A lot has been written about diversification in peer to peer lending, including on this site .It is the most important factor in P2P lending. Beginner investors sometimes pay too much attention to the details of each individual loan, occasionally forgetting to simply diversify their investment across hundreds of loans.

Many get really frustrated after few months, feel betrayed, turn, and doubt the entire asset class, are almost always investors who simply failed to diversify their initial deposit in enough loans.

Lot of people see my portfolio of P2P and then start investing in those platforms. An important point which most people overlook is that my portfolio allocation is applicable only for the size of capital I have invested.

To elaborate it let’s assume if somebody has only 50000 to invest and they put their money in Rupeecircle only how many loans they can invest in? Max 10 Loans. Even if 1 Loan defaults they have a NPA which is close to 10%. People start panicking and stop the investment in that platform.

The truth is 1-2 loans can default in your portfolio yet the total platform NPA percentage can be very low. How?

If the platform has disbursed loan worth 10 crore and 5% is NPA level which means around 50 Lakhs is delinquent. Your portfolio is 50000 ,it can have 2 loans in default ,somebody else can have a portfolio with 0 default and thus total default is still 5%. Numerous combination are possible.

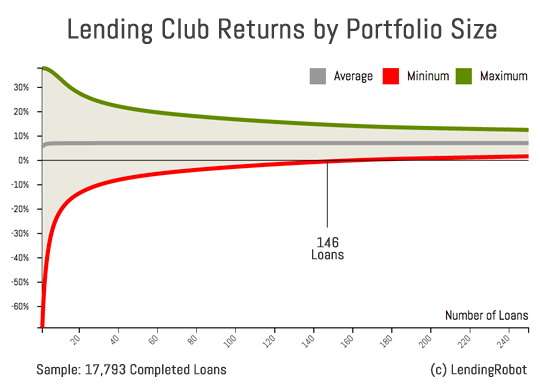

Its a very challenging question to identify at what level we can say that our portfolio of p2p loans has become fully diversified. Basically, how many loans does it take? To explore this concept I studied the performance of the P2P platforms in other countries got the data.

There were 2 factors on which it hinged:

- Number of Loans obviously

- Risk Category of Loans.

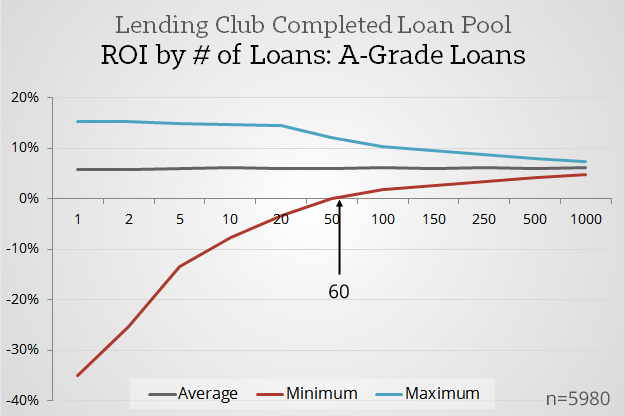

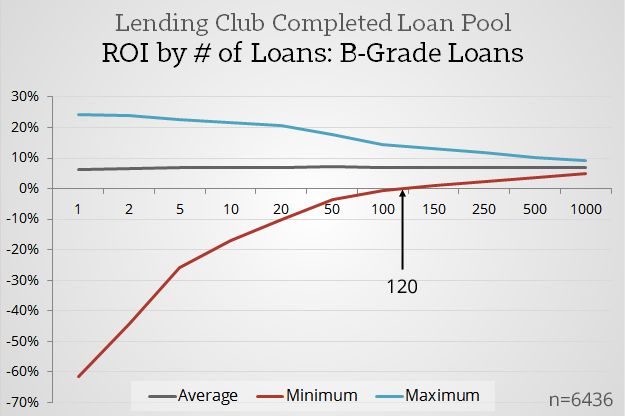

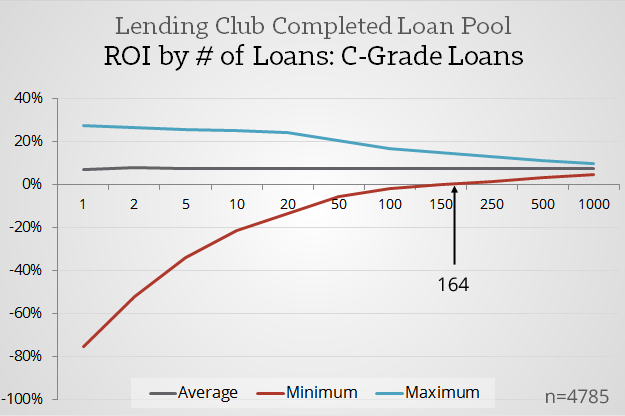

Below are the Charts which I got from a US P2P lending report.

Total Portfolio: 146 Loans for breakeven

High Grade Loans:60 Loans

Medium Grade Loans: 120 Loans

Low Grade Loans:164 Loans

It is evident that for diversification we need more low risk loans but obviously our returns are higher for high risk loans. So how do we balance it.

How do we manage this problem? There are 2 ways.

- We choose platforms which match our investment capacity.

- We increase our platforms when we increase our portfolio size

A platform which has short dated loans and small ticket size is ideal for small capital as the churn is pretty high and in no time you have diversified into many loans while a higher capital requires a combination of loan tenors so that there is no shortage of loans to invest at any given time

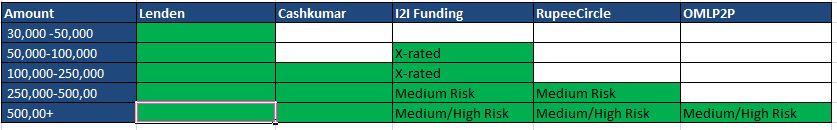

I have created a table which will help to choose platform combination based on your investment capital and rationale. I have recently started investing in a new platform called OMLP2P. When the portfolio size increases it becomes really hard to find good loans and it become necessary to evaluate new platforms. I will cover it’s performance when I publish my portfolio results.

I have marked in green the combination of platforms which should be chosen based on investment capital amount.

Eg: for someone with 1lakh-2.5 Lakh capital: lenden,cashkumar and XRated loans(1000rs) in I2I

I would suggest not to invest in P2P if you don’t have atleast 40-50k to invest else you run a risk of under diversification.

Lenden has the smallest ticket size(500) and lowest tenor (3 months) hence it is perfect for smaller capital while rupeecircle for people with larger capital

As your portfolio grow you can keep adding new platform and higher risk category. Based on my experience 5Lakh is the amount after which your returns start stabilising .

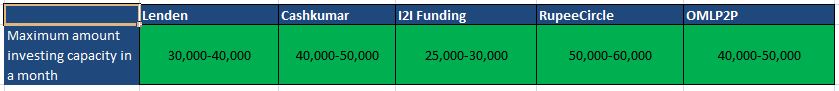

Once you have started investing you will have another problem,how much amount of good loans can I find on a platform in a month. I have created a table based on my experience, the amount of money which can be deployed in the various platforms in one month.

In Lenden I use auto invest so there is no hassle to evaluate borrowers. Other platform I check the borrowers before investing as ticket size is higher

Platform Referral Links:

I2I Account Referral Link(Use Code I2I50%DISCOUNT while paying to get 50% off,Mail me after registering to get further benefits)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

Mail me to get Cashkumar Referral