Another month of uncertainty of Lockdown and now people have struggling with their existing portfolio as lot of Debt Funds closed down and saving bank rates have been lowered as banks are no longer looking to borrow from the public.

I will cover the performance of various investments and the strategy going forward. This month I have made few changes in overall portfolio:

- Global and Indian Equity investment being added in staggered manner as a sudden crash cannot be ruled out.

- Keeping good liquidity in saving account in case things change for worse.

- Selectively investing in Bonds,P2P and Invoice discounting focussing on quality rather than diversification!.

Monthly performance for the assets is given below:

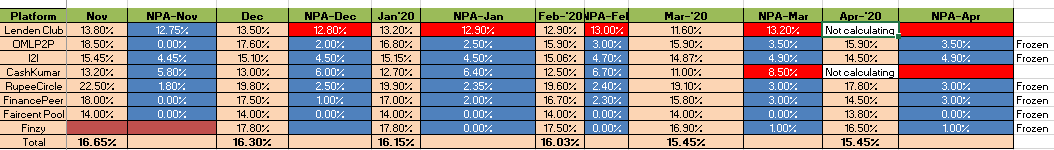

P2P Portfolio:

In my calculation I have not considered delays after March as quite a few people had gone for moratorium and real picture would be evident when the moratorium period is over.

The dip in yield is due to non payment of interest on few loans where moratorium had been granted

I have stopped calculating ROI for Lendenclub and Cashkumar as I m withdrawing money .

The new NPA have been frozen for April due to moratorium . Even If NPA rise by 4-5% more in a prolonged crisis , considering the economic scenario it would be a decent performance.

In terms of fresh investments.I am doing only in 3 places:

- Finzy Prime Loans( Salary around 1 L approx+): Finzy Referral Code(or you can apply the code : MAN635)

- I2IFunding education Loan with good salary and owned house I2I Account Referral Link(First Use the link to register then add the Code “discount50@i2i” while paying to get 50% off)

- RupeeCircle own house and essential category employment: Rupee Circle

Only when the lockdown is over I will consider other categories.

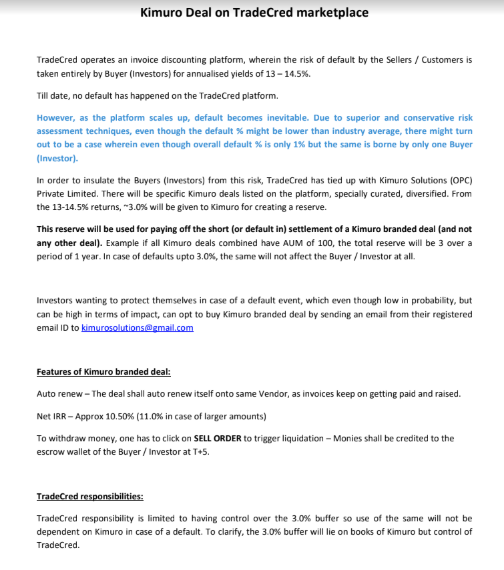

Invoice Discounting

Flight to safety has become the need of the hour hence it is unwise to indiscriminately lend for high yields.

I am restricting myself to selective names for the time being. Amazon,Flipkart or some invoice of blue chip like Coke,Metro etc. Had invested in Amazon at 14.25% last month

People who have higher amount to lend can consider the new deal created by TradeCred Free Link :

This essentially provides credit enhancement upto 3% by forgoing around 3% yield from your portfolio. It is a good mechanism to incorporate if you have larger portfolio because even if 1% invoice fail to pay that single could be in your portfolio and in times like these such things can happen. You also have to check what kind of companies Kimuro is choosing for protection. You dont want high risk exposure even after protection!

Equity /REIT:

I am keeping my Equity/REIT portfolio mostly static with only small incremental systematic buying after adding substantially in March during the crash.

The reason being:

- Have already increased portfolio to considerable extent.

- Don’t want to be without capital incase it corrects further.

I am able to generate 10% from alternate and option strategy so no point taking too much additional risk on equity unless it becomes cheaper!

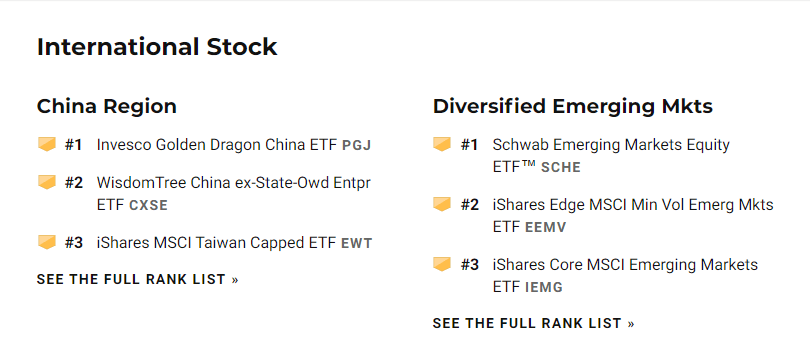

A good place for people to check out top global ETF is to visit this site. https://money.usnews.com/funds/etfs/international-stock

.It has list of ETF in various geographies and tracking different Index.You can buy ETF through Global Investing Platform Stockal

People should shortlist ETF/stocks etc they would like to pick if market goes south

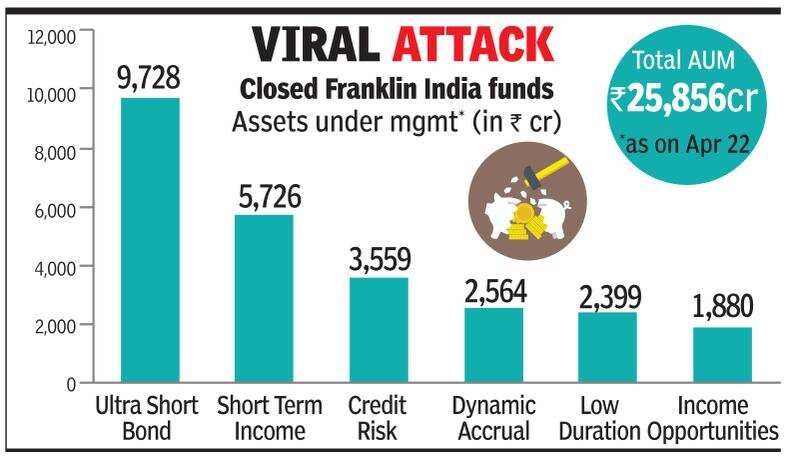

Debt Investment:

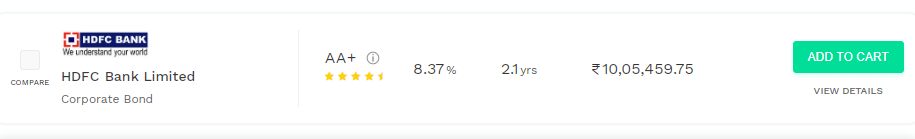

Last month onwards I have stopped buying fresh units of Debt fund considering the risk in underlying credit. A good alternative is to park the money in safer corporate bonds like HDFC in goldenpi. Return expectation should be around 8-8.5%. I am considering shifting some of my debt fund allocation to safer corporate bonds. You can invest through GoldenPi

People can put some money in PSU debt Funds but should not expect more than 5-6% yield as interest rates are all time low.

Most Liquid Fund are offering 4-5% which is almost equivalent to saving bank rate in Kotak .There is only some tax benefit if you hold for more than 3 years

Trading and Crypto:

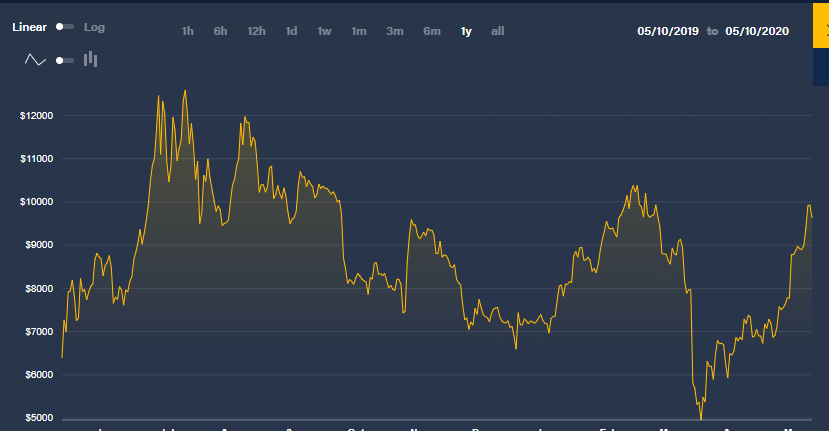

Unexpected sharp rise in my bitcoin investment gave me a windfall profit. I have booked half the profit and if it crashes then might considering again adding it. I keep a constant 1% allocation in bitcoin while another 1% is used for trading . You can trade at lowest cost through Wazirx

Option Trading : Option trading has been really effective in an uncertain market as a hedge and to generate income. This month I was able to generate 2% profit on my investment due to inflated Implied volatility.

I am soon going to publish weekly Option trades for various market views with limited downside risk and good risk/return rewards. People can replicate them based on their market view to generate income.