In the dynamic landscape of personal finance in India, where new investment avenues seem to emerge almost daily, traditional fixed deposits maintain their steadfast appeal as reliable investment options. The Reserve Bank of India reported that fixed deposits constituted over 57% of the total household savings in financial assets. This highlights the level to which FDs are preferred & popular among Indian investors.

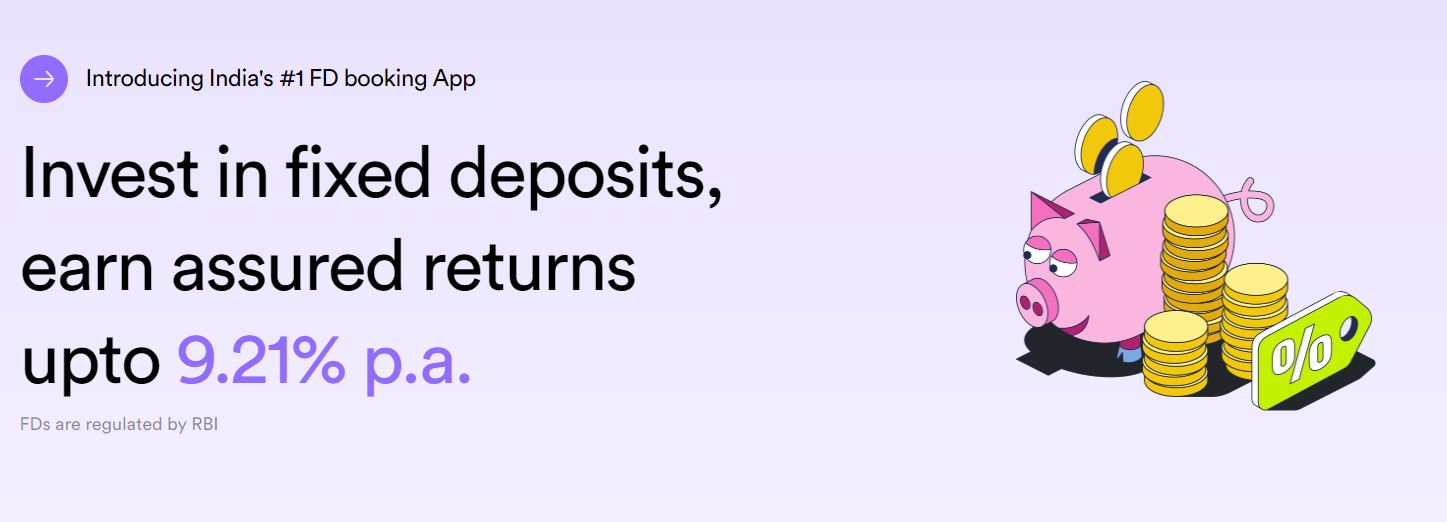

In this post, we review Stable Money, which is a recently launched mobile app that enables you to compare, book & manage fixed deposits with several banks and NBFCs. Let us explore this platform in depth, know how it works, its advantages & disadvantages followed by our Stable Money review.

Why prefer good old fixed deposits for investments? (over newer options)

Download and Get referral Bonus

- Stability: Fixed deposits offer a stable and predictable return on investment, making them a reliable choice for risk-averse investors.

- Assured Returns: Unlike some newer investment options with variable returns, fixed deposits provide a guaranteed interest rate, ensuring a known profit over the investment period.

- Low Risk: Fixed deposits are considered low-risk investments, making them suitable for those prioritizing capital preservation and a steady financial growth trajectory.

- Ease of Understanding: The straightforward nature of fixed deposits makes them accessible to a broad spectrum of investors, including those who may find newer, complex financial instruments intimidating.

- No Market Dependency: Fixed deposits are not influenced by market fluctuations, shielding investors from the volatility often associated with newer investment avenues.

- Liquidity Options: While fixed deposits have a lock-in period, they often come with options for premature withdrawal or loans against the deposit, providing a degree of liquidity when needed.

- Tax Benefits: Certain fixed deposit schemes (Tax Saver Fixed Deposit Schemes) offer tax benefits under Section 80C of the Income Tax Act, adding a favorable tax dimension to the investment.

- Diversification: Integrating fixed deposits into an investment portfolio provides a stable foundation, balancing the risk associated with potentially higher-yield, but riskier, investments.

What is Stable Money?

Founded in the year 2022, Stable Money is India’s top FD booking app which allows you to compare FD interest rates across 200+ small and large banks in India, book FDs online with their partner banks and NBFCs within a few clicks and manage your FDs on the app itself. The app is available on both Android & iOS. While they live only with fixed deposits at the moment, they plan to introduce debt mutual funds and bonds going forward, making it a platform for fixed-income investment options.

How does Stable Money work?

Download and Get referral Bonus

The main functionality of the Stable Money app is that it lets you create FDs with their partner banks and NBFCs within a few minutes without you having to physically go to the branch or fill up any forms offline.

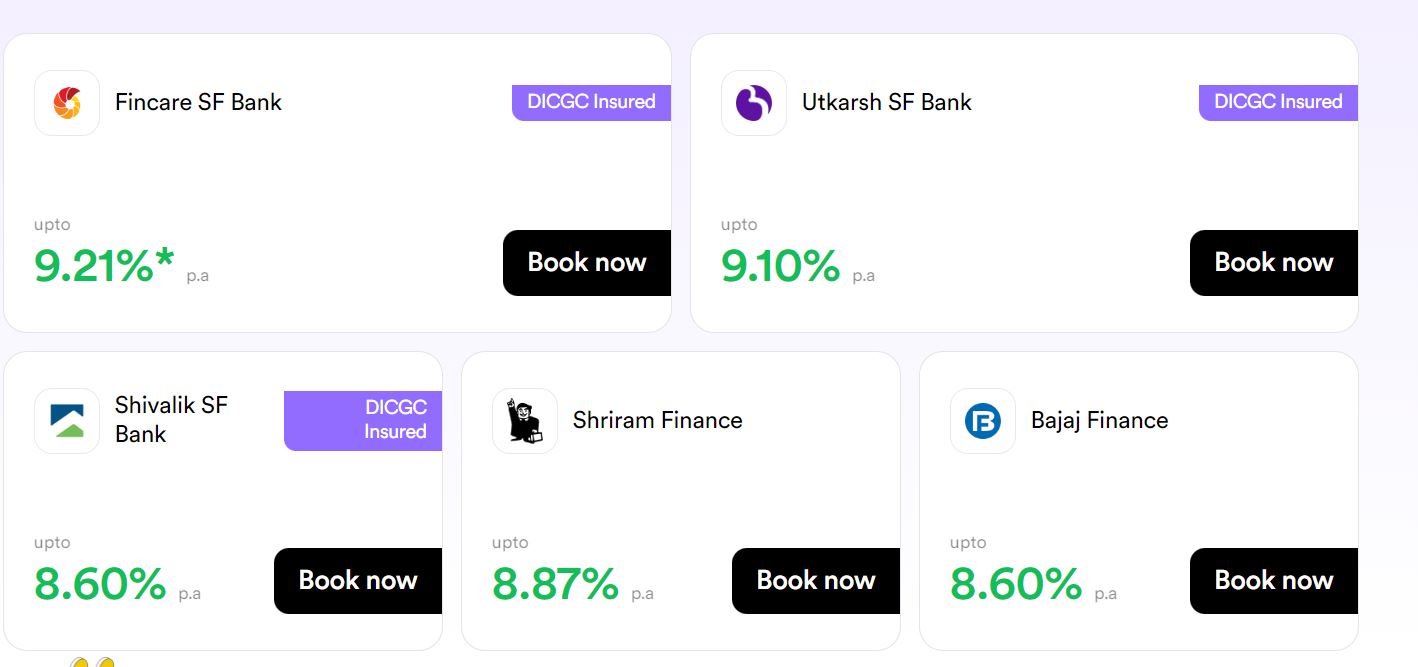

For this they have partnered with banks and NBFCs to offer their FDs to customers in a completely online manner. At the moment, there are 3 small finance bank partners- Utkarsh Small Finance Bank, Fincare Small Finance Bank & Shivalik Small Finance Bank & 2 NBFC partners- Bajaj Finance & Shriram Finance whose FDs are available online on the platform. I guess that these partner banks and NBFCs might be providing an incentive or commission to Stable Money for every FD created with them. This makes it a win-win business solution for all 3 parties- banks acquire new customers, Stable Money gets incentives & customers can create FDs with simplicity.

The process of creating FDs is 100% digital and can be opened with any bank account (you don’t necessarily need to have a savings account with the FD issuing bank to create FDs). The process is quick and FDs are created quickly. Moreover, even withdrawals can be done through the app itself.

Steps to create fixed deposits with Stable Money:

- Finalize the bank and the tenure for making the FD

- Verify your identity with the bank by providing your PAN and Aadhaar details.

- Ensure your bank account is verified; the maturity amount from the FD will be credited to this account.

- Complete the payment process through UPI or Netbanking.

- That’s all! The bank will approve your FD, and the FD receipt will be accessible via email or directly on the app.

Advantages of using Stable Money over directly creating FDs with the bank

Ease and Convenience: Apps like Stable Money provide a user-friendly interface, making it easy for individuals to explore, compare, and create fixed deposits with just a few clicks. The convenience of a mobile app allows users to manage their fixed deposits anytime and anywhere, eliminating the need for physical visits to banks or NBFCs.

Multiple Options in One Place: Aggregator apps like Stable Money offer a variety of add-on services under one -roof like interest rate calculators, option to compare interest rates, etc. (apart from the functionality to book FDs with their partners). This saves time and effort, ensuring that users can make informed decisions by considering multiple options without the need to visit each institution separately.

Paperless Transactions: Stable Money facilitates a paperless and digital process for creating fixed deposits, reducing the administrative hassle associated with traditional paperwork. The streamlined, online process enhances efficiency and contributes to a more environmentally friendly approach. Also, you aren’t required to have a savings account with the bank you are creating a fixed deposit with (which might not be the case if you visit the bank directly).

Real-Time Updates and Reminders: These apps often come equipped with features that offer real-time updates on fixed deposit performance, maturity dates, and interest accrual.

Automated reminders help users stay informed about upcoming maturity dates or other critical events related to their fixed deposits.

Stable Money Team

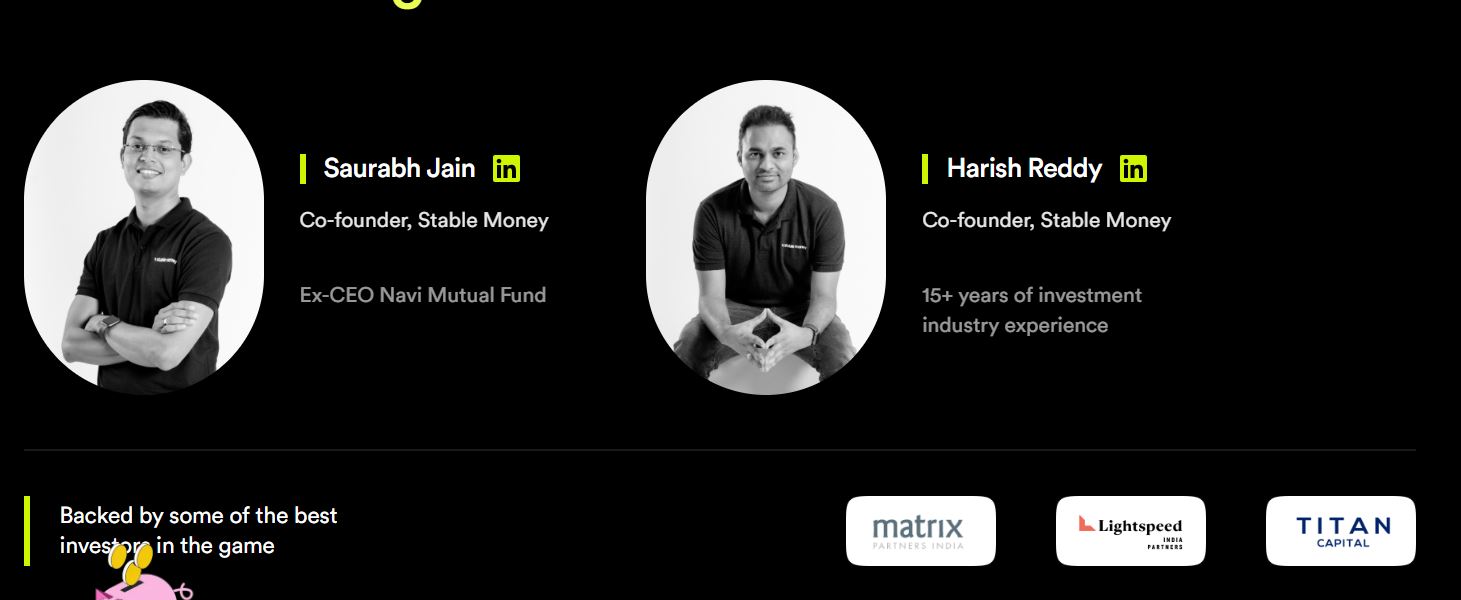

Stable Money was founded in 2022 by Harish Reddy and Saurabh Jain. Harish has graduated from IIT Bombay and has worked with several companies in derivatives, algo trading, etc. Saurabh was previously the MD & CEO of Navi Mutual Fund and has donned several hats in leadership positions in companies like Swiggy and Tinyowl.

Stable Money Funding

Founded in the year 2022, Stable Money has raised a seed round of $5 million, recently in around August 2023. The round was led by Matrix Partners India and Lightspeed, with additional support from Titan Capital, Mar Shot Ventures, and notable angel investors like Kunal Bahl, Rohit Bansal, Harsha Majety, Sandeep Tyagi, Abhishek Goyal, Madhusudanan, Ramakant Sharma, and Revant Bhate, etc.

Stable Money Alternatives

While there are not any apps that are exclusively for fixed deposits, there are many platforms that offer fixed deposits and other debt investment options like bonds.

For fixed deposits, the platforms include Wint Wealth which has a tie-up with Bajaj Finance at the moment for offering their FDs on its platform with more tie-ups in the pipeline. Kuvera offers FDs from Bajaj Finance, Mahindra Finance & Shriram Finance, and Axis Bank on its platform at the moment.

For bonds, there are many alternatives available in the market. Some of the notable ones are The Fixed Income, Altifi, Grip Invest, etc. The list of players offering bonds online is long!

People in higher tax brackets may consider Arbitrage and multi-asset funds to reduce tax liability. Investors can check out top alternatives below

Is Stable Money Safe?

Stable Money is completely safe. It just acts as an aggregator or a platform. When you invest, your money is directly deposited into the bank. Stable Money does not retain any of your funds. Once the FDs are created, you get the FD receipt directly from the bank/NBFC and in an unfortunate event, if Stable Money shuts down, you still have your money safe with the bank/NBFC directly. Coming to data security, they claim to employ robust encryption and adhere to industry-leading security protocols to safeguard your data.

Conclusion

Download and Get referral Bonus

In conclusion, Stable Money emerges as a very promising solution for those seeking the stability and reliability of fixed deposits in a digital landscape. The tech is solid and it solves a very crucial pain point- comparing fixed deposit rates across multiple banks and institutions and making FDs online without going through the lengthy procedures involved.

The platform currently has around 3 small finance bank partners who are offering pretty decent FD interest rates of up to 9.1% annually. These banks might not have a very good offline presence across the country – but at the same time we as investors would like to benefit from the high interest rates offered & the safety- because they are covered under the DICGC scheme for deposits upto Rs.5 Lakhs. Stable Money solves the problem for investors of investing in such FDs.

If you are an investor who invests in FDs, Stable Money is good to have app on your phone.