Agricultural land has always been one of the most lucrative alternative investment avenues. However, due to entry barriers in the form of high investment values and management costs, etc., it has traditionally been restricted to wealthy investors looking to save big on their tax liability.

With technology seeping into every other domain of financial services, today, we have prop-tech companies that offer fractional farmland investment opportunities for retail investors. In this article, we will look into one such fractional ownership platform (FOP)- FarmFraX by FAAB Invest, which offers fractional ownership of agricultural farmland.

What is FarmFraX?

FarmFraX is a fractional ownership opportunity launched by FAAB Invest. According to FAAB Invest, FarmFraX will facilitate the fractional ownership of agricultural farmland by simplifying the acquisition and development of high-potential agriculture land. Investors on the platform will benefit from regular rental income and capital gains from the sale of the farmland. The platform aims to make the process of acquisition of high-value agricultural land hassle-free for investors.

The Team behind FarmFraX

Use Code ROH996 to get 0.5% Cashback!

FramFraX is an upcoming brainchild of FAAB Invest. FAAB Invest Advisors Private Limited was co-founded by Ashwin Ananda Babu and Thejas Perayil. Ashwin brings 13 years of experience in investment banking, having served as an equity analyst and asset manager at the renowned global hedge fund D.E. Shaw & Co. On the other hand, Thejas, with an experience of 3 years at Infosys and Bridgestone, contributes skills in software development and IT consulting. Their combined expertise enhances FarmFraX’s ability to integrate advanced technological solutions, improve operational efficiency, and offer innovative investment strategies.

How does FarmFraX Farmland Investment work?

FarmFraX lists fractional investment opportunities in agricultural farmland. FarmFrax operates a model similar to that of fractional real estate investment platforms, with the only difference being that they offer farmland instead of commercial properties. Every farmland property listed on the FarmFraX Mobile Application is scrutinized by the team at FAAB Invest using an extensive selection process to ensure that the investors get the best possible return on their investment.

The asset selection process employed by FAAB Invest is data-driven. The key factors considered by the team when evaluating agricultural land to be offered on the platform include its location, soil type, water prospects, clear, marketable title, future capital appreciation, etc. The Investments are made directly to specific assets listed on the platform and are not blind pooled and allocated by FAAB at any point in time.

Besides looking into the above factors, FAAB also engages third-party players such as law firms to scrutinize the documentation, ownership, and title claims for every prospective farmland. Stringent legal scrutiny ensures that investors are not burdened with litigation and disputes arising from claims on ownership and title or regulatory hurdles arising from non-compliance.

Benefits of Investing in FarmFraX

As touched upon earlier, investing in agricultural land has always been a lucrative alternative investment avenue, especially owing to its tax benefits. The main benefit of investing in agricultural land is that any capital gains from the sale of such land are exempted from income tax liabilities for the Special Purpose Vehicle (SPV) company of which the investors get a share.

However, traditionally, farmlands have been accessible and affordable to wealthy investors owing to high investment value. Platforms like FarmFraX seek to democratize this asset class by offering fractional investment opportunities with low ticket sizes, making it accessible to the average investor.

Some other benefits of using FarmFraX for fractional agricultural land investment are as follows:

- Strategic Land Selection: As explained above, FAAB Invest uses stringent due diligence and land selection processes to ensure that the risks are minimized while the potential returns are maximized.

- Streamlined Ownership: A simplified fractional ownership model allows investors to own a share of farmland without the complexities of traditional ownership, making it easier to diversify portfolios.

- Secure Capital Growth: Besides rental income from agricultural land, capital appreciation of the land offers a stable growth potential over time.

- Flexible Exit Strategies: FarmFraX offers investors multiple exit options, allowing them to liquidate their investment when needed or capitalize on favorable market conditions.

- Inflation-Resistant: With non-market linked returns and inherent inflation-hedging properties, farmland investments serve as a reliable safeguard against the erosive effects of inflation. Additionally, being a fractional investment opportunity, the risks are minimized as they are distributed amongst the co-owners proportionately.

- Effortless Management: One of the reasons why retail investors traditionally stay away from farmland investments is the high cost of management. Fractional ownership lets you enjoy hassle-free farm management as the platform takes care of all operational aspects, allowing you to focus on maximizing your returns without the burdens of day-to-day management.

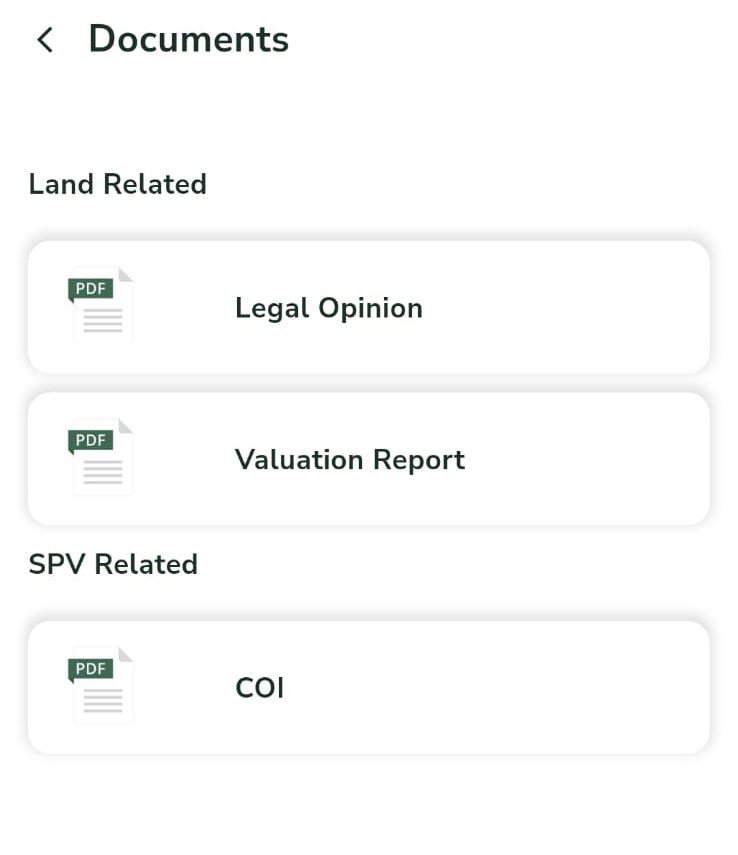

- Transparent Documentation: FarmFraX’s dashboard provides all necessary information and documentation about an agricultural property so that the investors on the platform are able to make informed decisions. Documents made available include soil test results, irrigation plans, topographical land survey reports, valuation reports, financial and legal briefs, etc.

Opportunities on FramFrax

Use Code ROH996 to get 0.5% Cashback!

In this section, let’s look into a sample fractional agricultural investment opportunity on the FramFraX platform and understand how the deals offered on the platform work. As discussed above, FarmFraX provides a range of documents and information regarding the opportunities listed on its mobile application, which can help you evaluate the prospects of farmland and make decisions accordingly.

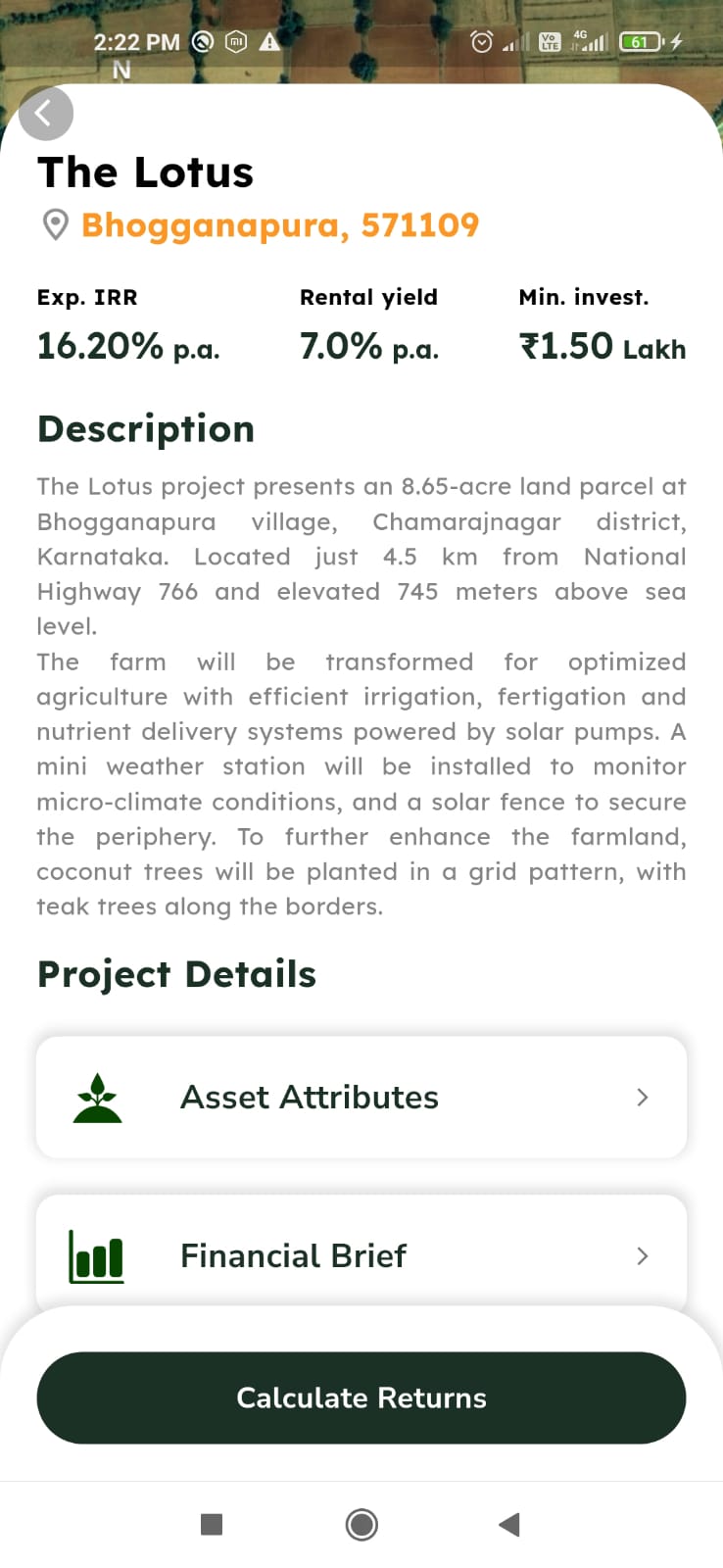

The Lotus Farmland Investment Opportunity

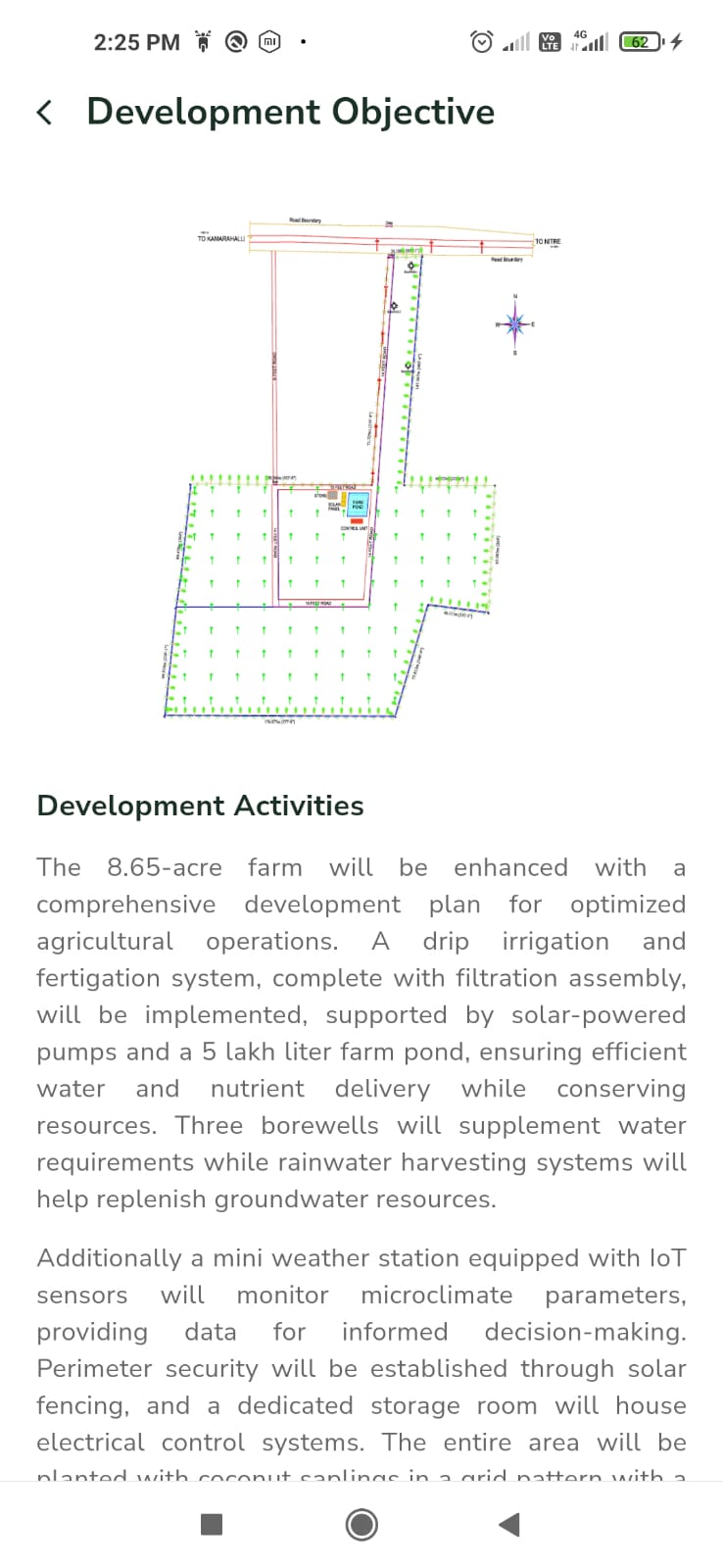

“The Lotus” is an active opportunity on FAAB Invest’s mobile application. It presents an 8.65-acre land parcel at Bhogganapura village, Chamarajnagar district, Karnataka, located at a distance of 45 minutes from Mysuru City. The opportunity seeks to transform farmland for optimized agriculture with efficient irrigation, fertigation, and nutrient delivery systems powered by solar pumps. A mini weather station is planned to be installed to monitor micro-climate conditions, and a solar fence to secure the periphery.

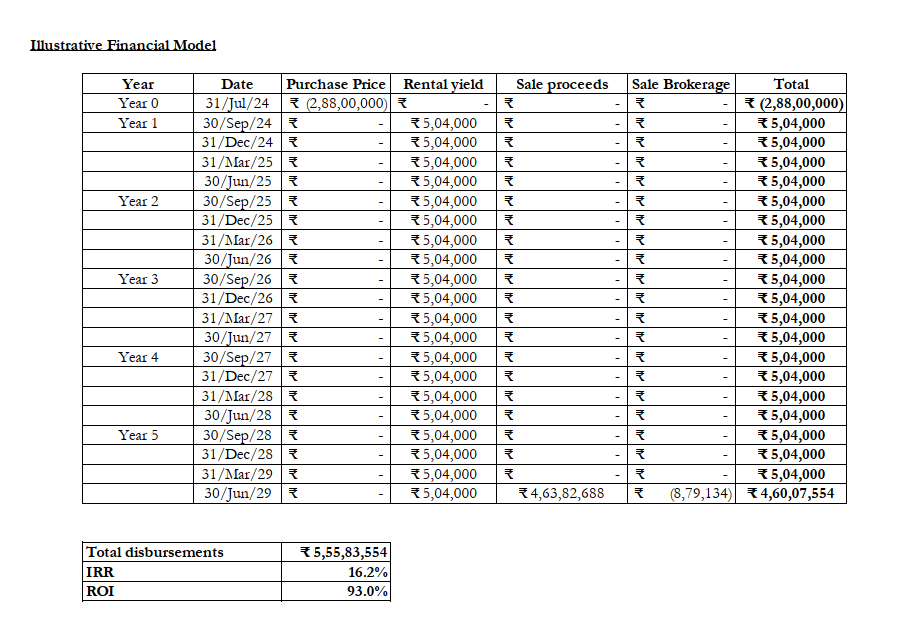

The opportunity offers an expected Internal Rate of Return (IRR) of 16.20% per annum and an annual rental yield of 7.0%. The minimum investment required is INR 1.50 lakhs.

You can access the project details on FAAB Invest’s mobile application including the topography plan, soil test reports, meteorology, and water prospects.

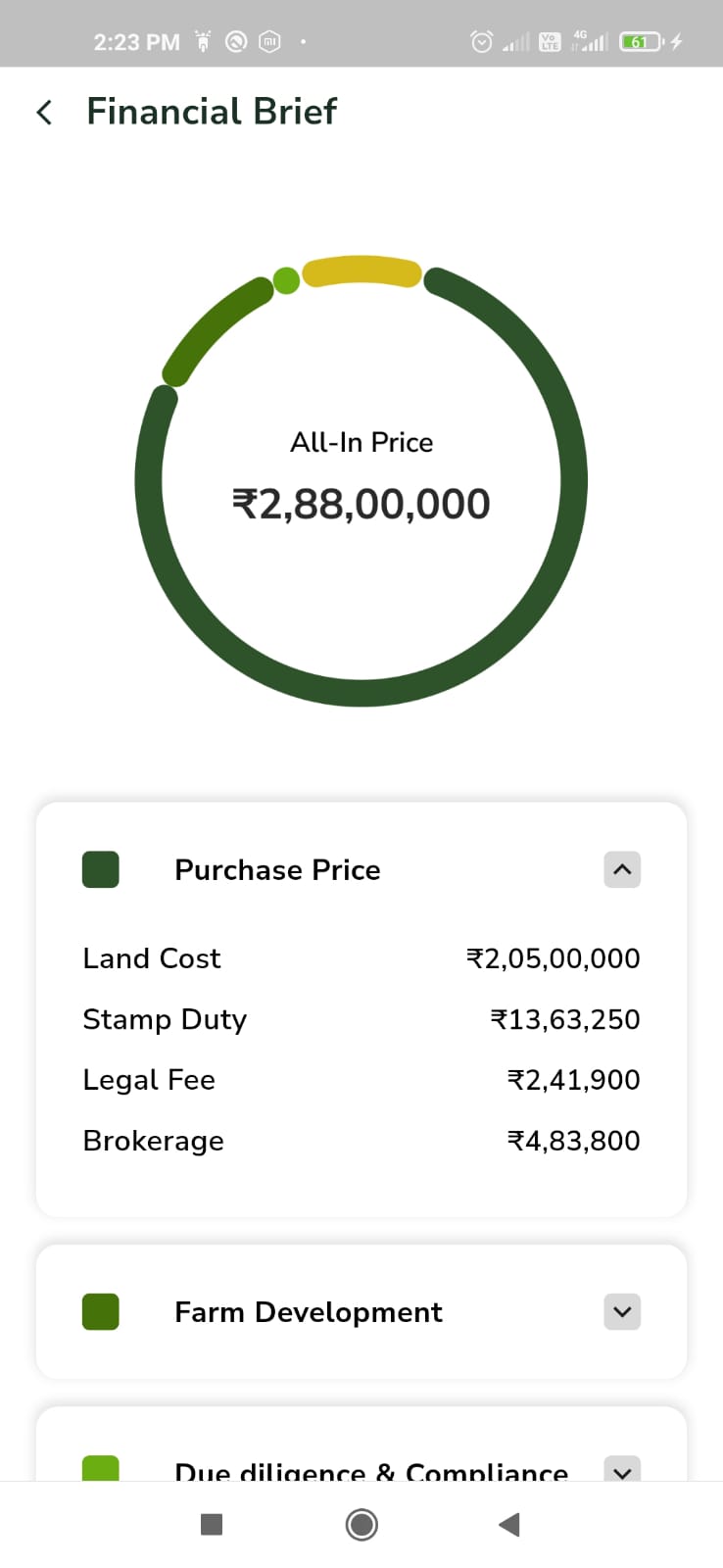

Besides, the platform also offers financial details in the form of a financial brief, including the particulars of the purchase price, compliance and due diligence costs, farm development costs, and the service fee charged. There are a total of 192 units available for INR 1.5 Lakh each, making the total deal size INR 2.88 Crores.

The development plan and irrigation plan available on the platform outline the development objectives of the project and lay down how the investment amount would be used.

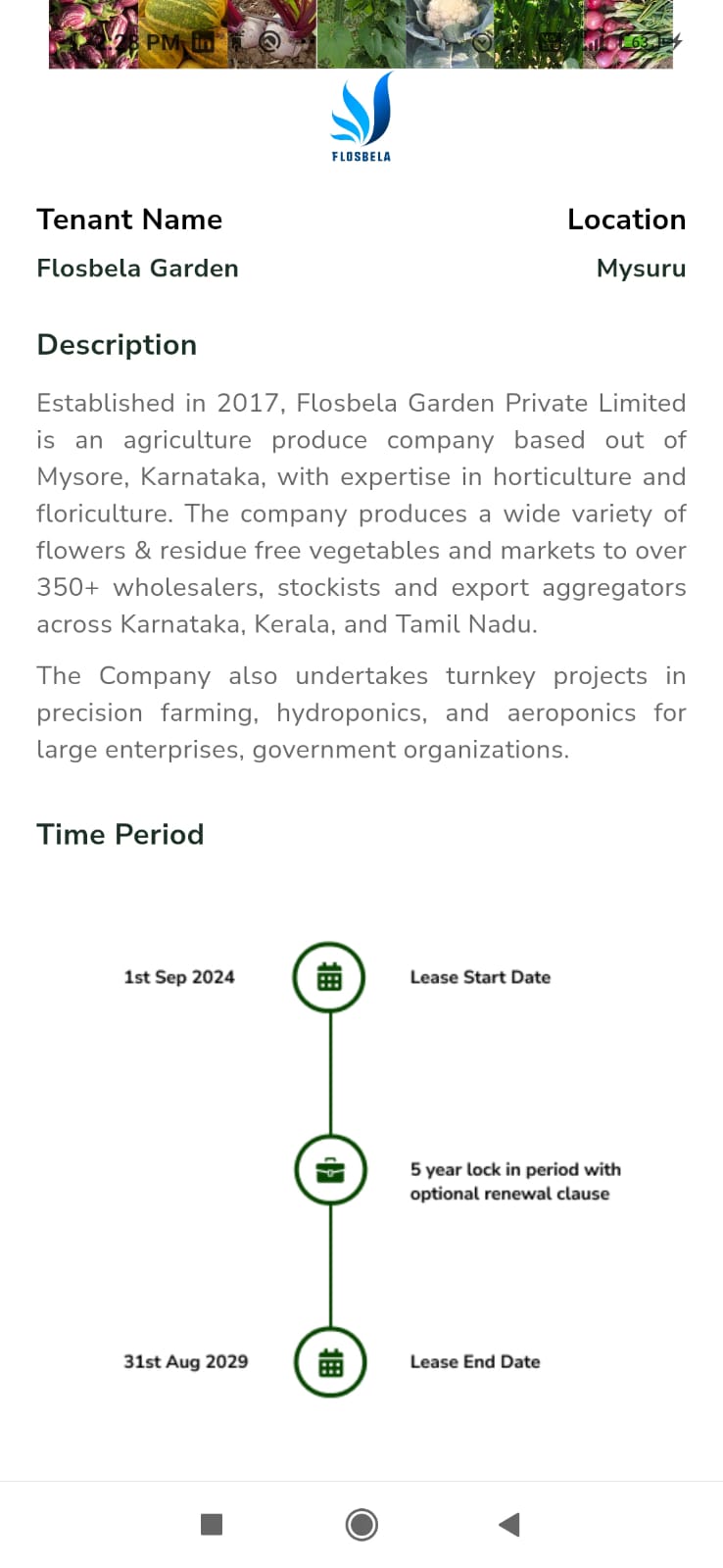

The tenant for the Lotus project is going to Flosbela Garden, a Mysore-based agriculture produce company that specializes in horticulture and floriculture.

Details of the tenant’s operations are also available on the application. Besides, the time of the lease for the project is laid out and shall start on the 1st of September, 2024, and end on the 31st of August, 2029.

You can use the Referral Code ROH996 and get 0.5% more!

Advantages of Project Lotus

Use Code ROH996 to get 0.5% Cashback!

- Project Lotus has a minimum investment requirement of INR 1.5 lakhs, which is relatively low compared to similar fractional real estate investment platforms.

- FAAB Invest’s mobile application has provided all the necessary information regarding the agricultural land in question, including financial details, legal opinion, details of development plans, and other asset attributes such as topography, irrigation, meteorology, etc. This transparency allows investors to make informed investment decisions.

- Being located in a rural area, any gains in the form of capital appreciation from the property would be exempted under Section 45 of the Income Tax Act, 1961.

Disadvantage of Project Lotus

- FAAB Invest has set up a company as a Special Purpose Vehicle (SPV) to facilitate this fractional ownership transaction. This company, called “Bogganpura Assets Private Limited”, was incorporated on June 6, 2024. Every investor who subscribes to the Lotus project will legally have a stake in the SPV. The SPV will then use the money received from investors to purchase the land. A separate Asset Management Services Agreement will be contracted between the SPV and “FAAB Invest Advisors Private Limited”. In turn, FAAB Invest will lease out the property to the tenor, “Flosbela Garden Private Limited”, via a separate Agricultural Land Rent/Lease Agreement. Now, the major concern here is that the beneficial owners of FAAB Invest, the lessor; Flosbela, the lessee; and Bogganpura, the SPV, are essentially the same two persons- Ashwin Ananda Babu and Thejas Perayil. This raises concerns regarding the possibility of related party transactions that would ultimately harm the interests of the investors. However, it needs to be noted that Bogganpura and Flosbella have a different set of directors than that of the lessor.

- The founders of FAAB Invest are hopeful that in the future as corporate farming gains traction in India, more and more companies will look to acquire ready-to-use precision farmland, such as the Lotus Project, instead of investing in new infrastructure. Thus, Flosbella is an initial tenant of the SPV and in the future FAAB will look to lease out its farmlands to other players as well.

- Project Lotus will not fall under SEBI’s regulatory framework concerning Small and Medium REITs (SMREITS). Being a largely unregulated deal, safeguarding investor interests remains a concern.

- Exiting the investment in case the lessee defaults on its periodic rental payments can be cumbersome. As per our communication with the founders of FAAB Invest, if Flosbela fails to pay rent for 2 consecutive months and declares insolvent, FAAB, as the asset manager, will immediately cover the defaulted 2 months’ rent using the security deposit. FAAB will then seek a suitable tenant to lease the property in the next 4 months while continuing to pay the monthly rent. Simultaneously, FAAB will begin searching for a buyer to facilitate the sale of the land. After 4 months, if FAAB is still unable to find a suitable tenant or buyer, it will recommend 3 trustees to the SPV, allowing shareholders to independently appoint a trustee to facilitate the property sale.

FAQs on the Lotus Project

- What is the security structure of the opportunity?

The Lotus project is an asset-backed fractional agricultural land investment opportunity. Firstly, the deal is backed by underlying physical assets in the form of farmland owned by the SPV, which in turn is collectively owned by the investors. Besides, a security deposit by Flosbela, the lessee, of around two-quarters worth of rent will alleviate the risks of failure in timely rental payments. The security deposit will be invested in a fixed deposit, and the interest earned from the deposit will be passed on to the investors annually. Each investor will receive 1 share and 9 compulsorily convertible debentures (CCDs) for every unit of investment they make in the SPV.

- Is there any provision for a year-on-year (YoY) increase in rent during the lease period?

The rate of rent payable by the lessee has been fixed for 5 years and there is no provision for a YoY increase. The founders of FAAB Invest informed us that in case the lease agreement is extended by an additional period of 5 years under the provisions of the agreement, a rental increment will be mutually decided during the process of renewal of the lease agreement.

Frequently Asked Questions (FAQs) about FarmFraX

- Who can invest in FarmFraX opportunities?

An Indian citizen, a Hindu Undivided Family (HUF), or a Company is eligible to invest in fractional agricultural land investment opportunities on FarmFraX.

- How and when does FarmFraX pay out rental yields?

The rental yields are disbursed monthly or quarterly. For instance, Project Lotus offers a quarterly payout cycle. The specific details of how and when returns will be distributed to the investors’ bank accounts are available for each opportunity on FarmFraX.

- Can you exit prematurely?

Yes, FarmFraX allows you to exit an investment prematurely anytime after 1 year. However, opportunities on FarmFraX are ideal for a longer time frame of around five years or more, as recommended by the platform.

- What proof of investment will I receive?

Post-investment, you will receive the title document, share certificates, lease, and other SPV-related documents. You can access these documents in the portfolio section of FAAB Invest’s mobile application.

Conclusion

Use Code ROH996 to get 0.5% Cashback!

Fractional real estate has revolutionized the way real estate investments work, opening up this alternative asset class to the average investors. Similarly, fractional agricultural land investment platforms can democratize farmland investment and make it accessible to retail investors. Besides being a hedge against inflation, farmland investments are mostly tax-free and can be used to diversify your portfolio. However, before investing in farmland properties, it is essential to examine and evaluate the potential of the opportunities to make an informed choice.

FarmFraX, as a fractional agricultural land investment platform, offers detailed information to gauge the prospects of active opportunities on the platform. It is advisable to go through these documents available on FAAB Invest’s mobile application before you decide to invest in a project, Like real estate investments, farmland investments are affected by many factors, in fact, more than real estate, and hence it is essential to undertake a thorough scrutiny of the available details before investing.

We would be investing in a small amount in the project and providing monthly review in monthly newsletter to the readers!

You can check other real estate opportunities here

Another Growpital Investment recommendations.

Fundamentally the major difference is here you are buying the land and giving onlease .the model is closer to fre platforms.

Growpital was managing capital ad you did not own anything.

However you should check the land records and title papers with your legal counselor if you plan to invest larger amount