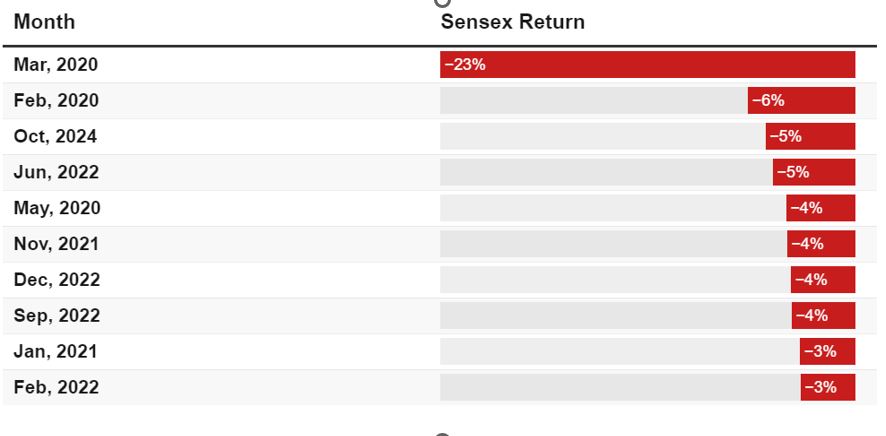

The Sensex has recorded its steepest monthly decline since the COVID-19 crash, falling by 7% in October. Contributing factors include FII outflows, IPOs, QIPs, and subdued Q2 earnings. In an unprecedented move, FPIs have withdrawn over ₹1 lakh crore from the Indian financial market this month—a level of outflow surpassing even the COVID-19 crash and the 2007-2008 global financial crisis. While broader indices have seen single-digit corrections, certain market segments have experienced more significant drops, presenting selective opportunities for skilled fund managers.

Apart from Indian markets, equity markets around the world continue to be on a tear. The MSCI Global Equity Index is close to its lifetime highs, up a staggering 30 per cent over the last year. But it is not just equities; all asset classes have thrived in recent months.

Gold and Biticoin both are hovering around all time high levels. The Bitcoin rally was partly driven by whale activity on Binance and substantial inflows into Bitcoin ETFs, which saw a net increase of 47,000 BTC in the last two weeks.

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital SEBI Order Update

- Betterinvest Delay statistics

Growpital SEBI Outcome

SAT has asked to unfreeze the amount lying in escrow and return it to the investors. However during the latest hearing growpital had not presented the plan for capital repayment hence the meeting has been scheduled for 11th Nov when the modus operandi for capital return will be presented. Below is the update from Prashant.

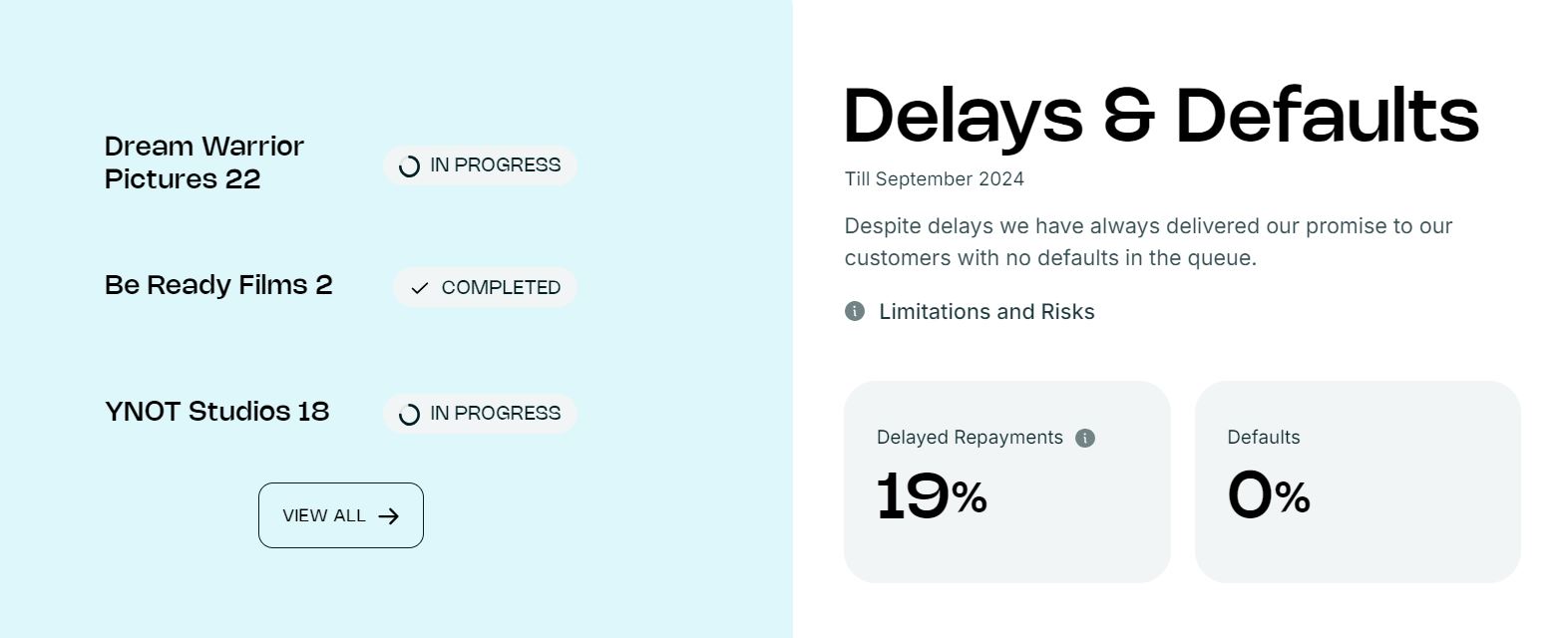

Betterinvest Transparency Report

Betterinvest has started actively publishing status of various deals that have been delayed. This is a good initiative and provides more transparency. Considering movie invoicing is a business where some delay is always expected , this measure helps to allay investor fears.

Alternative Investment Portfolio Updates

Policy Exchange Founder Interview

This month we interviewed the founder of Policy Exchange on the insurance investment product that can provide upto 14% tax-free returns. Below is the link to the video. We plan to do a follow-up video with the team to understand the PTC product which can be used for larger investments. Some of the points covered in the video are

- Introduction of Policy exchange and journey of the founder

- How the investment process works.

- Taxation and Returns

- Regulations and Risk Management.

Get Best Deals on Policy Exchange

AltDRX Referral Opportunity

We have engaged with the AltDRX founding team and negotiated a 1.5% referral bonus for all Randomdimes investors of ALTDRX who refer someone from their network. This means if you have invested in Altdrx and would like to refer someone through Randomdimes, Altdrx will provide 1.5% referral bonus without any cap on the number of investors you can refer!

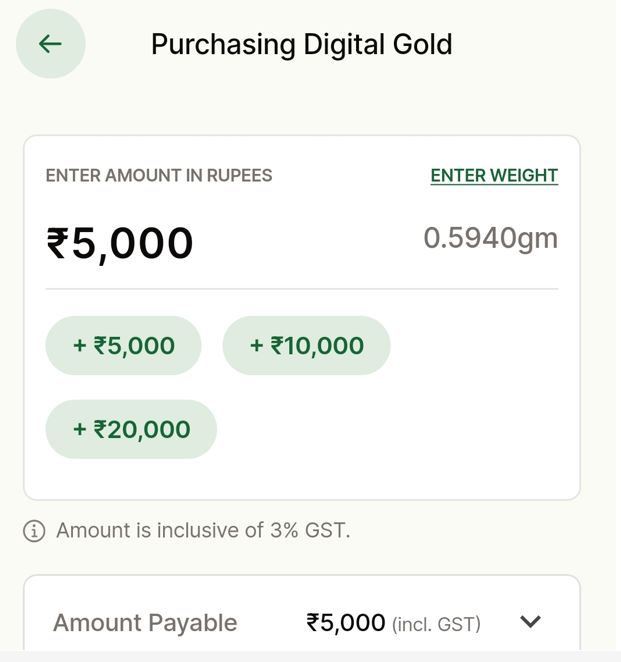

Tapinvest Digital Gold

Tapinvest has launched a new digital gold product for investors. You can now start investing from 5,000 in digital gold using their app. It is directly available under dashboard .The gold purchase is through their partner augmont largest player in digital gold.

Assetmonk 18% IRR Opportunity

Assetmonk has recently launched an 18% secured NCD. It is a 3-year bond with quarterly coupon payment.

Telegram channel for the Latest Alternative Investment News

Medium Term Investment

Some of the top high-yield bonds NCDs on Tapinvest and Altifi for this month

- Earnnest – Project Alpha 14.5% (Use Code PX64XW to get 0.5%)

- Tapinvest – Sri Creva 13.82%

- Policy Exchange – 14% IRR 2026 policy

- Gripinvest -13% Indel

- Betterinvest – 16.5%

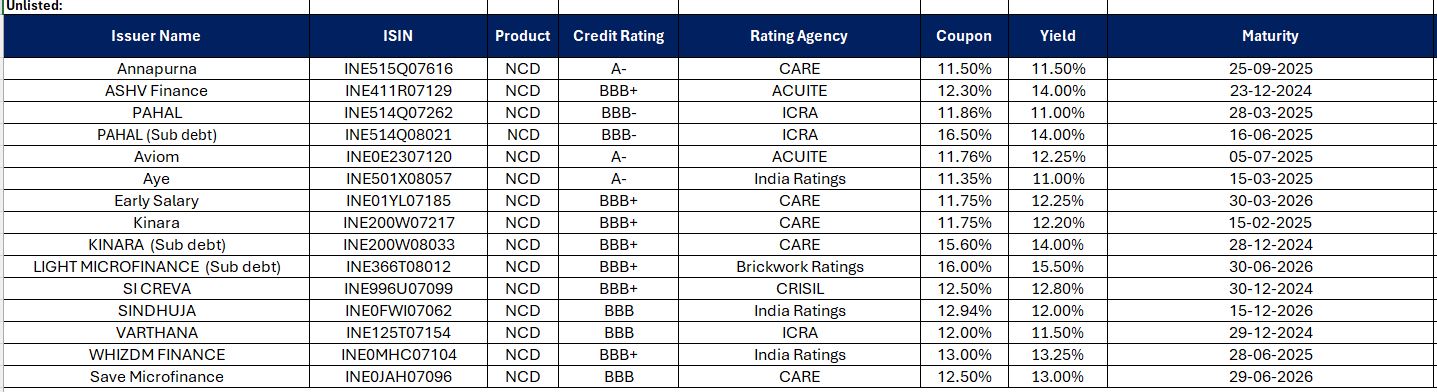

Altifi offers high-yield unlisted bonds offline through Northern Arc. Some of the bonds available are. We will update Telegram with the latest deals. Interested people can connect with the RM through our Telegram channel.

Current Altifi unlisted bond list

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- We have stopped using some platforms like Klub and Pyse due to non-availability of deals

- Paused Wintwealth as IRR is generally lower than other competitors.

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 3 Invoice deals on Tapinvest

- Invested in 2 deals on Tradecred

- Invested in 1 ID deal on Altgraaf with trade insurance

- Lendzpartnerz has rebranded itself as Monytics now

Crypto Investing

The recent crypto rally, led by Bitcoin, stems from a blend of influential factors. Prominent investors like hedge fund billionaire Paul Tudor Jones view Bitcoin as a hedge against inflation, especially as both government policies and the platforms of presidential candidates like Kamala Harris and Donald Trump are expected to add trillions to the national debt. The Federal Reserve’s interest rate cuts last month have fueled concerns among skeptics that monetary policy alone may not be sufficient to curb inflation. Traditional safe-haven assets such as gold have also risen, with gold up 6% since the September 18 rate cut. Bitcoin’s price increase has additionally paralleled rising odds in betting markets for a Trump victory, as Trump, once a Bitcoin skeptic, positions himself as the pro-Bitcoin candidate, even proposing a “strategic national Bitcoin stockpile.”

Bitcoin ETFs now manage more than $65 billion in assets, having crossed the $20 billion inflow threshold in less than a year—a feat that Gold ETFs took more than five years.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 40%

- I2IFunding- 30%

- Lendbox -30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.90% | 4.30% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 14.10% | 4.50% |

| Lendbox Per Annum | Low Risk Short Duration only | 11.50% | 0.50% |

- My current NPA in last couple of months in IndiaP2P has gone up gradually. Overall Returns have been close to 14% considering I enjoyed almost a year with very low returns.

- We are in the process of consolidating response from various p2p platforms on changes post RBI circular and will cover it in subsequent post.

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date.

Equity Market

PreIPO Stocks

There has been a correction in the pre ipo market due to overall volatility in the broader market, nevertheless Waree energy listed at 66% from its IPO price. Unfortunately we did not get the allotment.

Swiggy IPO of ₹11327.43 Cr opens for subscription from 06-11-2024 to 08-11-2024. The IPO consists of ₹4499.00 Cr fresh issue and ₹6828.43 Cr offer for sale.

The face value is Rs 1 and the price band is fixed at 371.00-390.00 per share. You can apply to the Swiggy Mainline IPO for a minimum lot of 38 shares amounting of Rs 14820.

The tentative listing date on the exchange (BSE, NSE) is 13-11-2024. The current GMP has dropped and the expected listing price is close to INR 410 down from 500 a month back.

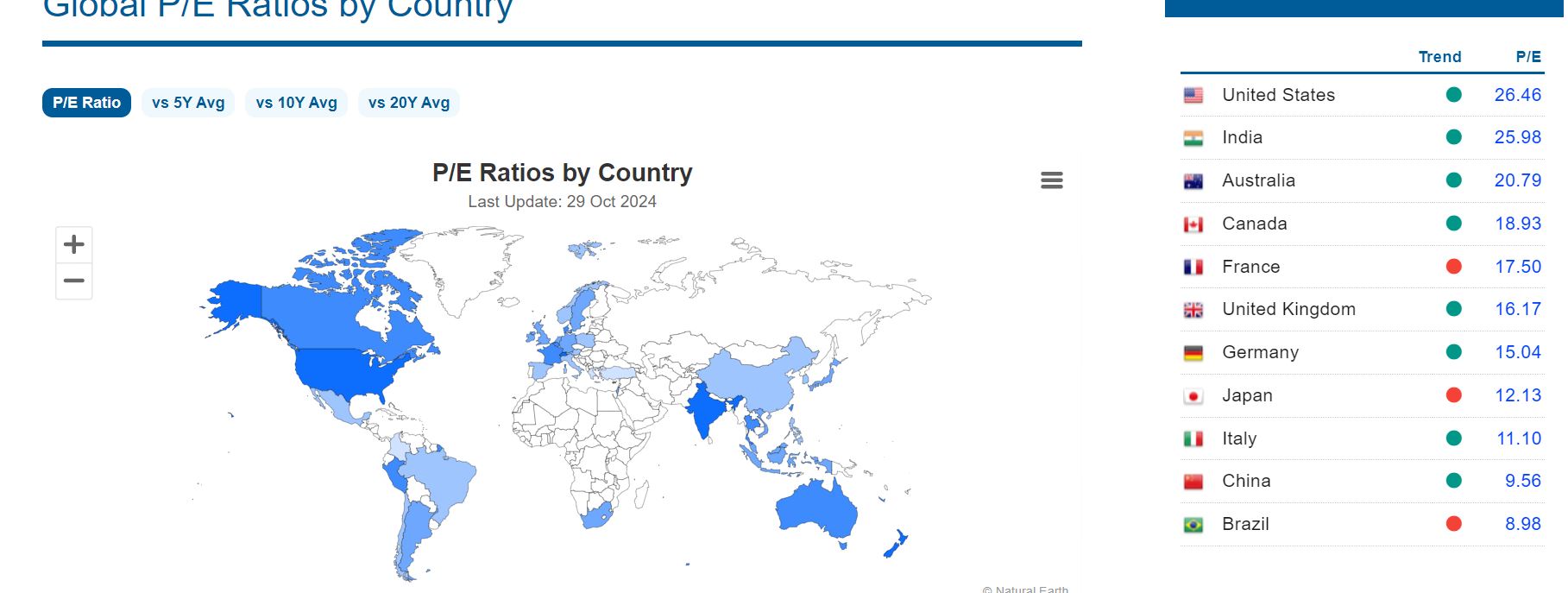

Listed Stocks

October was a dismal month for the Indian market. At such a high valuation, sharp corrections like this can never be ruled out. Even after this correction, Nifty is not very cheap if we consider the PE ratio. If Nifty goes further down from here and small-cap corrects sharply we will start adding selected stocks.

OptionTrading

October was a tough month for option selling and we were able to manage <1% on capital. The market was very volatile but the option prices were not factoring in the risk. It’s akin to selling cheap insurance policies when the mortality rate is high. As the weekly banknifty is being discontinued we will be exploring strategies on Nifty going forward.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Hello Rohan,

Have you heard of Hebbevu Farms on the outskirts of Bengaluru? They run managed farmlands where individuals can go and buy farmlands and they would be maintaining that for 15 years. They also have investment option in their diary business where the investors would buy Gir cows and they would be doing complete maintainence. Diary investment gives an annual returns of 16% to 20%. You can check out their website and also visit their farms

Hi Nagaraj,

Managed platforms have a management risk (similar to growpital).

1) You cant get audited results for most so mismanagement risk is there

2) It has keyman risk ie. if the owner makes bad decision then you would find it tough to exit

So investing a large capital is possible only if you really trust them. I will try to explore it in detail and then share my review.