Government Securities (G-Secs) are popular investment vehicles for their safety and steady returns. However, G-SEC STRIPS (Separate Trading of Registered Interest and Principal of Securities) offers a unique opportunity to maximize returns through tax efficiency by trading the principal and interest components separately as zero-coupon bonds.

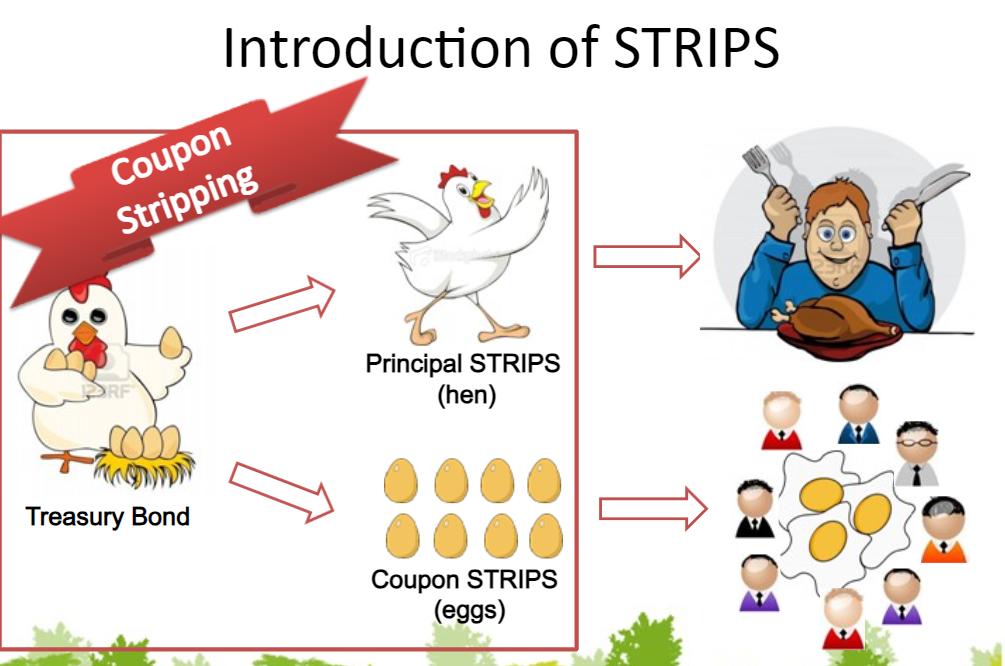

What Are G-SEC STRIPS?

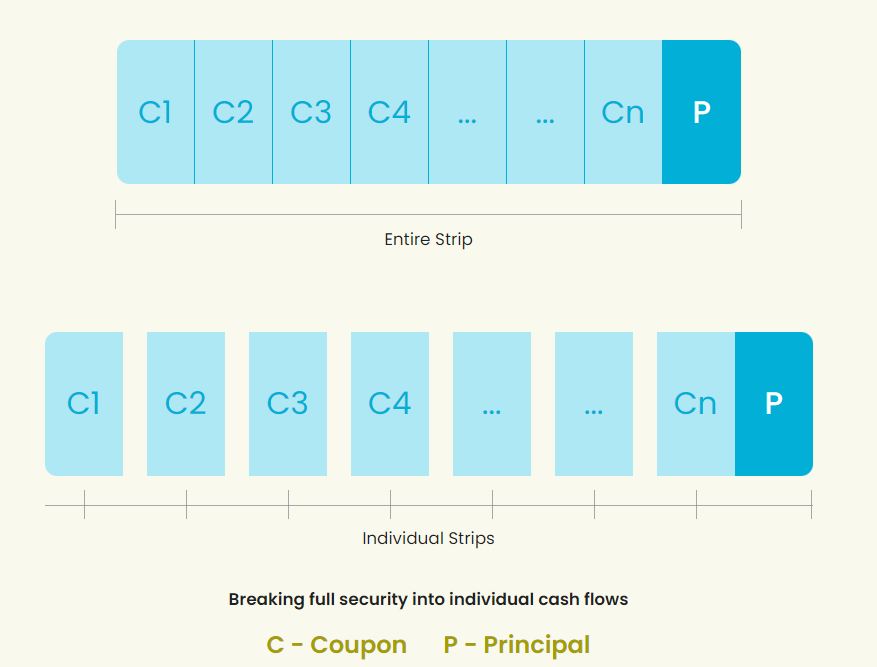

G-SEC STRIPS are essentially government bonds that have been “stripped” into two parts: the principal and the interest payments (coupons). These components are then sold as individual securities, each representing a single cash flow at maturity. This process allows investors to purchase the bond’s principal or interest payments separately, creating a zero-coupon bond with a fixed maturity value and a discount to its face value.

Benefits of Investing in G-SEC STRIPS

- Safety and Security: Since G-SEC STRIPS are backed by the government, they are virtually risk-free, making them one of the safest investment options.

- No Reinvestment Risk: Unlike regular bonds, G-SEC STRIPS do not pay periodic interest, eliminating the need for reinvestment of interest payments at uncertain future rates.

- Potential for Higher Returns: Investors can buy STRIPS at a discount and receive the full face value at maturity, potentially leading to higher returns than traditional fixed deposits.

- Flexibility: Investors can choose STRIPS that match their investment horizon, whether short-term or long-term.

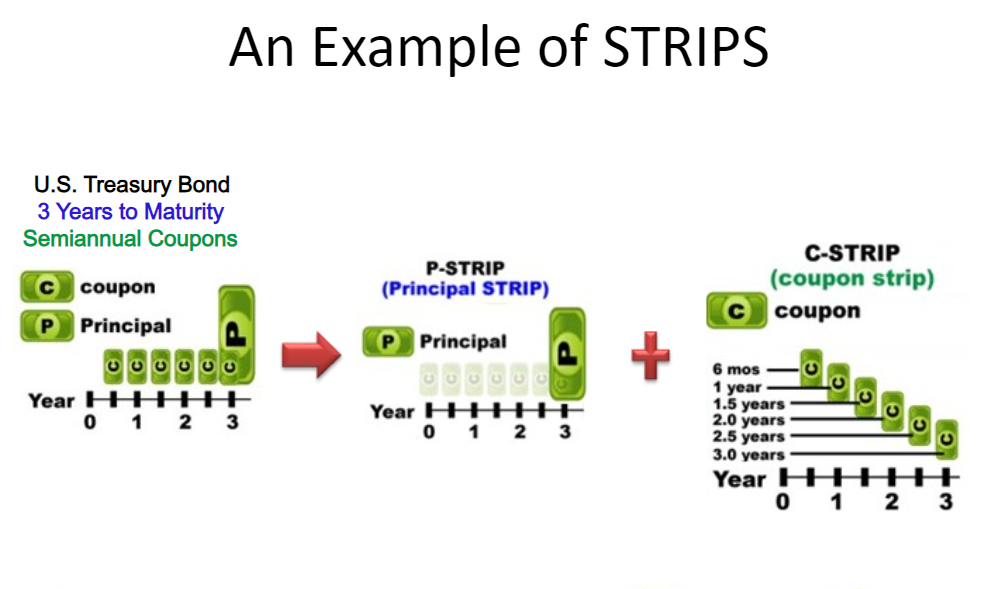

How Do STRIPS Work?

When a G-Sec is stripped, it is broken down into its component cash flows. For example, a 10-year bond with semi-annual interest payments can be divided into 20 STRIPS representing each coupon payment and one STRIP representing the principal repayment. Each STRIP is treated as an individual zero-coupon bond and can be bought or sold in the secondary market.

Pricing Mechanism: The price of a STRIP is determined by discounting its future cash flow to its present value using the prevailing interest rates. The absence of periodic interest payments and the deep discount to face value create an opportunity for capital appreciation.

Real-World Example: Consider an investor who buys a STRIP with a face value of ₹1,000 at a price of ₹750. Upon maturity, the investor will receive ₹1,000, resulting in a profit of ₹250, or a return of approximately 33%. This example illustrates the potential for STRIPS to provide significant returns over time.

What Returns Can Investor Expect?

There are 2 ways how investors can make money on Long Duration Gsec instruments

- Interest accrued at approx 7% rate in the strip

- Increase in price due to fall in Yield.

The modified duration of a strip is equal to its maturity which means if you hold 10 10-year strips and the rate falls by 0.5% you make a 5% gain.

Check out how modified duration work !

Considering that we might be at an inflection point for rate cuts a double-digit return cannot be ruled out. However, there is an element of risk also if rates go higher from here. Investor can then hold the strip closer to maturity and remove that risk!

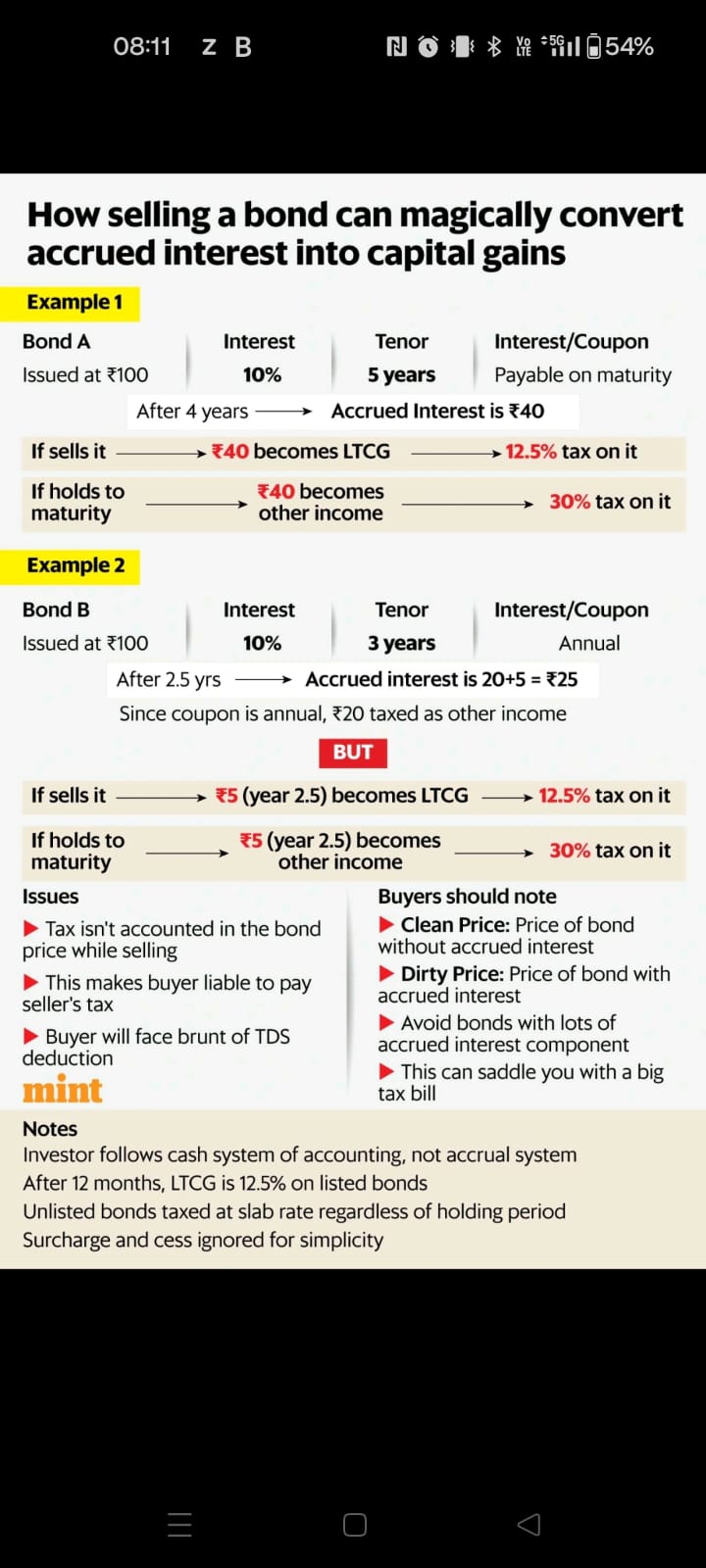

Capital Gain Tax In India

Investors can optimize their tax liabilities by strategically selling G-SEC STRIPS before maturity. By selling STRIPS before they mature, investors can realize capital gains, which may be taxed at a lower rate if the holding period qualifies for long-term capital gains. This strategy allows investors to benefit from the appreciation of the STRIP’s price while potentially reducing their overall tax burden.

Currently, the Long Term Capital Gain Tax on Listed Bonds is 12.5% after 12 months which means a post-tax return for an investor in a high tax bracket!

How to buy Gsec STRIPS in India?

There are different ways in which investors can access STRIPS

-

Broking Account

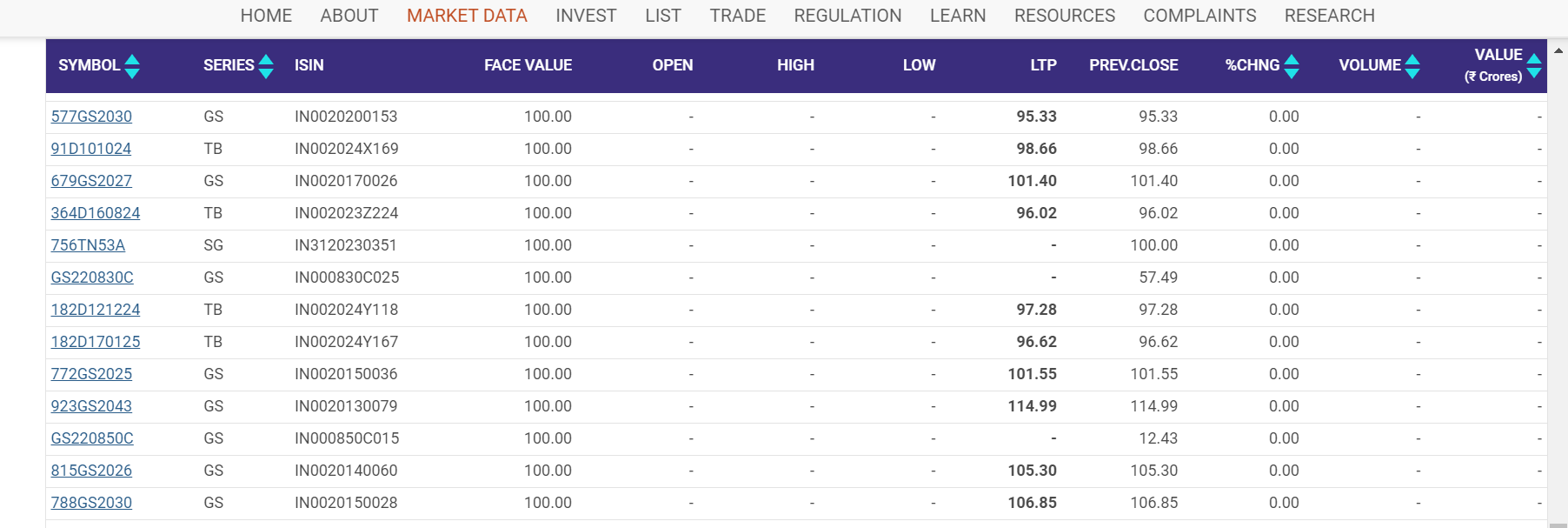

Gsec strips are traded in the secondary market and information can be availed from the NSE website however volume is lower in the exchange as a lot of over-the-counter trades happen especially by Insurance companies to hedge their interest rate risk in liability.

You can check out the trade details below. Please note Strips generally have a P or C suffix at the end of the name as an identifier.

https://www.nseindia.com/market-data/bonds-traded-in-capital-market

-

RBI Direct Account

Retail Direct allows investors to create an account on RBI Direct that allows them to buy GSEC on the primary and secondary markets. According to the RBI website Ekuber system can be used for stripping requests. Detailed Article.

We will explore this mechanism and check if we can create STRIPS via an RBI direct account.

Conclusion

G-SEC STRIPS is a powerful tool for investors seeking the safety of government securities combined with the potential for capital appreciation. By understanding how STRIPS work and leveraging their benefits, investors can enhance their fixed-income portfolios and achieve their financial goals. Some other interesting alternative investment options below