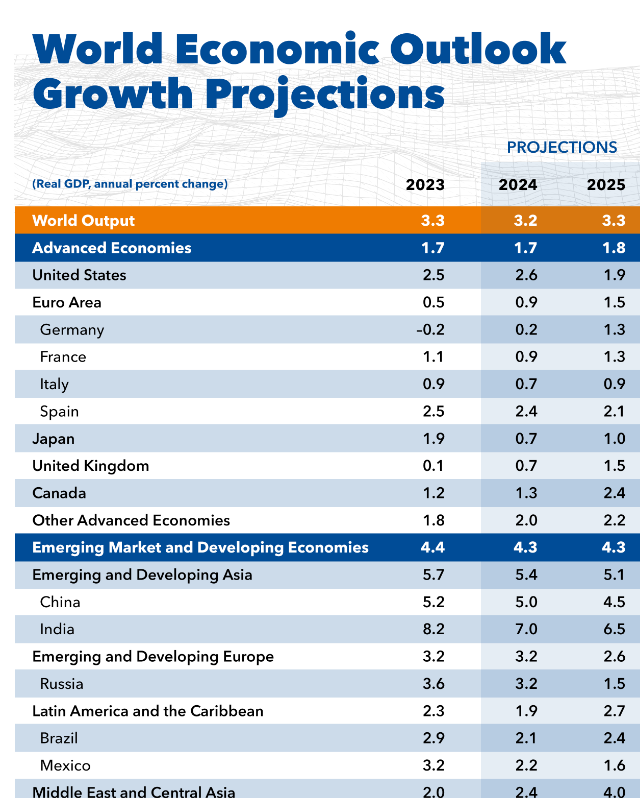

Indian Market had just crossed 25k without any resistance due to positive cues, but the global markets are now playing spoilsports.

Stock markets in Europe, Asia, and New York tumbled due to growing fears of a US economic downturn and disappointing earnings from technology shares.

Concerns about a potential US recession triggered a global sell-off, which intensified after a dismal employment report on Friday revealed that the US jobs market was cooling rapidly, resulting in a higher unemployment rate.

Economists worry that the US economy might be weaker than the Federal Reserve anticipated, potentially compelling the Fed to make a significant rate cut in September or even an emergency cut before then to boost demand.

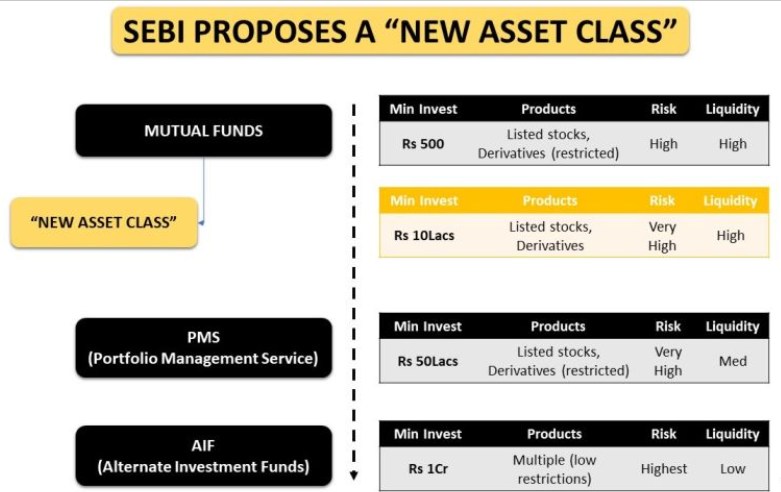

Meanwhile, SEBI is creating a new asset class to target the equity and debt gap and utilize derivatives.

Based on my experience investors should expect pre-tax 11-13 % returns in this product. The game changer could be if it is taxed like an Equity Mutual fund which will give good post-tax returns to investors.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital Freeze Update

- Exa Mobility Default

- Tap Exampur Default

Growpital Freeze Update

Update on SEBI matter:

The next hearing date of 26th August 2024 has been given by SAT.

They asked to return the funds to partners frozen in bank accounts. SEBI filed a reply to the appeal which Growpital reverting over before the next hearing.

It seems the 25% frozen in the account is the only amount that can be salvaged now if SEBI acts in due time.

Recently Mr Upadhyaya interviewed the Founder again. Below is the video

Examobility Default

Some of the community members informed me that they had invested in an EV leasing deal with a company called Exa Mobility.

They have not received payment for a few months now and the platform is not responsive. If anyone has invested do comment so that I can connect you with other investors and it will make it easier to approach as a larger group and make resolution faster.

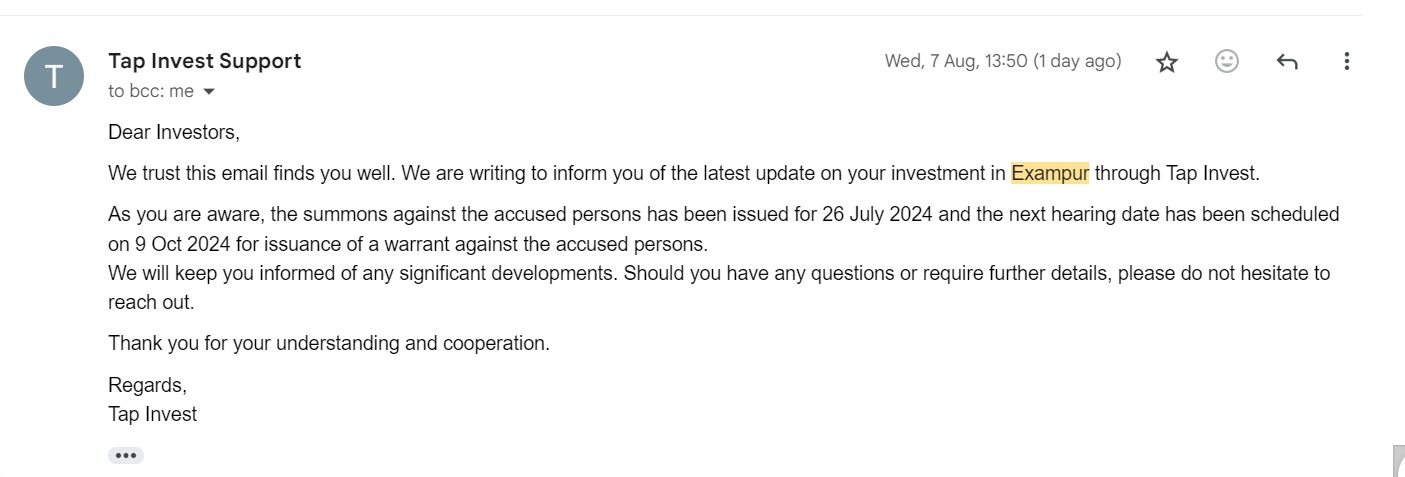

Tapinvest Exampur Default

Tapinvest has initiated litigation against Exampur for the asset leasing deal. Below is the communication.

Alternative Investment Portfolio Updates

This month we have added a new platform Farmfrax. A lot of people had shown apprehension as it is farm related platform after having poor experience with Growpital.

We feel the model is different as you are not investing in a business but investing in land. However, its good to critically review all new platforms and we urge anyone investing a large amount to do deeper due diligence.

Some of the key interesting opportunities for the month are –

- Farmfrax Opportunity

- AltDRX Munnar Opportunity

- Assetmonk NCD Opportunity

Farmfrax Opportunity (16% IRR)

This opportunity includes investing in land and then leasing it to Fosbella for a 6% rental yield. The land would be developed by them and sold in the future.

We are only adding a small amount currently as we would be monitoring the platform performance and then deciding if it makes sense to increase allocation.

Use Code ROH996 to get 0.5% Cashback!

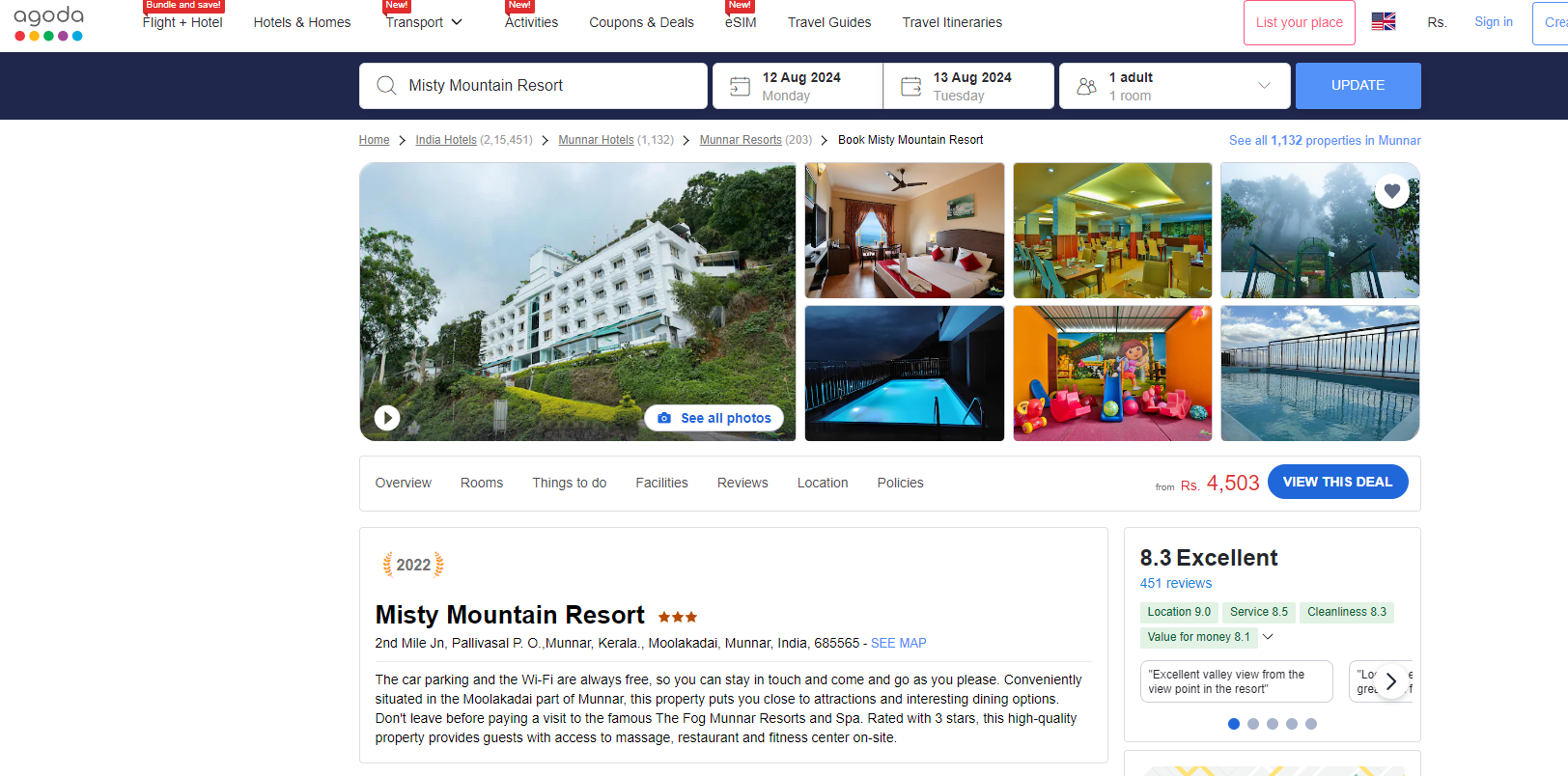

ALTDRX Kerala Opportunity (15-17%IRR)

Recording of the webinar conducted by AltDRX for the Munnar Opportunity – Webinar

The value proposition is interesting for investors who want to avoid debt-based products and are looking to own assets!

Wisex Navratana SDI Opportunity (13.26 % IRR)

A new interesting opportunity on Wisex that is listed securitized debt instrument with some of the large government-backed energy companies

The security collateral is a mix of land, Receivables, and Corporate guarantees.

As requested by many investors, we plan to do a comprehensive article on the various real estate platforms we are using for different kinds of products. We realized that different platforms have different strengths and it makes sense to use their specific expertise in the particular asset class

Lending Investment

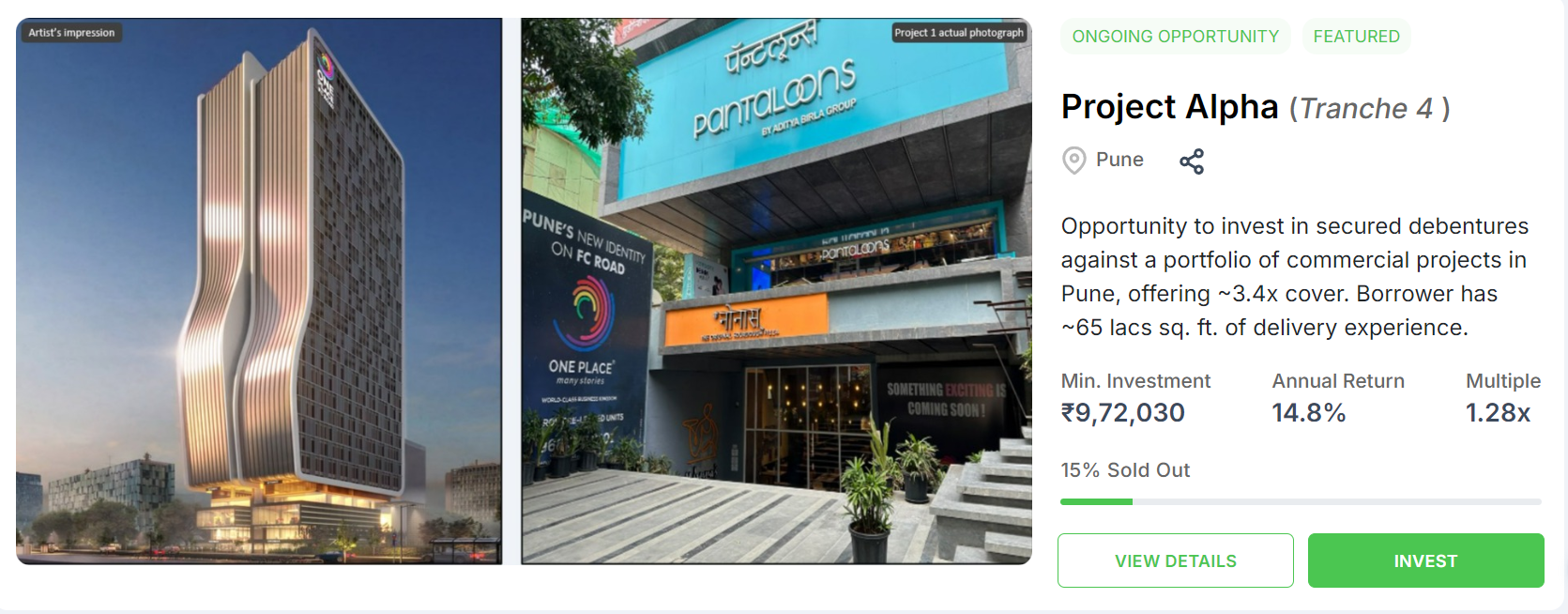

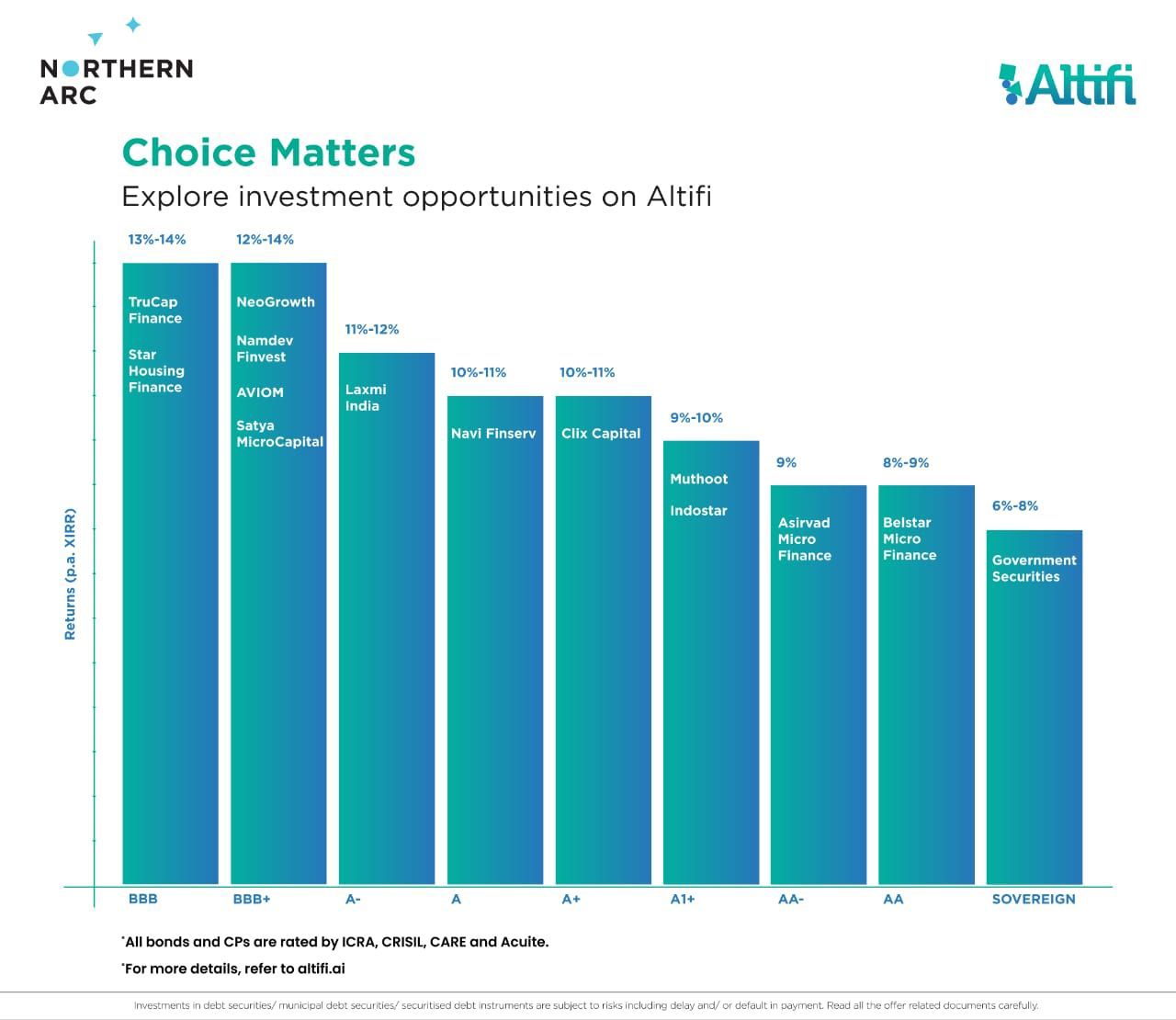

Some of the investments for this month include High Yield Bonds and Real Estate NCD

- Alitfi – Trucap Finance 13.5%

- Earnnest – Project Alpha 14.8%

- Gripinvest – Up Money SDI 13.2%

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.00% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- Earnnest project alpha 14.8% opportunity is live. You can use the below code to get 0.5% Extra!

- Tapinvest has started a 14.5% yield Invoice opportunities window every weekend!

- Multiple opportunities including commercial papers live on Altifi.

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 4 Invoice deals on Tapinvest

- Invested in 2 deals on Tradecred

- Invested in 2 ID deals on Altgraaf with trade insurance

- Lendbox per annum performance is satisfactory. (Only Low Yield)

Crypto Investing

India’s largest cryptocurrency exchange, WazirX, has suffered a major security breach resulting in the theft of over $230 million in digital assets. WazirX saw withdrawals in early European hours on Thursday (July 18) as a security breach affected one of its wallets, causing the loss of user funds.

We had faced serious issues with Wazirx in the past as the p2p transaction caused our bank to freeze our account as the platform had not done proper KYC of its fraud users who transacted with us. We quit the platform in 2021.

The platform has proposed to socialize the losses among its users which seems to be a very poor strategy.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 48%

- I2IFunding- 25%

- Finzy-7%

- Faircent Pool Loan -10%

- 13 Karat – 10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.8% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.8% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- There seem to be some delays for a few users on Indiap2p. We plan to interview the team on the same and gain insights.

- I2Ifunding (Referral code discount50@i2i) has given around 14% till date.

Equity Market

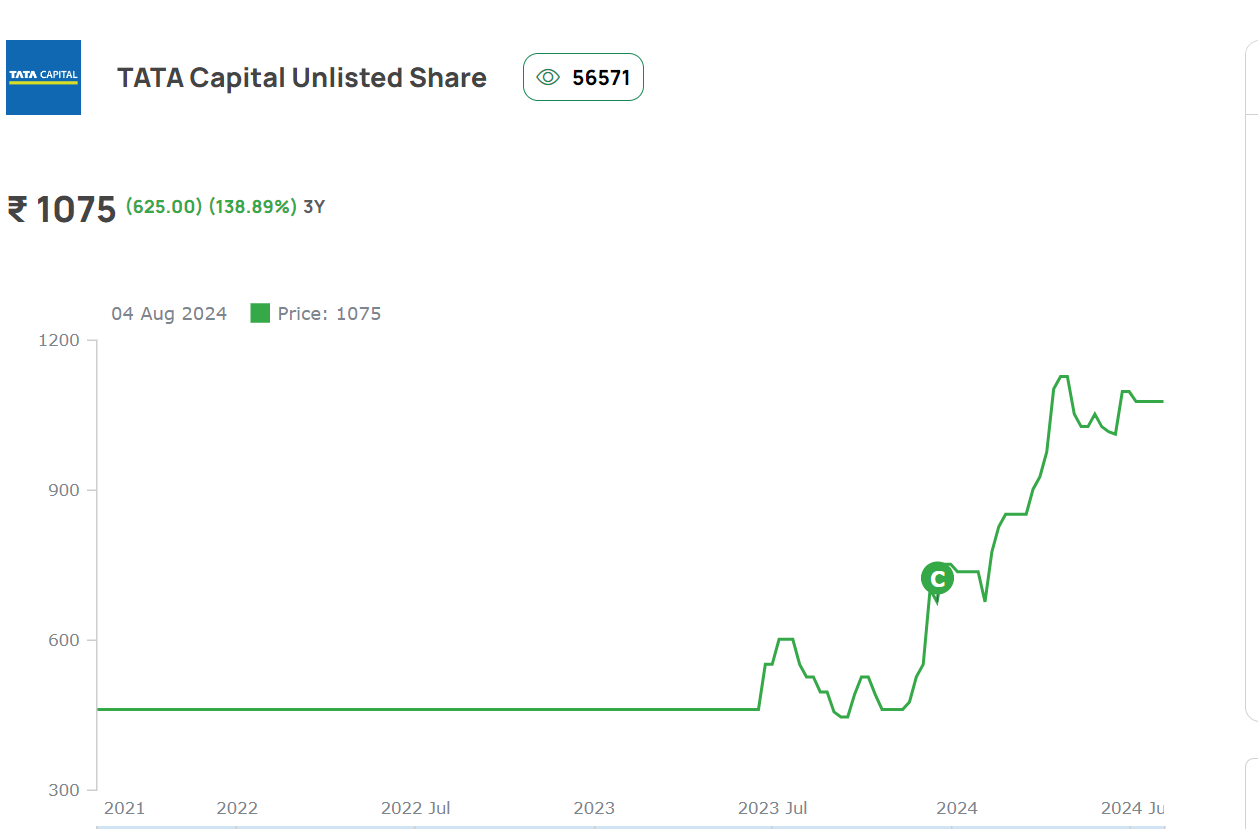

PreIPO Stocks

Tata Capital is one of the more popular stocks this month in the unlisted market. Unlisted shares of Tata Capital, a majority-owned subsidiary of Tata Sons, have risen over 46 percent in the grey market in the last six months, its market cap surging to $48 billion in that time from around $33 billion.

Listed Stocks

After many months the market finally showed some sign of fear as the latest data from the U.S. Bureau of Labor Statistics reveals that unemployment has climbed to its highest level since the pandemic. Temporary layoffs reached a three-year peak, while private-sector hiring hit a 16-month low.

OptionTrading

Currently, I have switched to 50% discretionary along with algo trading as the market regime has changed and it is difficult to make consistent returns with algo. We were able to achieve 3% returns in July as the market didn’t move a lot and non-directional trades were profitable.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30+ Lakh deployable capital can reach out to discuss more sophisticated algos

please add Exampur deal in tap invest as a delay

Thanks for sharing detail, updated !

I have invested in Exa mobility, can you add me to the larger group, the payouts are pending since start of this year.

Hi Divyank, Please share your number. You can whatsapp us also.

Thanks