Equity Investors couldn’t have been happier with the current state of the market!

A recent news story has left everyone stunned. A Delhi-based two-wheeler dealership, operating under the showroom name “Sawhney Automobiles” and exclusively dealing in Yamaha bikes—Resourceful Automobile, with just two showrooms, only eight employees, and an admitted less-than-promising outlook—decided to launch an Initial Public Offering (IPO) to raise a modest Rs 12 crore for expansion and debt repayment. This small-cap offering, which should have gone unnoticed, drew unexpected attention. It was oversubscribed by a staggering 418.82 times, with bids totaling an astounding Rs 4,800 crore!

Meanwhile, on the P2P front RBI came up with stringent and immediate regulatory changes on how p2p platforms are managed. The primary reason for it was due to how some platforms were being run however some of the changes brought by RBI are detrimental to the industry.

The salient points of the guidelines were

- No credit guarantee or enhancement by NBFC-P2P entities

- Fund transfer through an escrow account within T+1 days

- Restriction on cross-selling of products

- No Secondary sale of loans

We feel credit enhancement and secondary sales were good from the investor’s point of view, however, a more stricter portfolio performance audit guidelines could have been more helpful for the investors than a blanket ban.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital Freeze Update

Growpital Freeze Update

Update on SEBI matter:

26th August 2024 was the SAT hearing date. The date has been postponed because Growpital documents containing the response to SEBI were still in transit. This is highly unprofessional behaviour from them and I feel quite pessimistic about a fast resolution.

I hope SEBI provides a timeline on the return of the frozen money of investors as the possibility of a complete refund looks bleak now.

Mr Upadhyaya has summarized the outcome in the video.

Alternative Investment Portfolio Updates

This month we have been exploring a new platform. We will share the details in our next post!

Some of the key interesting opportunities for the month are –

- AltDRX Pune Opportunity

- Assetmonk New NCD Opportunity

ALTDRX Pune Opportunity (15-17%IRR)

An interesting opportunity where Investors can acquire under-construction property being developed by Godrej that can provide good returns in exit as under construction has more value unlocking opportunity.

AltDRX has also launched a private opportunity where market makers can get a 15% fixed+ Revenue Share. However, this opportunity is available only for a few anchor investors. You can register and we can connect you to the point of contact for this deal.

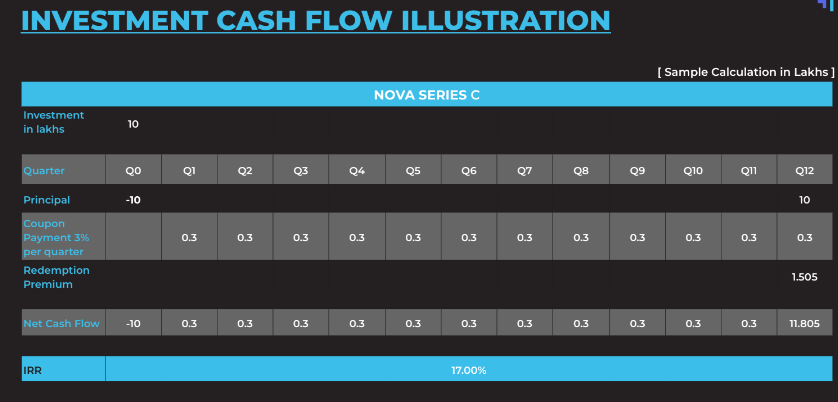

Assetmonk Nova Series NCD (17 % IRR)

Assetmonk has listed a new tranche of Incor group NCD at 17%. This is a small tranche backed by 1.5 X collateral.

The group had good debt servicing performance for the past deals listed on the platform. Incor is a diversified group with an interest in pharma and hospitality.

Lending Investment

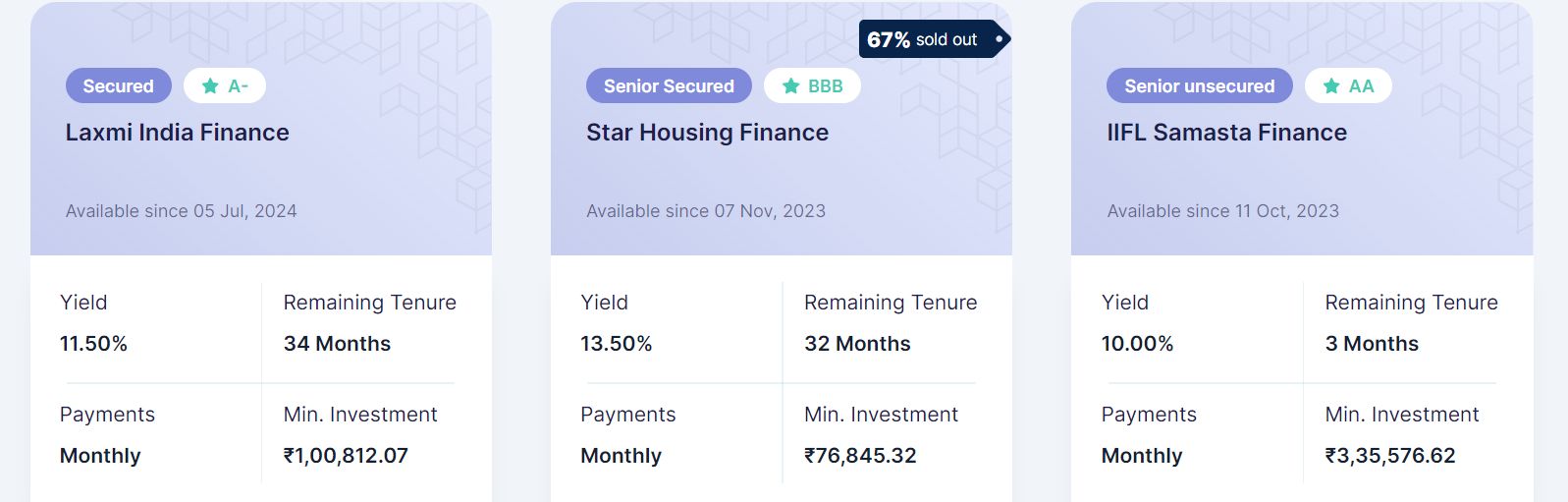

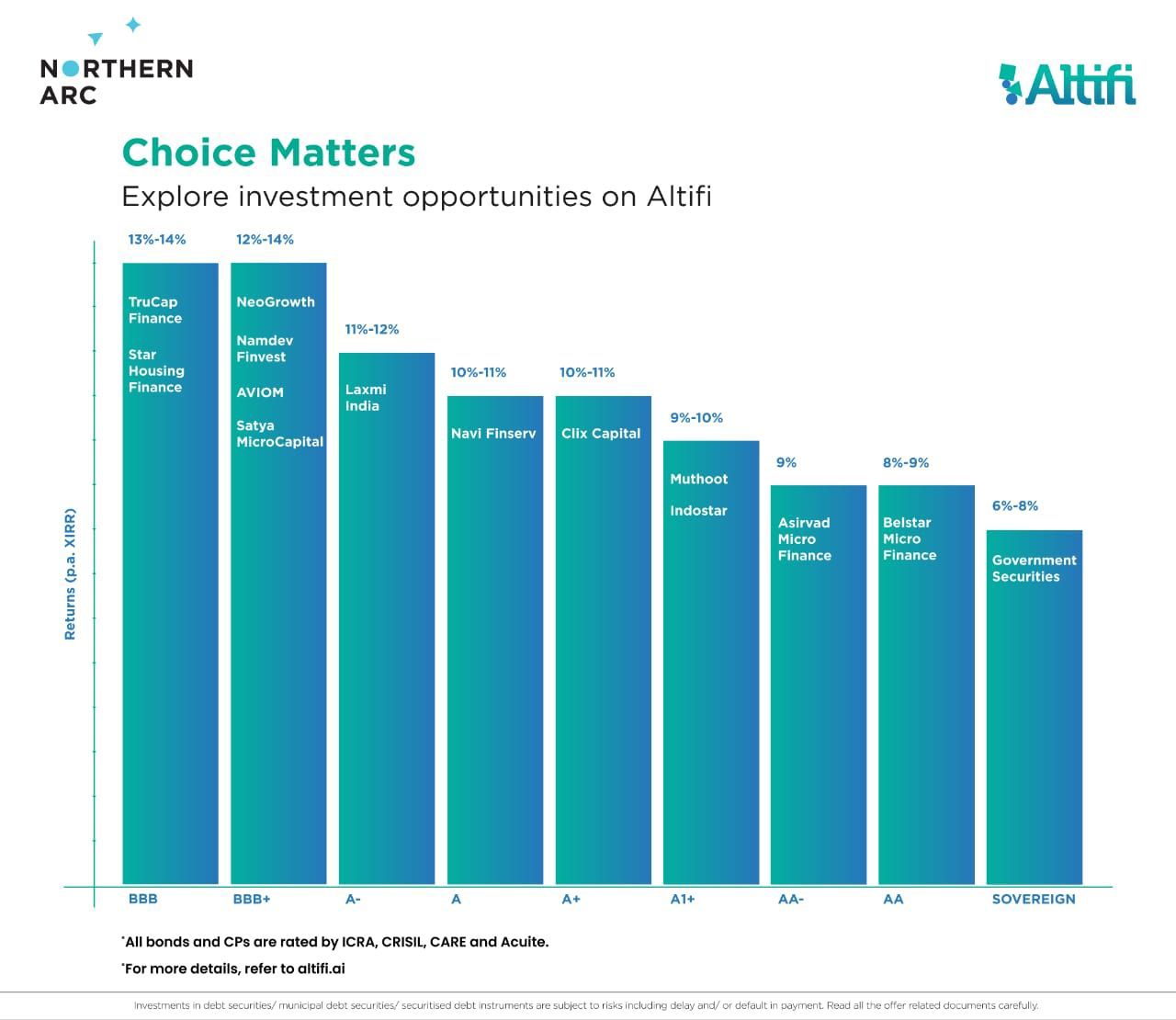

Some of our investments for this month include High Yield Bonds. We prefer high-yield bonds as post-tax returns should be upward of 9% for it to make sense from a risk-reward perspective

- Alitfi – Star Housing Finance 13.5%

- Tapinvest – True Credit 16%

- Gripinvest – LoanX velicham 13.5%

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.25% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 3 Invoice deals on Tapinvest and 1 on Lendzmarket

- Invested in 1 deal on Tradecred

- Invested in 1 ID deal on Altgraaf with trade insurance

- Lendbox per annum will slightly change the offering to be in line with RBI guidelines.

Crypto Investing

The crypto market has fallen almost 20% from its top this year. However, despite the volatility many investors are bullish for the long run.

The cryptocurrency market is rapidly expanding. From almost no value fifteen years ago, its market capitalization has now soared to nearly $2 trillion.

According to experts, this explosive growth is just the beginning. By 2027, institutional investors are anticipated to significantly boost their crypto asset holdings, increasing their portfolio allocation from 1.5% to 7%.

This trend is driven by several factors. First, in a low-interest-rate environment, institutions are seeking higher returns, leading them to alternative assets. Second, the tokenization of real-world assets is creating new investment opportunities. Lastly, enhanced infrastructure and regulatory clarity are making it easier to enter the market.

Analysts expect the crypto market’s growth to continue accelerating

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 48%

- I2IFunding- 25%

- Finzy-7%

- Faircent Pool Loan -10%

- 13 Karat – 10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.8% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.8% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- Indiap2p is making some changes to accommodate the RBI guidelines and will open up investments soon. Below is the update from the platform

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it already following direct borrower lending. The returns have been around 14% to date.

Equity Market

PreIPO Stocks

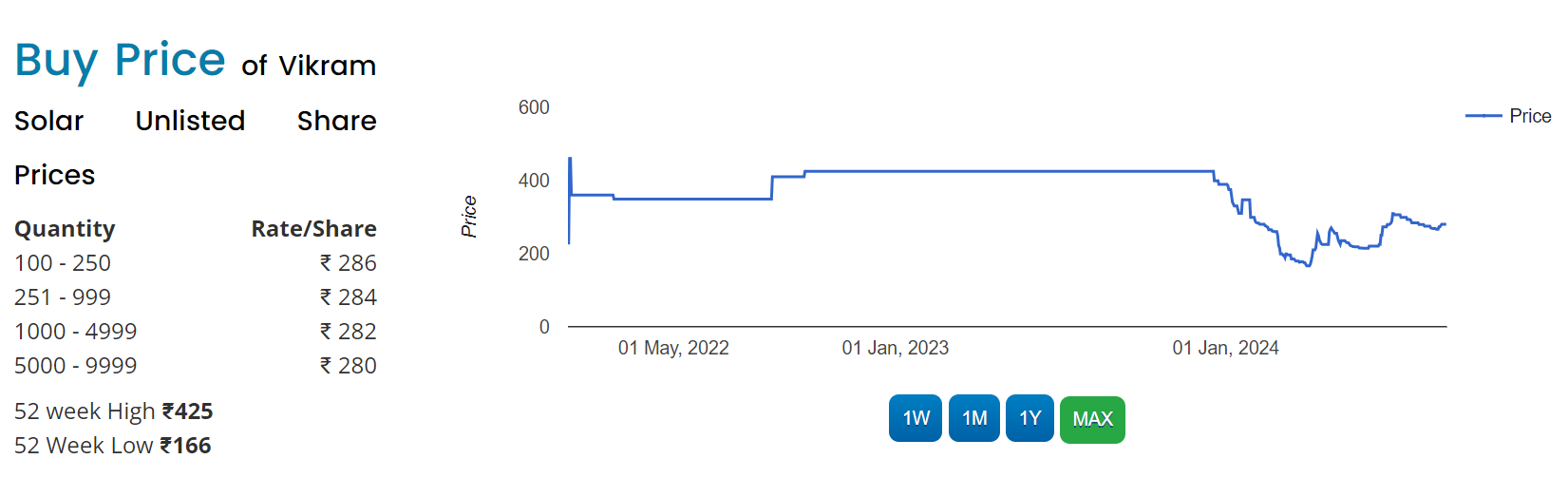

In March we highlighted that Vikram Solar was getting popular in unlisted space. It was around 170 at that time. It is now trading close to 280 in the unlisted market. This is largely due to a large fundraiser they did and also due to its comparison with Waree Energy.

Swiggy’s IPO is among this year’s most anticipated primary market offerings as the Softbank-backed Indian food delivery player is eyeing a $15 billion valuation for its issue. According to some media reports, the company is likely to raise about Rs 8,500-10,000 crore via its initial public offering (IPO). The price has already jumped to 500 in unlisted platforms.

Swiggy is in high demand in the secondary market but supply is limited! Check out Altius for financials

Listed Stocks

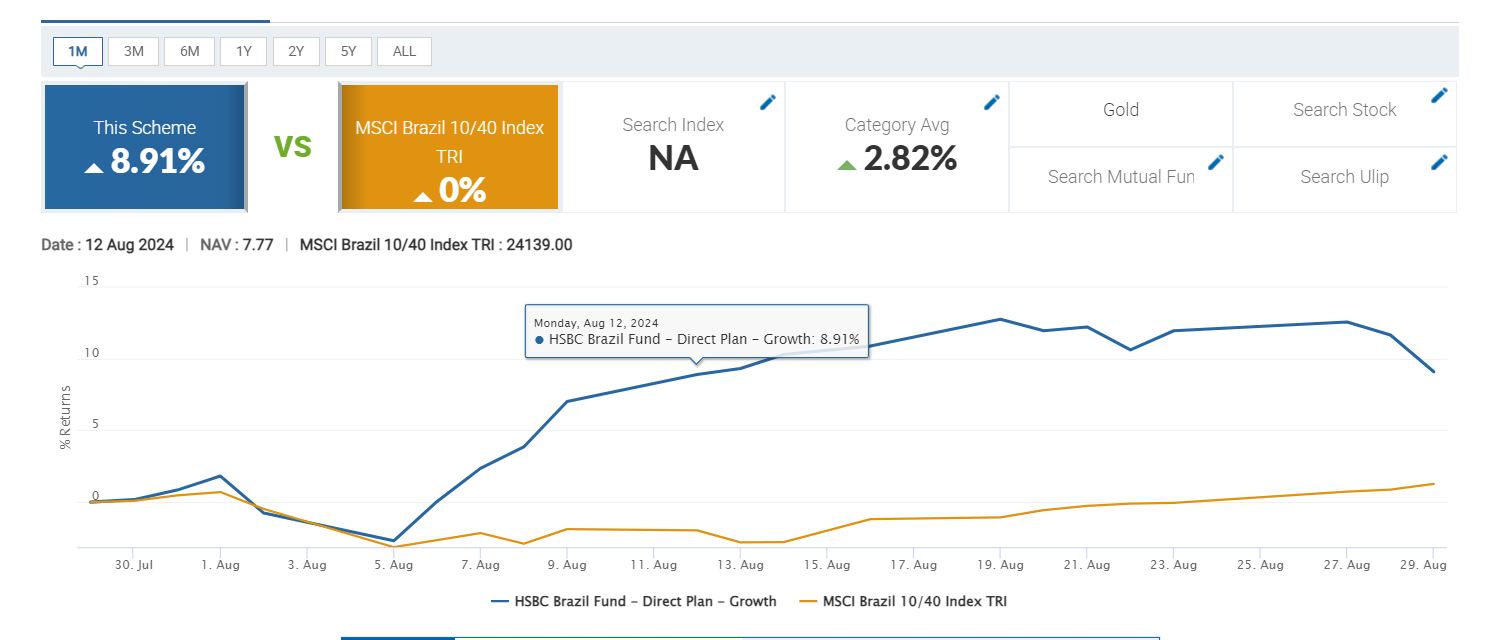

The market has been on fire, our returns in Nasdaq and some small-cap stocks have crossed 100%. We are booking some profits here and reinvesting in emerging markets along with China as valuations are much more attractive with a time horizon of 5-7 Years. We will buy if it goes further down from here. The emerging markets have gone 7-10% up since we bought but not reading to much into it and considering it beginners luck!

OptionTrading

Currently, I have switched to 50-55% discretionary along with algo trading as the market regime has changed and it is difficult to make consistent returns with algo. August was a great month for nondirectional and we were able to clock 5% returns as the market didn’t move violently except on the last expiry of Nifty when it moved 200 points in 5 minutes!

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Hello Rohan.. I have recently come across another investment platform by name `GHL India`. Have you heard about that? Could you do your due diligence on the investment opportunities and share it with the wider audience if possible?

Hi Sujatha,

Prima Facie I found some red flags with the platform such as no clear management structure, deal terms vague, mentioning AIF model etc.

Currently I have kept it as flagged – https://randomdimes.com/blacklist/

We appreciate you efforts to provide concise information updates in AInvt.

Thank you for your kind words Rajan!