In recent years (typically after COVID-19), alternative investment opportunities have gained significant traction among retail investors in India. Traditional investment avenues like fixed deposits, savings accounts, mutual funds, and even equity are no longer the sole focus for many investors. The increasing awareness of the need for portfolio diversification and the search for higher returns have driven investors to explore alternative assets. These include peer-to-peer (P2P) lending, invoice discounting, and asset leasing. etc. The ease of access to these investments through online platforms has further fueled this trend, making it easier for individual investors to tap into opportunities once reserved for institutional investors.

In this post, we will provide comprehensive information on Vested, a popular platform for US stock investments that has expanded its offerings from US stocks to various alternative investments. We will explore what Vested is, the investment options it provides, how to get started, the fees and brokerage involved, and some alternatives to the Vested platform. By the end of this article, you’ll clearly understand how Vested can help you diversify your investment portfolio and potentially achieve better returns.

What is Vested Finance?

Vested started as a platform for investing in US stocks from India in the year 2019. Over the years, it has evolved into a comprehensive platform for investing in various alternative assets like P2P lending, Indian bonds, solar project investing, etc. Vested aims to facilitate diverse and global investment opportunities for Indian and NRI investors.

Vested India Team

Vested was started in the year 2019 to simplify US stock and ETF investing for India. The vested India team comprises individuals with diverse expertise and a shared passion for innovation. The team under the leadership of Viram Shah (Co-founder & CEO) brings extensive experience in their respective domains.

Investment Options Available on Vested

Vested offers a variety of alternative investments, including:

- US Stocks and ETFs

- Access to over 5,000 US stocks and ETFs.

- Opportunity for Indian and NRI investors to diversify their portfolios.

- Invest in leading global companies and ETFs.

- Vested Edge (Peer-to-Peer Lending)

- Invest in Peer-to-Peer (P2P) lending platforms.

- Automatically diversify investments across RBI-regulated P2P platforms like Faircent and Lendbox.

- Potential for attractive returns with controlled risk.

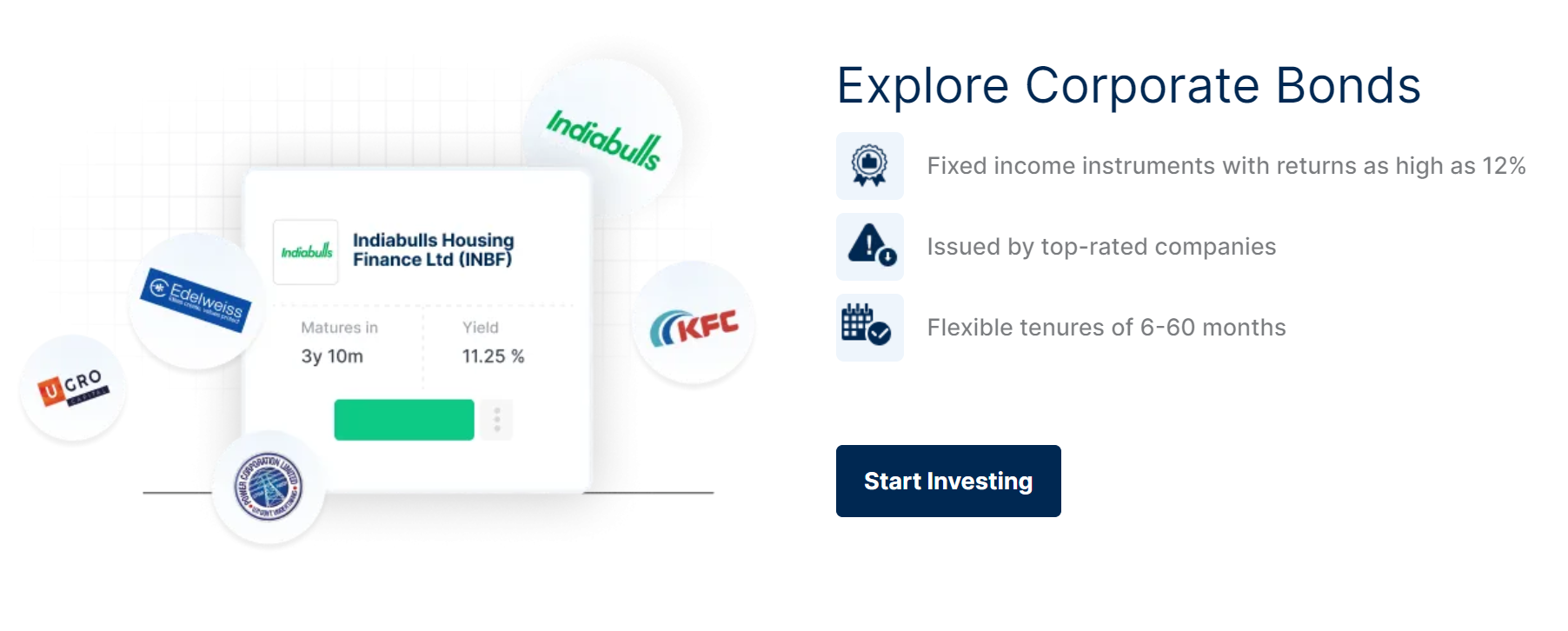

- INR Bonds

- Access to a curated list of corporate and government bonds in India.

- Includes corporate bonds rated A and above and government bonds.

- Offers potential fixed-income returns between 9-12%.

- Minimum investment starts at 1,000 INR.

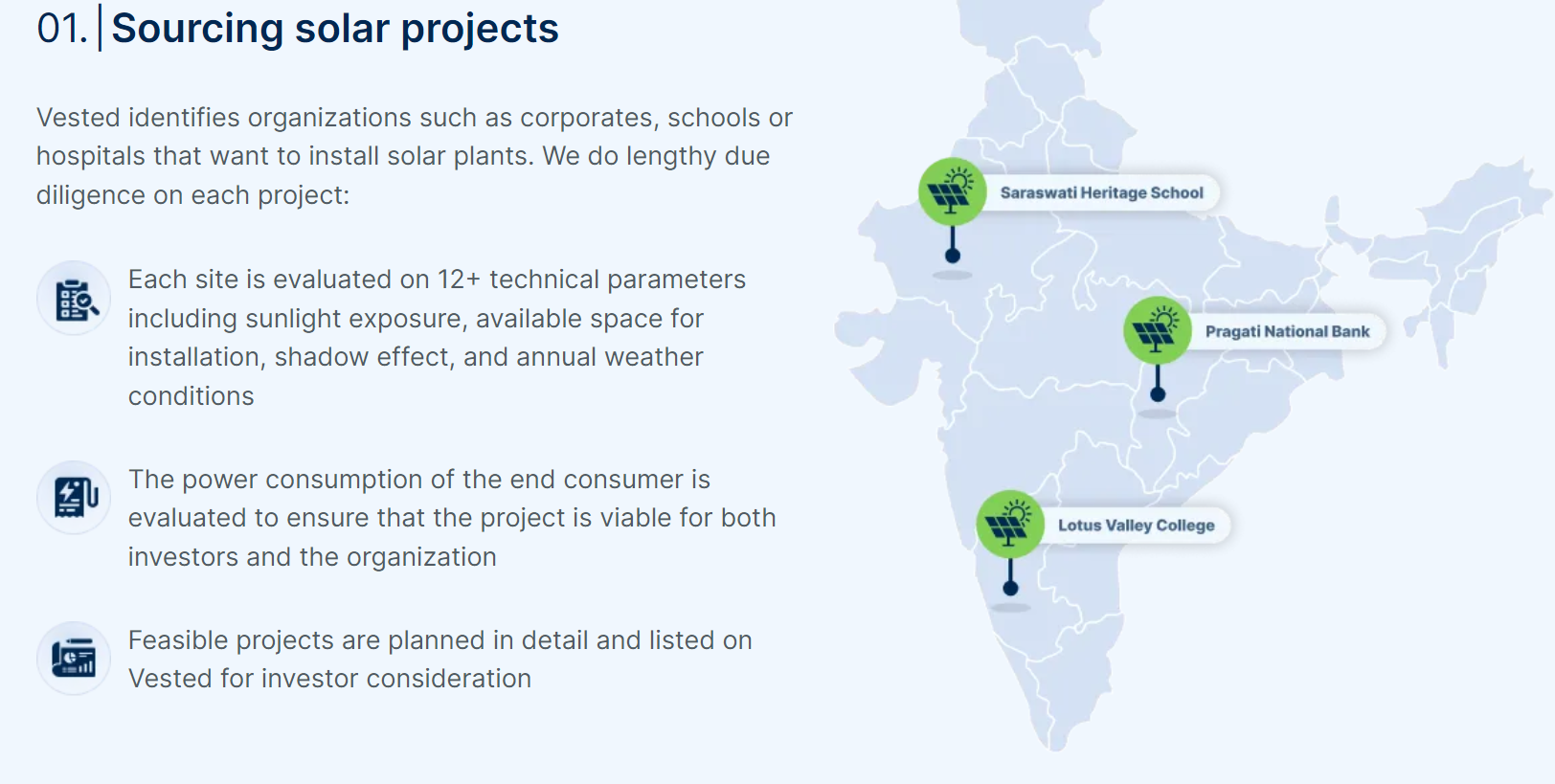

- Solar Investments

- Invest in solar panels for rooftop projects.

- Earn returns between 10-13%.

- Contribute to India’s clean energy movement.

Unique Opportunities available on Vested Finance

We believe that adding a platform only makes sense if it provides access to opportunities that are not available elsewhere. Some of the unique opportunities available on Vested are

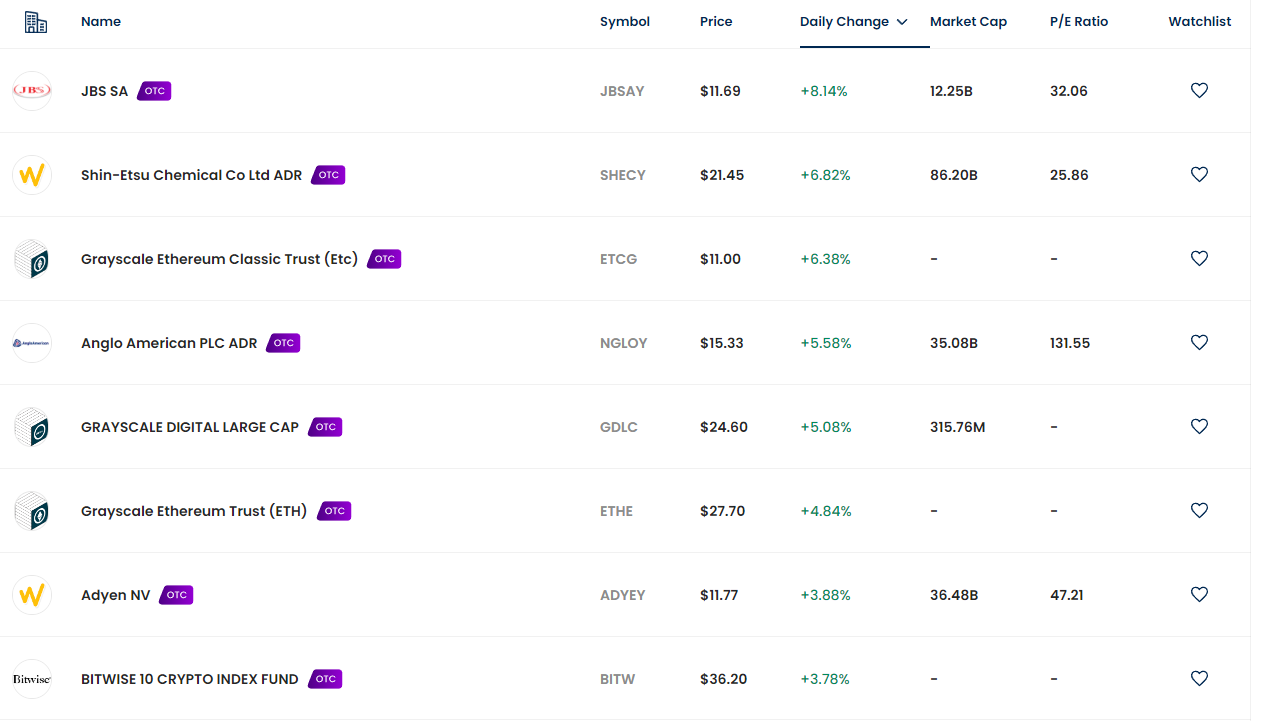

- OTC Deals in the US – These are products that are not listed on the US exchange and need to be bought directly from the fund house. Examples of such products are

- Crypto Index Fund

- ADR of a few companies.

- Unlisted Bonds

- Solar Investments

Vested is one of the active platforms that offer Solar opportunities in India that can offer between 11-13% IRR and are backed by green assets.

How to Get Started with Vested

To start investing with Vested, follow these simple steps:

- Create an Account

- Use the above link to sign up and get 5$ Bonus.

- Provide basic information to create your profile.

- Select Asset Class

- Choose the asset class you are interested in, such as US stocks and ETFs, P2P lending, or INR bonds.

- Complete KYC Process

- Submit the required documents for the Know Your Customer (KYC) process.

- Documents typically include your PAN card, address proof, and tax ID if you’re an NRI.

- Fund Your Account

- Add funds to your Vested account.

- Transfer money from an Indian bank account or via wire transfer from a non-Indian bank account.

- Start Investing

- Once your account is set up and funded, you can begin investing in your chosen asset classes.

Vested Fees & Brokerage

Understanding the fees involved is crucial for any investor. Here’s a breakdown of fees:

- US Stocks and ETFs

- Account opening fee: ₹250.

- Brokerage fee: 0.20% for standard users and 0.10% for Premium users on all buy/sell transactions.

- Note: The Bank may charge an additional fee for transferring funds to your US brokerage account.

- Other Alternative Investments (P2P Lending and INR Bonds)

- No fees are charged by Vested for P2P lending via Vested Edge or INR Bonds.

Alternatives to the Vested Finance Platform

Vested now offers a broad range of investment options- US stock investing being its core. However, it’s always good to explore other platforms as well. The list below provides a few alternatives in the spaces it operates.

US Stocks & ETF Investing from India

You can check out our detailed post on Stockal through which we have invested in US markets

- IndMoney

- Stockal

- Interactive Brokers

Peer to Peer (P2P) Investing

Most people already have explored the below investment platform and thus Vested here does not provide any significant value hence I will avoid this feature.

- Lendbox

- India P2P

- Faircent

- I2I Investing

INR Bonds

We checked the bonds and found that almost all these bonds are already available on Tapinvest, Grip, and Altifi.

- Grip Invest

- Altifi

- Incred Money

- Wintwealth

Solar Project Investing

This is one of the features that can be useful as in the current scenario there are no active solar investment platforms with live deals

- Pyse

- Sustvest (currently getting revamped)

One can also consider looking at platforms that offer multiple alternative investment options under one roof like Grip Invest, Tap Invest, Alt Graaf, etc.

Conclusion

In this Vested Review, we have tried to cover all the points that an investor who is new to the platform needs to know. Vested is one of the top choices in India when it comes to investing in US stocks and ETFs. Now it has transitioned itself into a versatile platform that caters to the growing demand for alternative investment opportunities among Indian and NRI investors.

Diversifying your portfolio with alternative investments can potentially enhance returns and reduce risk. The platform makes it easier for retail investors to access these opportunities and grow their wealth.

For us Solar Investment and OTC deals are only asset class that makes sense through this platform.

Some frequently asked questions about Vested Finance

Q: What types of investment options does Vested offer?

A: It provides a variety of alternative investment options to diversify your portfolio:

- US Stocks and ETFs:

- Vested Edge (P2P Lending)- via RBI-regulated platforms like Faircent and Lendbox.

- INR Bonds

- Solar Investments

Q: What are Vested Vests?

A: Vested Vests are curated portfolios comprising stocks and/or ETFs, designed with specific goals or themes.

Q: What are Vested’s fees?

A: The Platform charges the following fees for US stocks/ETF investing: Account opening fee: ₹250 & Brokerage fee: 0.20% for standard users and 0.10% for Premium users on all buy/sell transactions. For other services like P2P or INR bonds, no charges or fees are taken from the user.

Q: Can NRIs invest in Vested’s offerings?

A: Yes, NRIs can invest in Vested’s offerings. During the account creation and KYC process, NRIs need to provide their tax ID and other relevant documents. They can fund their accounts through wire transfers from non-Indian bank accounts.

Q: How does Vested Edge work for P2P lending?

A: Vested Edge allows you to invest in P2P lending through RBI-regulated platforms like Faircent and Lendbox. The platform automatically diversifies your investments across multiple borrowers, reducing risk and enhancing returns.