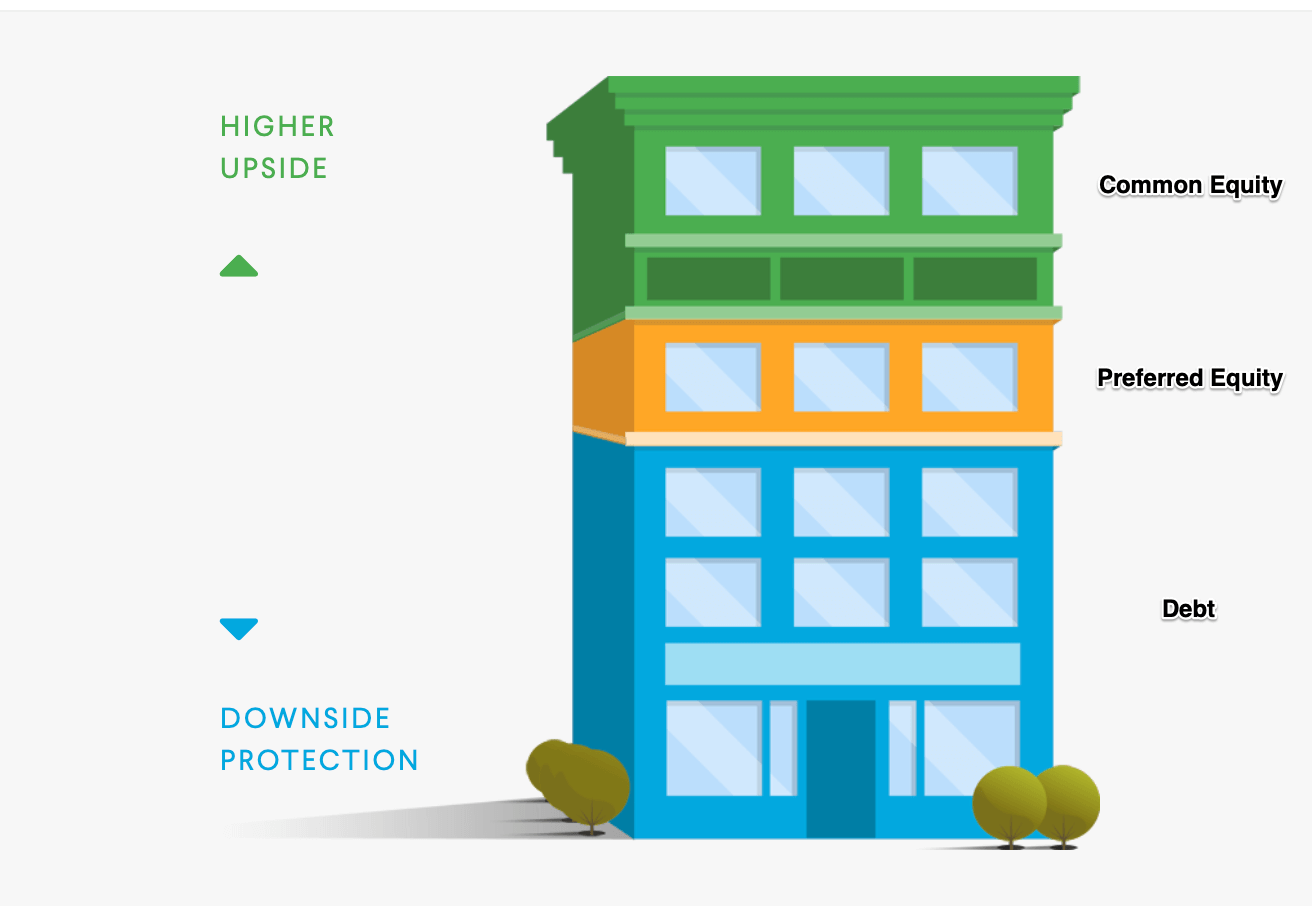

In Real Estate crowdfunding most platforms allow investors to choose either debt or equity investments (you can certainly include a mix of both in your portfolio).

When investing in debt instruments, you’re acting as the lender to the property owner or the deal sponsor. Depending on the structure — which varies by real estate crowdfunding platform — the loan is secured by either: (1) the property itself or (2) a promissory note backed by the LLC holding the property.

In either case, you are in the first position of creditors to get paid if the loan should go into default. The loan default process varies by platform, so you need to do your due diligence.

The upside of debt investment is you know upfront how much returns you will make from the property .In case the borrower default the property is sold and you get the principal back

Platforms we had covered in real estate crowdfunding were primarily debt based platform.

What Are Real Estate Equity Investments?

With equity real estate investing, you get a proportionate piece of equity in a specific property or portfolio of properties, and share in the profits as the property is developed and sold or managed for rental income .Even when you buy property conventionally ,it is actually an equity investment in the property(100% equity stake you purchase)

There are 2 ways in which you make returns

- Rental yield

- Capital gains when property is sold.

Equity Investment in property is a longer term bet as it takes time for the property price to go up.

It makes sense to invest in equity real estate crowdfunding when real estate price is depressed and upside potential is higher. It is best to have a debt vs equity combination in portfolio for diversification benefit.

Reinvest24 Platform

Reinvest24 is a real estate investment platform that allows users to invest in property in the upcoming capital of Estonia, Tallinn, and Latvia’s capital, Riga. All of the shares are in Euro and it is possible to invest in both residential and commercial property.They have financed 10+ projects with €12,000,000 invested and €4,000,000 returned back as profits to investors.

The CEO is called Tanel Orro and he started this company after working for LHV (Bank in Estonia) for years.

Reinvest24’s largest shareholder (owner) is a well-established real estate agency called Tina KVB OÜ.

They invest in the properties, for example, if funding is missing.

Reinvest24 is new and they are still in the process of establishing themselves as a recognized real estate crowdfunding platform.

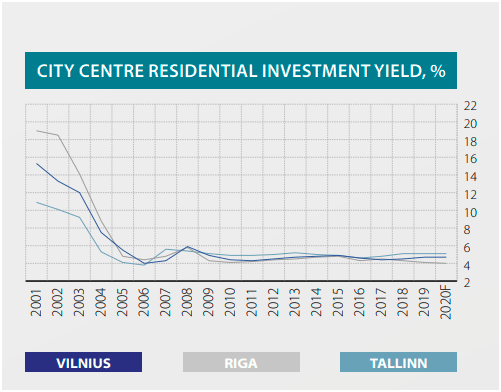

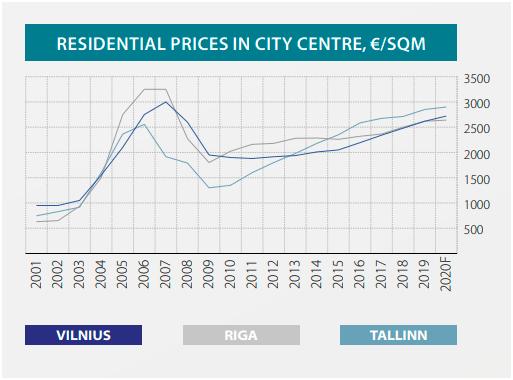

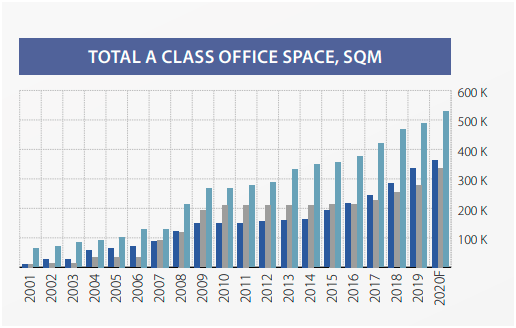

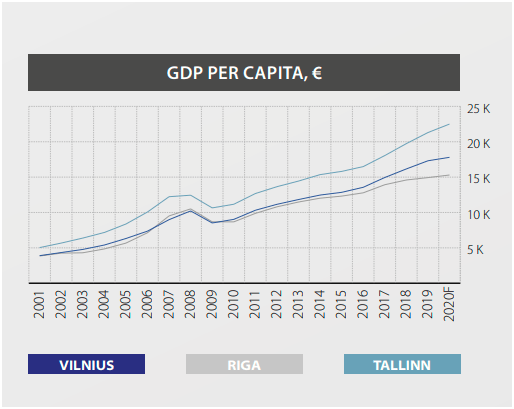

Analysis of Baltic Real Estate

Baltic has been becoming a hotspot for technology in Europe and thus the real estate market is in a booming phase.It has become the silicon valley of Europe.

Top cities in Baltic are Vilnius, Riga and Tallinn

We expect more growth in these region propelled by an increasingly well educated and English-speaking workforce, a strong Fintech industry and forward-thinking governments that promote foreign investment and startups.

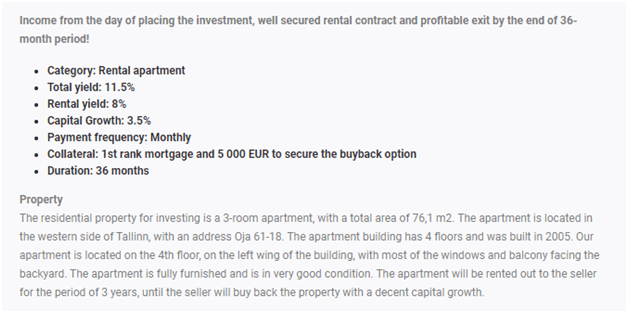

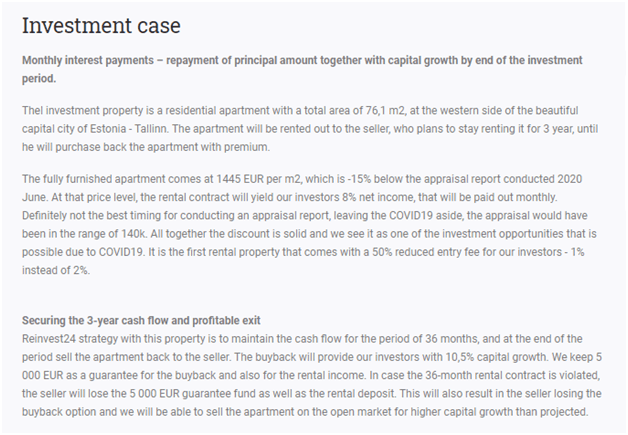

Example of an Investment

This apartment is in the city of Tallinn (the capital of Estonia).

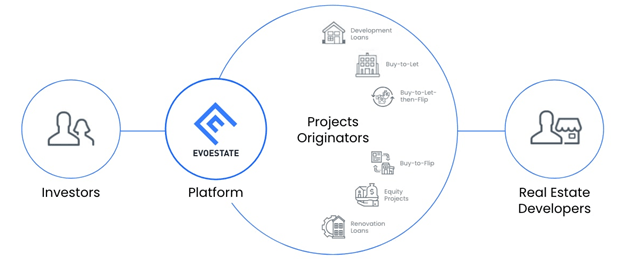

Investing In Reinvest24 through Evostate

People who have account in Evostate can directly invest in some of the properties available on Reinvest 24 .

Evostate is basically an aggregator of top properties on various platforms.Some of the project originators you can find on Evostate includes Crowdestor,Reinvest24 , and Nordstreet.

Due to the fact that Evostate is a layer on top of the other platforms, they are also able to offer features like a secondary market which some of the platforms you originally don’t have. It does its own due diligence and put some of its own money in promising real estate deals ,hence is a good place for beginners

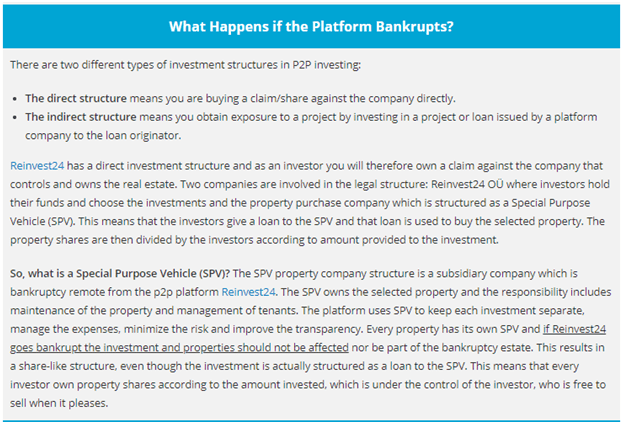

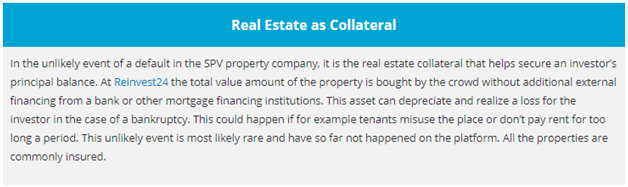

Bankruptcy Protection

How to Invest?

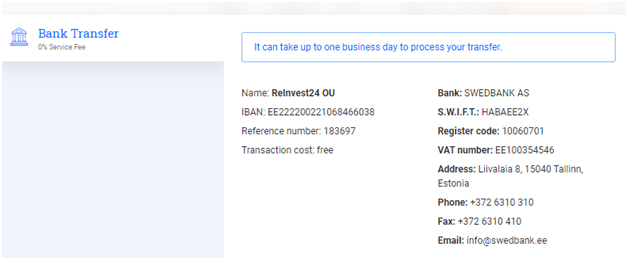

People who have a SEPA account can seamlessly add Reinvest24 to their bank for payment . You can register using the link in the article and get 15 Euro cashback for your first investment. Minimum Investment is only 100 Euro

Conclusion

Reinvest24 is a promising platform for individual looking to invest in rental properties. Due to Covid rental yields are higher and in a period of 3-4 years decent capital gains can be expected.