Wish you all a very happy new Year

I am publishing my latest P2P returns and performance.Will also provide comparison with my last month portfolio performance.I have evaluated more than 10-11 platforms before investing in these

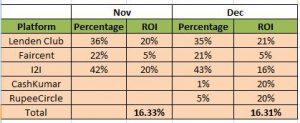

Portfolio Synopsis: I have been investing in 3 platforms actively for the past 12 months. I have added couple of more platform

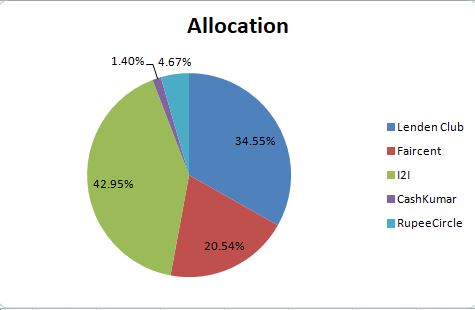

Portfolio Composition

I have added Cashkumar and Rupee circle to my portfolio while reduced my exposure in Faircent .

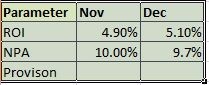

- Calculating Portfolio Performance:( I have covered methods to calculate portfolio performance in my earlier report(November)

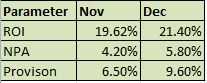

LendenClub (use code LDC11989 to get discount) : For lenden I have used conservative NPA approach where any delay more than 45 days past due date is considered default and written off)

Provision I have kept as the amount of NPA I can tolerate to get 10% Return on my investment,

My ROI in Lenden has improved thus now I can tolerate higher NPA (reason is I have been investing in 40%+ interest loans ,thus I have higher appetite to book npa)

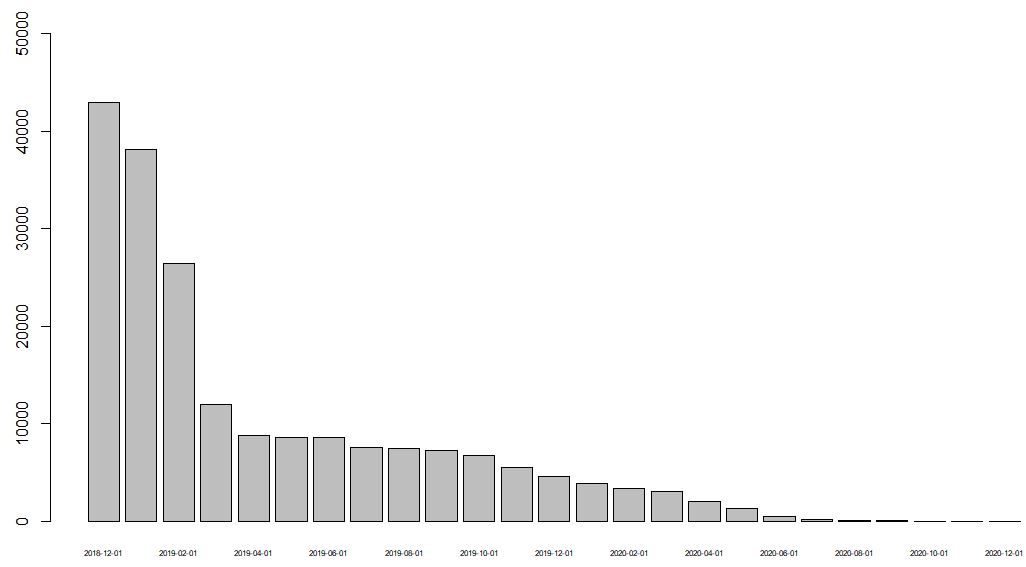

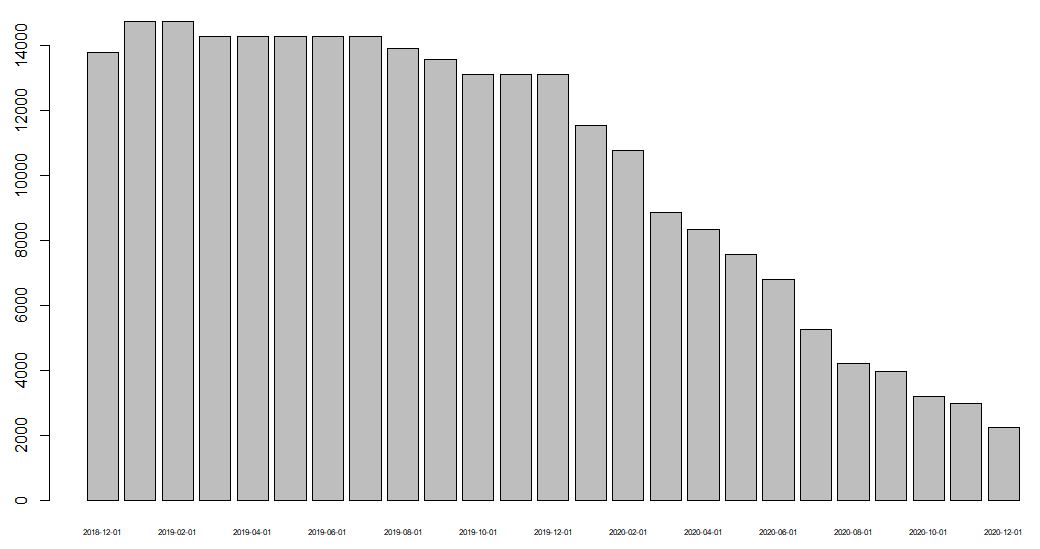

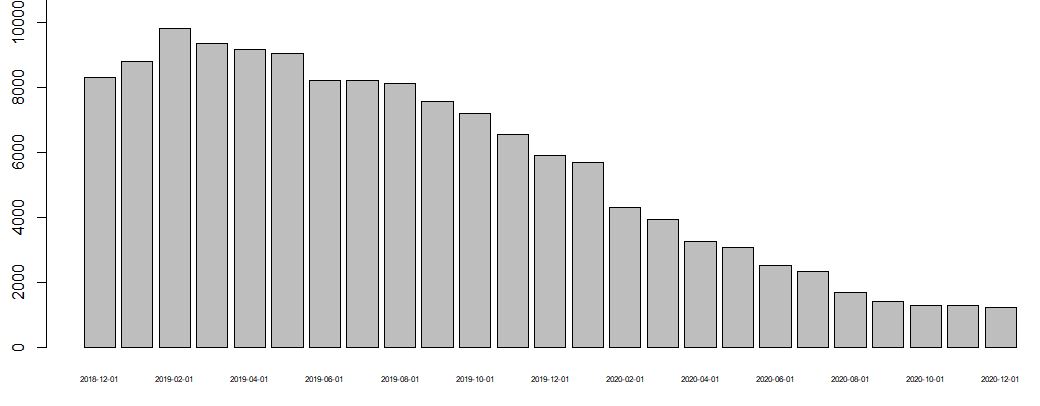

Future EMI

My december ROI has declined as i recently put one big loan in NPA because of EMI delay though it might not default in future. It was an old investment as now I dont invest more than 5000 per borrower in I2I to avoid concentration risk

Future EMI:

Faircent:

I am in the process of unwinding Faircent portfolio

Future EMI

:

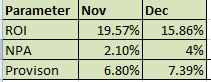

Now lets see Total portfolio Performance and Strategy

Returns look fine considering I have been Conservative in my calculation.Replacing Faircent with other p2p should increase the ROI over next 3 months

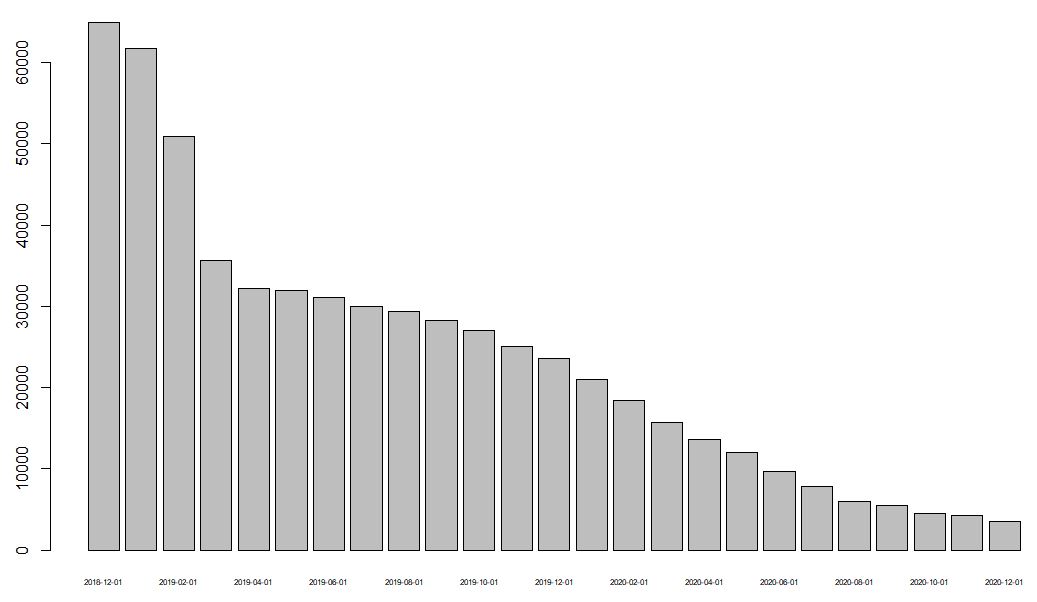

Now lets see the future EMI

As I had invested more in short term I have lot of inflows in the near future and thus need to balance out my lending long term

Strategy Going Forward:

- Move all Faircent EMI to Lendenclub(better risk adjusted Return)

- Monitor Investment in RupeeCircle and grow book(use code PIND145 while registering to get portfolio analysis reports)

- Increase investment in I2I (use referral to get portfolio analysis https://www.i2ifunding.com/referral/ud8cwng83/invest )

- Increase investment in cashkumar( positives are:short term loans(<6 months), overall good platform performance with low npa, high interest) Mail me for referral !

- Will Run Portfolio analysis next month again and compare results

People who wish to construct a quantitative P2P portfolio can mail me.