HDFC Long Duration Debt Fund

- Nippon India Nivesh Lakshya Fund

- SBI Long Duration Fund

Our Investment experience with Duration Funds

We started investing in duration funds in 2023 and have generated ~11% CAGR (not IRR ) without taking any credit risk. We would be further adding duration funds with a 2-year target.

For following more information on Alternative investments join our telegram channel and WhatsApp group

Join Telegram group or Whatsapp group for latest Deals

Follow our Youtube Channel for Insights

Points to consider while investing in Duration Funds

- if interest rate risk you can make losses in market value, hence investors should have the capacity to average down their investment in such times

- Should have at least 3-5 year time horizon to factor in any adverse macroeconomic conditions

- These are currently taxed at marginal tax slab hence consider this factor while investing

Conclusion

The Indian debt market presents a unique opportunity for discerning investors in 2024. A combination of favorable global and domestic factors, coupled with anticipated rate cuts, is expected to propel long-duration debt funds toward attractive returns. By carefully considering their risk tolerance and investment horizon, investors can strategically position themselves to capture this potential windfall.

If you are looking for other alternative platforms that offer up to 20% Return then check out the below list

Not clear how return of 12-14% is being generated from G-sec which gives 6-7%. Can you elaborate with an example pls.

Hi, the below article will explain hor bond duration and interest rate are inversely related to price