Inflation Hedge to protect against rising inflation is a key task in 2021. Fed recently announced that it will be keeping rates unchanged till 2023. However, the market has become very cautious as other countries are starting the rate hike process soon!

BOJ readied to adjust monetary policy and will look at measures that will allow long-term interest rates to move in “a slightly larger range of about 0.25%, versus 0.2% now” in order to make life easier for financial institutions. .Turkey has also started hiking the rate.

A low rate enviroment with strong growth will cause inflation and Fed will at some point of time in near future will have to start the interest rate hike process .

Interest Rate and Inflation History

Since about 1984, inflation rates (green) have hovered at a manageable 1-6%, with a downward trend. As a result, the 10-year Treasury and the Fed Funds rate have followed lower as well.

Interest Rate and Stock Market Comparison

The interesting thing about this chart is that whenever there is a recession (grey columns), the Fed has cut interest rates to help spur economic growth and employment.

The Fed seems to go excessive in rate cuts compared to the decline in the 10-year yield and therefore has to hurry up and raise sooner than expected.

Also, the good thing about the 10-year bond yield moving higher ahead of a Fed hike is that if and when the Fed does hike, the market will have already baked the hike in. Therefore, any negative reaction should be muted.

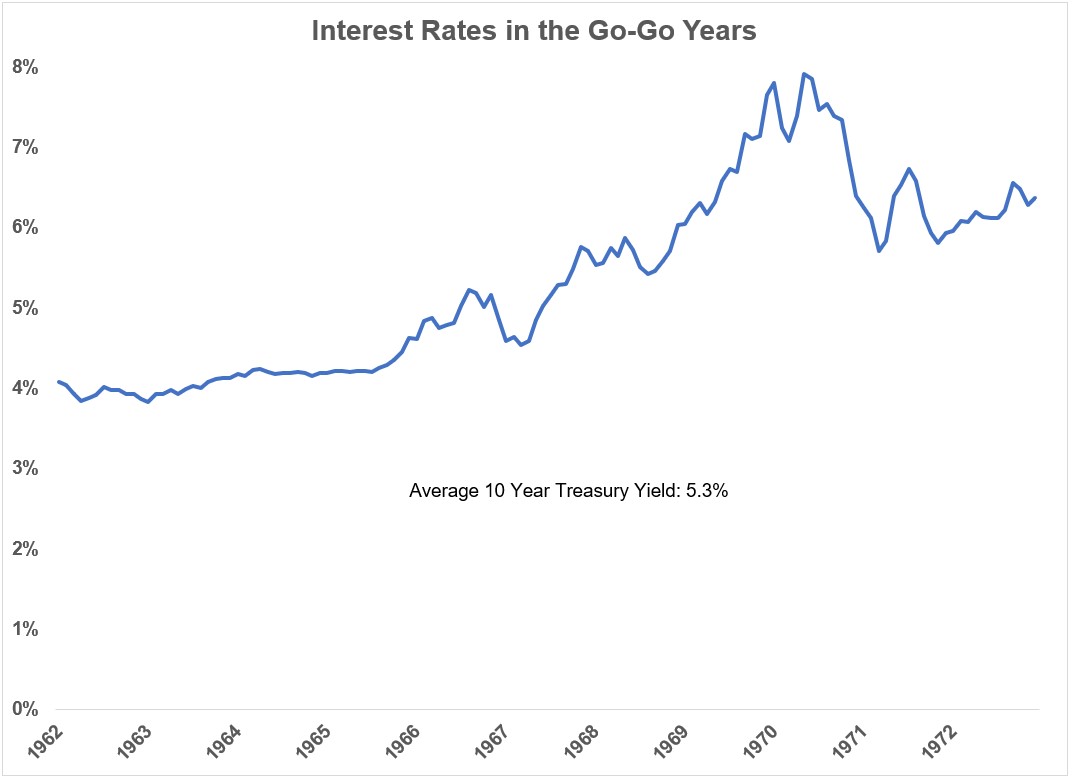

Bull Cycles in High Interest Rate Enviroment

It may come as a shock to investors in low and even negative interest rates that many growth stock rallies took place in an environment of high and rising interest rates:

The 10-year yield averaged more than 5% from 1962-1972. And it’s worth noting, inflation was moving ever-higher during this period as well.

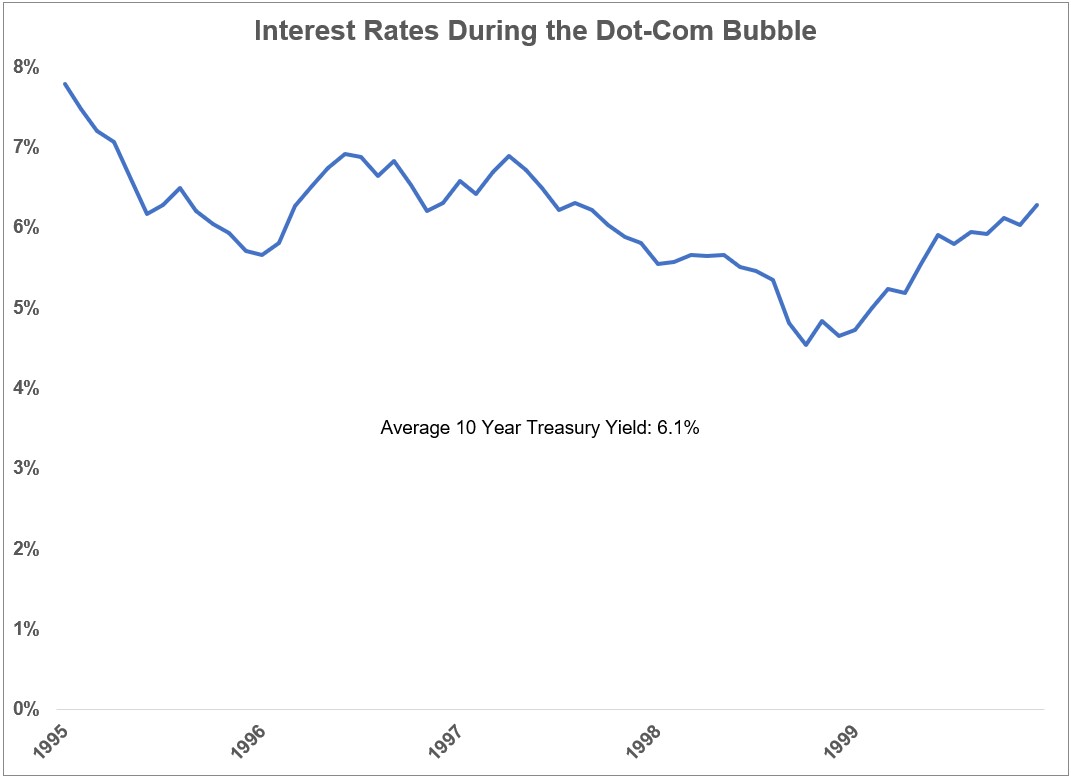

Interest rates were even higher during the dot-com bubble of the mid-to-late 1990s:

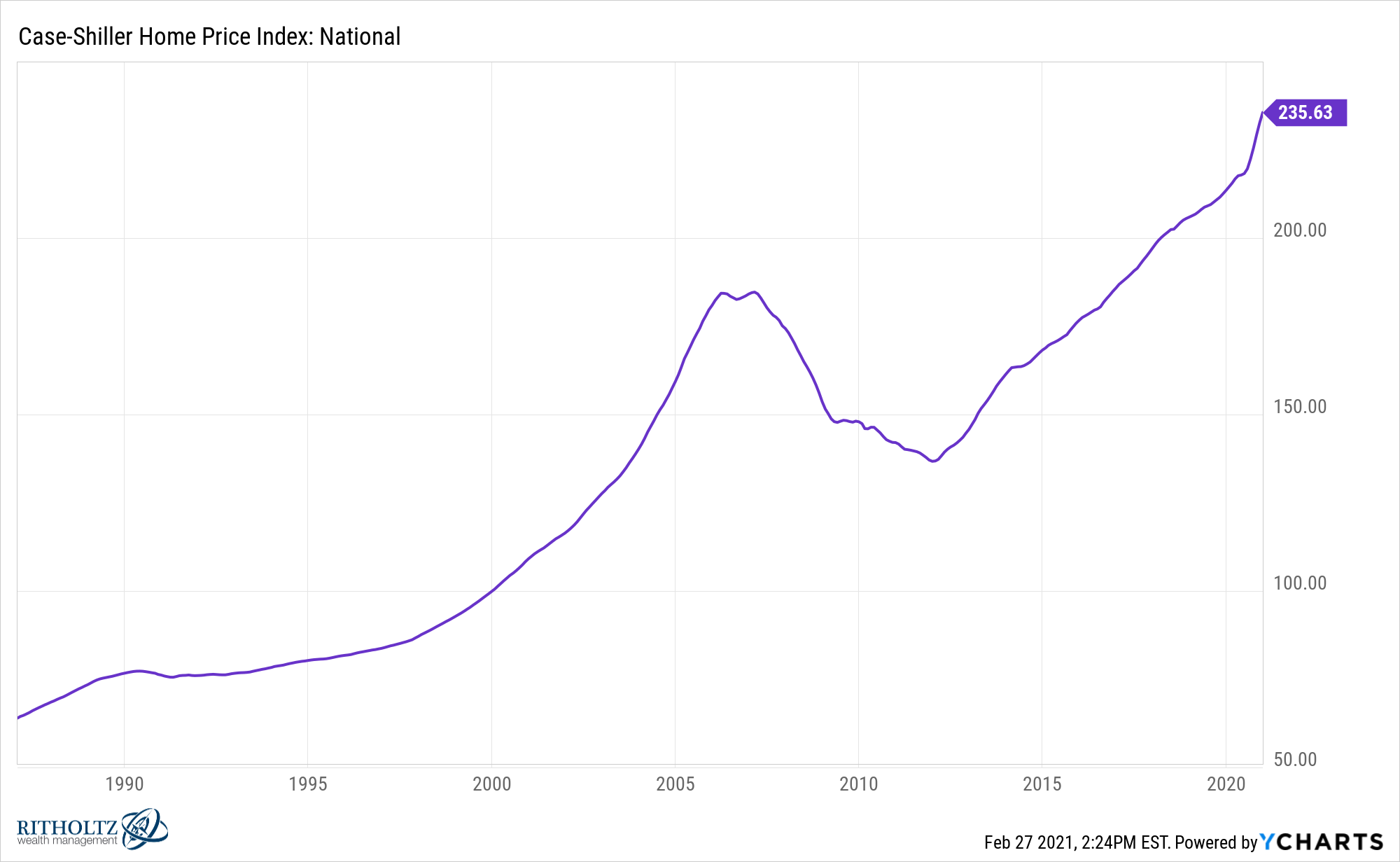

Housing Market Performance during High Interest

You can see the housing bubble really took off in the early-2000s and leveled out around 2006 before the crash began in 2007:

From 2000-2006, the U.S. housing market was up close to 70%.

Now look at mortgage rates in that time:

The average 30 year mortgage rate from 2000-2006 was 6.5%. When housing began to take off in 2001, mortgage rates were over 7%.

The greatest housing bubble of all-time didn’t need sub-3% mortgage rates for a trip to crazytown, just lax underwriting and people looking for the next unicorn

Interest rates do matter. They provide a hurdle rate, discount rate, benchmark, alternative to risk assets, however you want to look at it. But they aren’t the be-all, end-all to the markets some would have you believe.

There are so many other factors at play that determine why investors do what they do with their money — demographics, demand, risk appetite, past experiences and a whole host of psychological and market-related dynamics.

Hedge for Inflation and Growing Interest Rate

Even though we can never be sure of inflation impact we need to shift allocation to assets which are better suited for this scenario

Now there are 2 kind of assets people should start allocating to

- Assets which can do well in Inflation

- and which will perform in a scenario where interest rates start going up (atleast dont underperform in rising rates)

Assets to buy as Inflation Hedge

Gold

Gold has performed well during high inflation times though its performance is inconsistent

How to buy Gold

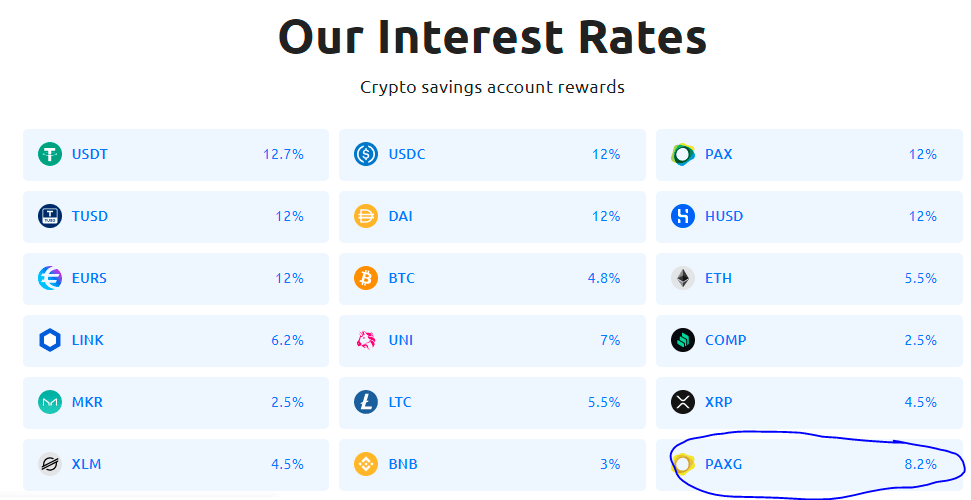

PAXG(gold backed token) on Youholder can provide gold performance and 8.2 % Extra yield. Also Any rupee depreciation will further enhance the returns as it is dollar denominated and during period of inflation rupee has trailed dollar in performance.

A more riskier but with greater upside potential would be to buy goldmine royalty on GoldFinX (Review of Goldfinx Investment in Gold Mines)

Bitcoin / Crypto

I think people who have not bought any crypto till now are too late to the party. At the current level it’s best to allocate smaller amounts and average incase of correction.

How to buy Crypto :

- Wazirx / Binance for Trading

- Iconomi Platform for Altcoin Portfolio

- Hedge it on Deribit

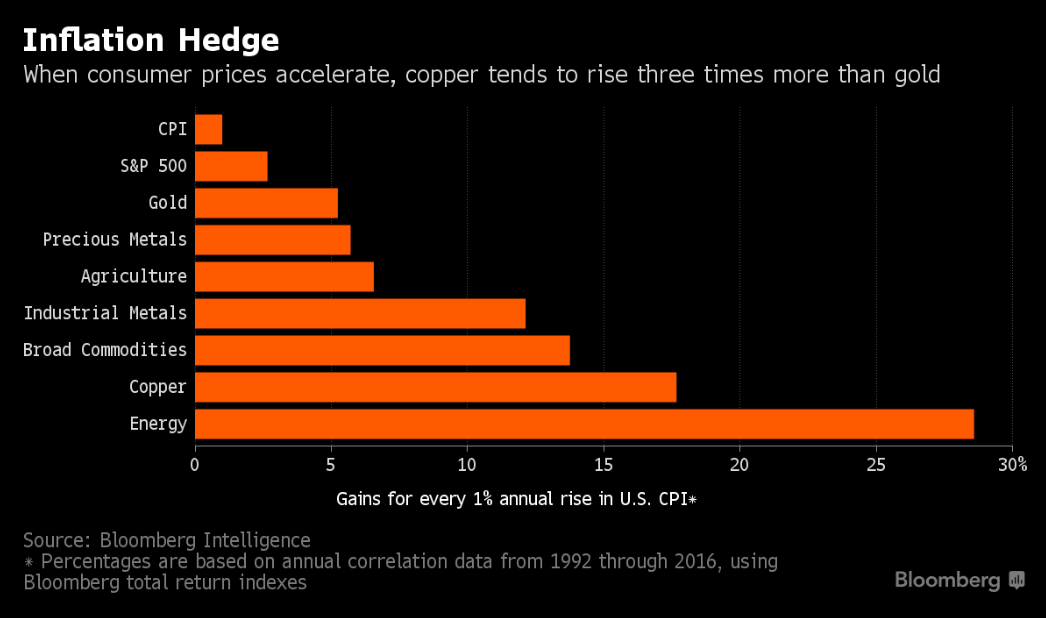

Metals and Energy

A small allocation to metals such as silver,Platinum and Palladium can be done through the Metex Platform .Copper and energy prices has historically proved to do well in inflation and their stocks can be bought.

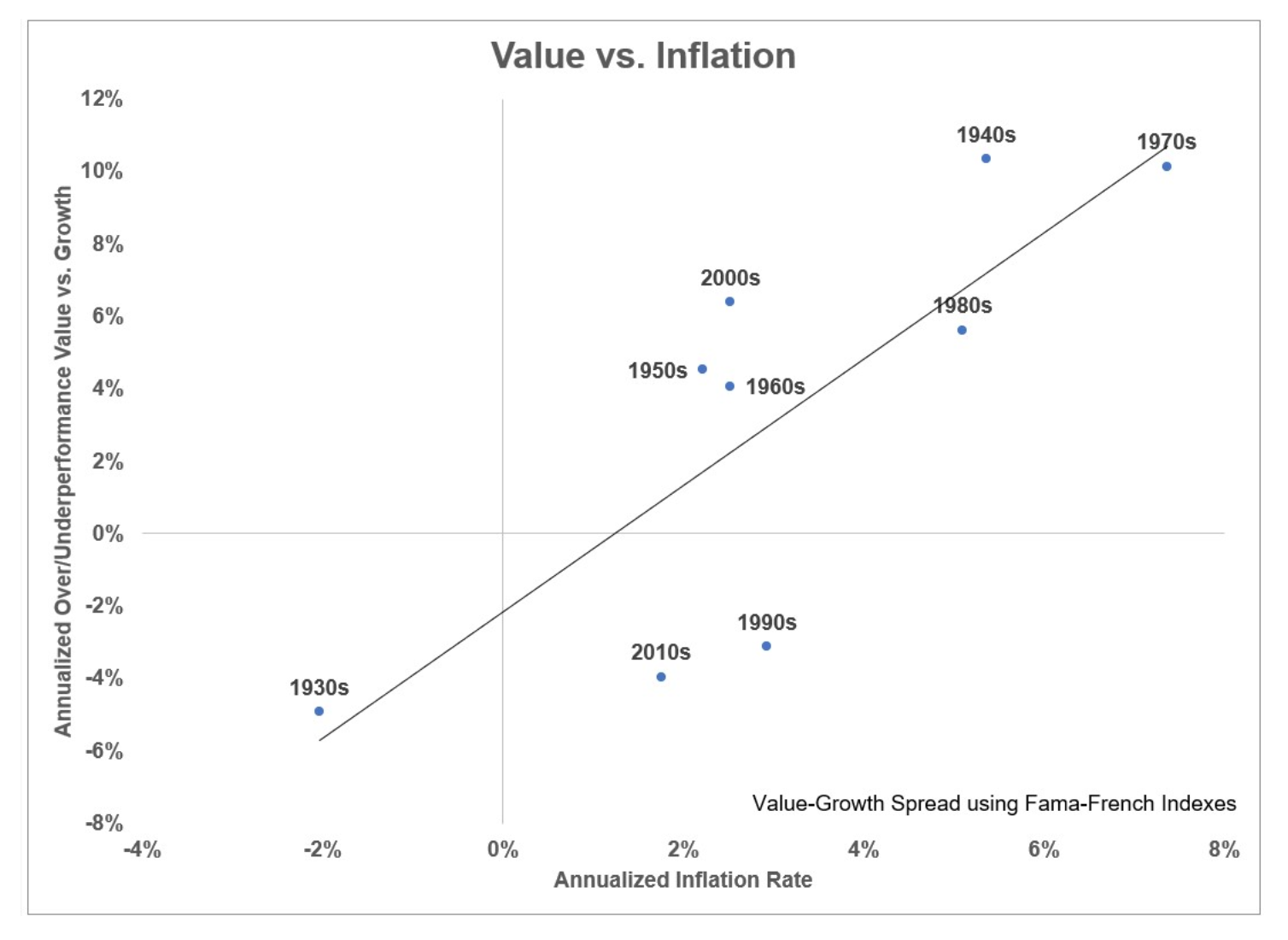

Value Stocks

In period of Inflation it is best to stick to Value stocks instead of growth stocks

Think about growth stocks like they are a bond. The reason inflation is such a big risk for bondholders is because the purchasing power of your fixed rate income payments is eroded over time by inflation.

The same thing is true of promised future growth in revenue or profits for growth stocks. Value stocks likely already have cash flows now that will likely decrease into the future. Thus, higher interest rates should hurt value stocks less than growth stocks since the higher hurdle rate makes future growth not worth as much.

Global Equity Options : Large cap Value ETF

Indian Equity options: ICICI Low Volatility ETF etc

You can buy global ETF on Stockal and Vested.

Alternatives

Assets which have locked in high IRR are a good way to reduce impact of any interest rate movement.People should do proper credit evaluation. Some of the alternate investment platforms people can choose are

Indian : Klubworks, Tradeced ,GrowFix and Grip Invest

Global :Evostate,EstateGuru,Reinvest24

Cryptobased Lending :Youholder,Celsius Network (code 133908fe3e)

Short Duration Bonds /Arbitrage Funds

Short duration bonds (<2 years) are a good buy as you can hold them to maturity. In case of Bond funds choose even shorter more duration as funds keep on churning portfolio to fix the duration so for a 1% hike you can lose upto 2% -3% for a 3 year Duration fund any given time. You can buy bonds on Golden PI if they are not available on broking platform.

What not to buy in rising Interest Rate ?

Highly speculative growth stocks : These stocks can do well in a low interest rate enviroment but in tight borrowing conditions the future earning become uncertain.

Highly Leveraged Firms: If you’ve got a lot of debt, your debt servicing cost goes up with higher rates. Your risk of default also goes up. As a result, investors will sell highly leveraged firms . REITs, utilities, and any sector that commands high ongoing capital expenditure will likely underperform

High Yield/Dividend Play: As interest rates rise, existing yields look relatively less attractive. Let’s say investors have been buying a REIT for their 5.5% yield. If the 10-year yield rises from 2% to 5%, investors would logically sell the REIT and buy a risk-free 10-year bond that provides a higher yield.

Long term Debt Funds: If you end up buying a long term gilt fund/PSU fund you can get shocked when interest rate start rising as due to high duration your portfolio can lose all the accumulated interest in 1 rate hike!

Conclusion

The exact impact of interest rate and high inflation is hard to predict but it makes sense to avoid glaring mistakes and tilt your portfolio pragmatically rather than picking the extreme route as is the case for many people in a low interest rate environment.