![Hilarious Free Real Estate Memes - [Click now!] - REthority](https://3ep8i83tueanxyzju14srzmy-wpengine.netdna-ssl.com/wp-content/uploads/2019/03/Investor-10.jpg)

Real Estate comparison with other asset classes has been done numerous times. Most articles are either in favour or against it. A balanced approach to add real estate in portfolio can be a successful strategy.

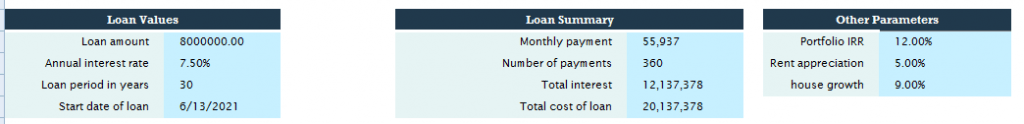

Compounding and impact of leverage is hard to grasp for many even if they are good in maths. The reason being that doing these calculations in your head isn’t intuitive. So the big question Whether to Buy or Rent?

Real Estate Investment Example

Mr X Buy INR 1Cr house.20% Upfront and rest loan at7.5% for 30 years,

Mr Y invest the Upfront in Diversified portfolio (stocks,Alt ,Etc) which yield 12% and monthly put EMI equivalent amount in the same portfolio

Rent is 2.5% of house cost and grows 5% annually.

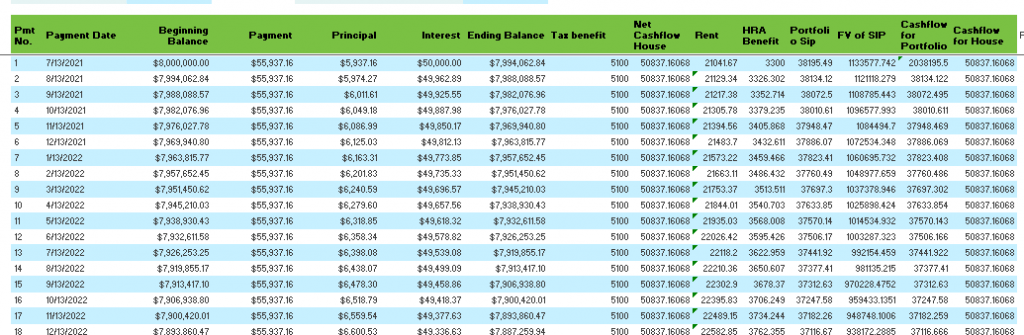

Calculations

In the both scenario we factor in Rent and HRA benefit, Tax benefit etc.

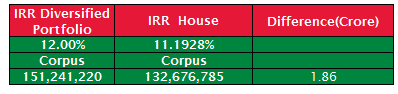

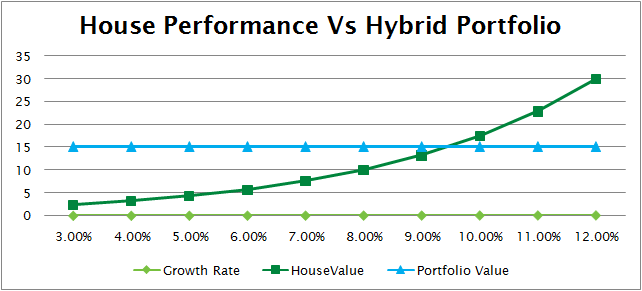

Returns on Investment

In the base case you end up Making INR 15 Cr in Diversified Portfolio while INR 13 Cr in House after 30 years.

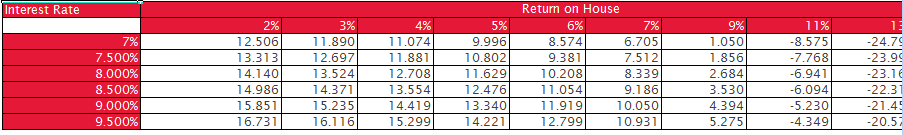

Scenario Analysis Real Estate vs Hybrid

It is evident that if Real Estate grows less than 10% you end up making more in Hybrid portfolio but at 10%+ growth rate Real Estate beat hybrid portfolio significantly because of leverage effect.

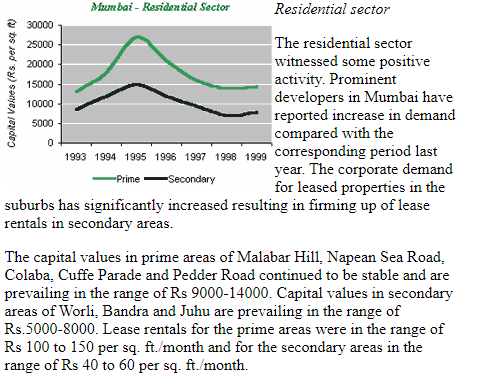

Actual Growth Rate of Real Estate

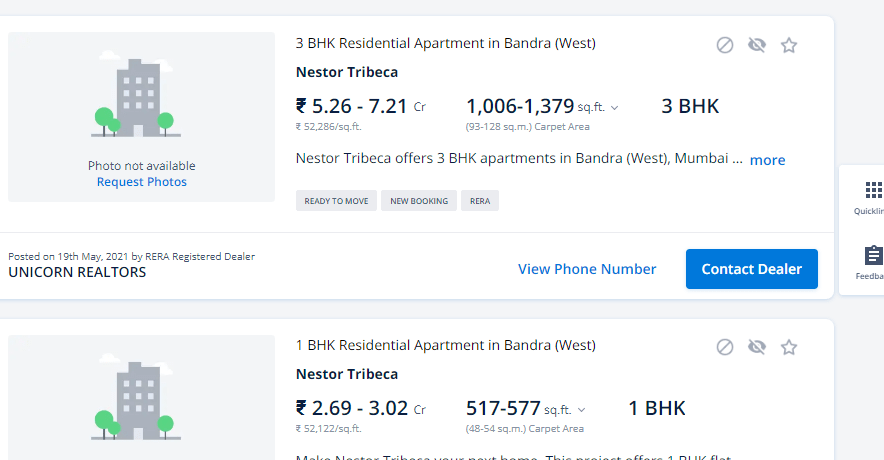

The property price depends on the local market suppy demand mechanics. An article from 2000 will help us guage approx price increase in real estate

Current Rate in Bandra, Juhu is at 45-65k sq feet rate i.e 9x in 22 years i.e 10% CAGR. So in a way you will be at par with Hybrid portfolio. Keep in mind Interest Rate were 10-15% in those days (remember FD double in 5 years) you would have still been better off with hybrid portfolio( higher borrowing Rate)

Also what property you bought determined current corpus.20 years ago Flat bought in Noida is a liability today and in Gurgaon an Asset.

NOIDA

Buying Flats is like buying Equity . If you buy at the right price, Right asset and right time it becomes an asset or else a liability!

Real Estate Investment Factors

Many factors which will decide the outcome:

- Your Cost of Loans

- How much you are leveraging

- Location, Location and Location( even within a city ,localities grow at different rate)

- Real Estate market growth

- The authenticity of the developer

- Rental yield you will get

- Stable cashflow to manage EMI

How many do you have control over? 2 maybe 3, out of 6

Are you an expert in assessing property or you want to buy because everybody is buying it?

If I suggest someone take 40 lakh Loan and buy Kotak Mahindra share today how many will do that!

They will tell me how can someone take so much risk even though chances are high they will make good return.

But people happily take loan 10 X of their annual salary to buy flats. Just because you cant see the price of Flat going up and down on your screen everyday doesn’t mean you are not taking risk!

You must be marvelling how much return your parents made in real estate. Just calculate the CAGR of those returns ,most are at par with Equity market.

What worked for your parents was Good Luck and Leverage!

They took a big Loan :

- 20 Rs their own and 80 Loan.

- Paid Interest of let’s say 10% on 80 Rs = 8 Rs.

- property grew at say 12%+ percent as real estate was in boom . They made 4rs (12rs-8rs) on 20 Rs investment = a cool 25% return

- Had the opposite happened .Real estate crash then!

- They would have paid 8 rs and let’s say Real estate didn’t move i.e. 8 Rs loss on 20 is 40% loss!!

If you have 100 Rs its ok to put 20 in real estate. If you have 20 rs don’t put 100

Looking Back it’s easy to connect the dots. Gurgaon Flat owners can boast about their investment accumen and Noida Owners can blame their bad luck

It’s not about whether Real Estate is good or bad .

It’s about it’s whether you want to bite more than you can chew !

Conclusion

Adding Real Estate in Portfolio is good way to diversify but you can incorporate more strategies with it.

- Use REITs/INVIT if your portfolio is small

- Try Fractional Real Estate (Tax efficient alternative a plus !)

- Find good plots which are cheap and can grow exponentially.

- When buying flats also factor in that flats have annual maintenance, and premium properties even more expensive to manage.

- Add Equity, bonds and other alternative like,FINZY Klubworks, Tradeced ,GrowFix and Grip Invest or others if portfolio is large

There are other factors like emotional value, sense of ownership which have not been factored in. Mail me if you need the excel.