One major detractor for mutual fund is fees.Lets say somebody has been very disciplined in investing in mutual Funds for years .He made decent money and now his portfolio value is 50 Lakh INR.What would happen if the market does not move for the next 5 years.

average Expense ratio = 1.5%

Portfolio Value = 5000000

Loss = 3.64 Lakhs

Thats a substantial Loss .Why is the mutual fund making money when I am Losing

Another point is when the portfolio becomes huge market movement impacts the portfolio profit immensely!Doing SIP is great but anyway you going to lose money on existing portfolio:

Eg:Your Portfolio is worth 10 lakh and you doing 10000 INR SIP evry month.If market Crack 10% you are going to lose 10% networth.Period!!

Maybe you made good profit in the past at some good rate of return but who like to see the current value eroded?

Is there a solution ??

Yes ,The solution is synthetic replication.Its a method to replace your current portfolio with a strategy which can provide better risk return reward!!!

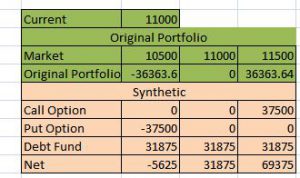

I have reiterated benefits of ETFs of Mutual Funds many time.Now Let’s say someone has been investing in Nifty ETF through SIP and has a 800000 INR position over a period of time. I will demsonstrate how he can change his risk profile:

Scenario 1:

Person wants exact payoff as holding 800000 worth of Nifty 50 ETF.

Step1: Sell Nifty 50 ETF

Step 2: Buy ATM call ,sell ATM put for December expiry

We can see when market was trading at 10840 Call price = 361 ,Put Price =360

Our total exposure is 10840 * 75 (Lot size) =813750

So if we Do the postion we have zero upfront cost and return exactly like our underlying position .

Now see the benefit:

We had to put 60000 as margin for the position .We are left with 813750-60000.

Now we put that money in high yielding debt fund .eg corporate Opportunity Fund etc.

Average Return is 8.5%

Till December interest earned = 8.5% * 180/365 * 750000 = 31875.

We have made 31875 extra with same market risk as our cash position.

P&L for a 800000 Portfolio in 6 months

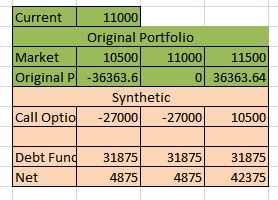

Scenario 2:

Person wants all the upside but choose principal protection

Step1: Sell Nifty 50 ETF

Step 2: Buy ATM call , for December expiry

We can see when market was trading at 10840 Call price = 361

Cost for 75 call lot = 361*75 =27075

Our total exposure is 10840 * 75 (Lot size) =813750

So if we Do the postion we have zero upfront cost and return exactly like our underlying position .

Till December interest earned = 8.5% * 180/365 * 750000 = 31875.

We have made( 31875 – 27075 )extra with same principal Protection.

This is just 6 months return .Just imagine doing this year on year with bigger portfolio!!

This is just couple of replication I have shown .We can adjust our option position preiodically to get more yield. Add a bit a P2P

etc to gain higher yield extra.

The bottom line is we are able to control our market risk plus get extra income.Its like buying a Mutual Fund and getting paid with Expense Ratio