The investment world is going through a revolution. Investors are now looking to diversify into alternative investments besides the traditional assets of stocks and bonds. Fractional real estate investing is becoming the talk of the town, with innovative platforms offering high-value investment products.

Fractional investing allows you to invest and earn returns from a high-value asset class by co-owning a property for a fraction of the cost. High-yielding commercial real estate has traditionally been limited in access and affordability to high-net-worth investors or financial institutions. Fractional investing products offered by fintech platforms are revolutionizing how real estate investing works by removing the barrier to entry, offering lower ticket sizes, and providing ease of access through online investment platforms.

In this article, we will comprehensively review Assetmonk, a new-age alternative realty investment platform. By the end of this post, you will get to know about the team behind Assetmonk, the most innovative products offered on the platform, and how they manage risk, among other details.

About Assetmonk

Assetmonk is a new-age alternative real estate investment platform that offers strategically curated high-potential real estate investment opportunities with small ticket sizes via fractional ownership. The platform offers fractional investment products to suit individual financial goals like passive income capital appreciation and portfolio diversification.

Assetmonk operates with a vision to offer portfolio diversification opportunities for non-institutional investors through alternative realty investments. The company aims to make high-quality alternative real estate investments accessible through an investor-friendly platform. The new-age investment platform seeks to identify issues with traditional investment strategies and offers innovative solutions to tackle the same.

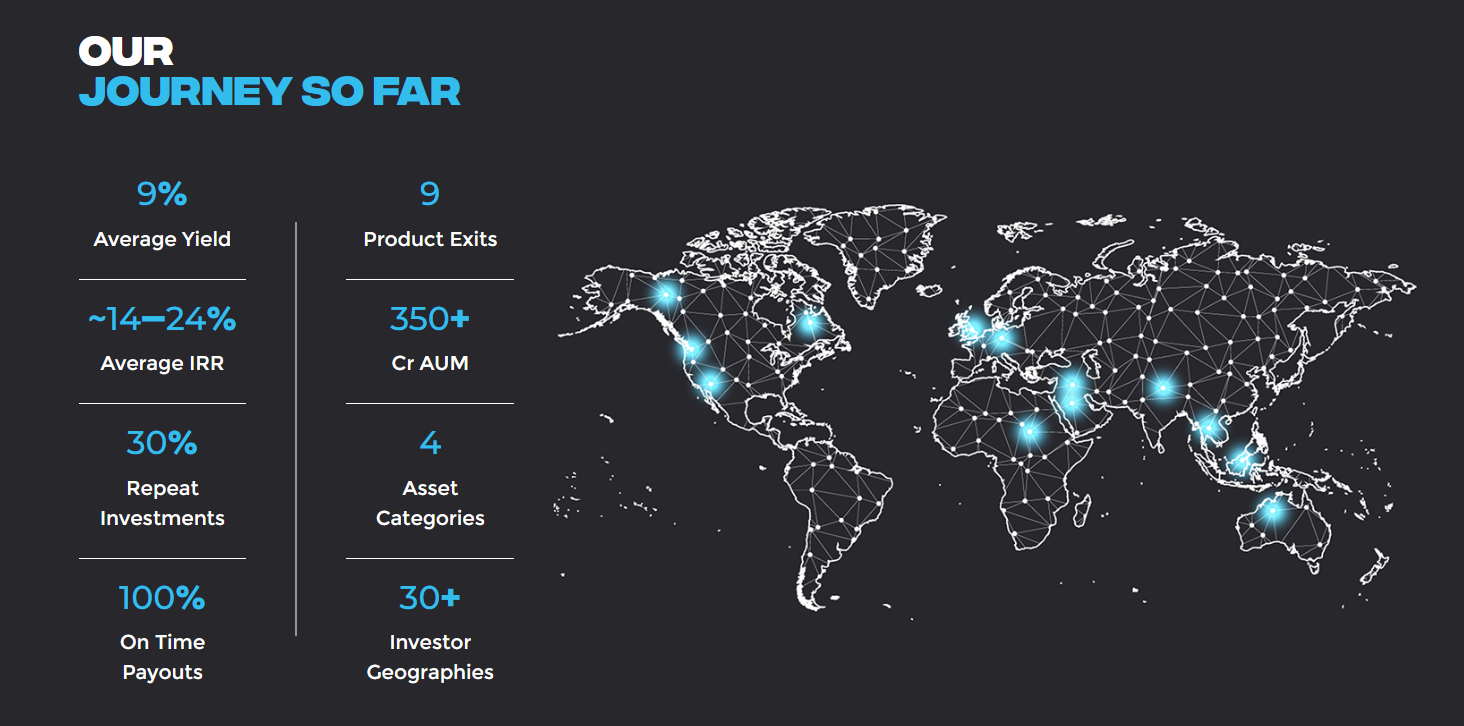

The platform offers investment opportunities over four asset categories and thirty investor geographies. The company has over 350 crores of rupees in assets under management (AUM) and has delivered an average internal rate of return (IRR) of 14 to 24% and an average yield of 9%. The platform’s track record is testified by nine successful product exits, with 100% on-time payouts and 30% repeat investments.

Team behind Assetmonk

Prudhi Reddy, the founder and CEO of Assetmonk, built the firm from its conceptual stage. He has a professional experience of 14 years spanning across technology, manufacturing, education, fintech, real estate, and electronics. An alumnus of the prestigious BITS, Pilani, and IIM, Calcutta, Prudhi is passionate about new technologies and has worked on new businesses that solve problems and bring solutions to light.

Besides Prudhi, Assetmonk boasts IIM Indore alumnus Ashithya Mokshagundam as Assistant Vice President of Products. Assetmonk’s Director of Investments Upendra Kinhal has experience working with prominent financial institutions, including DSP Investment Managers, Kotak Mutual Fund, and PNB MetLife Insurance.

Assetmonk: How it Works

Assetmonk has an investor-centric investment philosophy that prioritizes the financial goals and aspirations of the investors to give purpose to each of its real estate investment products. The platform offers tailor-made alternative investment solutions designed for investors to choose from based on their financial goals. Investors’ financial goals are reflected in three attributes identified by Assetmonk- passive income, capital appreciation, and long-term rentals.

Drawing lessons from traditional investments, Assetmonk offers fractional investment products that are recession-ready and have a hedge against inflation. This helps investors tackle volatility, market influence, and liquidity concerns associated with traditional asset classes. The platform focuses on the strategy of diversification to beat the woes of traditional investments.

At its core, Assetmonk offers fractional ownership opportunities that enable like-minded investors to come together and create a pool of funds to invest in larger assets, which would otherwise be inaccessible by retail investors due to large capital requirements. For an investor, fractional ownership gives you access to the benefits of a high-value asset, in proportion to your investment share. This also helps you mitigate the risk and reduce the cost of management and maintenance by sharing the asset with a number of co-owners.

Assetmonk’s investment opportunities are backed by income-generating underlying assets. This gives investors an opportunity to benefit from higher yields and less volatility. Assetmonk also offers high transparency with detailed transaction reports and strong investor protection through loss-absorbing features.

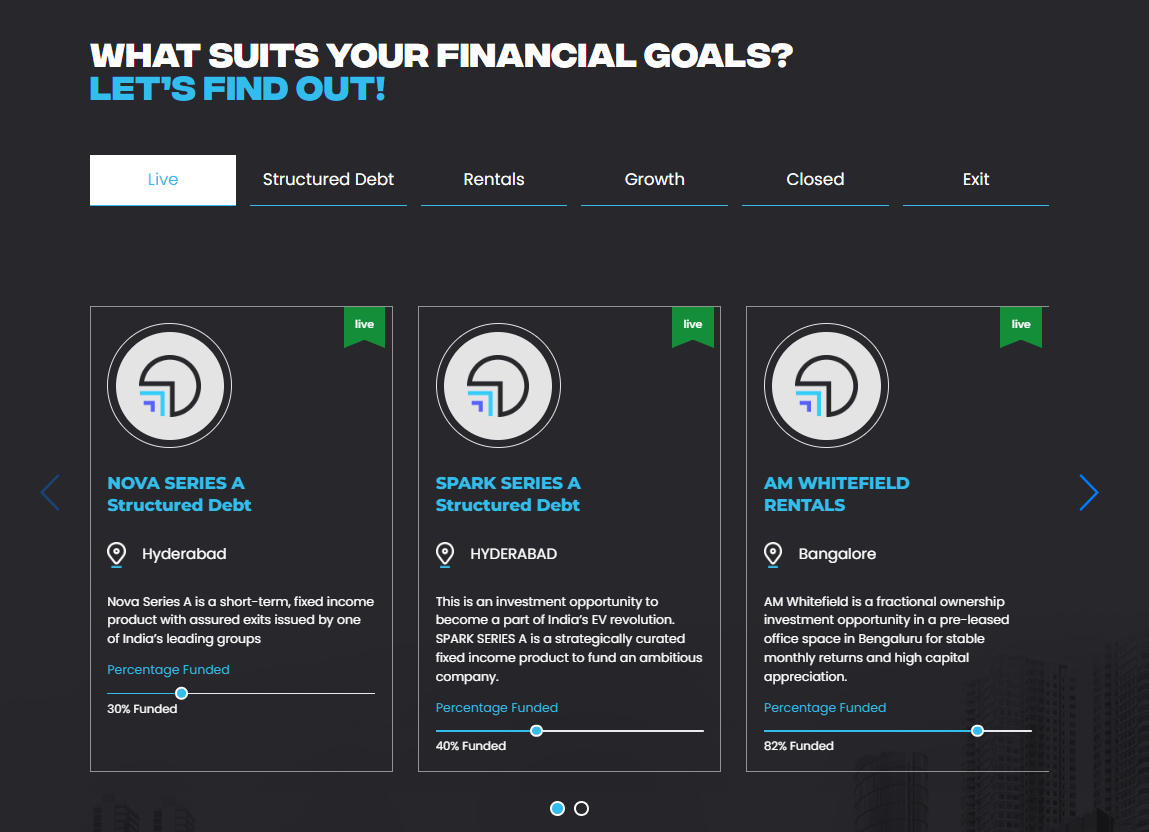

Based on all of the above principles and investment strategies, Assetmonk offers commercial real estate investments that revolve around the following:

- Growth: for long-term value investment and capital appreciation.

- Structured debt: short-term fixed-income products collateralized by a real estate asset with assured exits.

- Rental income: for periodic income along with capital appreciation.

As an investor, you can sign up on the Assetmonk platform to explore its investment products. For a customized approach to investing, Assetmonk lets you set your investment objectives per your financial needs and goals for a goal-oriented approach. This helps you realize whether you wish to achieve passive income, capital appreciation, or long-term gains and accordingly choose your investments.

You can choose from various commercial real estate projects in strategic locations and the most in-demand sectors like co-living, office spaces, and warehouses. Once you have made your investments, you can track and manage them in an all-inclusive dashboard that offers all the information you need, from cash flow statements to property documents.

The platform lets you exit an investment, offering insights into future liquidity to ensure a smooth exit and sale at the most opportune time. Throughout this journey, investors are guided by qualified asset advisors.

Assetmonk Risk Management

Assetmonk follows a stringent risk management procedure that is underlined by the following processes and strategies used to offer investment opportunities with minimum risks:

- Stringent due diligence: All the curated assets offered on the platform go through legal, financial, and tenant due diligence processes. An 80-point checklist and risk mitigation frameworks are followed to assess risks associated with each asset and evaluate the right measures for investor safety.

- Asset-backed: All investment opportunities curated by Assetmonk are asset-backed, thoroughly vetted, and carefully structured.

- Technological safeguards: The platform uses data-encrypted transaction processes and secure electronic documentation processes to safeguard investor details.

Besides internal research, Assetmonk also partners with third-party experts to detect and avoid any litigation properties that come with high risks, ensure greater profits with effective risk assessment tools, and provide easy liquidation with investor-friendly resale terms.

Assetmonk Past Performance

Assetmonk boasts of 0% default rate for its products and has already done more than INR 300 Cr AUM. They have also navigated the tough conditions of the 2020 covid period without losing money which is commendable.

Assetmonk Investment Products

As discussed above, Assetmonk offers customized investment opportunities to match your financial goals and needs.

Here are a few of the key investment products currently being offered on the platform:

-

The Landing

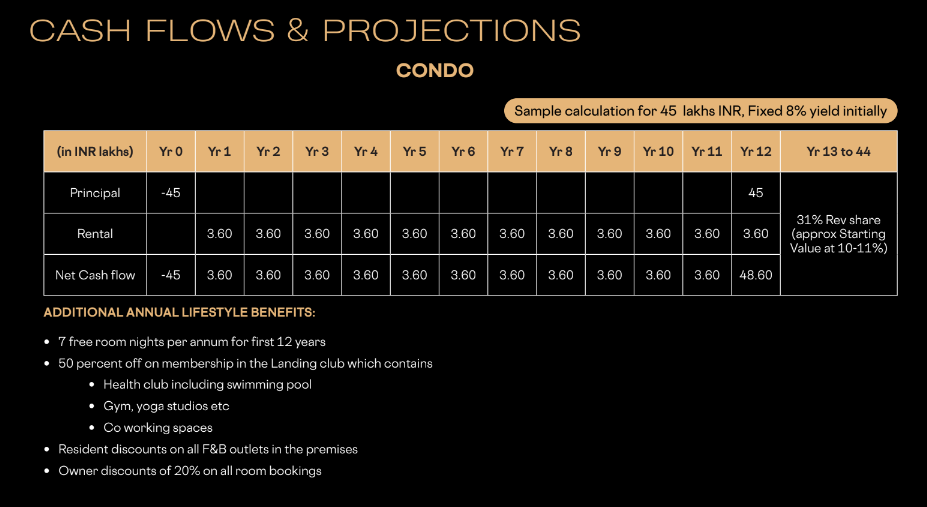

The Landing is India’s first co-living space at Hyderabad International Airport. This 45-year project is part of a developing Aerotropolis hub, promising long-term stability.

Key benefits:

- High returns: 16.8% average rental yield, a reliable source of passive income.

- Starting yield: 8% fixed

- Location: Hyderabad International Airport

- Tenure: 45 Years

- Security: Non-market-linked product backed by a leading real estate company with freehold collateral.

- Transparency: Online tracking portal, regular updates, and third-party verification.

- Convenience: Automated payouts, tech-enabled management, and exit assistance.

-

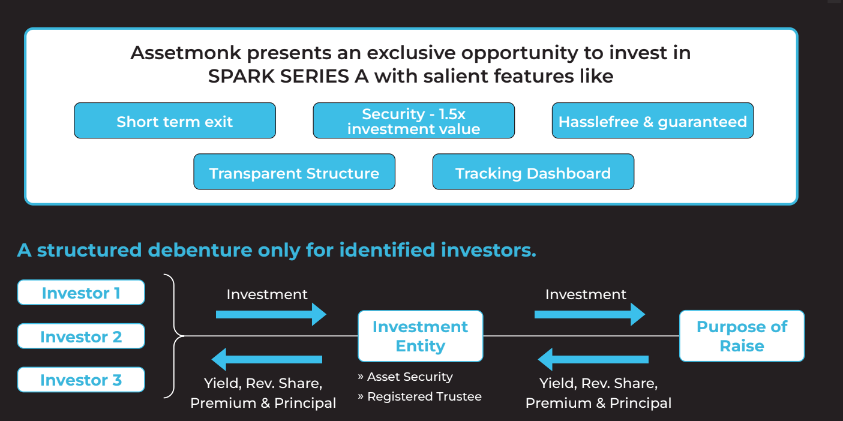

Spark Series A

Assetmonk is offering a new fixed-income Revenue-based opportunity called Spark Series A. Real assets back this investment and promise a fixed return with a chance for additional earnings over a limited timeframe. It lets you explore the growing Electric Vehicles market in India.

Key Highlights:

- Type: Fixed-income, asset-backed

- Return:

- Fixed yield: 9% per annum (paid monthly)

- Targeted yield: 18%

- Security: Assets valued 1.5 times the investment amount (combination of real estate and charging infrastructure)

- Term: 39 months

- Issuer: Voltran Electric Pvt Ltd

- Product Type: NCD (Non-convertible Debenture) offered through a private placement

- Opportunity: The Rise of Electric Vehicles

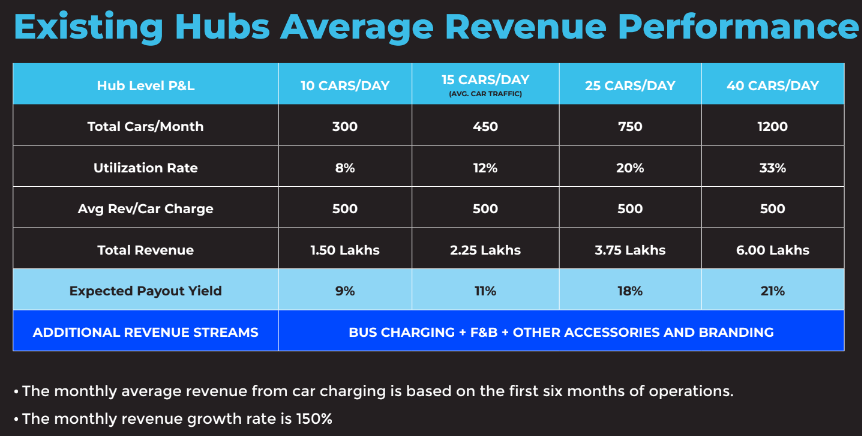

Spark Series A is linked to the growing electric vehicle (EV) industry in India. The issuing company, Voltran Electric, is building a network of public charging stations along major highways, particularly in the Southern Corridor. These stations will feature advanced fast chargers and comfortable customer lounges to minimize waiting times. Voltran has partnered with major EV car and bus companies like FreshBus, GoZinc, NeuGo, OHM, and TATA Motors. Currently, they operate 4 fully-staffed charging hubs that are operational 24/7. With ambitious expansion plans, they aim to establish at least 5 more by the end of 2024.

Assetmonk Alternatives

Only a few platforms have similar kinds of deals as listed on Assetmonk. However, deals like Revenue Based Finance are unique and only found on Assetmonk. The yield on Assetmonk is also attractive.

Some other platforms that you can also check for real estate products are

Conclusion

With alternative investments becoming increasingly popular, innovative investment platforms like Assetmonk are offering investors to explore traditionally restricted asset classes like high-value commercial real estate. Fractional real estate allows you to benefit from long-term asset appreciation, periodic rental income, and much more. Assetmonk as a platform curates alternative investment assets based on investor’s financial needs and aspirations and lets you choose from a range of promising real estate projects offering growth, rental yield, and fixed income from structured debt. However, it is important to assess the risk of each opportunity and invest as per your overall networth and risk profile.

We would be participating in a few deals on the platform and sharing our investment journey.