To enhance my portfolio diversification I have increased my investment in some of the platform which have been performing well and my initial investment had been low. viz OMLP2P and FinancePeer.

I have also decided to not increase my investment in Lendenclub and cashkumar for now primarily because auto invest is very slow in these 2 platforms and it’s a hassle to invest manually in these. I am using these platforms as liquidity buffer (replacement for Liquid Funds) as they have short maturity and I can use the EMI if I need cash in future

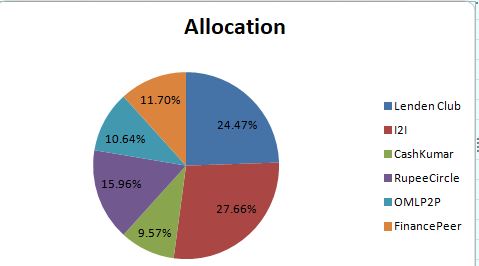

Portfolio Composition

Portfolio Changes:

- My portfolio is more uniformly distributed now among multiple platform compared to when I started

- I have added fresh investments to FinancePeer and OMLP2P

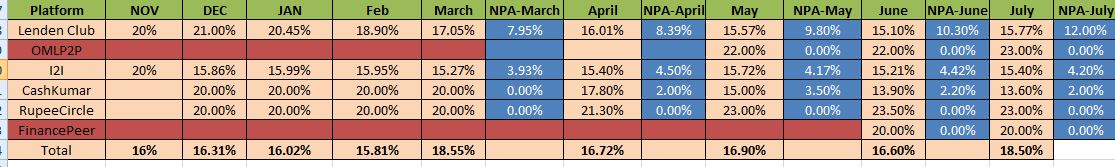

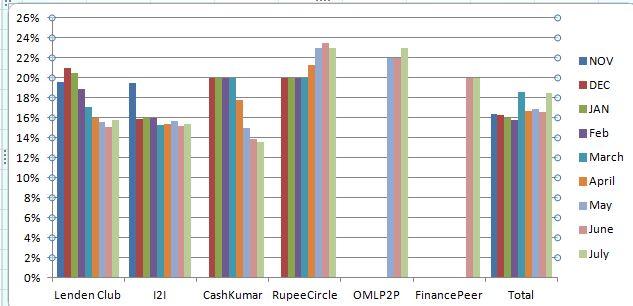

Portfolio Performance

:

Performance Analysis:

Key Points from this month’s performance are:

- LendenClub: I had mentioned I am cutting down my Insta Loan exposure ,slight increase in my portfolio yield can be attributed to it

- I2IFunding : Have decreased investment size per loan in D and E category to 2000 per borrower to diversify optimally

- RupeeCircle :Till now 1 delay that too within 30 days

- FinancePeer : I am using the platform only for Education Loans which is going to add a new diversification to my overall portfolio. No defaults till now

- OMLP2P : I am sticking mostly to salaried People in OMLP2P. For the yield I am getting ,the credit worthiness of the borrowers is pretty impressive here.

- Cashkumar: The yield has been fluctuating between 13-14%. The platform is decent but very tough to find borrowers even after auto invest which makes it good for only small investment

*some fluctuation in yield and NPA can be attributed to the date on which I calculate returns i.e sometime I receive EMI just after calculation, thus people should focus on the trend rather than look at individual numbers

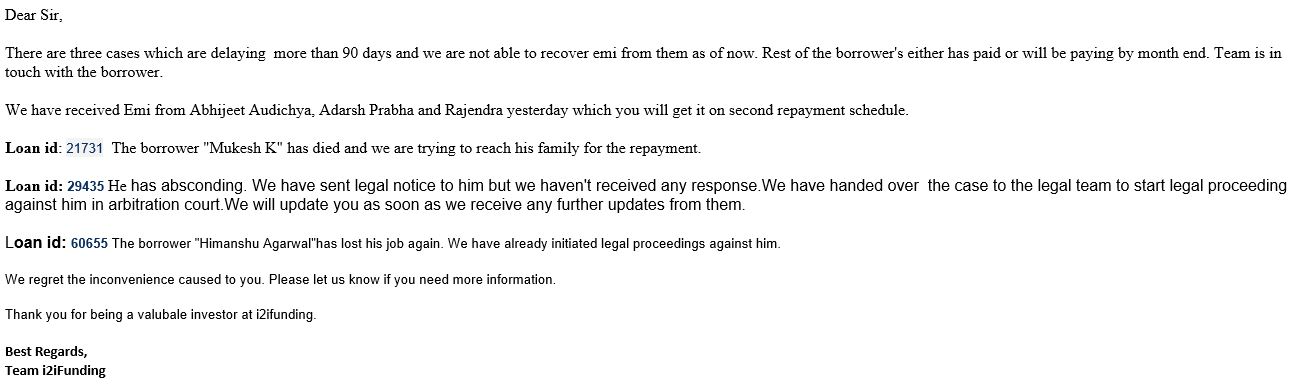

Historical Default Pattern for each Platform:

I2IFunding: 3 defaults 90 plus days:

My Portfolio breakup : around 70% is in D category Government Loans 20% in E and 10% (B&C). On a hindsight I would have invested in C and B categories more in the start rather than going for D category totally.

Although Municipal employees in D category have performed well in my portfolio

Below is the status of my delinquent loans

The absconded guy was from category F, I could have avoided that loan as the guy had made enquiries in 10 other places which is a red flag.

The 1st loan was from E and 3rd from D.

That’s why diversification is very important especially in high risk loans

OMLP2P : No Defaults

My portfolio breakup: 75% of portfolio is in salaried(P2,P3 and P4) while 25% is high quality business loan(B2 and B3)

Interestingly in OML we have even MBA candidate with 60K monthly salary in P3 Category giving 23-24% which is much higher ROI compared to a similar credit loan in I2I.

RupeeCircle: No Defaults

My Portfolio breakup: 50% D category 30% E Category 20% F

Range of ROI is 24-30%

RupeeCircle has some really High CIbil score borrowers(750 +) even though salary is low which implies that they have decent credit history but due to the nature of their job they do not have access to cheap credit from banks which is a great opportunity for P2P investors!

FinancePeer: No Defaults

100% education Loans

ROI is 20%

Till now the platform does not have any defaults in this category as the parents are guarantor of the loan and wilful defaulters would be very low.

(Need to keep in mind Financepeer does not charge any Fees so 20% in FInancepeer is equivalent to 22-23% in other platforms)

LendenClub: 12% Default

Portfolio Break up 35% in Insta , 65% in High Risk

Interestingly my Portfolio yield is 30% plus but due to Defaults the net yield is 15%. Yield will dip now as I am reducing Insta but NPA will also come down

Default break up: 75% of my defaults are in Insta Loan while rest in other category

Cashkumar: 1 Default

Defaulting guy had average monthly account balance less than 1000 .Repayment capacity of such borrowers will always be doubtful

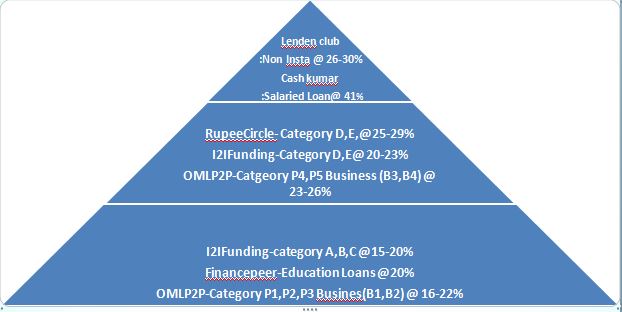

P2P investment Pyramid:

Based on my experience I have created a structure for people to follow when they start investing in P2P .People should start from the base and then go up the pyramid

It implies people who are starting to invest or have lower capital to invest should first concentrate on the Loan categories and platforms which are at the bottom of the pyramid and invest lesser on the ones at top.

Eg: if you have 10Rs : Invest 6 in base 3 in middle and 1 in top.

When the investment amount grows you can increase the allocation for mid level

eg: if you have 10Rs : Invest 4 in base 4 in middle and 2 in top.

Logic: if some one is sufficiently diversified it doesn’t matter which category he focus more on as the expected payoff is same

ie. for 25% loan at 10% default you earn almost same as 20% loans with 5% NPA.

The reason for the structure is that though payoff of the total portfolio is deterministic the path of return is not uniform.

Let’s say we have 100 Loans , in a high risk category 10 loans will be bad but portfolio will give 25% ,while in low risk 5 will be bad but portfolio total return is same.

For someone who starts to invest in 10 loan ,he can pick up 10 bad loans in first scenario while in the other max bad loans he can pick is 5. This can make his portfolio performance substantially even though for few months.

One factor which can further worsen it is that a new investor lack the experience to pick up good loans hence chances are higher that he will pick up bad loans. With experience he can improve the skills.

Once he has 100 loans it does not matter in which category he invested more as the net payoff is similar.

To enable this kind of investment one can use small ticket size for high risk loans(say 2000) and larger ticket for safer loans(say 5000)

Invoice Discounting Performance:

I keep rolling my invoice discount investments. Currently I am invested In Flipkart and Amazon for average duration 40 Days

My current Portfolio yield and duration:

While selecting a company in Invoice discounting factors which I check:

- Latest Quarterly report if available

- Current Leverage and cashflow

- Any adverse news in the last 3 months.

- Financial strength of the vendor too ensure in the scenario enterprise fail to honour receipt , the vendor is able to pay me .

Footnotes:

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

For starting invoice discounting mail me or drop a message on 9967974993 or mail me at rohanrautela9@gmail.com