India’s real estate sector offers diverse investment opportunities, including residential, industrial, commercial properties, and the rawest form of property: land. Let’s take a detailed look at the land investment opportunity in the country.

Why Should One Invest in Land?

Investing in land in India offers several compelling benefits, making it an attractive asset class for investors. One of the primary advantages is the high appreciation potential. As cities expand and infrastructure develops, land values in urban and suburban areas increase significantly. Limited availability of land in prime locations drives up prices over time, ensuring good returns on investment. Additionally, land investment provides asset stability, acting as a hedge against inflation and offering a reliable form of diversification in an investment portfolio.

Land can also generate income through leasing for agricultural, commercial, or residential purposes, providing steady rental revenue. The potential for development into residential complexes, commercial spaces, or industrial parks further enhances returns. Government initiatives, such as the Smart Cities Mission and affordable housing schemes like Pradhan Mantri Awas Yojana (PMAY), boost infrastructure and increase land values in designated areas.

Recent Trends in Land Investment Opportunity in India

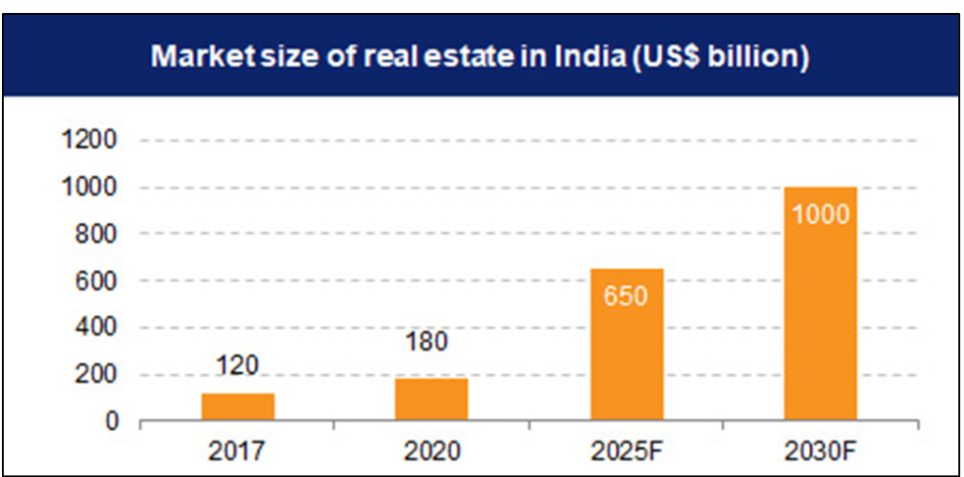

Land investment is considered a burgeoning market in India with estimates suggesting that over 40% of India’s population will live in urban areas by 2030. A direct impact of urbanization can be comprehended from the fact that major real estate markets like Bangalore, Hyderabad, and Pune have witnessed exponential growth in the past few years.

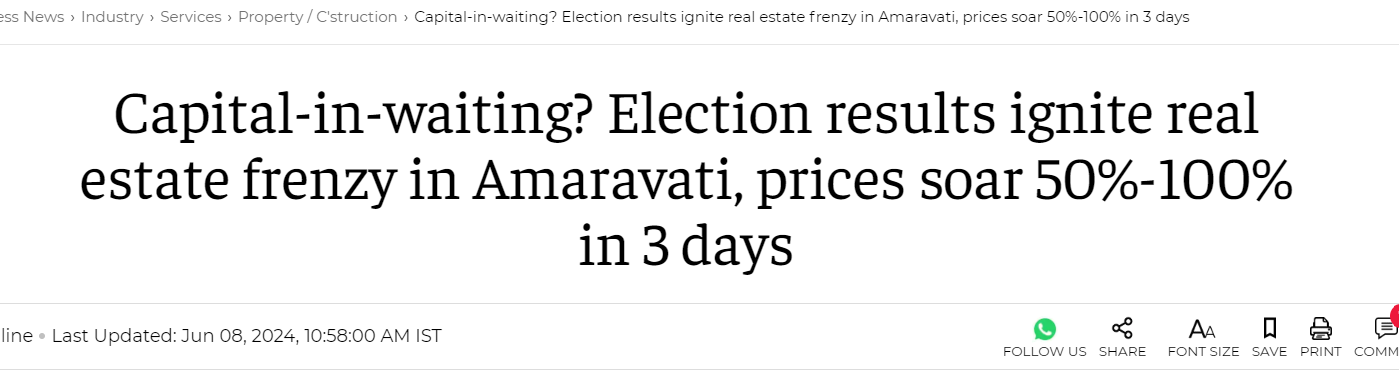

According to the real estate consultancy firm ANAROCK, property values in the Hyderabad market have surged by nearly 45% from 2021 to 2024. Bengaluru, known for its tech industry, has seen land property values rise steadily, with certain localities witnessing 20-30% annual growth. As India’s financial capital, land prices in prime areas like South Mumbai have always been high, with recent years showing a resurgence in demand and prices stabilizing at elevated levels.

Similarly, a recent survey by RnR, the independent research division of Rise Infraventures Limited, reveals that approximately 57% of land and real estate investors plan to invest within the next 3-5 months, indicating a rising demand for properties.

Furthermore, the government’s efforts to build 100 smart cities under the Smart Cities Mission are likely to enhance infrastructure, thereby boosting land values in these areas. Similarly, Major projects like the Delhi-Mumbai Industrial Corridor (DMIC), the Bharatmala project, and various metro expansions are significant drivers of land value appreciation.

Factors to Consider When Purchasing a Land

When buying land, several critical factors need careful consideration to ensure a sound investment. Firstly, examining the microstructure of the land is essential. This includes assessing the soil quality, topography, and drainage patterns to determine suitability for the intended use, whether for agricultural purposes, residential construction, or commercial development. Ensuring that the land has access to basic infrastructure such as roads, electricity, water supply, and sewage systems is crucial for future development and value appreciation.

The legal aspects of purchasing land are equally important. Conduct a thorough title search to verify ownership and ensure there are no legal disputes or encumbrances. It’s vital to confirm that the land has a clear title and that all necessary permissions and approvals for sale and development are in place. Checking for compliance with local zoning laws and regulations is essential to ensure the land can be used for the intended purpose. Additionally, verify the land’s registration details and ensure that all property taxes have been paid.

Understanding the local market conditions and potential for future growth in the area is also important. Researching nearby development projects, infrastructure improvements, and economic trends can provide insights into the land’s potential for appreciation. Environmental factors, such as proximity to flood-prone areas or protected zones, should be considered to mitigate risks. Engaging with local real estate experts or consultants can provide valuable guidance and help navigate the complexities of land purchase.

Traditional Residential and Commercial Investment

The simplest way to invest in real estate is to buy or lease land or property for a long term and rent it out to tenants—whether residential or commercial. However, one must ensure the asset is free from legal hassles, register it (if commercial), and advertise its vacancy. It’s also important to have overlapping lease periods for tenants in the same asset to ensure consistent occupancy and timely maintenance. Property management firms can handle tenant-related tasks, but their commission charges apply.

Land vs. Residential Property vs. Commercial Property

Land Investment

– Pros: Land appreciates over time, has lower maintenance costs, and offers flexibility (e.g., agriculture, development).

– Cons: No immediate rental income, potential regulatory hurdles.

Residential Property Investment

– Pros: Steady rental income, potential for capital appreciation, Easier to sell than commercial property

– Cons: Maintenance costs, market fluctuations, Difficult to get tenants

Commercial Property Investment

– Pros: Higher rental yields, long-term leases.

– Cons: Tenant turnover, market volatility, Large Minimum ticket, Difficult to exit

Returns: Residential vs. Commercial vs Land in India

Residential Real Estate

Rental Yield: Typically ranges from 2% to 4% per annum. This is relatively low due to the nature of residential leases, which tend to have longer terms and lower rent escalations.

Capital Appreciation: Varies significantly based on location and market conditions. Prime urban areas (like Mumbai, Bengaluru, and Delhi) can see annual appreciation rates of 8% to 10%.

Total Yield – 10-15%

Commercial Real Estate

Rental Yield: Generally higher, ranging from 8% to 11% per annum. This higher yield is due to shorter lease terms, more frequent rent escalations, and higher rental values.

Capital Appreciation: Similar to residential properties, this varies by location. Prime commercial hubs can experience appreciation rates of 5% to 10% annually, driven by demand from businesses and retail establishments.

Total Yield – 12- 16%

Gains in Land Investment

Yield: This can be variable and often depends on whether agricultural or residential. Leasing agricultural land typically provides lower returns, around 1% to 3% per annum, but can be higher if used for specialized crops or organic farming.

Capital Appreciation: Historically, land in peri-urban areas (areas on the outskirts of cities) has seen significant appreciation due to urban expansion, with rates varying widely from 5% to 30% annually.

Data Insights (Example Cases)

Bengaluru: Residential properties in prime areas like Whitefield and Koramangala have seen appreciation rates of 8% to 12% annually, with rental yields around 3%. Commercial properties in these areas yield about 7% to 9% annually, with capital appreciation rates of 10% to 15%.

Mumbai: In areas like Bandra-Kurla Complex (BKC) and Lower Parel, commercial properties have rental yields of 8% to 10%, with capital appreciation of 12% to 15%. Residential properties in these areas yield about 2% to 4% with annual appreciation rates of 6% to 10%.

Hyderabad: Gachibowli and Hitech City have seen residential property appreciation of 10% to 15% per annum, with rental yields around 3% to 4%. Commercial properties here yield 7% to 9%, with similar capital appreciation rates.

Land investment in some of the above areas has gone up 2x the rate of residential and commercial Properties.

Problems with Conventional Property Investment

Problems in Buying Land

If someone has a great understanding of micromarket and understands legal know how land purchasing can be a great option. Buying land in India can be challenging due to several key issues:

- Title Disputes:

- Unclear titles and multiple ownership claims.

- Legal and Regulatory Hurdles:

- Restrictive zoning laws, land ceiling acts, and environmental regulations.

- Fraud and Scams:

- Fake documents, impersonation, and illegal sales.

- Land Acquisition Issues:

- Potential government acquisition and disputes with local communities.

- Due Diligence Challenges:

- Difficulty verifying land records and survey discrepancies.

- Infrastructure and Accessibility:

- Poor infrastructure and connectivity issues.

- Financial Constraints:

- High land prices and difficulties obtaining loans.

- Bureaucratic Delays:

- Slow processing and corruption in administrative procedures.

- Encroachment:

- Risk of land being encroached upon by squatters.

- Cultural and Social Factors:

- Local resistance and customary laws complicate transactions.

Thorough due diligence and legal advice are essential to navigate these complexities.

Issue with Buying Residential and Commercial Properties

Residential Properties

- Maintenance:

- Upkeep costs and utility management can be high.

- Tenants:

- Issues with non-payment, damage, and eviction challenges.

- Selling Old Houses:

- Depreciation, structural issues, and lower marketability.

Commercial Properties

- Maintenance:

- Higher costs and regulatory compliance.

- Tenants:

- Complex lease agreements, vacancy risks, and need for professional management.

- Selling Old Properties:

- Depreciation, market dependency, and renovation costs.

Fractional Real Estate in India

Over the last few years, innovative products have come up to allow people to invest in Real Estate directly or indirectly.

Some of the products are

- REITS – To invest primarily in mega commercial properties through listed companies.

- Real Estate NCD to give access to the development of these projects

- Fractional Residential and Commercial investment

- Fractional Land Investments

Platforms for Real Estate Investments

Some of the platforms we have explored or invested in deals are below

Real Estate NCD – These platforms can provide up to 15-18% on various real estate project development with tenor from 3- 5 years

- Altgraaf – Detailed Review

- Assetmonk- Detailed Review

- Earnnest.me – Detailed Review

Land Investment Platform

AltDRX (Detailed Review) is an innovative platform that allows fractional ownership of land. Investors can buy fractional shares, beginning with the purchase of 1sq ft of the land, thereby diversifying their portfolio. AltDRX has built a stock exchange-like platform where these assets can be posted, bought, and sold with ease, all in real time. Moreover, AltDRX handles legal aspects, maintenance, and paperwork. It democratizes land ownership, making it accessible to a wider audience.

We participated in 2 deals till now in Bangalore and Hyderabad with good returns

Fractional CRE and Residential

We have participated in these platforms through

- Asset Monk – Detailed Post

- Wisex – Detailed Post

There are a few other platforms also in the market that provide Fractional CRE and residential real estate opportunities including Holiday Homes

Conclusion

In conclusion, land investment in India presents exciting opportunities. A diversified portfolio can help to overcome the risk of idiosyncratic problems of a single property. Fractional real estate has made that possible today. Whether you choose traditional models, explore fractional ownership, or invest in residential or commercial properties, thorough research and understanding are essential.