In the dynamic world of investing, one needs to move out of their comfort zones and explore different avenues that can often lead to lucrative opportunities & high returns. One such avenue gaining traction in India is investing in unlisted shares. These shares, not listed on any stock exchange, offer unique prospects for investors. In this post, we’ll understand what exactly unlisted shares are, pros and cons of investing in them, tax implications, the process involved in buying them, and finally, we’ll explore some of the best platforms to buy unlisted shares in India.

What are Unlisted Shares?

Unlisted shares are shares of a company that are not traded on any stock exchange. Unlike listed shares that are openly traded, unlisted shares are bought and sold through private transactions.

Investing in unlisted shares means acquiring a stake in a private company, which can include startups, small and medium-sized enterprises (SMEs), or even established businesses that have chosen to remain private.

These shares are typically owned by the founders, early investors, employees, or private equity firms of a company. Since unlisted shares are not subject to all the regulations and reporting requirements imposed on publicly traded companies, they offer a different investment opportunity.

Investing in Unlisted Shares vs Pre-IPO Investing: Is it the Same?

While both involve investing in private companies, there is a slight difference between investing in unlisted shares and pre-IPO investing. The difference is in the focus and approach.

Unlisted shares represent ownership in companies not listed on stock exchanges, offering opportunities across various growth stages but with risks like liquidity constraints.

However, pre-IPO investing targets companies before their IPO, aiming to profit from potential value appreciation post-listing, often demanding substantial capital and restricted to accredited investors.

Deciding between the two is based on factors like investment amount, timing, and exit strategies. One has to carefully consider all factors before deciding to invest in either of them.

Pros of Investing in Unlisted Shares in India

- Potential for higher returns compared to listed shares.

- Opportunity to invest in promising startups and emerging companies.

- Ability to participate in the growth story of private firms before they go public.

- Diversification of investment portfolio beyond traditional asset classes.

- Possibility of capitalizing on undervalued assets that may not be reflected in the public markets.

Cons of Investing in Unlisted Shares in India

- Lack of liquidity makes it challenging to buy or sell shares at desired prices.

- Relatively less regulated compared to listed shares, potentially exposing investors to governance and transparency issues.

- Difficulty in conducting thorough due diligence due to limited availability of information.

- Governance and transparency issues may arise, posing risks to investors’ interests.

- Limited exit options compared to publicly traded companies, leading to potential delays or inability to liquidate investments.

Performance of Unlisted Shares in India

Though unlisted shares can be multibagger due to the “less price discovery” they can still be risky if not analyzed properly.

Some of the companies that have given great performances are

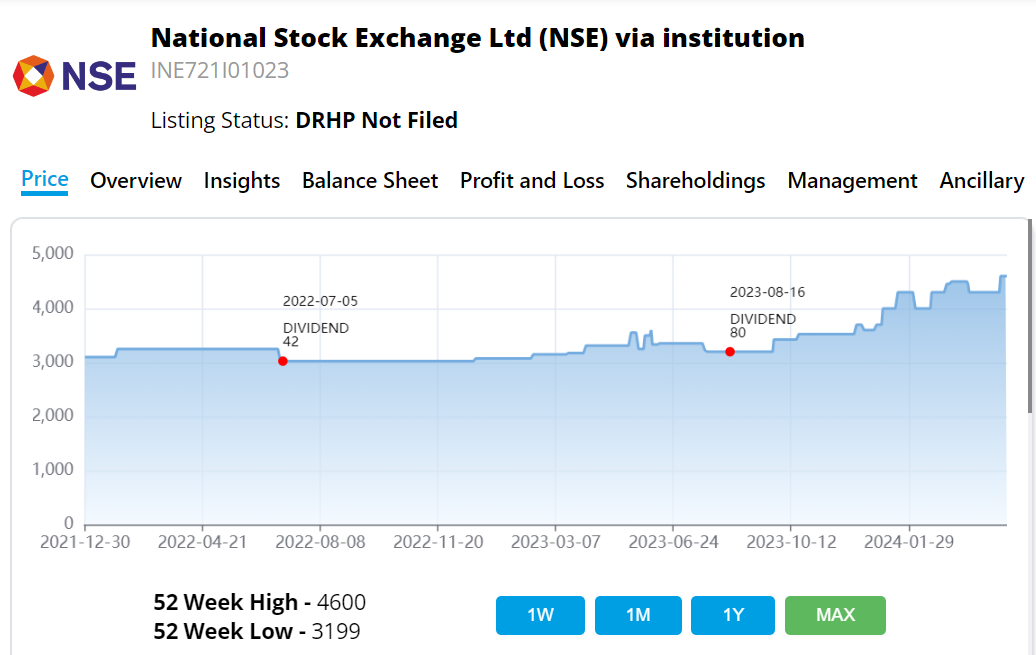

- NSE

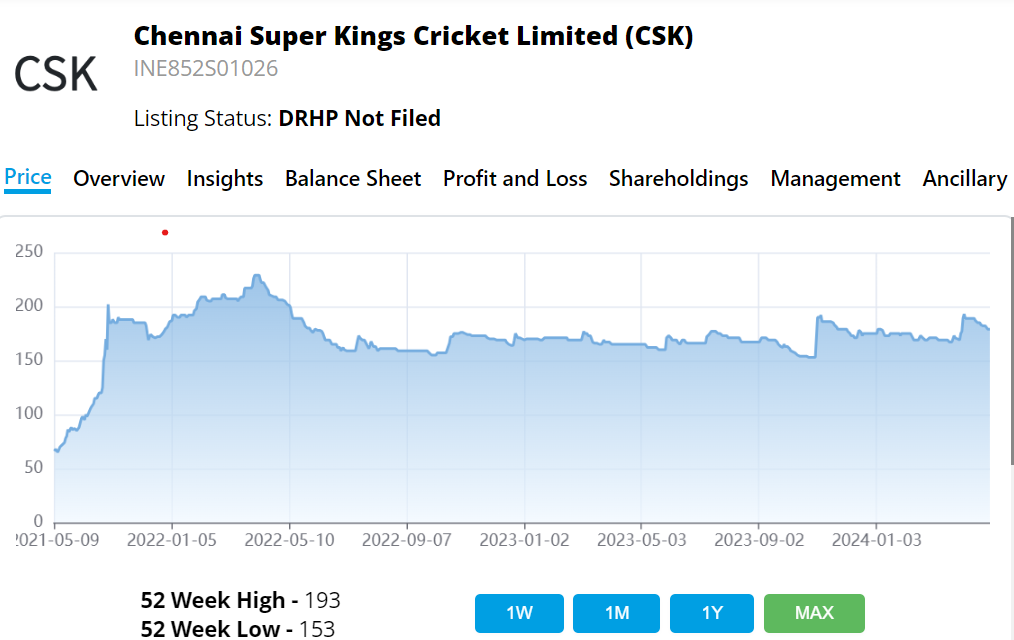

- CSK

- Waree Energy

People have also burned their hands in some stocks like

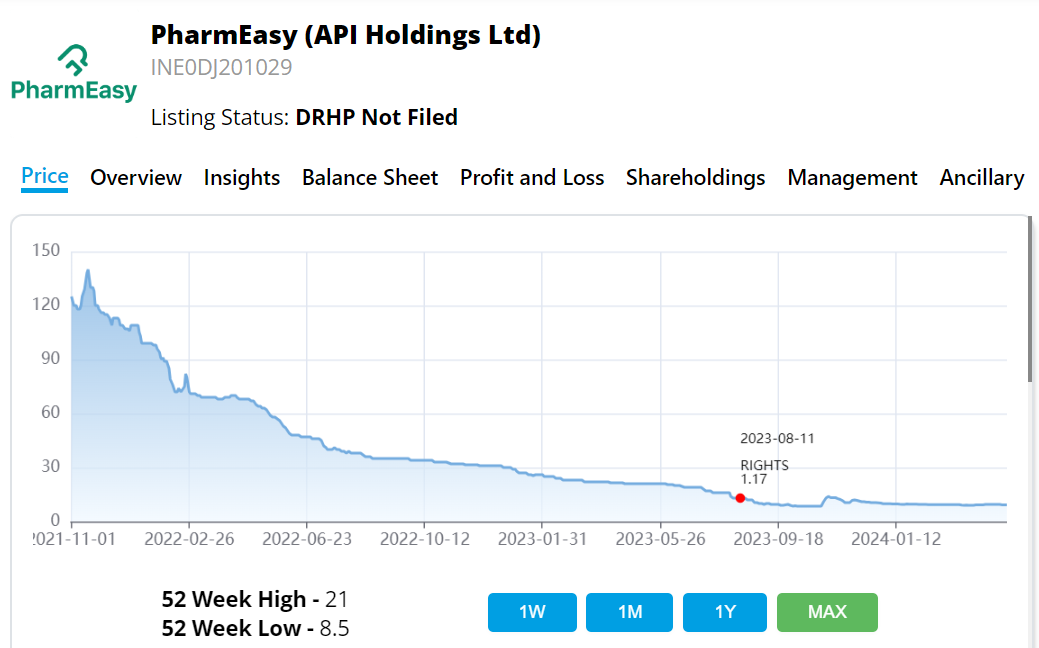

- Pharmeasy

- Reliance Retail

Altius is one platform that helps to analyze the price changes and fundamentals of these stocks and can be a handy tool for creating a healthy portfolio.

How to buy & sell unlisted shares in India?

The process is straightforward. After you have decided on the company in which you want to invest, find a reliable platform and buy the shares.

- Find a platform to buy unlisted shares in India. (we have suggested some platforms below in the article)

- Register on the platform and complete the KYC

- Check the price of the share you intend to buy and place an order & make the payment.

- Shares will be credited to your demat account in 24-72 hours.

Top Platforms for Investing in Unlisted Shares in India

Following are 2 popular platforms to buy unlisted shares in India which I or the people in my knowing have used.

Altius Investech

This is a leading platform for buying and selling unlisted shares, pre-IPO shares, and ESOPs in India. They claim to have 25+ years of experience, having done more than 15,000 deals with 300 crores plus transaction value across 8,000+ clients.

The process involves signing up on the platform and completing the KYC by providing the required documents, selecting a company, deciding how much to invest, and placing an order by completing the necessary payment. Once the payment is received, the shares are transferred to your demat account within 24 working hours. It’s that simple!Read our detailed analysis of Altius

Click below to sign up on Altius Investech and invest in unlisted shares.

Unlisted Zone

Founded in the year 2018, this is another popular platform where you can buy unlisted pre-IPO shares in India. They claim to have transacted in unlisted shares worth 500 Crore+. They have a long list of companies whose unlisted shares are available on the platform- including a dedicated section of companies who have filed the DRHP. They source their shares from ESPs, initial investors, direct company allotments, secondary market transactions, etc.

Apart from the ones listed above, there are a few more platforms like the following:

- Stockify

- WWIPL

- Precize

My suggestion would be to check the prices of the companies whose shares you want to buy on all platforms and see which company is offering the best prices as the prices vary across platforms. Do proper due diligence and research from your end before investing.

If you plan to invest a large amount do reach out to us below and we can share the best quotes available in the market to help you make an informed decision.

Taxation on Unlisted Shares in India

If you intend to buy unlisted shares in India, you need to understand the applicable income tax. There are 2 types of taxes applicable on unlisted shares in India- long-term capital gains tax and short-term capital gains tax.

- Long-Term Capital Gain Tax: If the duration of holding the share is more than two years, your gains would be subject to Long-Term Capital Gain (LTCG). LTCG is applicable at 20% with indexation on unlisted shares.

- Short-Term Capital Gain Tax: If the duration of holding the share is less than two years, your gains would be subject to Short-Term Capital Gain (STCG). STCG on gains from unlisted stocks is as per the investor’s tax slab.

Conclusion

Investing in unlisted shares presents a great opportunity for Indian investors to invest in promising companies before they reach the public markets. While it does come with its risks and challenges, the potential for high returns and portfolio diversification makes the space compelling.

Platforms such as Altius Investech, Stockify, and Unlisted Zone are playing a crucial role in providing access to retail investors to the unlisted market- which was probably not accessible for many except HNIs and institutions. With almost all investment options, investors are suggested to tread carefully in the world of investing in unlisted shares, with diligent research, prudent decision-making, and strategic diversification to ensure long-term success.