Last couple of months saw lot new and interesting loans and products been launched by few platforms.A brief over view on those products

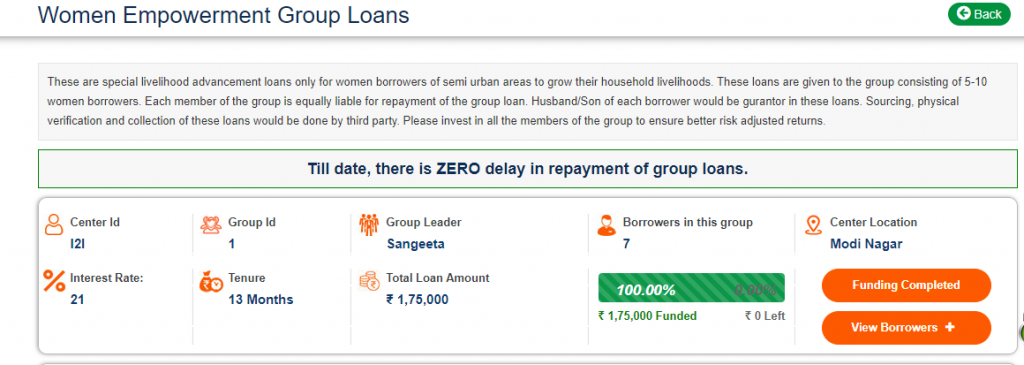

I2I Funding group Loans:

The product is interesting as the yield is quite high and there are multiple guarantor. Due to cross guarantee I will consider it less riskier than single borrower loan for a similar risk profile.

To make the most out of this loan it makes to invest in each member of the group. Another positive is that borrower are women and historically delinquency is generally lower for women compared to men.

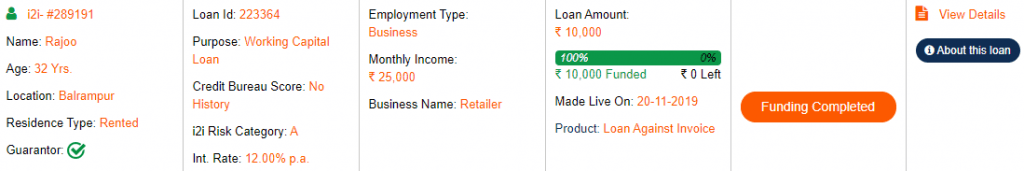

I2IFunding Invoice Discounted Loans:

i2iFunding has partnered with Oxigen to provide loan against the amount debited by NPCI from the Micro ATM customer. This amount is settled by NPCI in next 1 to 2 days in Oxigen account. Oxigen will recover the loan amount before settling it further into borrower’s bank account.

This loan is similar to settlement finance loans on TradeCred. The yield is also similar. This loan suit those people who wish to invest only smaller amount else they can choose either TradeCred or Faircent Micro ATM loans instead

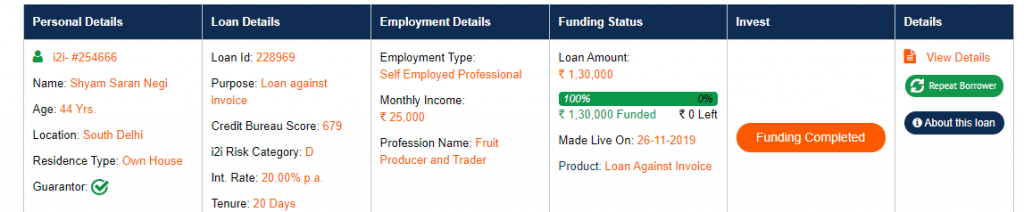

A slightly higher risk category with higher yield for invoice discounting is loan against farm product invoices

i2iFunding has partnered with a third party to provide loan against invoices to Fruit farmers and vendors. Company which purchases the fruits will be guarantor in the loans and will make the repayment directly in i2iFunding’s escrow account on behalf of the borrower. As tenor is very low (20 days) if the defaults are close to zero then only it makes good sense to invest here and people should start with small capital.

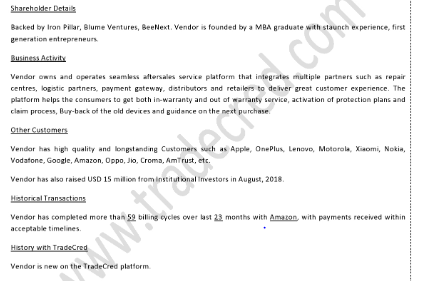

TradeCred GST discounted Invoices:

This is a new product launched by Tradecred. Above is an example of one such deal. In this kind of setup a vendor has multiple enterprises for which it is providing service( Servify in this example which provides after sales service in multiple category).

The GST invoices are used to see history of transaction with various enterprises ( which are mostly blue chip).

Advantage of this over single enterprise is that your 3 lakh gets distributed amoung multiple enterprises instead of one and vendor will find it easier to pay you if even one defaults. Thus

1) your max exposure to one enterprise is lower

2) vendor does not have a big amount to pay incase of default and hence lower risk of vendor not being able to make up for enterprise default.

If you are very confident of the enterprise then go for normal deal but if you want more conservative trade and want to protect portfolio from black swan event,multiple enterprise is a good option

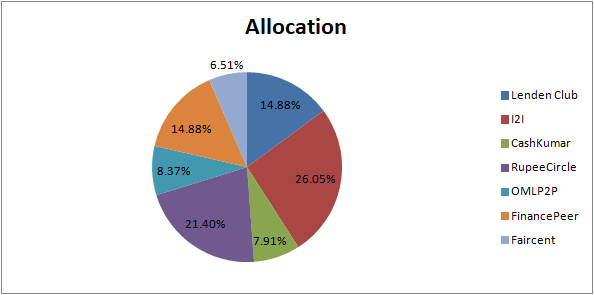

P2P Portfolio Composition for November

Portfolio Changes:

- Adding new investments to RupeeCircle

- Exploring lower risk loans in I2I( NBFC guarantor, Education Loans, Pool Loans) as initially I had lot of D and E category loans in my portfolio

- Adding new investment Faircent consumer loans (Pooled)

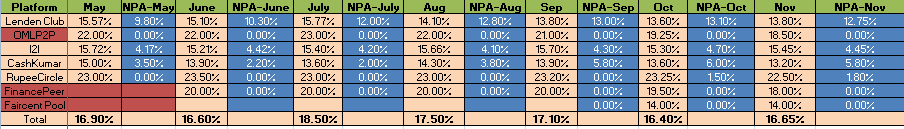

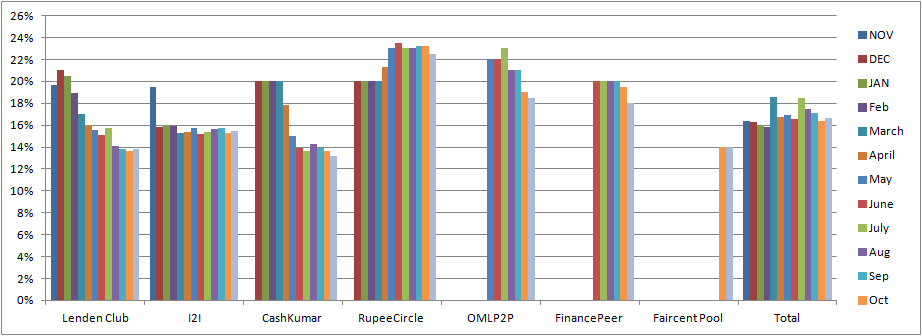

Portfolio Performance

Performance Analysis:

Key Points from this month’s performance are:

- LendenClub: After discontinuation of Insta Loans my yield has slightly gone up . I will stick to the strategy of investing in only 12 months plus loans. Will not add any new investment

- I2IFunding : My yield has stabilized around 15% and now I will start experimenting with different kind of loans. Recently started pool loans!

- RupeeCircle : Robust performance continues.As minimum ticket is 5k here this platform is advisable only if you have more than 1lakh to invest

- FinancePeer : Fewer loans in last few days but overall NPA still zero

- OMLP2P : The yield has started dropping due to idle money in account as very few new opportunities

- Cashkumar: Not a good platform if you want to put more than 70-80k as limited loans

- Faircent Pool Loans: Investing in consumer loans (pool loans) . It’s a good product if return expectation is around 13%.

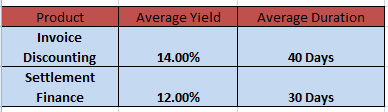

Invoice Discounting and Settlement Finance Performance:

I keep rolling my invoice discount investments. Invoices Invested till now

- Amazon

- Flipkart

- Future Enterprise

- Paytm

- Instakart

- Hiveloop

- Blackbuck

- Cloudtail

I have also invested in Settlement Finance which has daily settlement against Aadhar ATM invoice using TradeCred.

Off late few invoices are raised by vendors which they raise against multiple enterprises thus it diversifies risk of one entity default with multiple low correlated entities who are vetted based on past record with the vendor.

Examples of these are generally logistics companies like :

Blackbuck, Rivago and Deliphery

My current Portfolio yield and duration:

Footnote:

For buying zero cost MF and lowest Derivative Trading

For alternate investment you can use these links

(First Use the link to register then add the Code “NEWYEARSPECIAL” while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com

Thanks Rohan for the detailed information and opening up new avenues of investing.I actually started researching on this products after reading this blog.

However , how safe are these products to invest in ? and secondly you have mentioned about some of the global sites which invest in Europe etc.- Is it allowed and legal to invest in global markets and how is the rupee conversion done ?

sorry I may sound dumb , but these are the queries that I had

Thanks! India is still catching up with other developed and hopefully we have many more interesting opportunities in future

You are allowed to invest in global Equity/realestate under Liberalized Remittance Scheme(LRS) upto 250k USD per year.

You can do a transfer through account also (Banks ask for form A2). Depending on how the final transaction is happening FX transaction can vary. Sometimes crypto based transfer are cheaper

In terms of risk each platform has to be evaluated case by case. The one I have covered are which seem to have good risk adjusted reward