Picking stocks and mutual funds on your own can feel akin to gambling in Las Vegas. You may hit lucky sometimes, but the house usually wins. This troubling reality motivated the creation of Dezerv – an investing platform that leaves stock picking to the experts.

Dezerv is a wealth management platform that provides customized portfolio management services for investors. It aims to optimize returns based on each user’s risk tolerance and time horizon.

In this Dezerv review, we’ll take an in-depth look at how the platform constructs tailored portfolios combining different asset classes. We’ll assess how it allocates capital across stocks, bonds, real estate, and other alternatives for balanced growth.

A key aspect we’ll analyze is Dezerv’s use of professional fund managers to actively manage user portfolios versus passive indexing approaches. We’ll also evaluate the fees charged and compare projected returns versus self-directed investing.

Our goal is to objectively weigh the pros and cons of Dezerv’s robo-advisor services against alternatives. We aim to determine who stands to benefit most from leveraging the platform based on investment style and portfolio size considerations. By evaluating if Dezerv’s “leave it to the experts” philosophy delivers on its promise, our review arms investors with the knowledge to decide if it’s a miracle drug or snake oil when it comes to portfolio returns.

About Dezerv

Dezerv is an investing app that lets experts manage your money. First, Dezerv asks you questions about your goals and risk tolerance. Then it builds a custom portfolio just for you.

The experts at Dezerv pick investments to match your needs. They avoid risky assets and focus on steady returns over time. The app helps you meet your goals without having to select stocks yourself.

Dezerv also monitors your investments to suggest changes. If some funds underperform, it tells you to move money. This keeps your portfolio strong. The free check-up finds weak investments in 15 minutes.

In short, Dezerv takes the work out of investing for you. Experts handle everything and give advice. This makes growing wealth simpler for regular investors.

Dezerv Features

Dezerv offers a range of features to help you make the most of your investments. Here’s a closer look at what they provide:

- Investment Performance Analysis: Dezerv helps you understand how well your investments are performing. Experts use their knowledge and tools to analyze your investment portfolio. This analysis can give you valuable insights into where your money is going and how it’s doing.

- Fund Optimization: Sometimes, certain funds in your portfolio may not be delivering the results you expected. Dezerv can identify these underperforming funds and recommend exiting them. By divesting from such funds, you can prevent missing out on potential gains and keep your portfolio efficient.

- Investment Recommendations: To make the most of your investments, you need to know where to allocate your resources. Dezerv provides recommendations on how to invest better. These suggestions are based on the latest market trends, risk tolerance, and your financial goals. By following these recommendations, you can ensure that your investment portfolio stays up to date and aligned with your objectives.

Dezerv’s features are designed to simplify the investment process and help you make informed decisions to grow your wealth.

How To Get Started with Dezerv in Easy Steps

Here are the simple steps to start investing with Dezerv:

- Apply online to join Dezerv

Dezerv currently has an invite-only signup process where you need to submit an application online to get started. This seems to be for capacity management purposes. The wait time to receive an invite after applying can be a few weeks or longer.

- Login after getting invite

Once invited, you can create your account by logging in with your registered phone number. No other documentation or steps are needed to start using Dezerv.

- Select “Set Up My Account”

This initiates the investment account creation process. You need to set up your account with your initial deposit before Dezerv will build and manage a portfolio for you.

- Choose an investment approach

Dezerv allows you to pick from five broad approach types – Careful, Conservative, Balanced, Growth, or Aggressive. This lets you customize based on your risk tolerance and goals.

- Dezerv recommends an approach

Based on your application answers, Dezerv also suggests one of the five approaches it thinks aligns best with your profile. But you can override this and choose any approach you prefer.

- Review portfolio details

You can analyze the specific asset allocation and funds selected for your portfolio before investing. This provides full transparency into where your money will be invested.

- Read FAQs

Dezerv offers detailed FAQs explaining its management process, fees, fund selection methodology, and more. Going through these can give you enhanced clarity on how the platform operates.

- Invest a minimum ₹50,000 to start

Dezerv requires an initial investment of at least ₹50,000 to open an account. This minimum threshold is higher than some competing robo-advisory platforms that allow starting with ₹500-₹1000. The higher amount allows Dezerv to invest in its curated basket that targets optimized returns.

- Add more money in ₹20,000 increments

After opening your Dezerv account, you can add more funds for investment in increments of ₹20,000 or more. There is no upper limit on how much you can invest through Dezerv.

- Dezerv experts manage your portfolio

Once your account is activated with the initial capital, Dezerv’s investment professionals actively manage your customized portfolio based on your selected approach.

- Avoid risky bets for steady returns

Dezerv states its fund managers aim to generate consistent market-beating returns by avoiding risky speculative assets and focusing on quality picks.

Which Dezerv Investment Option is Right for You?

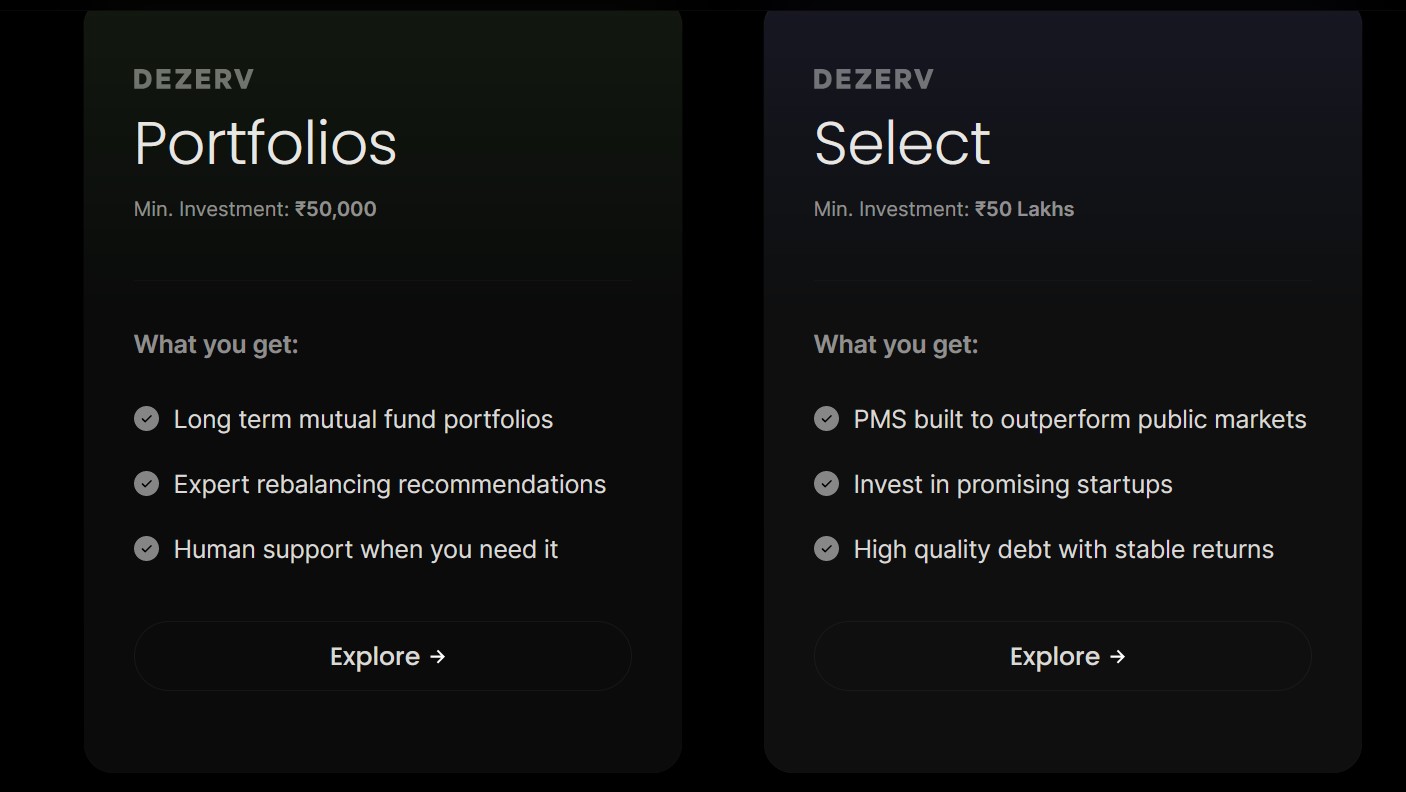

Choosing the right investment option can be a significant decision, especially if you want to grow your wealth and secure your financial future. Dezerv offers two distinct investment options: “Dezerv Portfolios” and “Dezerv Select.” Each option caters to different financial goals and risk preferences. In this guide, we’ll help you understand the features, benefits, and suitability of each, so you can make an informed decision about which one aligns best with your financial objectives.

- Dezerv Portfolios

Dezerv Portfolios offer a way to invest with a minimum investment of ₹50,000. When you choose Dezerv Portfolios, here’s what you can expect:

- Long Term Mutual Fund Portfolios: You’ll have access to portfolios designed for long-term investments. These portfolios typically include a mix of different mutual funds, allowing you to diversify your investments and potentially grow your wealth over time.

- Expert Rebalancing Recommendations: Dezerv’s team of experts provides recommendations on when and how to adjust your portfolio. Rebalancing helps ensure your investments remain aligned with your goals and risk tolerance, making it easier to adapt to changing market conditions.

- Human Support When You Need It: Dezerv offers support from real people who can assist you when you have questions or need guidance regarding your investments. This human touch can be reassuring, especially for those new to investing.

- Dezerv Select

Dezerv Select is a premium investment option with a higher minimum investment requirement of ₹50 lakhs. Here’s what you’ll get with Dezerv Select:

- PMS Built to Outperform Public Markets: Dezerv Select offers access to a Portfolio Management Service (PMS) that’s designed to outperform the public markets. PMS involves professional management of your investment portfolio, with a focus on achieving superior returns.

- Invest in Promising Startups: This option allows you to invest in promising startups. Startup investments can be an exciting opportunity to support innovative companies with high growth potential. While they come with higher risk, they may also offer substantial rewards.

- High-Quality Debt with Stable Returns: Dezerv Select includes high-quality debt instruments that provide stable returns. Debt investments are generally considered lower risk compared to equities, making them a potential choice for more conservative investors looking for stable income.

It’s essential to carefully consider your financial situation and risk tolerance when deciding between these options, and you may want to consult with a financial advisor to make a better choice.

Dezerv: Pros and Cons

Pros:

- Dezerv offers diversified portfolios that cater to different risk appetites, providing investors with a range of options to choose from.

- For investors, especially those new to the world of finance, having access to expert advice and human support can be a significant advantage. Dezerv provides expert rebalancing recommendations and human support when needed.

- Dezerv simplifies the investment process, making it accessible to a broader audience. Their approach is designed to be easy to understand and navigate.

Cons:

- The minimum investment amounts for both Dezerv Portfolios and Dezerv Select are relatively high. This could make it less accessible for individuals with smaller budgets.

- Dezerv operates on an invite-only basis, which may restrict access for many potential investors. While this is a marketing tactic, it could be frustrating for those who want to start investing immediately.

- In comparison to some other investment platforms, Dezerv’s features and benefits may not be as competitive. It’s essential to consider other options and assess which one aligns better with your financial goals.

Alternatives to Dezerv: Exploring Better Options

Investing your money is a crucial decision, and choosing the right platform is key. Dezerv is an option, but is it the best one? Let’s explore some notable alternatives to Dezerv, each with its own unique features.

- Cube Wealth:

Cube Wealth provides access to over 17 investment options, including stocks, gold, P2P lending, and liquid funds. One standout feature is its ability to facilitate global investments, allowing users to invest in stocks from the US, Europe, and other regions. Additionally, Cube Wealth offers a dedicated wealth coach who provides personalized guidance for investments. Users also receive free custom investment portfolios based on factors like savings, expenses, and goals.

- Groww:

Groww specializes in making mutual fund investments more accessible through its mobile apps and web platform. In addition to providing a range of investment options, Groww focuses on educating investors about the risks associated with each portfolio through its Groww Assist feature. The platform is actively working on expanding its product offerings, starting with stock investing.

- INDWealth:

INDWealth is a personal financial advisory platform that caters to high net worth individuals. Leveraging advanced technologies like artificial intelligence and machine learning, INDWealth offers advice across asset classes, loans, and tax management. The platform provides machine learning-driven recommendations and offers researched investment products to improve financial futures. INDWealth also collaborates with certified wealth advisors to assist users. They have recently introduced a wealth advisor-facing web application to enhance communication with clients.

- Kuvera:

Kuvera is a robo-advisory platform that aims to simplify mutual fund investments. It’s easy to understand, user-friendly, and doesn’t charge transaction fees for mutual fund investments made through its online platform and mobile application. Kuvera provides customized financial advice based on individual needs and allows users to switch from regular mutual funds to direct mutual funds, reducing investment costs.

- Clearfunds:

Clearfunds is a direct mutual fund investment platform known for its data analytics and automated processes, offering low-cost investment advisory services. They feature ‘Smart Portfolio,’ which utilizes algorithms to create diversified mutual fund investment portfolios that match users’ goals, time horizons, and risk tolerance. Clearfunds charges no fees for investments, making it a cost-effective choice.

- Scripbox:

Scripbox simplifies mutual fund investments with algorithmic recommendations and investment management tools. They provide quantitative and qualitative algorithms to select funds, eliminating biases and uncertainties. Scripbox doesn’t charge fees to customers but earns commissions from mutual fund companies over the life of the investment, covering the cost of its services.

When you compare Dezerv to these alternatives, it becomes clear that there are better options. Each of these alternatives has unique strengths and cost-effective features. So, before you make your investment, explore these choices to find the one that aligns best with your goals and offers the most value for your money.

Final Verdict

In the world of investment platforms, Dezerv might not be the best choice. There are other options out there that offer more features, better support, and cost-effective solutions. Platforms like Cube Wealth, Groww, INDWealth, Kuvera, Clearfunds, and Scripbox are worth considering. They provide unique benefits that surpass what Dezerv offers.

So, the final verdict is this: While Dezerv might work for some, there are better alternatives available. Explore these options to make the most of your investments and achieve your financial goals more effectively.

FAQs

Here are some FAQs:

- Can I trust Dezerv with my money?

Yes, Dezerv is a trusted platform for investments, but it’s always a good idea to do your own research.

- Are there any fees to use Dezerv?

No, there are no fees to use it.

- What are the alternatives to Dezerv?

Some alternatives to Dezerv are Cube Wealth, Groww, INDWealth, Kuvera, Clearfunds, and Scripbox.

- How can I sign up for Dezerv?

You can sign up for Dezerv by requesting an invite and going through their evaluation process.

- Can I invest in stocks through Dezerv?

Yes, you can invest in stocks through Dezerv.

- Can I get support if I need help with my investments?

Yes, Dezerv provides human support when you need assistance.

- Is Dezerv suitable for beginners?

Dezerv has different options for both beginners and experienced investors, so it can work for all types of users.

If you are looking to beyond conventional assets that can give you upto 20% IRR checkout the below list.

Terrible start, I uploaded my data 4 weeks back..still showing processing and asking me to click if urgent. What’s the point of having a platform that takes so long to review portfolio? Quite a waste

Personally I think a savvy investor do not need platforms like Dezerv as they don not offer anything new. It makes more sense for people who wan to be totally hand’s off in their investment approach and do not have bandwith for making financial decisions.

Its a waste platform with almost no tech, with huge fundings which is going into scaling sales teams.

Hi shubham, They are yet to show any USP that would make sense for investor to take a paid service!