In recent months & years, the awareness among Indian investors around the importance of diversifying investment portfolios has grown significantly. With the unpredictable nature of stock markets and the low returns from traditional savings accounts, investors are increasingly looking for alternative investment options.

Bonds & debentures are becoming a popular asset class in India. Stable & predictable returns is one of the key reasons for its popularity. This post reviews SMEST- a platform to invest in bonds & debentures in India. Read ahead to know the complete details including its review & a few alternatives to this platform.

Why Should One Have Bonds & Debentures in Their Portfolio?

Before we proceed with the actual review of SMEST, let us first understand why investing in bonds and debentures offers several key advantages:

- Steady Income: Bonds provide a fixed income stream through regular interest payments.

- Lower Risk: Bonds are generally less risky than stocks, offering more stability.

- Portfolio Diversification: Bonds help diversify an investment portfolio, reducing overall risk.

- Capital Preservation: Bonds preserve capital by returning the principal amount at maturity.

- Tax Advantages: Certain bonds, like tax-free bonds, offer tax benefits.

- Inflation Hedge: High-yield bonds can protect against inflation, maintaining purchasing power.

By including bonds and debentures in their portfolios, investors can achieve a balanced mix of income, stability, and potential growth.

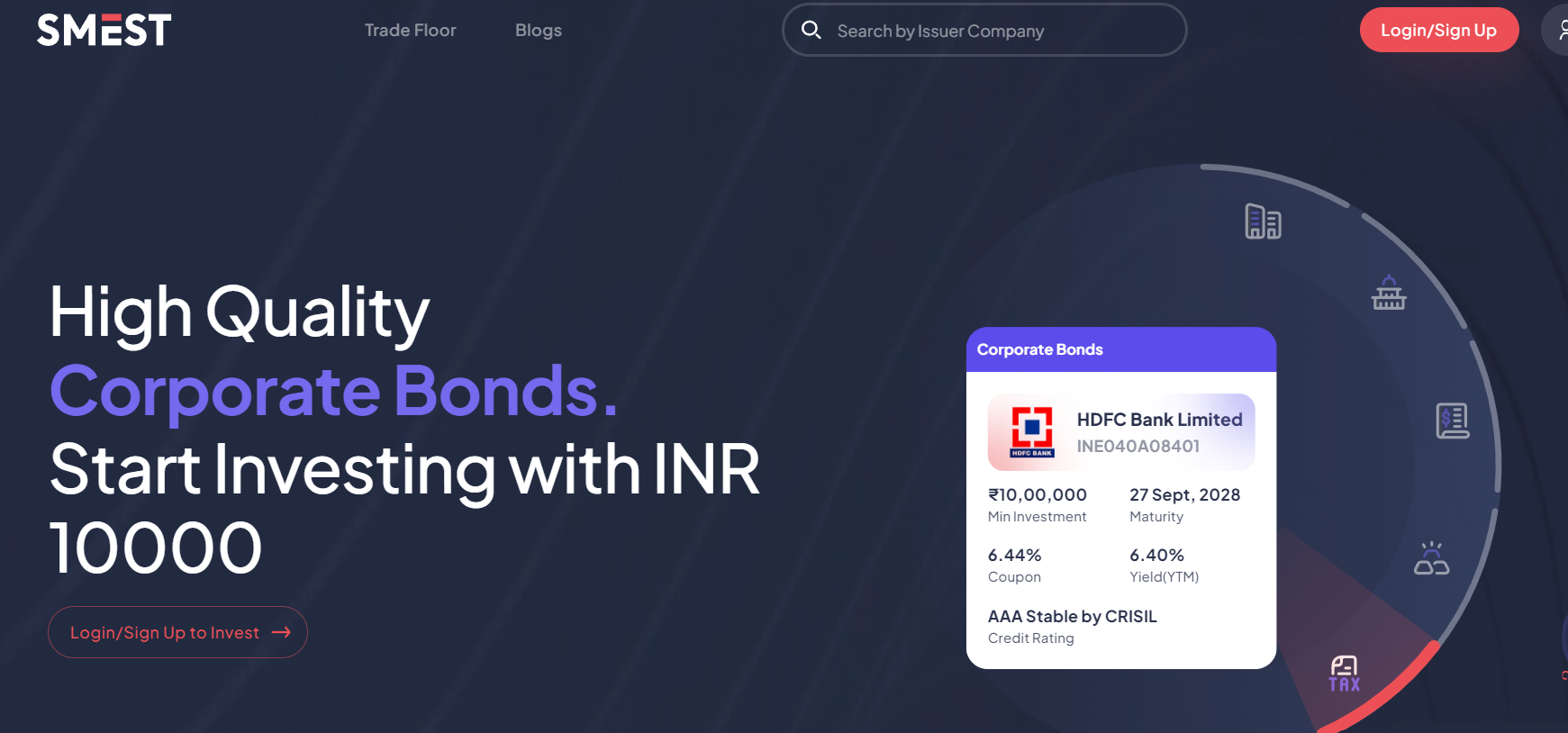

What is SMEST?

SMEST Capital (SM from Smart & EST from Invest) is an Indian fintech firm incorporated in 2018 that is dedicated to enabling individual investors to invest in bonds and debentures online. It is a SEBI Registered Stock Broker, a member of the BSE, and a licensed Online Bond Platform provider (OBPP) & is based out of Mumbai.

Historically, bonds have been a reliable source of secondary income and, in some cases, even primary income. However, their accessibility has been primarily limited to financial institutions and high-net-worth individuals (HNIs).

SMEST aims to change this by making bonds and debentures publicly accessible to all retail investors through a user-friendly online platform. This platform simplifies the investment process and ensures that a wider range of investors can benefit from the stability and returns that bonds and debentures offer.

Investment Options on SMEST

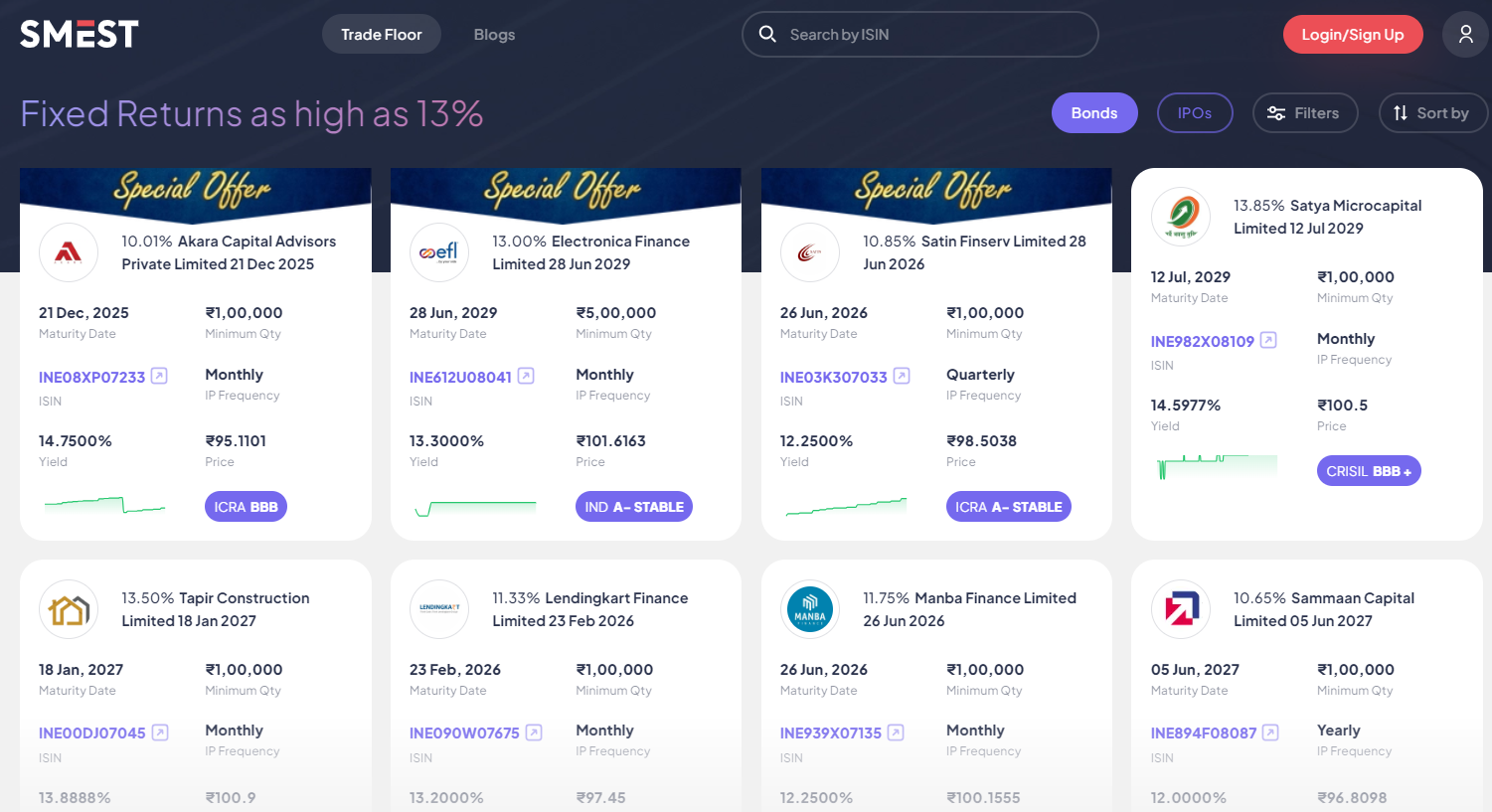

SMEST allows you to invest in secondary bonds as well as bond/NCD IPOs.

Currently, at the time of publishing the article, there are 2 bond IPOs available: Edelweiss Financial Services Limited & SMC Global Securities Limited – both yield upwards of 10-11% p.a.

The collection of secondary bonds listed on the SMEST Trade Floor is quite impressive. There are bonds of several companies like NAVI, IIFL, Piramal, and several other companies. The yields at which the bonds are offered are quite competitive compared to the same bonds on other platforms available online.

Illustration: Yield Comparison on SMEST vs Other Platforms

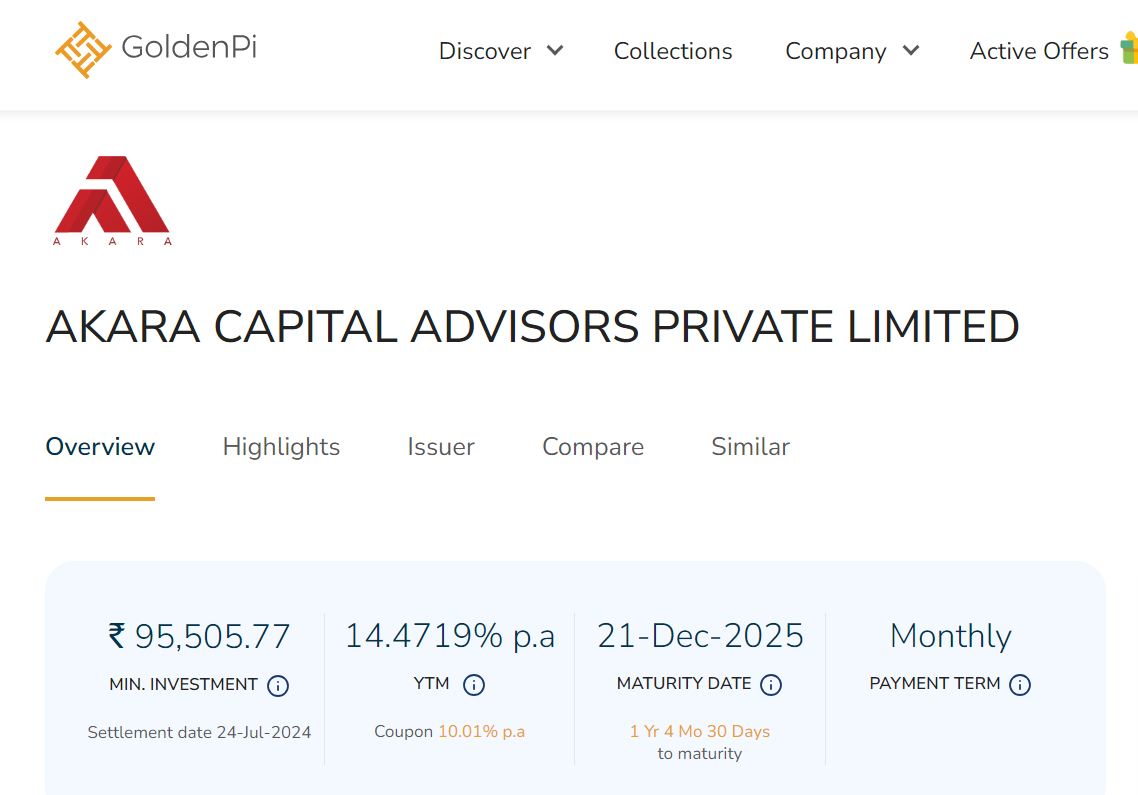

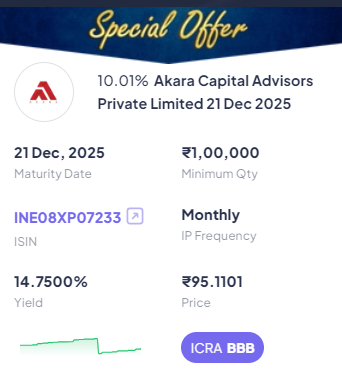

Let us now compare yields for a bond across multiple platforms where it is listed. For instance, let us take the Akara Capital Advisors Pvt Ltd bond.

- Maturity: 21st Dec 2025

- ISIN: INE08XP07233

- Interest Payment Frequency: Monthly

- Min Amt: 1,00,000

- Coupon: 10.01%

- Yield (on SMEST): 14.75%

- Yield (on Golden Pi): 14.4719%

We have generally found Goldenpi yields to be worse than other platforms!

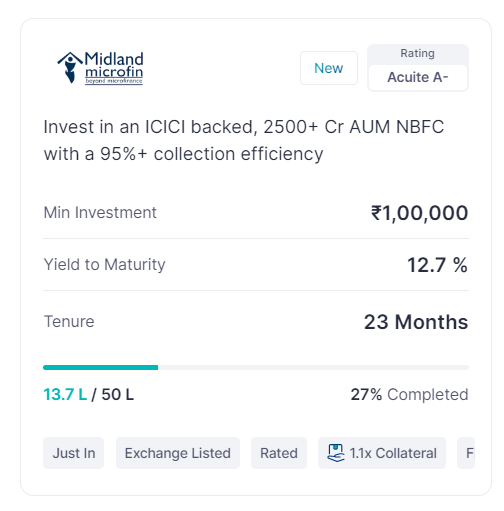

Let us consider another bond: Midland Microfin Limited

- Maturity: 2 July 2026

- ISIN: INE884Q07707

- Interest Payment Frequency: Monthly

- Min Amt: 1,00,000

- Coupon: 10.75%

- Yield (on SMEST) : 12.5816%

- Yield (on GRIP): 12.7%

As we can infer, the bond yields might vary for the same bond across platforms. Some platforms offer high yields or lower minimum investments. It’s always a good practice to check multiple platforms before you decide to invest.

How to buy bonds through SMEST?

- The Know Your Customer (KYC) process needs to be completed to start investing through SMEST. For bond IPOs, no KYC is required.

- SMEST handles all necessary documents for the investment, ensuring a smooth and hassle-free experience.

- To purchase Bonds/Debentures, you must transfer the investment amount to the counterparty settlement authorities’ (ICCL/NSCCL) bank account held with the Reserve Bank of India.

- You can transfer the money via RTGS, NEFT, or Payment Gateway.

- The bonds will then be transferred to your Demat account after the payment is verified.

SMEST Founders & Team

SMEST is the brainchild of Mr. Harsh Punjabee. He is an entrepreneur and & a fixed-income enthusiast. He is an investor in several early-stage and second-stage ventures across the UK, UAE, and India across a portfolio of companies. He started SMEST Capital in the year 2018. The entire team of SMEST is highly experienced in their respective domains and working together towards the aim of democratizing the fixed-income corporate bond market in India.

SMEST Alternatives- Investing in Bonds & Debentures

Since bonds and debentures have great popularity in India, multiple platforms cater to this segment.

Following are some of the best platforms for investing in bonds in India (listed in no particular order).

- Grip Invest

- The Fixed Income

- India Bonds

- Wint Wealth

- Altgraaf

- Tapinvest

- Altifi

- RBI Retail Direct for G-Secs & SDLs only (no corporate bonds)

Read our detailed article on top bond platforms in India!

Conclusion

The rise of bond investing platforms in India marks a significant shift in how retail investors approach their investment portfolios. Platforms like SMEST, Grip etc. are democratizing access to bonds and debentures, traditionally the domain of financial institutions and high-net-worth individuals.

SMEST is a decent choice for anyone looking to invest in bonds and debentures. Its user-friendly online platform, transparency, and wide range of high-quality bond papers make it an appealing option for both novice and experienced investors. The streamlined process of completing KYC, selecting bonds, and making investments ensures a hassle-free experience, allowing investors to focus on their financial goals.

By providing easy access, reliable returns, and a user-centric approach, With careful comparison and strategic planning, investors can leverage these platforms to achieve financial stability and growth.

However, it is always a good practice to compare bond yields across different platforms before making an investment decision. By doing so, investors can ensure they are getting the best possible returns for their money.