Most of the answers support either buying a house or investing in mutual funds.The case is not that one sided . It depends on many factors such as:

cost of interest

House appreciation

Mutual Funds Return

Rental yield.

Leverage ratio to buy house

I will show you how slight change in any factor can make one look more profitable than other:

Assume cost of house is 50 lakh

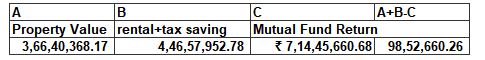

Case 1: House appreciation is 10% per annum, Rental yield is 2.5%, Mutual fund gives 15% return in 20 years,tax saving is included ( we reinvest rental income and tax saved in mutual funds monthly)

So my property in 20 years grew to 3.66 Cr

Rental money and saved tax grew to 4.46

Mutual fund gave 7.14( includes 10 lakh upfront too invested at 15%)

property beats mutual fund by 1 cr

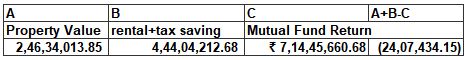

Case 2:House appreciation is 8% per annum, Rental yield is 3 .5%, Mutual fund gives 15% return in 20 years,tax saving is included ( we reinvest rental income and tax saved in mutual funds monthly)

What happened now???

because how appreciation dipped to 8% I am making net loss if mutual funds gave 15% return.

I can try numerous permutation and compare my profit and loss.There fore factors I need to consider while making any decision are :

- What is my cost of funds.Lower the better

- Rental yield of property.How to check?Check price of house and rent people are paying in that area for similar property.

How much appreciation.Its hard to predict.I will still prefer Tier 2 cities where appreciation can be higher than big cities(they are like mid and small caps). Best thing about them is they paying dividend( rental yield) like big city(large caps) and they appreciating like small caps! - How much leverage to take.High leverage in a growing market can give great returns!

Need to know about P2P lending

Let me know your queries