For someone who has never invested in P2P, starting from scratch is a hassle. I have written down the process and strategy for a beginner.

- How to Open an account :

As of now I am actively investing in 4 Platforms

- I2I Funding

- LendenClub

- RupeeCircle

- CashKumar

Some of the platform I had evaluated and stopped investing due to various reasons are : Faircent, Monexo, Lendbox and Finzy

To open accounts in these 4 Platform you may use these Referrals to avail discounts

I2I Funding: https://www.i2ifunding.com/referral/ud8cwng83/invest

( add I2I50%DISCOUNT code while registering to get 50% discount )

RupeeCircle: https://www.rupeecircle.com/investor-register

( use Referral code PIND145 while registering )

LendenClub : https://app.lendenclub.com/signup

( use Referral code LDC11989 )

* You need to put referral code under Referral code heading on the first page. Many people skip the first page and then try to put it under promotional code which doesnt work)

Cashkumar: https://cashkumar.com/application/lender/signup

(Mail me to get referred for Cashkumar)

- How to Start Investing :

Before starting make sure where P2P fit in your asset allocation ,you can put it between 10-20% of your total portfolio depending on your comfort

Unlike Equity Market where you can get some advantage by timing the market due to valuation , in P2P timing has no impact so it doesn’t matter you do a SIP or Lumpsum but I recommend doing a Lumpsum and then SIP because it has three advantage:

- Initially with Lumpsum you are able to diversify into multiple loans which is critical for P2P lending

- With SIP You dont run out of good borrowers as you don’t have excess cash and few borrowers at any given time

- By SIP You are able to gradually gauge platform performance. It takes around 3-4 months to understand portfolio performance, NPA issues etc

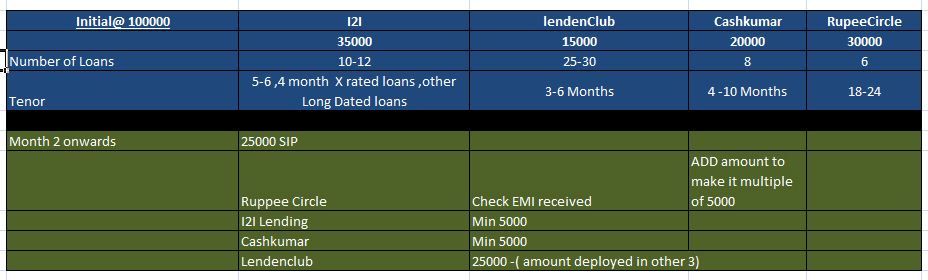

Now as we have decided to put monthly amount in P2P we will break it down between the 4 platforms. Lets assume we have 100,000 to invest in the first month and after that we plan to do 25000 sip every month.

We will break 100,000 in such a way that we are able to able to diversify across decent number of loans in each platform.

Secondly we also do not want to put money more than the platform can disburse in 10-15 days.

I have created the table which can do justice to all the platforms .

For month 2 first we need to check how much EMI we are going to receive in rupee circle as it has minimum ticket size of 5000.

For example if we are receiving 2500 in EMI we can invest 7500 or 2500 so that we can disburse that amount.

after Rupee Circle we can divide the rest of the amount in Cashkumar and I2I.

Whatever is pending can be put in Lenden as it has minimum ticket of 500 and even 1000 can be disbursed easily.

- Maximum Amount per Loan: I always suggest go for the minimum platform required ticket size for a loan. This ensures that we are not concentrated on any particular Loan. Only time you may break this rule if you are very confident of a borrower. I follow the policy of minimum ticket regardless of the quality of borrower.

- Monitoring Platform performance:

I suggest after you have used the platform for 3-4 months and have sufficient number of loans you should monitor portfolio performance every month.

I have already covered how to use XIRR method to calculate portfolio performance

http://randomdimes.com/2019/calculating-portfolio-return-for-i2i-funding/

http://randomdimes.com/2019/calculating-portfolio-return-for-lendenclub/

Conclusion: Initially NPA and delinquency seems discouraging but we need to understand its a part of P2P lending model. What we need to ensure is that our NPA adjusted ROI is better than alternate investment of similar time horizon . eg Bonds, FD, Liquid Funds etc. Platform which promise zero defaults are probably a sham as its impossible to achieve underwriting with zero default.

I had written an article on using Kelly Criterian to invest in P2P. Excerpts from the article are given below.

http://randomdimes.com/2018/peer-to-peer-lendingp2p-investing-strategy-based-on-kelly-criterian/

Happy Investing !

Hello, I just started investment through CashKumar, I2I, and LendDenClub. I have one question for I2I. How do I auto lend amount to X category loans in I2I? Like we do in LenDenClub for the unidentified category.

That feature is still not available on I2I funding. I guess one reason could be that they do not have sufficient X rated loans as of now to meet the appetite of auto investing. Hopefully we get that feature in future!