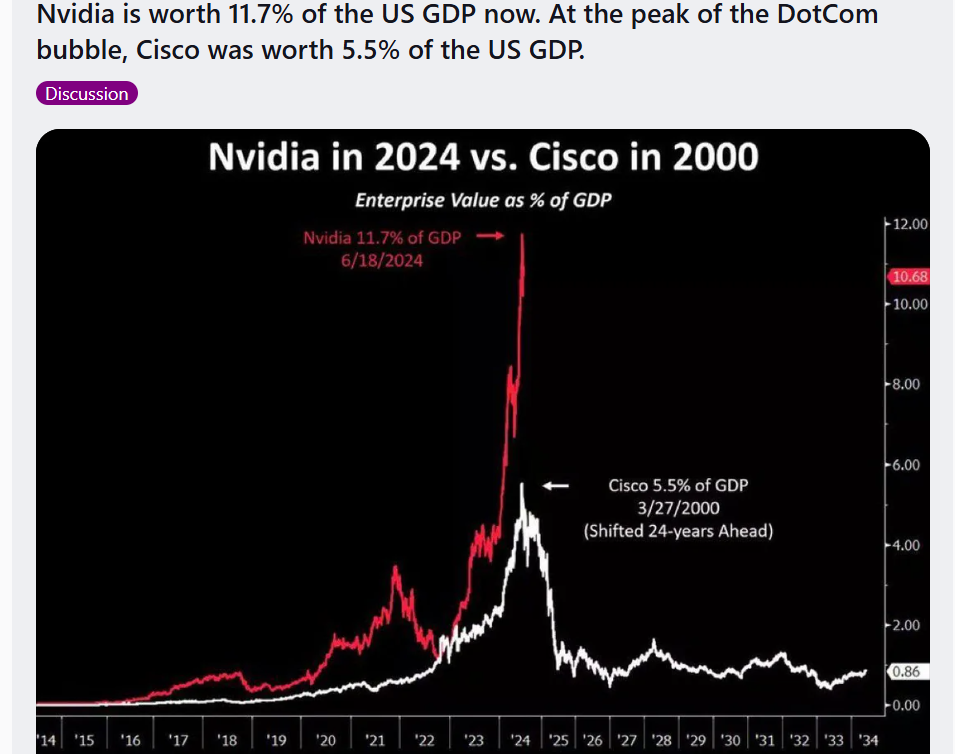

The Indian equity market stabilized at the end of November after 45 days of continuous selling by foreign investors. On the other hand US market has been in a crazy run mostly led by Tech stocks. Nvidia stock itself has contributed to significant gains for Nasdaq. This brings reminiscence to the 2000 Tech bubble. The valuation hasn’t stretched to those levels yet and markets have tendencies to stay in the bubble for long hence a crash doesn’t need to be imminent.

The crypto market has been in a tear with Bitcoin breaching the 100k magical number for the first time. There is a significant demand from institutional investors and with multiple ETFs and companies (Microstrategy) having bitcoin exposure the asset class has outperformed all others.

On the Alternative Investment front Securities and Exchange Board of India (SEBI) has ordered four unregistered online platforms (UOPs) to halt their operations involving the public subscription of unlisted securities on their platforms. The UOPs are AI Growth Pvt Ltd (owner of altGraaf), Texterity Pvt Ltd (operator of altGraaf), Purple Petal Invest Pct Ltd (owner and operator of Tap Invest), and Berkelium Technologies Pvt Ltd, the owner and operator of Stable Investments. The regulator feels that by providing these opportunities publically on the website they are flouting regulatory norms.

Personally having multiple unlisted options was a positive for me as I could compare yields. Currently, Altifi offers unlisted NCD to selected investors but won’t be available publically, you need to connect with the Altifi RM after registering here.

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital SEBI Order Update

- Tapinvest Growpital Leasing

Growpital SEBI Outcome

SAT has already asked the platform to return the frozen capital to the investor but the plan and process must be approved under SEBI guidance. SEBI had requested some information from Growpital, which seems they agreed to provide. I was disappointed that the 3rd Dec SAT hearing was again postponed to 28th Jan 2025 as the quorum was full.

The whole case has become an ordeal for investors with ever-increasing changing timelines for the return of capital.

Tapinvest Growpital leasing Assets

Recently TAPinvest communicated on the assets they had leased to Growpital. They have sent out a mail to their investors on the status. The liquidation of assets looks unlikely until SAT and SEBI close this case.

Dear investor,

We trust this email finds you well.We are writing to share the latest updates and actions that we are taking in the Growpital issue.As communicated earlier, we have tracked and verified the licensed assets at Barmer, Rajasthan. However, it is pertinent to highlight that due to non-payment of wages and rent by the directors of Growpital, the local farmers are restraining us from conducting the valuation & sale of the licensed assets. Our team has had multiple run-ins with the locals there without much respite.We have filed a police complaint in HSR Police Station regarding the issue, which is pending investigation. We are also filing a police complaint in Jaipur PS as well as the Office of the Economic Offence Wing, Rajasthan. Our recourse here is to use legal methods to get the assets in place as well as claim damages against non-payment of dues.We appreciate your understanding and patience.Thanks

Alternative Investment Portfolio Updates

This month we shared queries on the new Insurance Investment product we have just started investing through Policy exchange. The product can provide up to 14% post-tax returns. If someone is interested in being a partner with them they can also register as a partner using the link.

Get Best Deals on Policy Exchange

We also did an article on the new invoice discounting products on Altgraaf with a deep dive into how they work and the risk management around it.

AltDRX Referral Opportunity

The AltDRX 1.5% referral bonus is still available for all Randomdimes investors of ALTDRX who refer someone from their network. This means if you have invested in Altdrx and would like to refer someone through Randomdimes, Altdrx will provide a 1.5% referral bonus without any cap on the number of investors you can refer!

We will be doing an article this month on 1 year of our investment journey stand details of the opportunities we participated in and the realized vs unrealized gains. We were able to achieve a 20% return on our first investment.

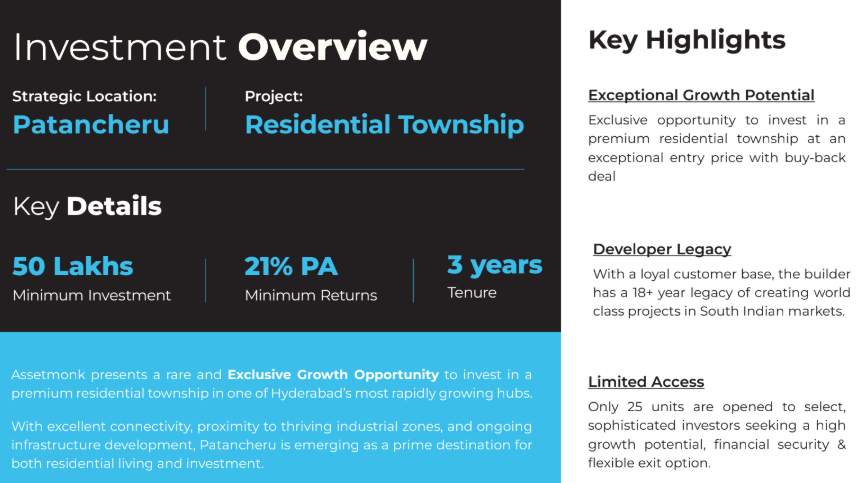

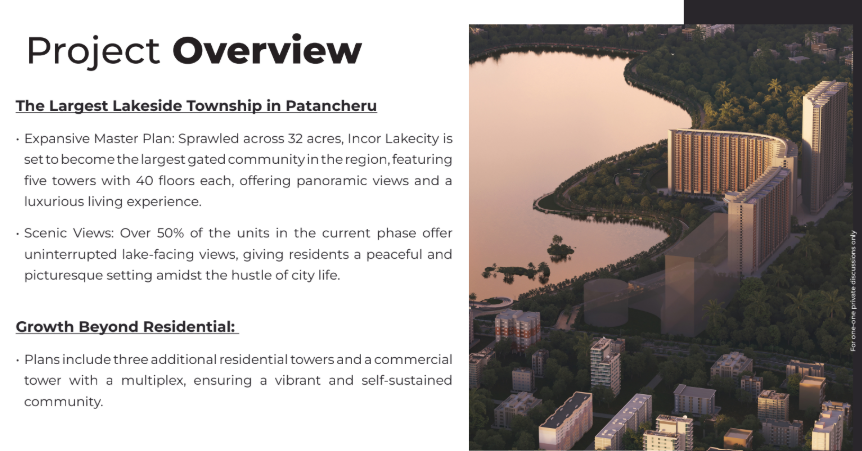

Assetmonk 21% IRR Opportunity

Assetmonk has recently launched a 21% real estate opportunity where investors can purchase collateral at a discount to market value and the builder will buyback at a pre-decide rate. This will ensure ownership of assets. Investors can choose to hold on to the assets and sell them later. The minimum ticket is INR 50 Lakh hence investors should connect with RM for complete information.

This project is managed by Incor with whom they have done multiple deals in the past.

Telegram channel for the Latest Alternative Investment News

Medium Term Investment

Some of the top high-yield opportunities for this month

- Tapinvest – 14.6% Axisbank

- Policy Exchangee – 13.5% IRR 2026 policy

- Gripinvest – kanakdurga 13%

- Betterinvest – 16.5%

- Afinue -15% post-tax Bowling lane Lease

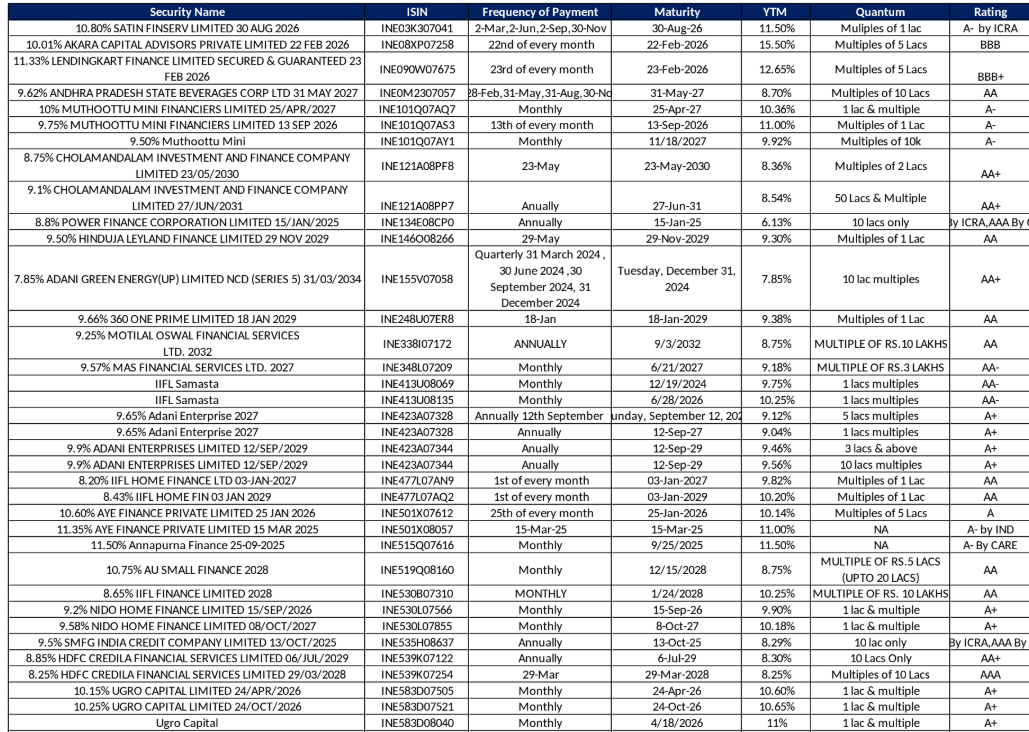

Altifi offers high-yield unlisted bonds offline through Northern Arc. Some of the bonds available are. We will update Telegram with the latest deals. Interested people can connect with the RM through our Telegram channel.

Current Altifi unlisted bond list. Akara Capital has a Yield of 15%+ with an A- Rating.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- We have stopped using some platforms like Klub and Pyse due to non-availability of deals

- Paused Wintwealth as IRR is generally lower than other competitors.

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 4 Invoice deals on Tapinvest

- Invested in 2 deals on Tradecred

- Invested in 1 ID deal on Altgraaf with trade insurance

- Lendzpartnerz has rebranded itself as Monytics now

Crypto Investing

Bitcoin has reached a historic milestone of $100,000, with its market capitalization surpassing $2 trillion. This surge is fueled by investor optimism surrounding President-elect Donald Trump’s pro-crypto stance.

Bitcoin’s market cap now surpasses the GDPs of Mexico ($1.85 trillion), Australia ($1.8 trillion), and Spain ($1.73 trillion), and is just $0.15 trillion shy of Russia’s GDP ($2.18 trillion), Brazil’s ($2.19 trillion), and Canada’s ($2.21 trillion). Earlier, Bitcoin also surpassed the market valuations of Saudi Aramco ($1.796 trillion), Silver ($1.791 trillion), Facebook ($1.549 trillion), and Elon Musk-led Tesla ($1.148 trillion), making it the 7th largest asset in the world.

Along with Bitcoin Ripple, Ethereum, and Solana have also been in an upward trajectory. After the U.S. Election Day on November 5, Ripple’s XRP has been causing waves in the crypto market with an amazing price rise. The coin has gone 5x in a month!

While these returns look tempting it is important for investors to be prudent as crypto is still the wild west with multiple Ponzi schemes and rug pulls.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 40%

- I2IFunding- 30%

- Lendbox -30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.80% | 4.45% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 14.00% | 4.70% |

| Lendbox Per Annum | Low Risk Short Duration only | 11.50% | 0.50% |

- This month we will be doing a post on the changes IndiaP2P and Lendbox have undertaken post RBI regulation

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date.

Equity Market

PreIPO Stocks

We had invested in Swiggy before the IPO and also connected investors to the sellers who were selling at a better rate than the online platforms that were selling at exorbitant prices. The investment looks really good currently with almost 50% gain in a month.

We hope to invest in a few more opportunities and will share their details for others to evaluate.

Listed Stocks

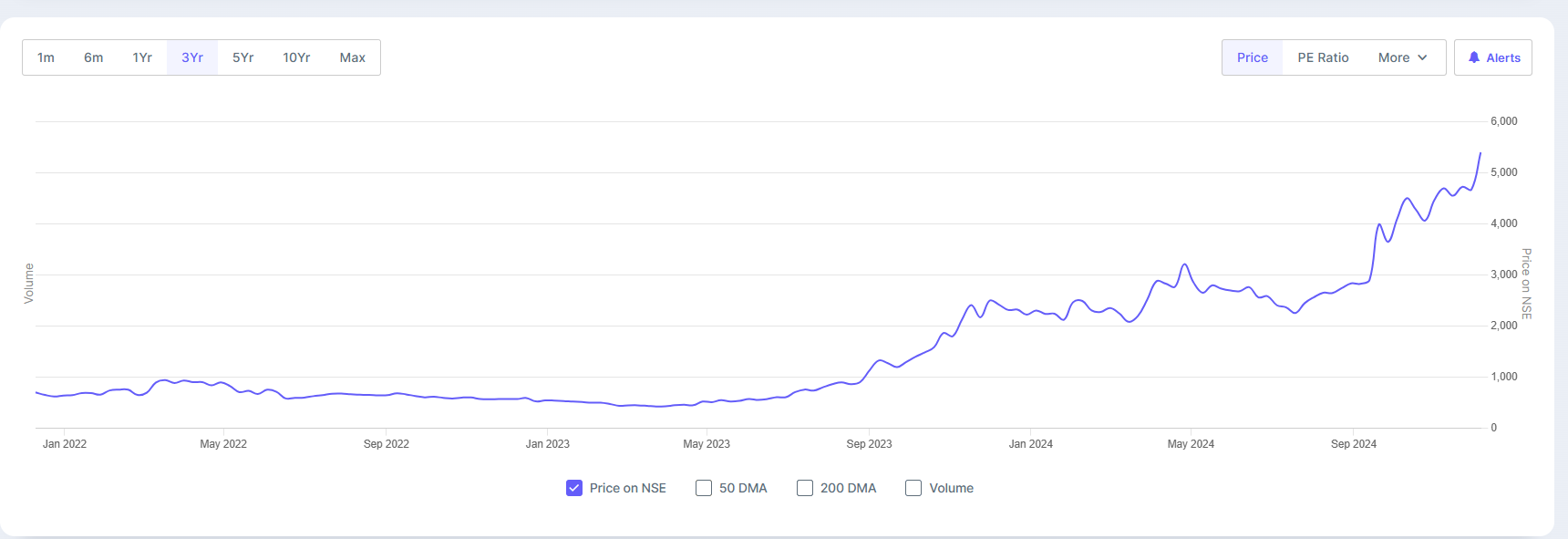

The market has been muted but few stocks have been rallying in the last month such as BSE.

We added a few stocks during the current market fall. We also bought undervalued Index funds like private banking for a 5-year target.

OptionTrading

November was better than October for trading. The volatility declined as compared to October. We managed to achieve 2% during this month.

We are planning to compile some good material for investors who are keen to learn to trade. We realized many people on the internet are selling courses with guaranteed strategies. These are not to be trusted as there is no magic strategy that can make money forever but its long learning process requiring discipline and hard work if someone wish to excel in this.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy\

traders.

sir payment for clensta deal for nov month not credited and delayed for tradecred platform. please mention in your post

hi what is the current status?

Hi Rohan, Which Algo are you using for Options trading ?

Hi Aayush,

Currently im allocating more to non algo systematic trading. I will do a post on the platforms that allow user friendly execution algos!