Alternative investments are more popular today than ever before. This popularity and increased attractiveness are fuelled by alternative investment platforms that democratize assets that were once restricted to institutional investors and high-net-worth individuals.

One such investment platform is Tyke (rebranded as Amplio), which has made it possible for the average retail investor to invest in early-stage startups and benefit from their growth. A low minimum investment amount in the range of a few thousand rupees has enabled investors to explore a new kind of investing. Tyke’s investment products are neither private inquiry investments nor venture capital. They can best be described as crowdfunding opportunities with a mix of benefits for the investor and the startup founder.

In this review, we will look at what Tyke is, how it works, its investment products, and what it offers to investors. Besides, we will also look at the team behind Tyke and see whether its offerings are good enough to be true!

What is Tyke?

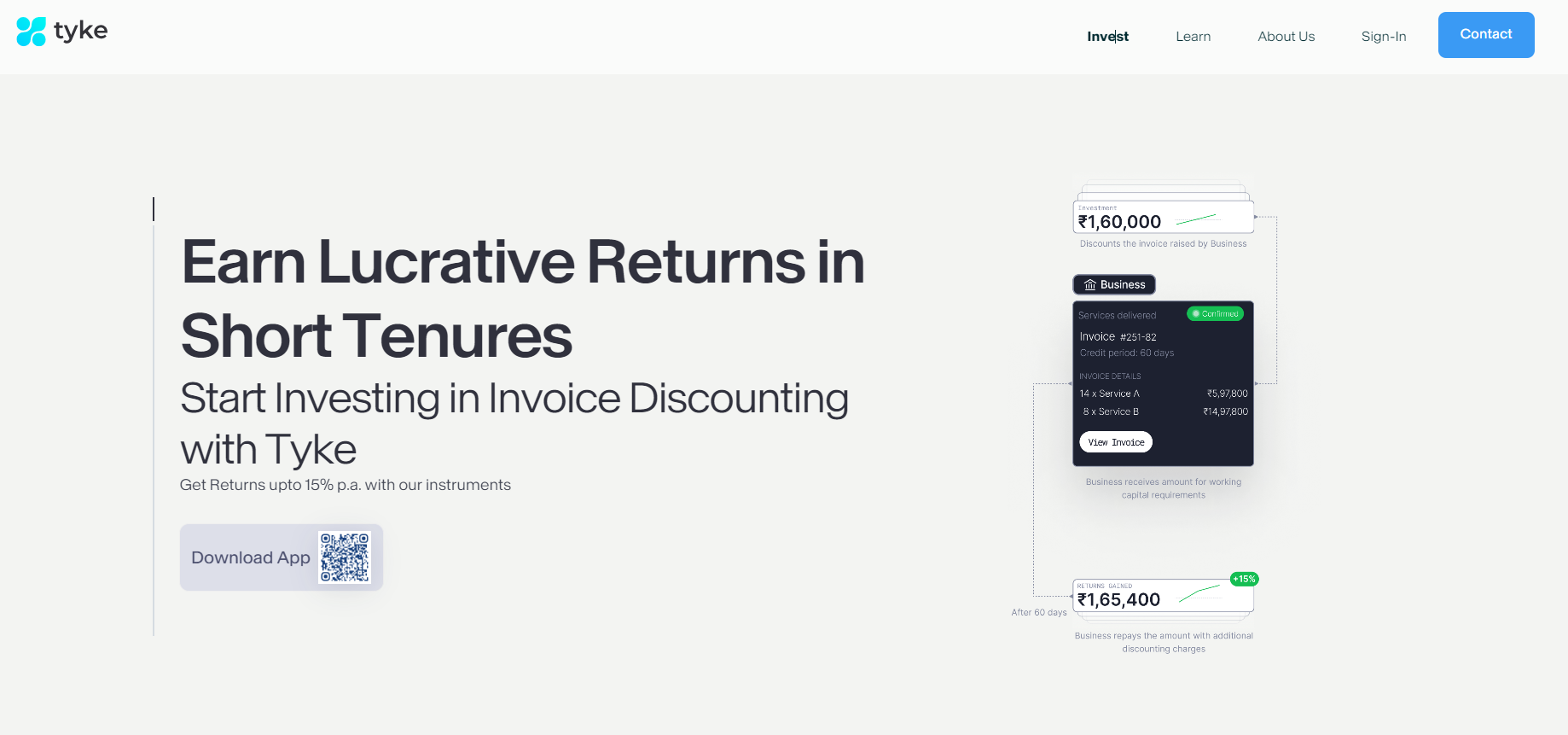

Tyke is an alternative investment platform that offers various investment products through which you can invest in startups. As an investor, you can choose from a range of investment campaigns on the platform. These include- a Community Stock Option Pool (CSOP) campaign, a Compulsorily Convertible Debenture (CCD) campaign, a Compulsorily Convertible Preference Share (CCPS) campaign, a Discounting (ID) campaign, or a Non-Convertible Debenture (NCD) campaign.

We will look into these investment avenues later and understand what each of these entails.

Tyke’s stated vision is to make investment opportunities accessible to all. The platform’s investment philosophy is based on the three pillars of stability, consistency, and growth. Its investment products offer an opportunity to reduce volatility by investing in products that are resilient to market swings, offer predictable returns, are liquid, and can be withdrawn in relatively short investment periods.

Team behind Tyke

At the helm is Tyke’s CEO and Co-founder, Karan Mehra, a CA and CFA by qualification. Karan worked with Deloitte before starting Tyke. Purab Bubna is Tyke’s COO and the other Co-founder besides Karan.

Karan and Purab started Tyke to democratize the investment space by providing retail investors access to opportunities that earlier were available only to a very small share of the population.

How Tyke Works

To become an investor on Tyke you need to start by registering on the platform. All you need to do is sign up using a mobile number. Verify your mobile number and provide your first and last name.

Once you have registered on Tyke, you can explore different investment opportunities on the platform. To enable investors to make an informed investment decision, Tyke offers detailed information about the opportunities. Once you have made a decision, you can subscribe to the specific investment campaign by investing your money and signing the agreement. For verification purposes, the platform will ask for your PAN Card and bank account details before you invest.

Once you invest in the platform, depending on the type of campaign, you will receive details of the instrument. In the case of CSOP, an agreement will have to be signed by you at the time of transacting. After the campaign ends, the signed agreement as well as the SAR letter signed by the founders of the startup, will be available in the Portfolio section on the platform. In the case of NCD, CCD, or any other similar campaign, post successful signing of the agreements will be available in your portfolio.

Instruments for proof of investment will depend on the type of subscription:

- For CSOP: CSOP agreement and SAR Letter.

- For CCD/CCPS/NCD: Subscription agreement and Offer Letter

- For Discounting: An acknowledgment email and Agreement document

The minimum subscription amount on Tyke starts at Rs.5000. However, the minimum subscription amount for each campaign is different and is mentioned on the campaign page.

Both individuals and non-individuals can subscribe to investment campaigns on Tyke. Individuals need to be above 18 years of age and hold a valid PAN card. Non-individuals can invest on the platform by registering as either a company, a partnership firm, or a HUF. Non-individuals are required to fill out all the legal details of their organization by choosing the appropriate option while completing KYC.

Tyke’s team reviews several startup details before shortlisting it to go live on the platform. Some of the details reviewed include-

- Financial statements and cash balances

- Founder pedigree including education qualifications, previous experience

- Fundraising history and investor cohorts

- Market position and potential

- Social media presence

Tyke’s Investment Products

The different types of investments available on Tyke include- CSOP, Compulsorily Convertible Debenture (CCD), Compulsorily Convertible Preference Share (CCPS), Discounting, and Non-Convertible Debenture (NCD).

A CSOP or Community Stock Option Pool is a contractual agreement between the subscriber (an investor who subscribes to the campaign) and the company (a startup seeking to raise funds on Tyke). The agreement entitles the subscriber to community benefits and the potential to be granted Stock Appreciation Rights (SAR).

As a subscriber to a CSOP campaign, you will be entitled to community benefits offered by the company. These can include-

- Discounts or other exclusive offers on products and services.

- Access to exclusive events organized by the startup.

- Opportunity to participate in testing of beta launches or provide feedback on prototypes.

- Brand ambassador benefits and engagement with the founders.

Besides, the startup may also offer Stock Appreciation Rights or SARs through CSOP subscriptions. If offered, SAR entitles the subscriber to receive a value equivalent to the appreciation in value invested linked to factors such revenue of the company. However, there is no issuance of equity shares involved, and SAR can only settled by the company by payment of cash or other such incentives.

CCDs or Compulsorily Convertible Debentures, are hybrid instruments that have elements of both debt and equity instruments. They are debentures that are compulsorily convertible into equity shares of the company. CCDs do not carry any voting rights. Terms and timelines of conversion of CCD into equity shares is determined at the time of issuance; however, it cannot exceed 10 years from the date of issuance in any case.

Compulsorily Convertible Preference Shares (CCPS) are securities that offer a fixed income to the subscriber till the time of conversion into equity shares. CCPS converts into a predetermined number of equity shares at a pre-determined date agreed upon at the time of issue.

An NCD or Non-Convertible Debenture is a secured fixed-income debt instrument that entitles the subscriber to regular fixed-interest payments. NCDs have a fixed tenure, which can be a maximum of 10 years. The principal amount, which is the amount invested, may be repaid in tranches during the tenure of the instrument or at the end of the maturity period.

Now, let’s have a look at one of Tyke’s open campaigns:

Tyke Wealth

Tyke Wealth Theme 1 is an investment opportunity to explore the Online Payments landscape in India. Retail businesses often need their money from digital transactions quicker than it normally takes for settlement. Tyke Wealth Theme I solves this by giving retailers the money upfront and then settling the exact amount within one or two business days. This helps retailers with their cash flow and gives investors a steady return on their money. The campaign offers up to 10% annual returns with a 7-day lock-in period and weekly interest payouts.

The different investment strategies and opportunities under Tyke Wealth include opportunities in the online payments segment such as Instant Payments Settlement Arbitrage, Point-of-Sale (PoS) Machine Financing, Aadhaar Enabled Payment System (AePS), and Bharat Bill Payment System (BBPS). Tyke Wealth seeks to finance transactions through these routes by offering immediate payments to merchants or retailers.

Tyke’s Investment Note for Tyke Wealth identifies the three risks of credit risk, market risk, and liquidity risk and provides different risk mitigation strategies including, due diligence by Tyke’s team, indemnification clause in agreements between the merchants and the investors, and a liquidity reserve amounting to 2% of the total fund value.

Tyke Personal Experience and Risk Factors

Unlike other angel investment platforms, angel networks, or angel funds, Tyke’s investment products are unique and come with their own risks. Community Stock Option Pool or CSOP offers the same financial rights as equity shares; however, it does not offer any voting rights. Unlike equities, CSOPs don’t put retail investors on the startup’s cap table.

The CSOP agreement is a contractual agreement where SARs are granted to the subscriber, but SARs do not give subscribers any shares in the company. The benefit of SAR can be realized when the subscriber decides to sell their CSOPs or during an IPO. It only gives the opportunity to benefit from appreciation in the value of the company’s stock and does not give the stock itself.

The following factors highlight the risks involved in a typical CSOP contract:

- CSOPs are not considered a security under the Companies Act, 2013 and does not grant any rights to the subscriber as a security holder.

- Contributions to CSOPs are considered subscriptions, not deposits or loans, and subscribers cannot request a refund except in case of an exit event.

- CSOP agreements do not guarantee any monetary return to the SAR holders. Instead, it just gives an opportunity to benefit from the growth of the company.

- Not being a security, CSOPs attract high taxes as they are categorised as products or services, attracting an 18% GST.

- For non-individual investors, CSOP is recorded as long-term/short-term provisions on the equity and liabilities side of the balance sheet and is not an allowable expense under the Income Tax Act, of 1961.

Tyke’s track record is full of mishaps that need to be considered before making an investment on the platform. For instance, Geeani Electric Tractor, which raised over 1.5 crore rupees on the platform, promised an electric cycle worth 60,000 rupees to every investor who invested more than 1 Lakh rupees. However, the company did not deliver on the promised electric cycles. Similarly, the valuation of the startups becomes a major determinant. Rising Superstars, a startup that offers games-related activities for kids, raised 1 crore rupees from Shark Tank India at a valuation of just 26 crore rupees and subsequently raised 3.78 crore rupees from Tyke at 75 crore rupees valuation. The difference in valuation became a major concern for subscribers.

Detailed article on Tyke CSOP risk

We have invested only a small amount in Tyke and will wait for few more months to add more capital as we do not have complete confidence on the platform.

Tyke Alternatives

Some of the platforms that investors can explore for similar alternative investments are

Grip Invest is a platform that lists equipment leasing, inventory-based financing, and commercial real estate investing deals on it. It has a constant flow of new deals and has been one of the pioneers in this space in India. The minimum amount to invest is Rs.10000 and you can get an average IRR of 12-15%+ depending on which deals you invest in.

Leafround lets you invest in assets that are then leased to Enterprises. They have multiple opportunities available to invest on the platform. The minimum investment is Rs.10000 and you can expect 20-25% IRR.

This is another fast-growing alternative investment opportunity listing platform backed by Sequoia and other popular angel investors. Apart from invoice discounting, corporate debt, and other instruments, it also has equipment lease-based investment options on its platform. The minimum investment is slightly higher at Rs.100000 per deal but might vary depending on the deals.

Check out the complete list of alternative investments below

Conclusion

Tyke is offering innovative investment opportunities to retail investors. Investing in early-stage startups for as low as five thousand rupees is truly democratizing startup investments in India. However, the investment campaigns offered on Tyke are complex in terms of their agreements and the terms of conditions.

As an investor, it is highly recommended that you go through the terms and conditions and agreement documents tediously before making a subscription. For instance, a CSOP may only offer community benefits and no Stock Appreciation Rights or SARs. Similarly, it is important to note the timelines associated with each campaign and the basis of the IRR promised. Being largely unregulated, disputes arising from investments on the platform will largely be privy to the contractual agreements between the investor and the startup, and as a result, it is important to understand the terms of such agreements before investing.