In Part 1 I covered how important is to manage expense and track them religiously ( Managing Expense )

In Part 2 I am covering

- Investment Allocation

- Liquidity Management

Investment Allocation : Somebody tells you about some great investment product. What do you do? You put some money into it .Does this change the outcome of your future corpus. The answer is no! Unless you allocate a substantial amount of money in a a particular product it would not have much bearing on the result. If you put too much money in it you run a huge risk of losing the capital. After all Risk and Reward are Related.

It sounds like a cliche but for any investment we can only choose 2 out of 3

- Quick

- Easy

- Sure

Either you can choose it to be sure and easy but it wont be quick or it can be Quick and Sure but it wont be easy

So a balanced approach is important. This bring me to the point why ” an average investor does not need a wealth manager who charges annual fees” because the loss in fees over a 10 year period is substantially higher than any valuable advise he can provide which is not already available in the public domain.

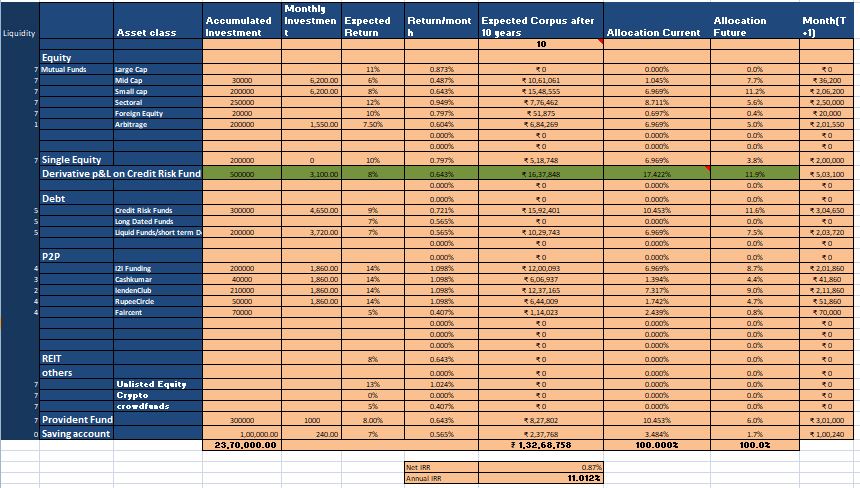

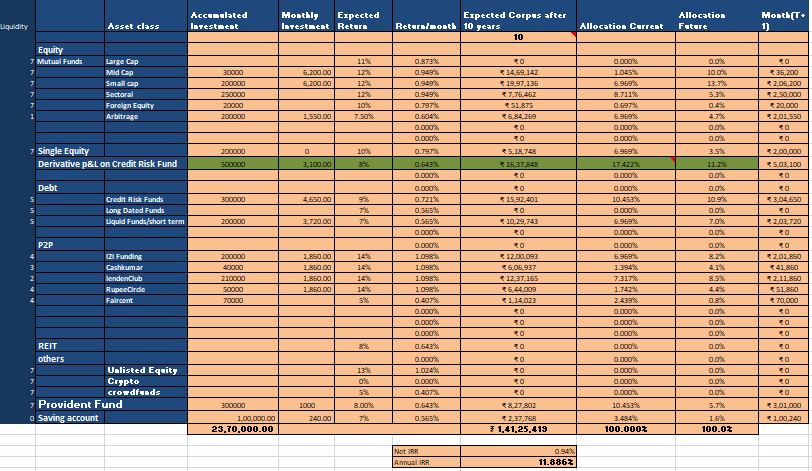

Now I will show how my excel tool helps in asset allocation:

In our example Mr X had 100,000 monthly cash inflow. His expense was 69000 and 31000 was the saving. Now as the individual is young he wants to go for slightly aggressive portfolio with a 10 year horizon.

In the “Accumulated Investment” column I have added all the existing investment of Mr X. In the “Monthly Investment” column I have added the amount he would put monthly. In the last row we can see anything left would be put in the saving account ,which should be minimum unless its a strategy.

Points to note in the investment allocation are

- I have not used any names of Mutual funds. The idea is that the individual will invest in 1-3 funds in each category as he does not want to take too much risk on one particular fund.

- This tool can project corpus for any tenor,Also your ROI for that tenor and allocation percentage

- I have added expected return column where the investor can put how much he can expect to gain per annum on that category. Always use a conservative figure to have cushion for unexpected times.

- I have used p2P funding as an asset class which gives me good diversification and returns at par with equity. It is an add on and not a replacement.

- I do not have any Large Cap exposure .Why?

Here is the Trick.! Lets say I wanted to have 7 Lakh exposure to Nifty 50 . What I did is I bought 5 lakh worth of Credit funds and 2 lakh nifty liquid bees ETF.

So lets say my investment in Large Cap would have fetched on an average 11% annually.

Now My 5 lakh will fetch around 9% , 2 lakh 7 % .ie. around 8.5 % on this portfolio.

I can use the Liquid bees to get margin. I will Sell 1 year tenor 2 Deep OTM (10% OTM) put on Nifty . I will get around 5% for this. Now if Nifty is at 11000. I will sell 2 puts at 10000.

If market tanks 10 percent I am still safe and get around 8.4% +5% = 13.4% return. Compared to this my large Cap would have been 10% down now. In most scenario this will be better except say a 25% drop or lower in Nifty.If I am scared of that I can sell further OTM at 3% yield instead which will be better off even at 30% Nifty Fall.

- The portfolio IRR is around 11% . what will happen if I had bought a different fund which gave more return than my existing small cap and midcap fund. So where I had put conservative figure of 6 and 8% now I have put 12%.

Whats the impact ? only 0 .7% on the total portfolio . This is much lower than what my Wealth Manager would have charged me!!

Therefore it more important to do the asset allocation right, use low cost ETF products and optimise investment than try to find some Dream mutual fund.

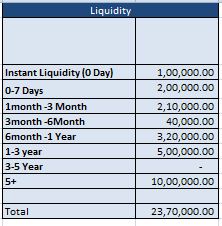

- Liquidity Management : My tool helps me to manage liquidity of my investment. This is very important because many times people have to liquidate assets just to meet immediate requirement.

what comes in instant Liquidity? Your Saving account then In 0-7 days Arbitrage Fund. From 1 month -1 year Lot of my P2P investment provide liquidity as I keep getting back EMI payment. P2P has been very helpful in providing balance between Liquidity,low volatility and high Returns.

I have considered debt funds in 1-3 year because they need atleast 3 year to become tax efficient.All equity and PF will fall in the last bucket.

After having a look at the Liquidity chart I can gauge what needs to be done if I have to allocate more in the nearby bucket if there is some cash outflow soon.

If you need help in structuring your portfolio and need this tool ,please drop me a mail .