June will be a significant month for the market due to the upcoming Lok Sabha elections

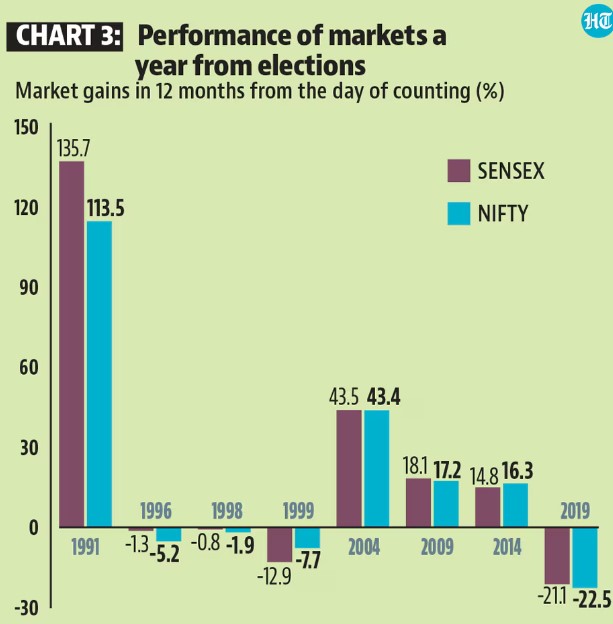

Analyzing the impact of elections on the Indian stock market reveals intriguing trends. While markets typically demonstrate a subdued response to election results on the counting day, exceptions exist, notably in 2004 and 2009. In those years, the market witnessed significant fluctuations, with a downturn following the unexpected victory of the Congress-led UPA in 2004, and a subsequent upsurge in 2009 as the UPA retained power.

Post-election market performance is crucial for investors. Analysis of eight past Lok Sabha elections indicates that in four instances, markets experienced a decline one year following the declaration of results. Notably, periods of political instability, such as during 1996-99, often correlated with market downturns. Similarly, the market dip after the 2019 elections was attributed to the global impact of the Covid-19 pandemic.

However, barring extreme instability or external crises like the COVID-19 pandemic, Indian markets have historically provided favorable returns to investors. For instance, the period following the 1991 elections, marked by economic liberalization under the PV Narasimha Rao-led government, yielded substantial gains. Even after the 2004 elections, despite an initial crash, markets rebounded swiftly, driven by robust GDP growth and increased foreign investments.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital Freeze Update

- Bigspoon Gripinvest Default

Growpital Freeze Update

Honestly, the Growpital case doesn’t seem to be heading anywhere. SEBI has given the next date at 21 June for Growpital to share the relevant documents. Recently someone interviewed a SEBI employee on the Growpital case. Her response doesn’t seem positive.

Gripinvest Bigspoon Default

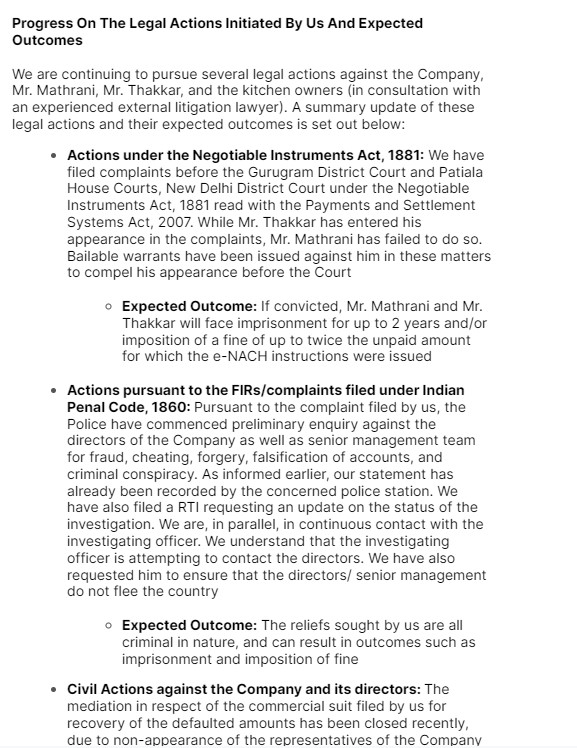

Grip has recovered around 75% of the principal from Bigspoon through asset sale and liquidation. They have proceeded with litigation against the founders as well as the kitchens that are holding the assets.

Grip Has been good at communicating the development of the case and recovery process. They have recently shared an update on the legal actions they have pursued.

Alternative Investment Portfolio Updates

This month we have added a new platform Assetmonk. We met their team and went through some of the deals they have offered as well as talked to their old investors.

Some of the key deals we are investing in this month are

- Altdrx Hyderabad opportunity

- Assetmonk EV revenue-based opportunity

- Earnnest Real Estate NCD

-

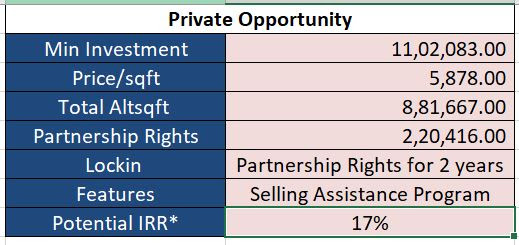

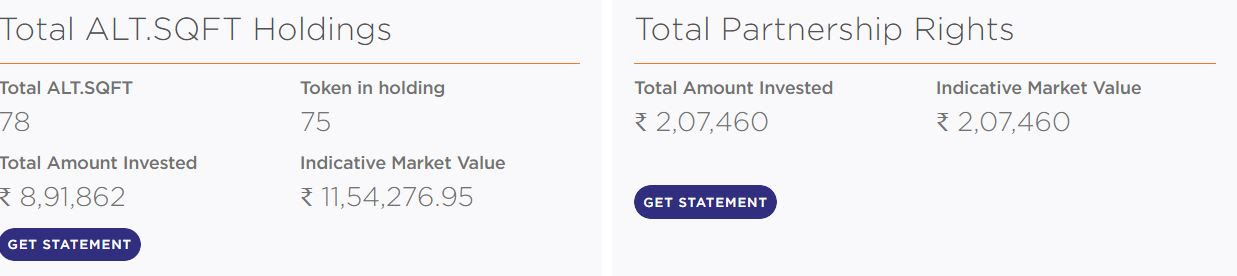

ALTDRX Hyderabad Opportunity (15-18%IRR)

We would be participating in the Hyderabad opportunity as our experience with our first investment had been good. Below are the deal highlights and Hyderabad Prime Plots Market Overview .

-

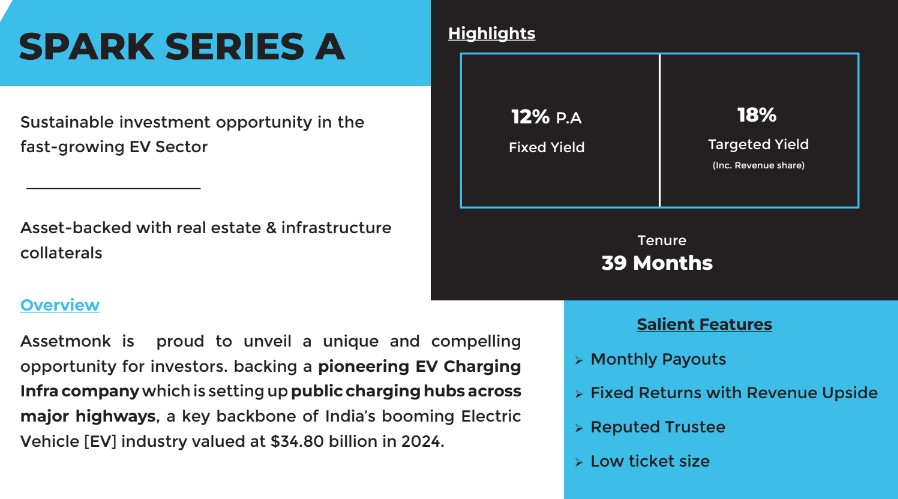

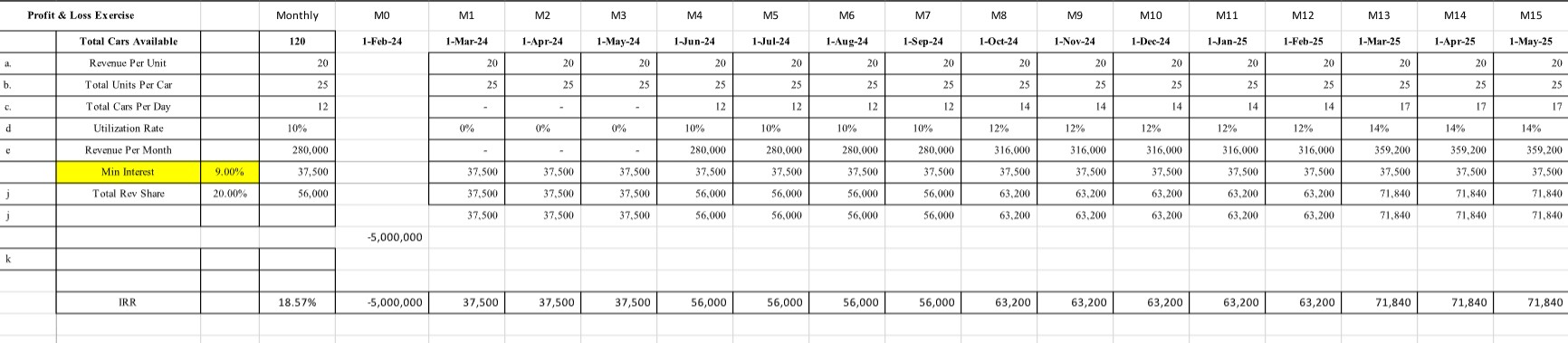

Assetmonk EV revenue-based opportunity (Upto 18% IRR)

Assetmonk has recently issued an RBF deal with a potential of 18% IRR. What we liked about this deal is that though it’s a RBF deal we still have hard collateral that includes a charging station real estate and security thus overall risk is lower than the Klub Direct to customer deals that were mostly unsecured or had depreciating assets as security.

-

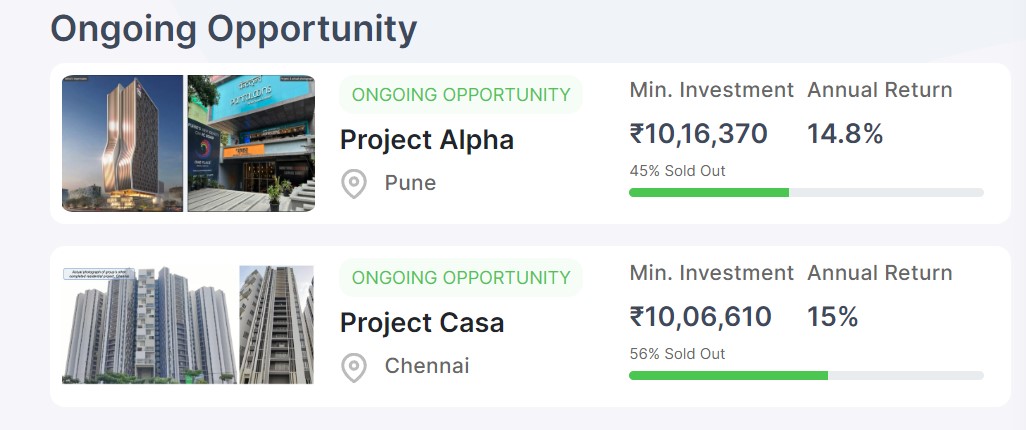

Earnnest Real Estate NCD (Target IRR 15.5%)

The third tranche of Project Rise is Live. The company had a robust Jan to Mar 24 quarter with 50 units sold across projects. Both construction and sales are progressing well. This investment has already returned 28.5% of the principal amount (16% on Mar 24 / 12.5% on May 24) to the investors. The handover of advanced stage phases will begin soon and construction/sales have also begun for the subsequent phases.

Apart from that 2 other opportunities are also live. You can use the below code to get 0.5% Extra!

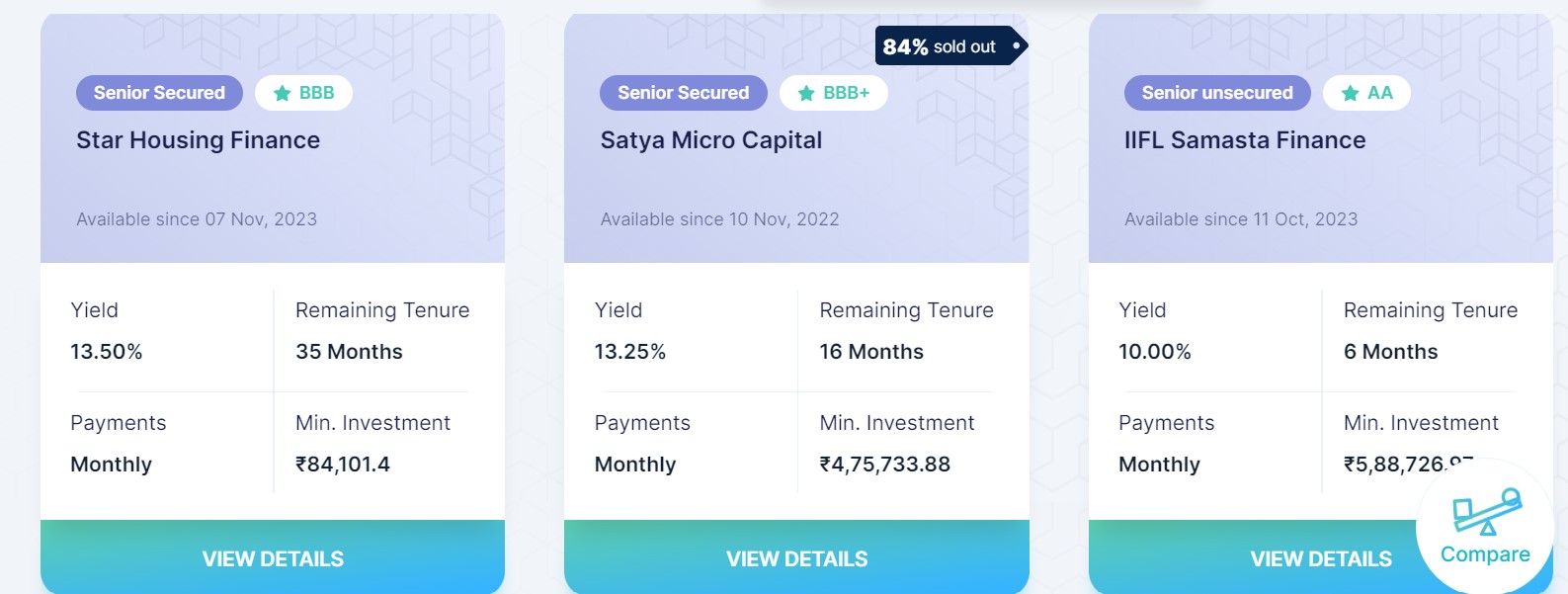

Lending Investment

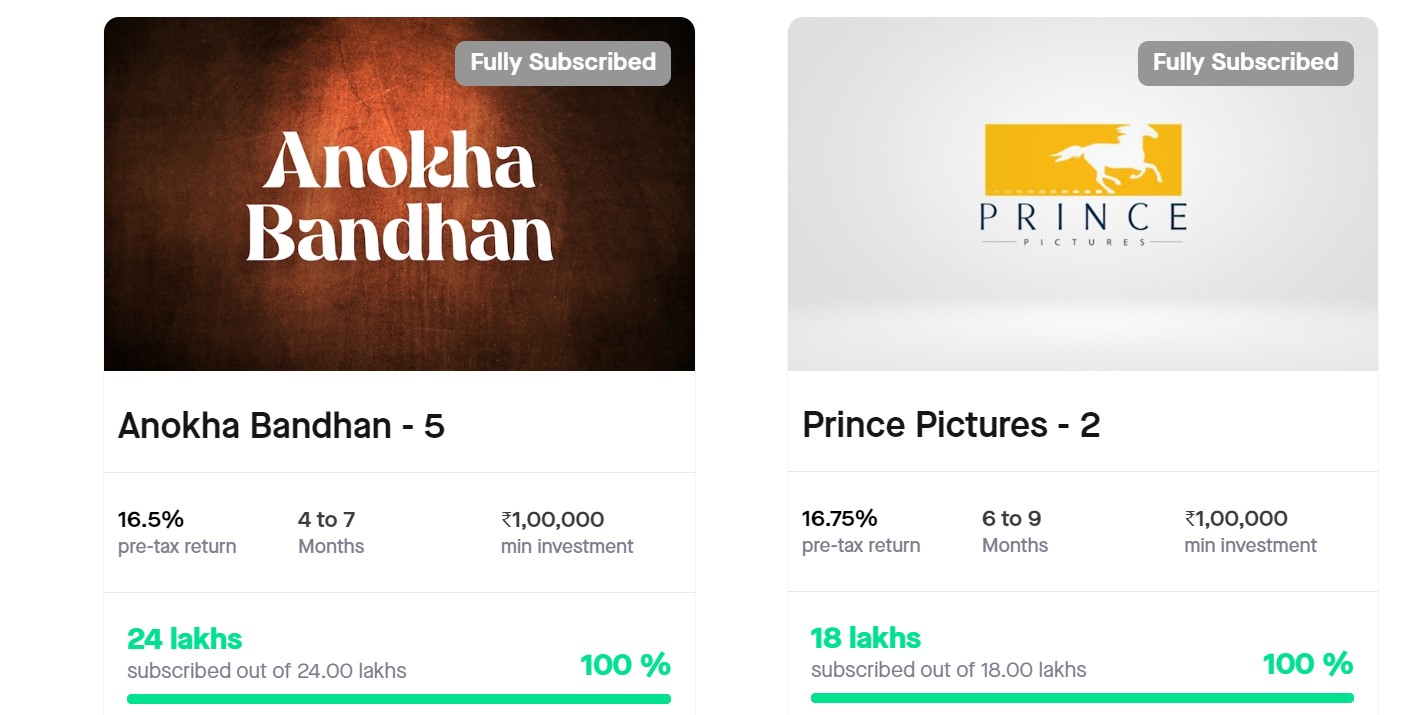

Some of the investments for this month include High Yield Bonds and Real Estate NCD

- Satya Microcapital -13.5% Altifi

- Clix capital -10.75% Altifi

- Save LoanX- 13% Gripinvest

- Anoka Bandhan -16.5% Betterinvest

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.00% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | SEBI Pause | SEBI Pause | N.A. |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

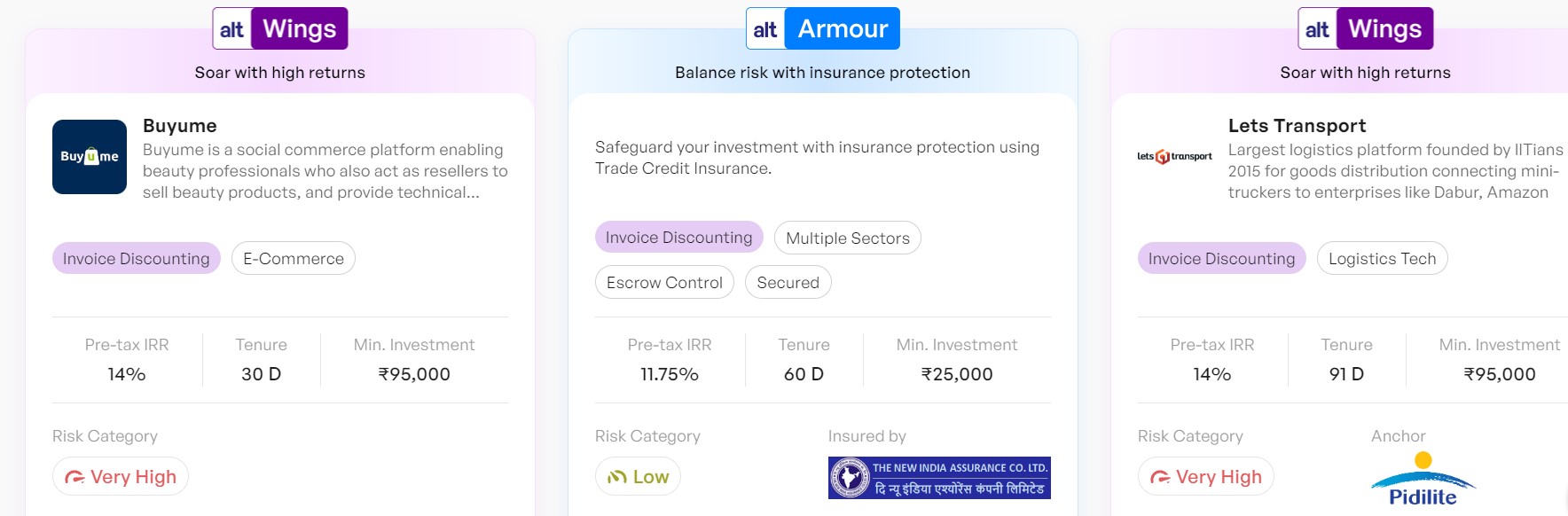

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX (Stopped) | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

We have finally decided to put a stop to our investment in Kredx. Over the period there have been multiple defaults on the platform. Though we did not face any loss personally we feel that the yields on the platform are too low considering the risk of the deals hence it is best to stop our investment. We will update if in future we decide to invest again.

- Currently Invested in 2 deals on Tapinvest -Effigo and Zappfresh

- Invested in Lifestyle on Lenderpartnerz

- Invested in Amazon on Tradecred

- Buyume on Altgraaf

- Lendbox per annum performance has been as per expectation. I avoid high-yield investments on it.

Crypto Investing

The crypto ecosystem is abuzz following the stunning announcement from the SEC: the approval of Ethereum ETFs. This decision, which could redefine institutional investors’ access to digital assets, comes at an important time for the market. While Bitcoin had already paved the way with its ETFs earlier this year, Ethereum, the second-largest cryptocurrency by market capitalization, is set to gain unprecedented exposure in traditional financial markets.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 50%

- I2IFunding- 20%

- Finzy-10%

- Faircent Pool Loan -15%

- 13 Karat – 5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.7% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.8% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- My Indiap2p performance has been fine. There was some delay in March and April but things are normalizing.

- Planning to do a detailed review on I2Ifunding (Referral code discount50@i2i) as I have been using this since 2017 and can share my personal experience.

Equity Market

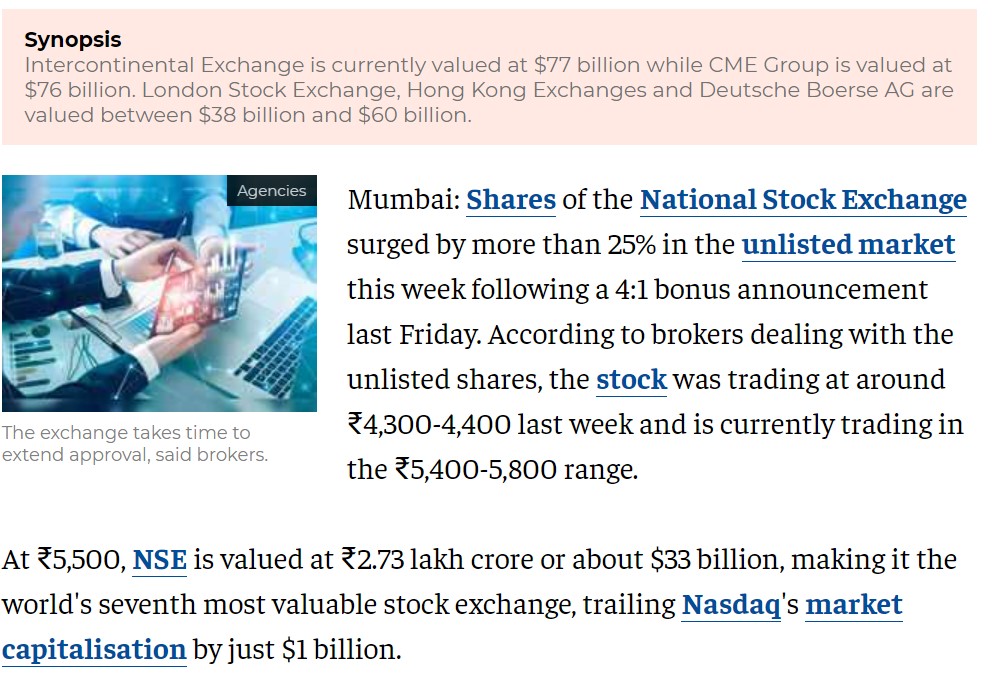

PreIPO Stocks

NSE stock has been on steroids with the price crossing INR 5,000. We had purchased the share at levels between 2700- 3300 and in this 1-year time frame, it has given good upside along with dividends!

Currently, the most popular stock in the unlisted market is Swiggy! The stock is not easily available in the retail marketplace.

Listed Stocks

the first week of June will decide the trajectory of the markets. The overall sentiment looks positive going into the election. The mid-year budget might have some surprises that can impact the enthusiasm.

A higher capital gain tax possibility is being heard in the grapevine but there is no confirmed information.

Investors should show constraint and not get too much impacted by both upside or downside market movements, as in the long run election knee-jerk reaction will not have much consequence on economic growth.

Algo Trading

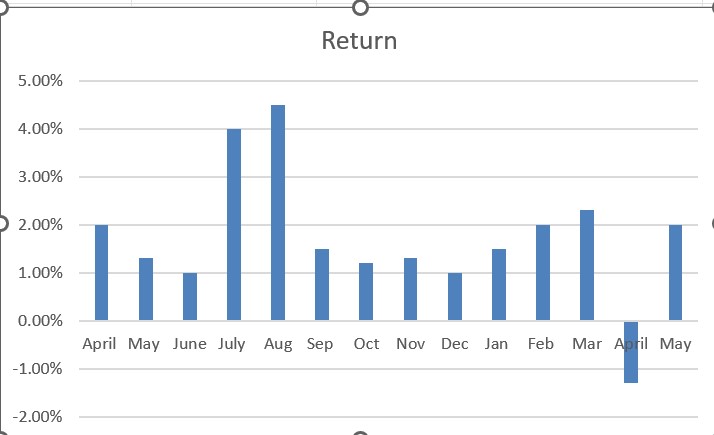

May was a much better month as Option prices had shot up because of the upcoming election outcome which meant option selling gave us a higher premium to manage the risk.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30+ Lakh deployable capital can reach out to inquire on more sophisticated algos