I2Ifunding is one of the country’s oldest p2p platforms, and I started investing here as early as 2018.

Before I go into my investment journey let’s start with p2p lending and the background of I2Ifunding.

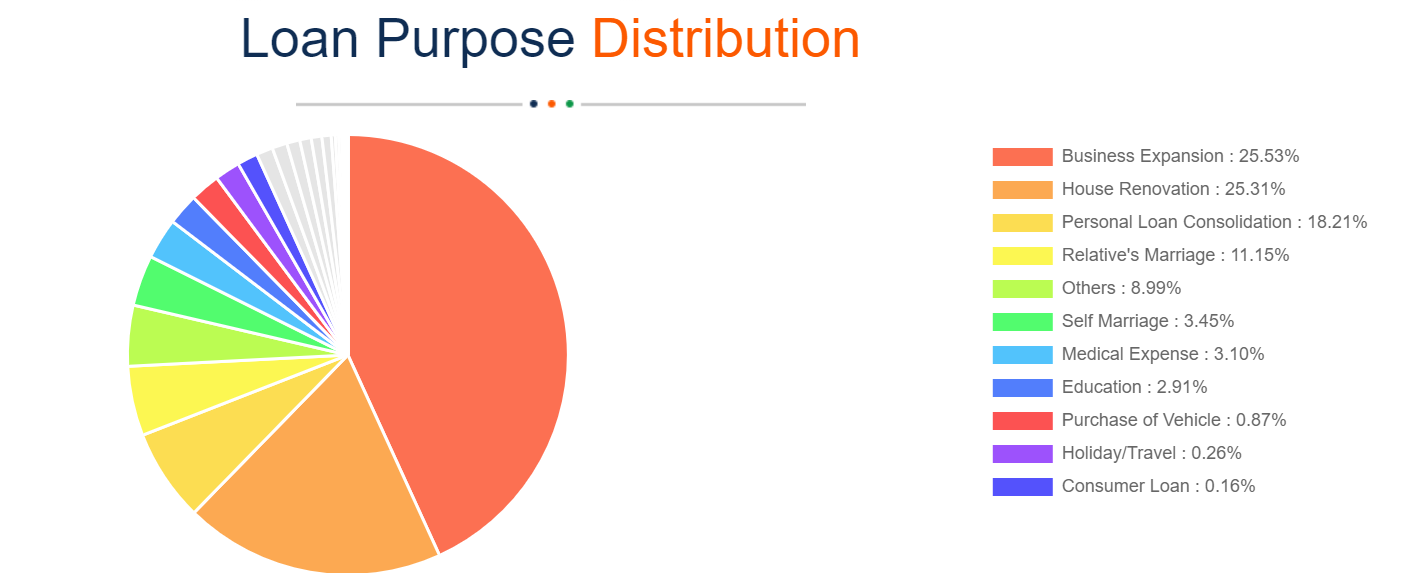

Imagine this, you are a disciplined investor who invests monthly in bank FDs or mutual funds but also wants to explore new investment avenues. At the same time, someone in your city or the country needs a loan for their purposes, such as a medical emergency, a child’s education, or maybe to start a business.

What if I tell you these two needs can be connected directly and cut out any middleman? Today, this is possible with P2P platforms in India.

This article will explore P2P lending platforms and how they work. Let’s dive in and explore it more.

What are Peer-to-Peer Lending Platforms in India?

Peer-to-peer lending, or P2P lending, is a financial tool that allows you to lend unsecured personal loans to borrowers seeking loans or vice versa.

When you are an investor, i.e., lending, you get a chance to earn higher returns on your investments. As a lender, you can see all the listed borrowers and find their details before you lend money to them.

Peer-to-peer lending is booming and is a successful model globally, so how can India left behind? RBI is taking steps to innovate this sector and introduce regulations for it.

What is I2IFunding- P2P Platform in India?

I2IFunding (discount50@i2i” for discount)

I2i Funding (RNVP Technology Pvt Ltd.) is a Non- Banking Financial Company – Peer Peer Lending Platform (NBFC- P2P) registered by the Reserve Bank of India (RBI) where you get the opportunity to lend your money online to borrowers and earn high-interest rates. On the contrary, you can also get a personal loan from the platform.

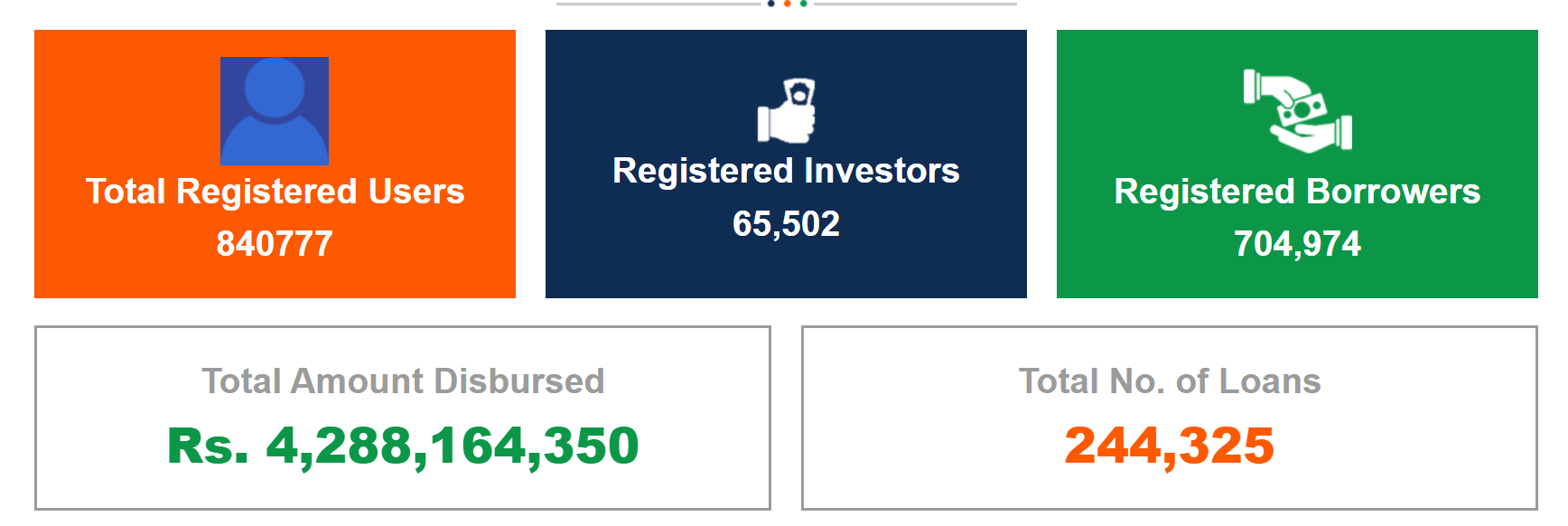

Borrowers have applied for loans worth over 1500 Crore, and investors have lent over 480 Crore from the platform.

I2I Funding Founders

We believe that having a strong founding team is key for any platform. I2Ifunding has a highly experienced team with the relevant experience to manage the credit risk of p2p lending.

Vaibhav Kumar Pandey, Raghavendra Pratap Singh, Neha Aggarwal, and Manisha Bansal are the co-founders of i2i Funding, a peer-to-peer lending platform in India.

Vaibhav Kumar Pandey

Vaibhav is an IIM-Ahmedabad graduate with over ten years of experience building large-scale operations and managing teams efficiently. His role in i2i is to make strategic alliances, fundraise, and develop technology. His technology team has built many enterprise-level solutions used by 5000+ users in the company and across vendors’ locations.

Raghavendra Pratap Singh

Raghavendra is an IIM-Calcutta graduate and an ex-merchant mariner. He has over ten years of global experience in product development, e-commerce, operations, digital marketing, and client service. He is among the founding team at i2i and is responsible for product development and marketing. He also looks for growth strategies in the organization and has previously worked at British Petroleum, Genpact, and Aptara.

Neha Aggarwal

Neha has completed her MBA from XIM- Bhubaneshwar and graduated from Delhi University with distinction in Finance. She has previously worked in brand management in the FMCG sector and product development in the finance sector. She contributed to bringing new products into the priority lending sector in ICICI. She has handled SHG and FDOD instruments of more than $25 million at ICICI. At i2i, Neha is responsible for Credit Risk evaluation from borrowers.

Manisha Bansal

Manisha is a Chartered Accountant with over eight years of domestic and overseas work experience in multiple fields. Previously, she worked with NGOs such as CAT Protection and ADHD in the UK, overseeing finance and treasury activities. She also has worked with Birla Sunlife Insurance. AT

I2Ifunding, Manisha is responsible for investor interaction, making strategies, strategic tie-ups, and regulatory relationship management apart from day-to-day business involvement, and she also oversees Mumbai office activities.

What is the I2IFunding Business Model?

The primary business of i2i funding is bringing a common platform for lenders and borrowers where lenders can earn high returns by lending money to the borrowers. In contrast, borrowers can take personal loans from the platform.

Investment Products on I2IFunding

I2Ifunding generally ties up with third parties through which loans are acquired. This model helps them to get good borrowers once they are able to evaluate strong anchors. Some of the products available on the platform are :

Urban Company

The platform started this loan category for the professionals working at Urban Company. Urban Company deducts the EMI directly from the borrower’s earnings and transfers the deducted EMI amount to i2i Funding on behalf of the borrowers.

- Investment size: Rs. 1,000-5,000

- I2i Risk Category: X

- Expected Returns: 16% p.a.

- Loan Tenure: 180 days

Backed by Partner Company

I2IFunding has partnered with a third party to offer small loans to salaried employees for personal use. Third-party agents also do the job of collecting agents to recover EMIs from the borrowers. This kind of loan is considered very safe as it is a short-term loan provided only after conducting a complete verification.

- Investment size: N/A

- I2i Risk Category: C

- Expected returns: 18% p.a.

- Loan Tenure: 60 days

Employer Partnership

I2I has partnered with a company directly with employers to offer employees loans tied to paid leaves. If an employee leaves the company before repayment of the loan, the employer will deduct the amount from the final settlement, which includes cashing in on any balance paid leave. Then, the company pays directly to I2Ifunding.

- Investment Size: N/A

- I2i Risk Category: C

- Expected Returns: 18% p.a.

- Loan Tenure 24 Months

There are many more investment options available on the i2i Funding website.

I2IFunding Lending Fees

I2IFunding (discount50@i2i” for discount)

Registration Fees

I2i Lending charges a one-time fee of Rs. 500 + 18% GST Rs. 590, which is non-refundable and is to complete the registration process. You can use the above link to get a discount on the registration fees.

Investment Fees

If you invest more than Rs. 50,000, you have to pay a fee of 1% +18% GST of the investment amount.

If you invest Rs. 1 lakh, you have to pay Rs. 1,000 + 180= 1,180 as a fee.

Other Charges

If you withdraw your investment before a loan is fully funded, the charges are Rs. 200 + 18% GST.

How Does I2IFunding Manage Risk?

I2Ifunding follows a tight credit matrix along with strong collection to mitigate the risk

Provides Collection and Recovery

I2i Funding has a team for collection and legal recovery support to the investors who lend on the platform, reducing the risk of default by the borrowers.

Verified and High-quality P2P Loans

Every loan undergoes a very strict CIBIL check and physical verification, and only high-quality borrowers are listed on the platform.

Registered by the Reserve Bank of India (RBI)

I2i Funding is registered by the RBI as an NBFC- P2P, which makes it a trusted platform.

How Does I2IFunding Work For The Lenders?

I2IFunding (discount50@i2i” for discount)

Create an Investor Account

First, you must create an investor’s account on their official website by filling out a simple form and completing your KYC. Once registered, your account will be credited with a notional money of Rs. 50,000.

Review Pre-Verified Loan Projects

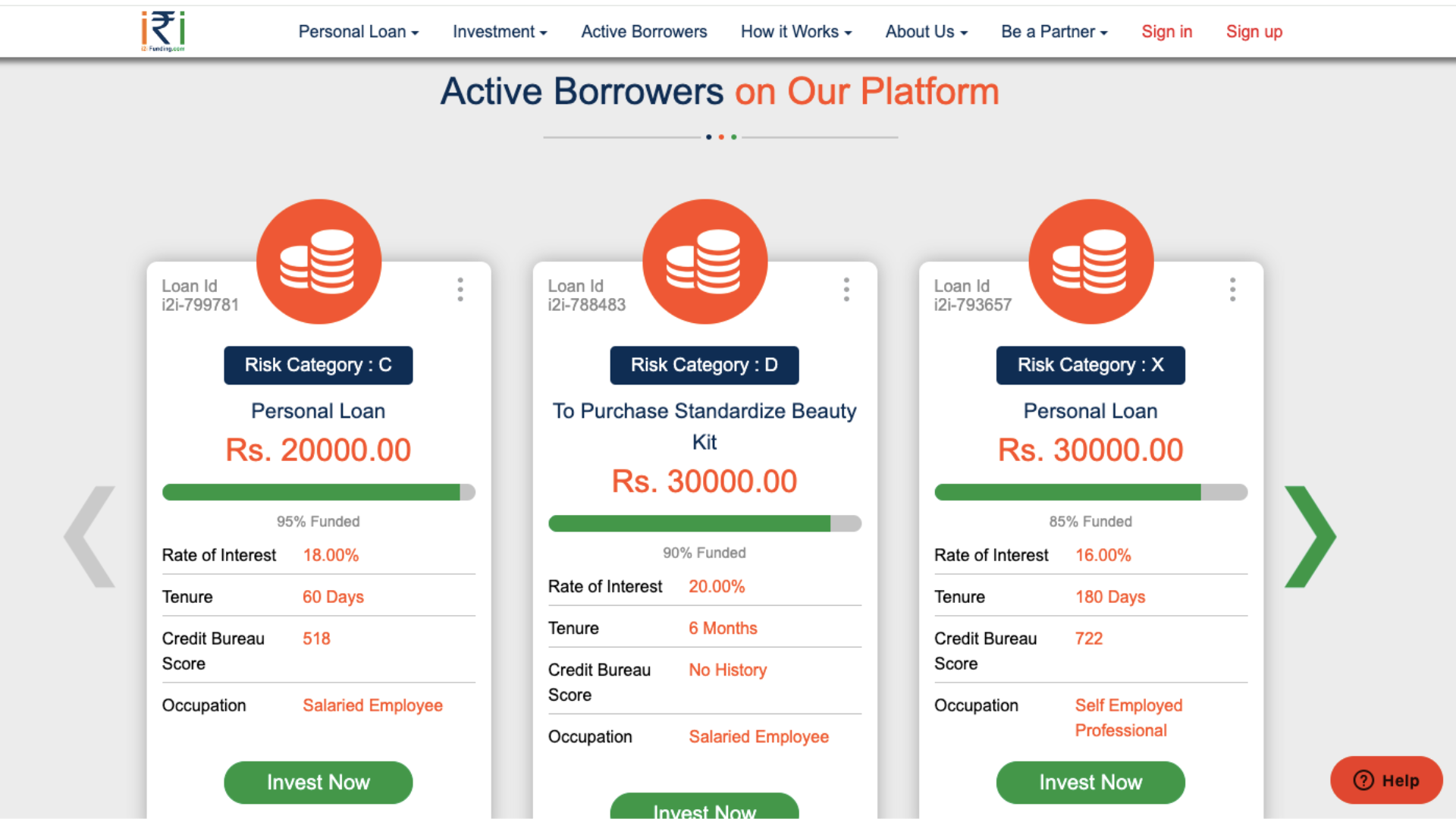

Once you have completed the registration, you can review various P2P loans requested by the borrowers, which have already been assessed by the i2i team using their credit score model, and recommend an interest rate with risk category.

Invest in P2P Loans of Your Choice

You can then select and fund the loan projects per your preference and invest as low as Rs. 5,000. But remember that you can fund a maximum of 20% of the loan amount requested by the borrower, and you can recharge your wallet after Rs. 50,000.

Physical Verification and Documentation

Once the borrower accepts the loan, i2i physically verifies the borrower. Then, the borrower has to sign a legal agreement and provide undated cheques equal to the EMI amount for each investor. These documents are sent to all the investors in digital format.

Transfer Funds and receive payments from Next Month

Once you complete all the legal formalities, you have to transfer funds to a Unique Escrow account assigned to you for disbursal and start getting monthly payments in your bank account from next month onwards.

Build a Portfolio and Grow Your Money

You can start investing in multiple loans listed on your portal and create a diversified portfolio based on your risk profile, and you can earn high returns.

I2IFunding Alternatives

Faircent

Faircent is a P2P lending platform certified by the RBI. This platform allows you to lend to potential borrowers listed on the platform and earn high returns.

Jiraaf

Jiraaf is a platform where you can invest in invoice discounting, real estate NCD, venture Debt and leasing.

India P2P

It is a women-focused P2P lending platform that has gained popularity among investors and consistently provided 18% returns.

Lendbox

Lendbox is amongst one of the oldest P2P lending companies in India. It claims to provide a return of 24%, and it also has a lower risk product Per Annum plan in partnership with Unicards with returns of up to 11.5%.

Pros of Investing in Peer-to-Peer Lending through I2IFunding

Contribution by the Co-Founders

All the company’s co-founders are personally involved in the company’s operations. For example, Neha takes care of the credit risk and is responsible for evaluating the credit risk of the borrowers. Manisha looks at Mumbai office activities, while Vaibhav and Raghavendra are accountable for the business’s growth, strategies, and marketing. This shows that each of them has a different skill set and focuses on providing the best services to investors.

High returns

Investing in i2i Funding, you can earn upto 30% returns as claimed by the company and earn as per your preference, i.e. selecting borrowers yourself.

Collection and Recovery

The company provides Collection and recovery services, so you do not have to worry about default in payments by the borrowers, and the company does not charge anything extra for this service.

High- Quality P2P Loans

Before getting listed, every loan goes through a strict credit analysis process that includes a CIBIL score check and physical verification, making the investment secure for the investors.

Transparent and Secure

I2i Funding has security and safety standards that keep your data confidential.

Cons of Investing in Peer-to-Peer Lending through i2i Funding

Limited Data

P2P lending platforms are new in India compared to other investment options; hence, there is less historical data present, making investors sceptical about their investing decisions.

Default Risk

There is always a risk of default present as the borrowers may fail to repay their loan amount on time, which may delay your principal amount and interest.

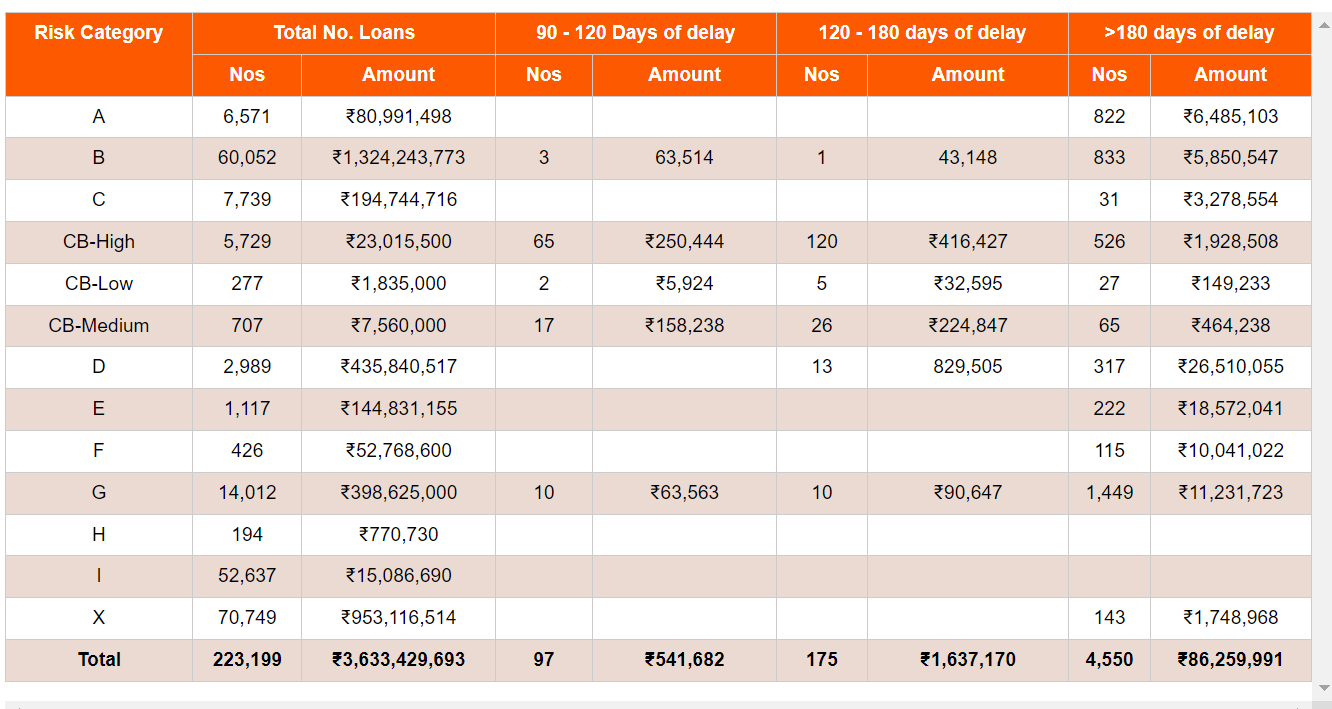

I2IFunding Performance

Below is the snapshot of I2Ifunding portfolio performance. The overall Gross NPA is around 2.5% and most of it is in high-risk category D and E. This is Gross NPA that means some of it will be collected back and actual NPA can be lower.

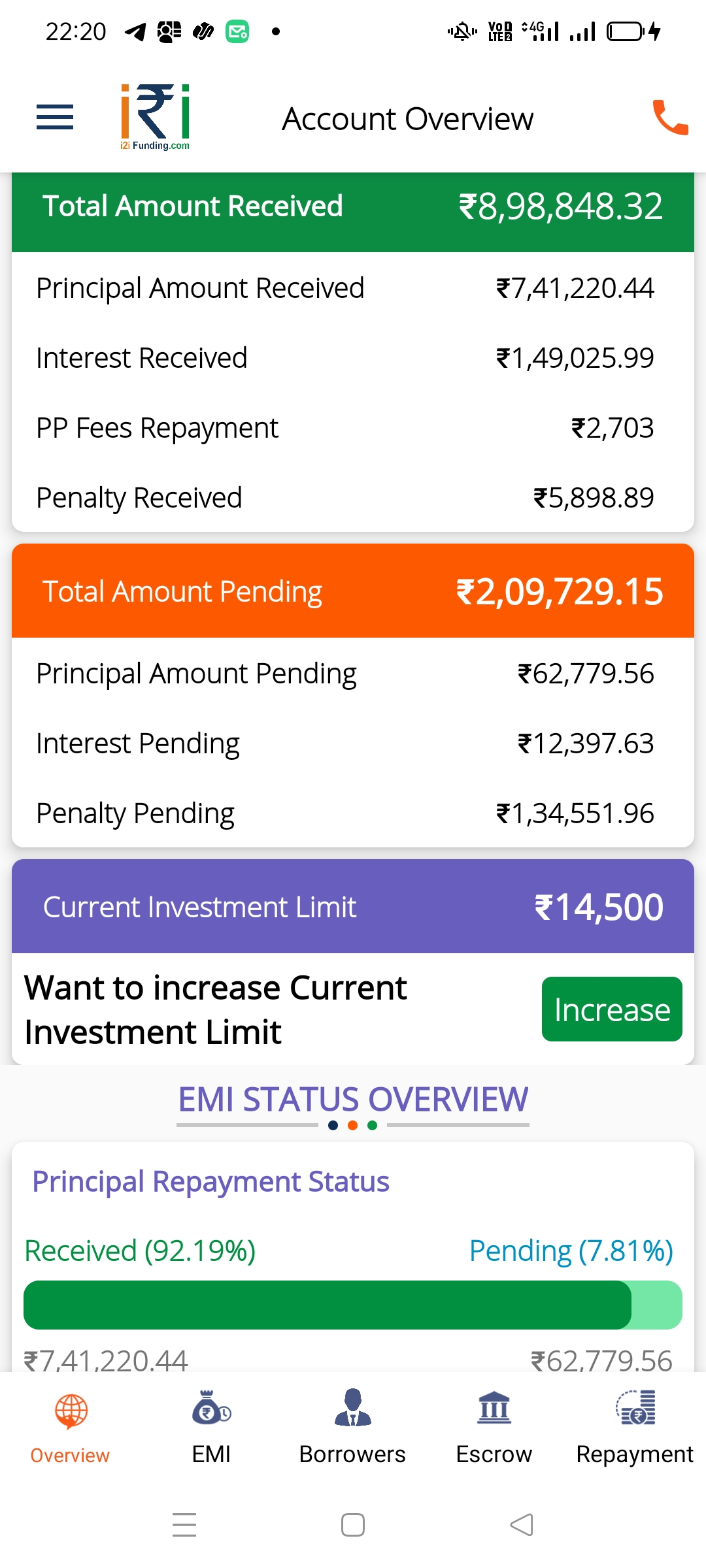

Personal Experience of Investing in I2IFunding

I started investing in I2Ifunding way back in 2018. One of the biggest fire tests for the platform was the covid period. Many platforms like Rupeecircle and Lendenclub ended up with 50% + default during that period.

I2I funding was able to recover a substantial part of the loans through efficient collection. In fact the performance of my investment including the COVID period is 13%+ which is phenomenal. I ensured that I created a diversified portfolio on the platform.

I had written an article post covid on the recovery status of my I2Ifunding loans shared below

https://randomdimes.com/p2p-i2ifunding-covid-impact-and-recovery/

Some key points investors should keep in mind while investing

- Do not put more than 2% in one loan

- Diversify across loan categories

- Use the auto-invest mode to reinvest and avoid cash lying idle in escrow

I2IFunding (discount50@i2i” for discount)

Conclusion

Investing in P2P Lending platforms can be a rewarding experience, but it comes with challenges. There is always a potential for higher risk, but spreading your investment to various borrowers can diversify your portfolio, and you can mitigate some risk. My Experience with I2I funding has been positive and considering the time frame I have invested in, it is evident the performance of this platform has been better than most of the other p2p platforms.

Frequently Asked Questions (FAQs)

How much does I2Ifunding charge the fee?

The platform charges 1% of the investment amount as an investment fee if you invest more than Rs. 50,000. There are other changes, such as if you withdraw before a loan is fully funded or change your bank account details, you have to pay Rs. 200 + 18% GST for each, respectively.

How does I2IFunding ensure borrower creditworthiness?

Every loan undergoes a very strict CIBIL check and physical verification, and only high-quality borrowers are listed on the platform.

What happens if a borrower defaults on a loan?

I2i Funding provides free collection and legal recovery support to the investors who lend on the platform, which reduces the risk of default by the borrowers.

Can I pre-pay my loan as a borrower on I2I funding?

Yes, you can prepay your loan as you prefer, and there is no penalty for the prepayment.

How secure is my data on the I2IFunding platform?

I2IFunding follows security and safety standards prescribed by RBI to protect your data and keep it confidential.